Stock Watch: Greggs

Long-term shareholders of Greggs have been done very well from their investment in the Newcastle-based baker. The simple business model of selling freshly prepared food at competitive prices has been a big hit with consumers.

Anyone who bought and held on to the shares from when they first listed on the stock exchange in 1984 would have seen the value of their investment multiply many times over - by 81 times in fact. They would also be pocketing an annual dividend which is more than double the price they paid for the shares. If you are looking for an example which shows the benefits of long-term investing then Greggs is a pretty good one.

In recent years Gregg's shareholders have experienced mixed fortunes. The company has faced tough competition from supermarkets, higher food costs and less people visiting high street locations all of which have made it difficult for its profits to grow.

Now things seem to be on the up again but how long can the good times last?

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

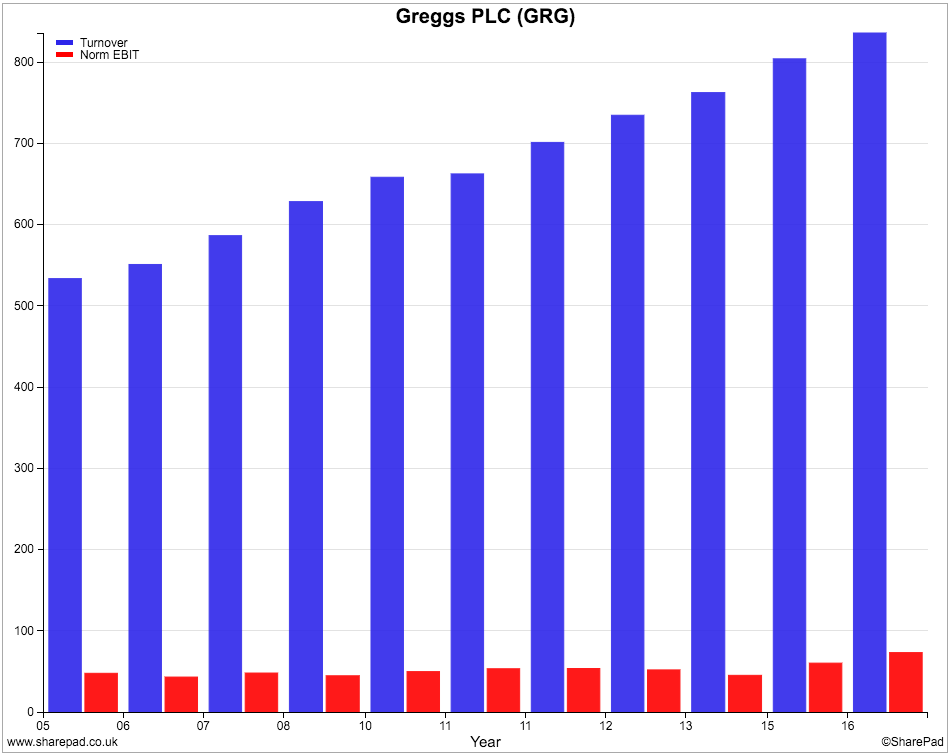

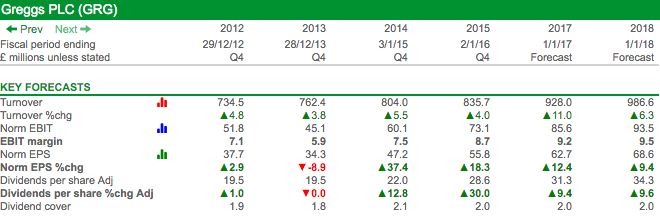

Turnover and profit history

As you can see, Greggs has a good track record of growing its turnover. Growing profits has been more difficult. Profits have been flat for much of the last decade before growing again in 2014 and saw a big jump up last year.

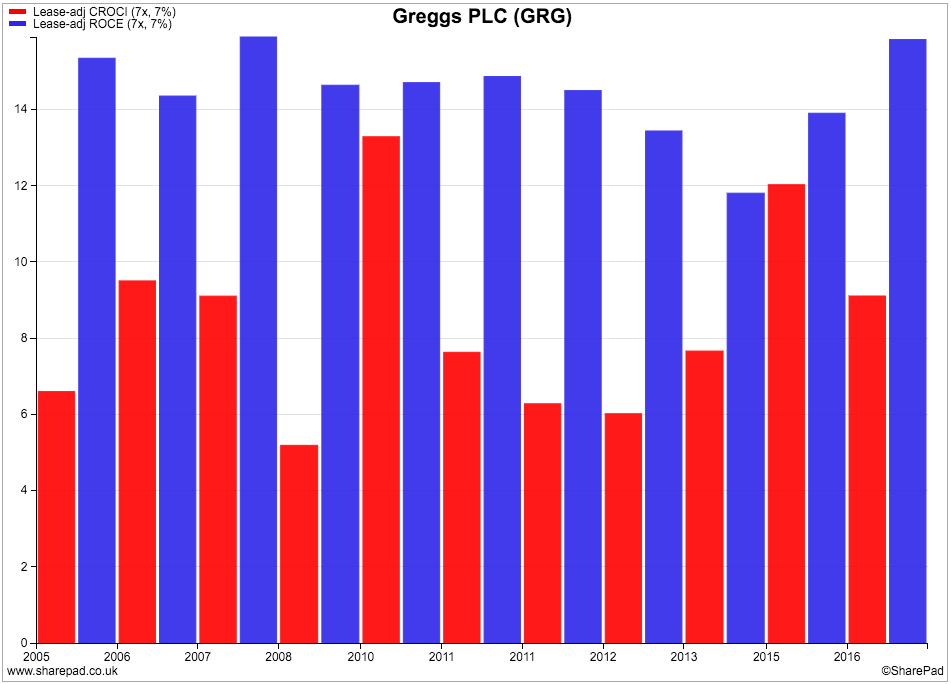

Financial returns

But how good a business is Greggs? Does it get a good bang for its buck on the money it invests?

Not too bad is the answer.

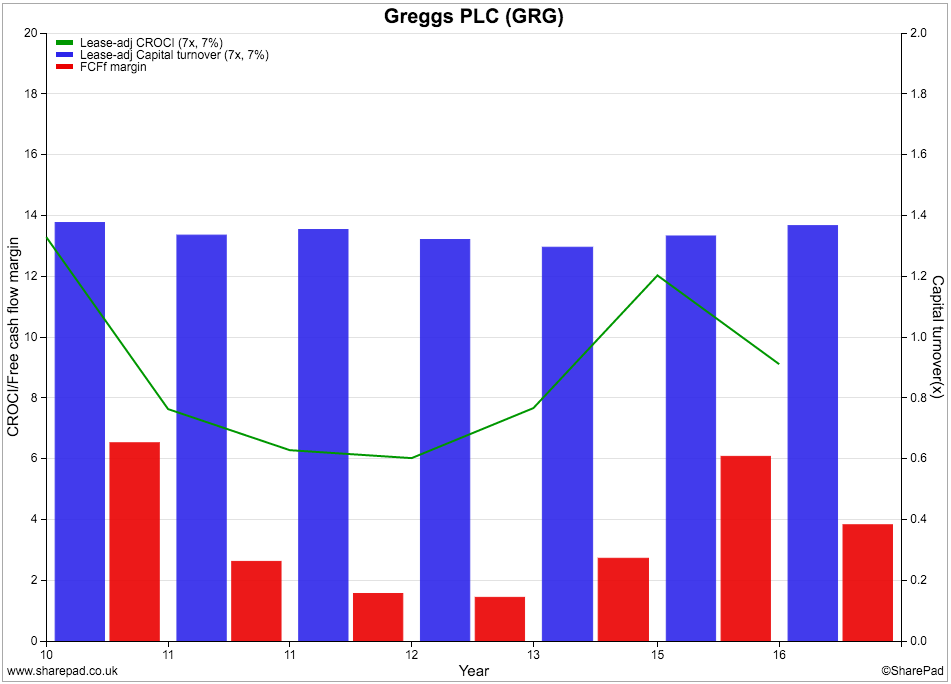

Greggs rents its shops so it is important to look at its financial return by adjusting for this. As usual I have multiplied its annual rent bill by seven to estimate the value of hidden assets and debt to add to capital employed. I have used a 7% interest rate on this estimate to adjust profits. (For more on this important subject click here).

Return on capital employed (ROCE) is a healthy 15.8% and has been rising for the last three years. Free cash flow returns (CROCI) are less impressive at 9.1%.

This might be explained by a period of heavy investment in new assets, but CROCI has been consistently below 10% for the last decade which is my rough and ready benchmark for what I think a high quality business should be capable of.

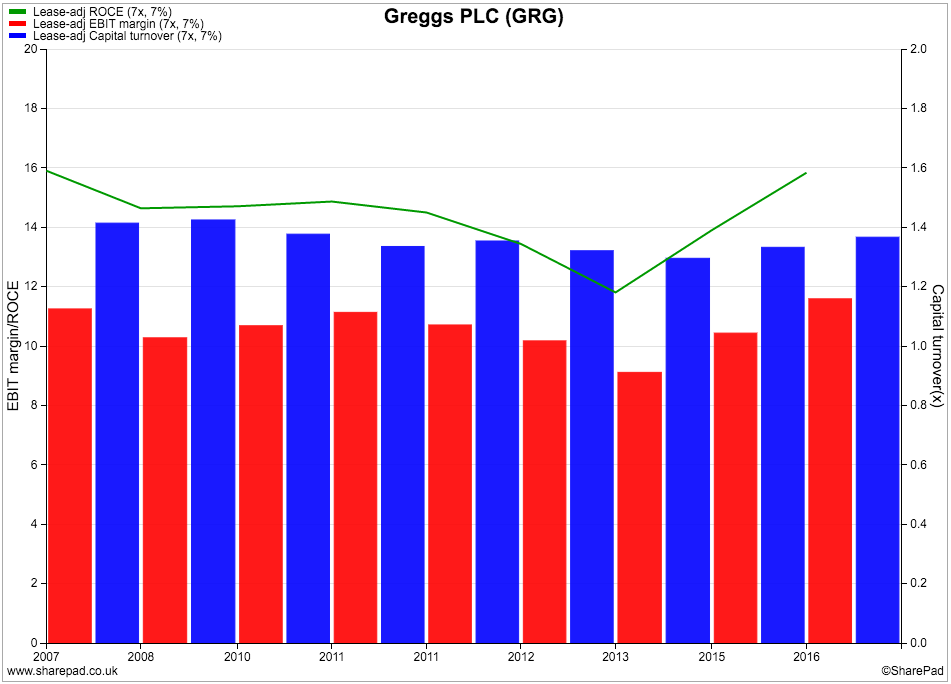

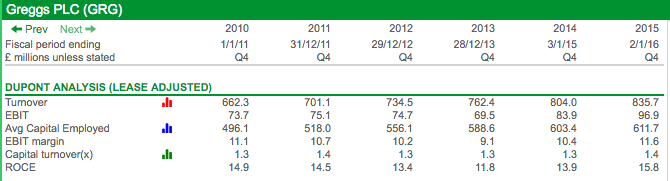

Let's look at Gregg's ROCE in more detail using Dupont analysis (to read more about this click here).

The trend in Greggs' ROCE has changed recently. Capital turnover has remained fairly steady at around 1.3 or 1.4 (£1.30 of sales generated per £1 of capital employed) as capital employed has increased due to the company opening more shops.

However, ROCE declined between 2010 and 2013 as profit margins fell quite sharply. A bigger focus on margins by the management and a helpful fall in the cost of food ingredients has seen margins bounce back during the last couple of years and this has produced a healthy increase in ROCE. Greggs' margins are significantly better than those earned by supermarkets at the moment.

CROCI has been trending downwards as free cash flow margins have fallen. We will take a closer look at Greggs' free cash flow performance next.

Cash flow

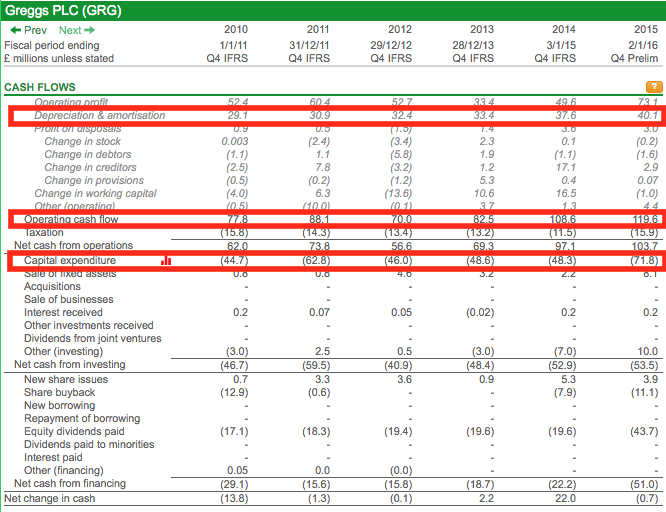

Greggs' cash flow performance can be seen more clearly in its cash flow statement above. I have highlighted the key areas to focus on.

Its operating cash flow performance has improved dramatically since 2013 and is nearly £40m higher. This is an impressive jump driven mainly by the improvements in profitability.

However, more cash is flowing out of the company as well. This is normal for a company that is growing its shop numbers, refurbishing many of its existing ones and spending money on a big revamp of its in-house food manufacturing operations. Capex was just over £71m last year compared with a depreciation and amortisation expense of just over £40m. Capex is expected to be close to £85m in 2016.

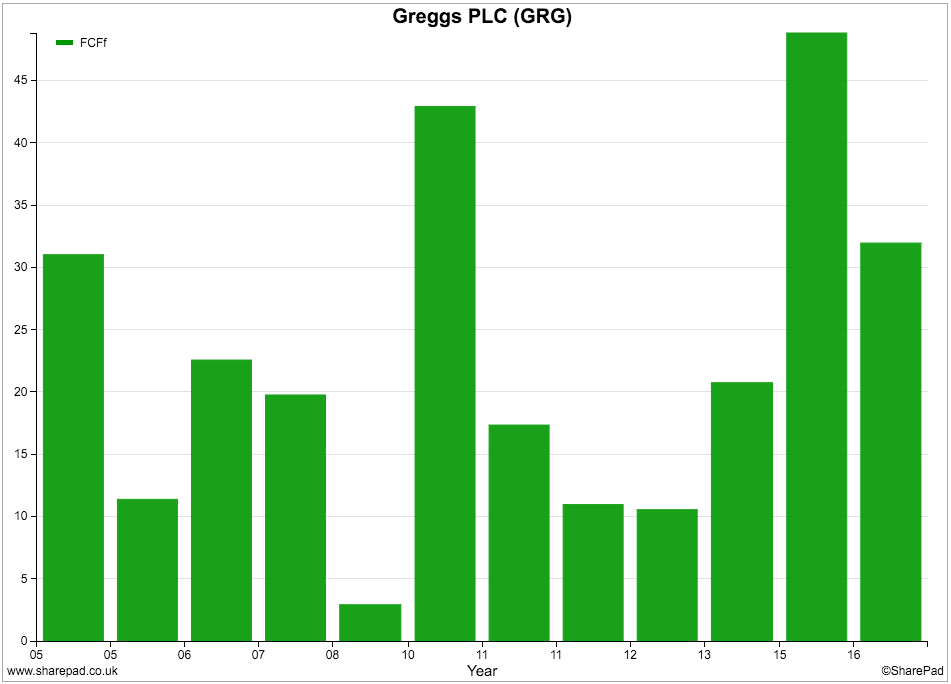

Greggs does consistently generate free cash flow which is always good to see. However, heavy spending on new assets saw a big decline in free cash flow last year and could fall again this year as capex spending increases.

It is no surprise that Greggs' ability to turn its profits into free cash flow has been hampered a little in recent years.

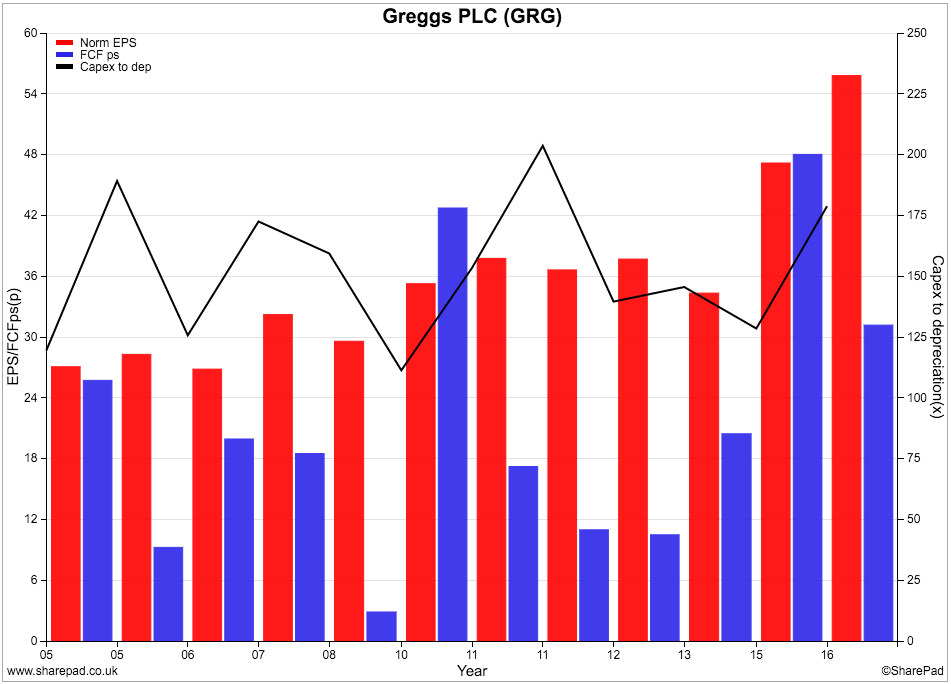

If you look at the chart below, the black line shows that capex has been consistently higher than depreciation. During the last ten years, free cash flow per share (the second or blue bars) has quite often been a lot less than earnings per share (EPS).

Does this mean that Greggs has a problem with profit quality? Not necessarily. Between 2011 and 2014 when free cash flow per share was a long way below EPS this might have been the case. I think this is less of an issue now as profitability has improved.

That said, with the current high levels of spending on new assets, Greggs will be under pressure to make sure that it gets back a healthy cash flow return from this spending in the years ahead.

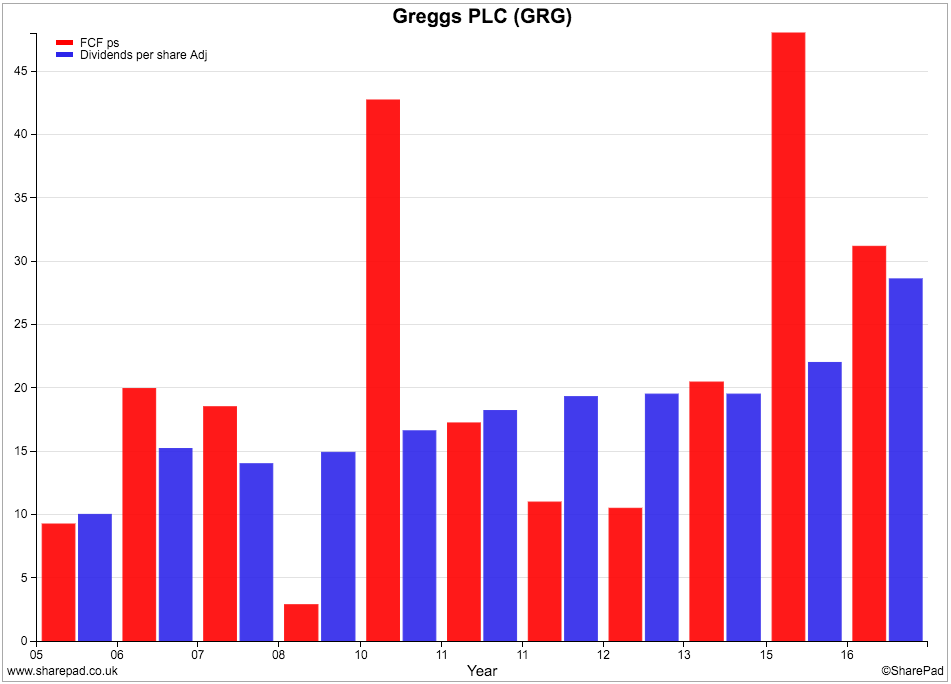

Greggs pays out around a half of its profits as dividends. As you can see from the chart below, the company has a good dividend track record and has had enough free cash flow to pay dividends most years. This is a good sign.

Financial Position

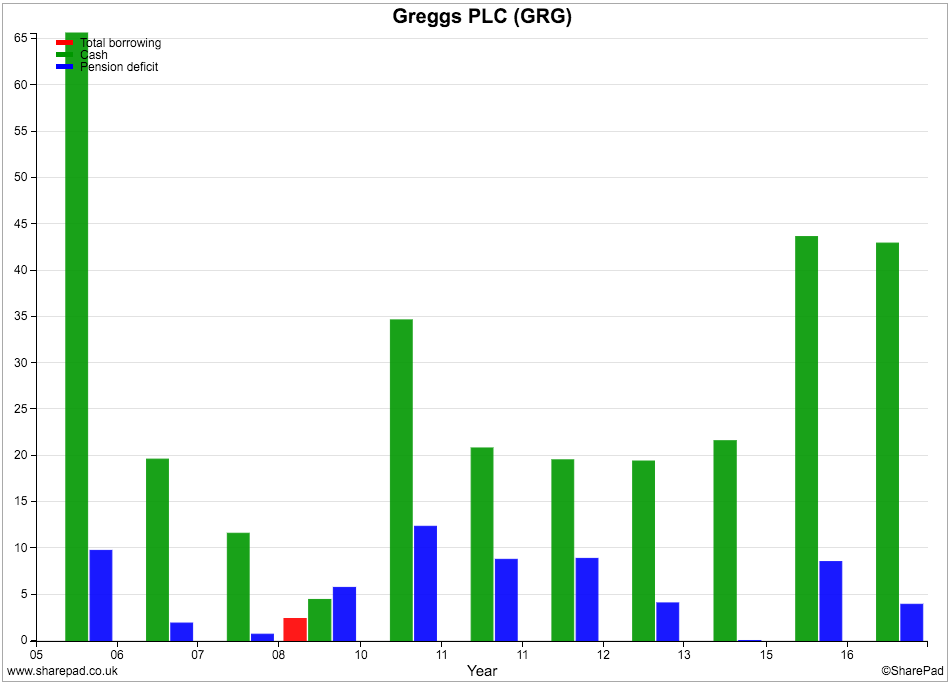

Greggs has a strong financial position. It has no borrowings at all, a final salary pension scheme with a very small deficit and a healthy cash balance.

It is encouraging to read in the company's recent full year results statement that it is taking a very prudent approach to its financing:

"In 2015 the Board reviewed the capital structure of the Group and its distribution policy, taking into account the views of shareholders and advisers. The Board continues to be mindful of the leverage inherent in the Group's predominantly leasehold shop estate (which will in due course appear as part of the balance sheet in line with new accounting requirements) and of working capital requirements. As a result we have concluded that it is not currently appropriate to take on structural debt and we will aim to maintain a year-end net cash position of around GBP40 million to allow for seasonality in our working capital cycle."

Greggs says that it needs £40m of spare cash to finance the day-to-day activities of its business (working capital). This is important because it shows that the £42.9m of cash on its balance sheet cannot be paid out to shareholders. It is being used instead of a bank loan.

Despite high levels of investment in its business, Greggs has said that it will not need to borrow money to pay for it:

"In 2016 we expect that cash flows will be sufficient to meet the Group's investment plans whilst maintaining a year-end net cash position in line with our stated target."

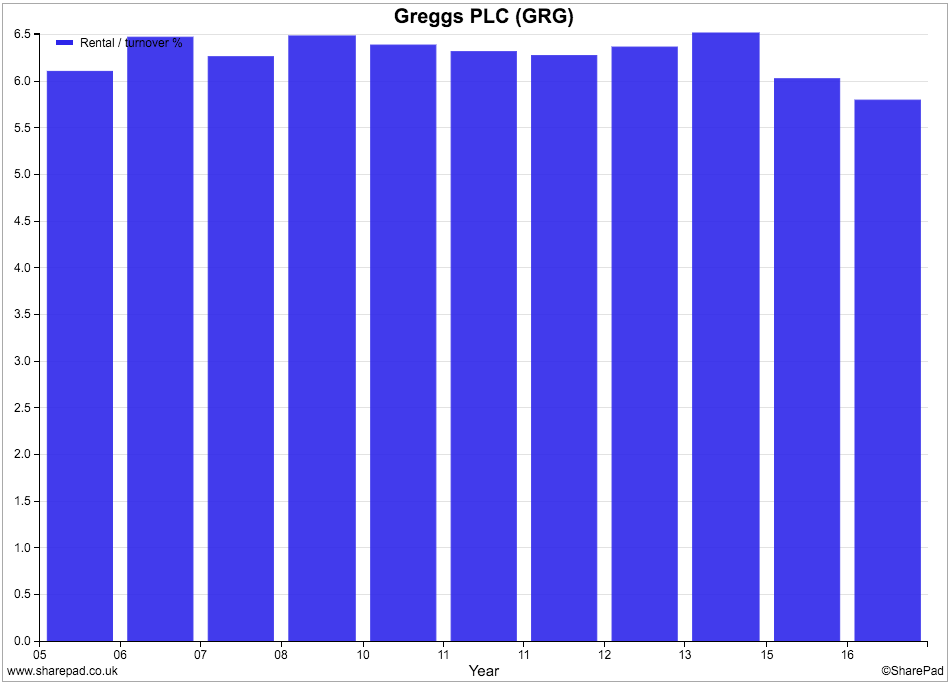

Greggs has an annual rent bill of just over £48m or just under 6% of sales. It is encouraging to see that rents as a percentage of turnover has been falling recently.

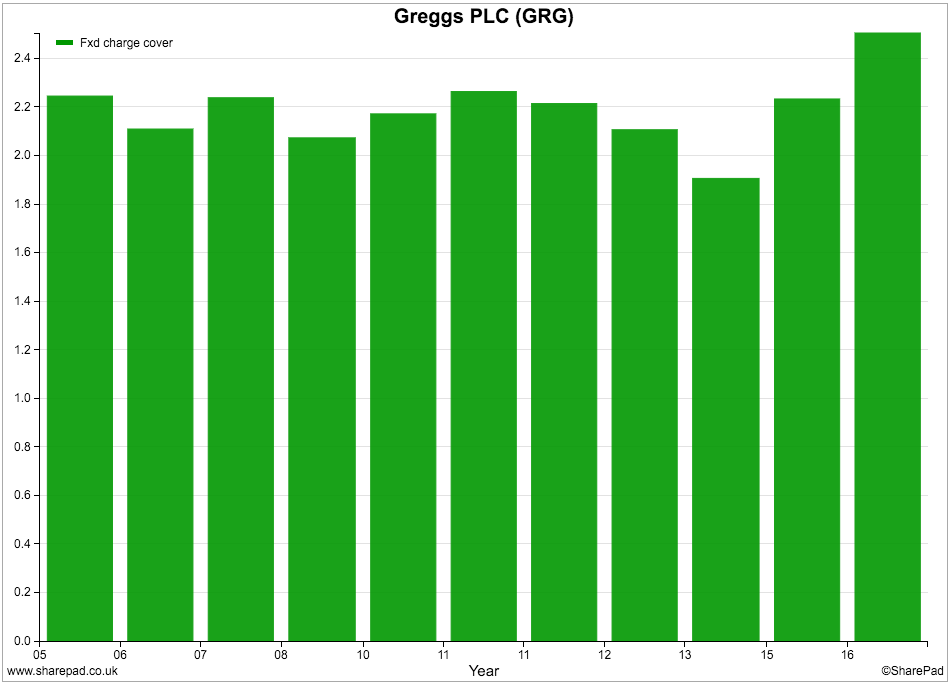

When you are looking at a company with a big rent bill then you should pay close attention to its fixed charge cover ratio. This looks at how many times a company's trading profits can pay the annual rent bill as well as any interest on borrowed money.

As a rule of thumb, a fixed charge cover of less than 1.5 is usually a sign that a company's finances are becoming a bit uncomfortable and needs to be watched. Greggs' fixed charge cover is comfortably over 2 further confirming that it has a strong financial position.

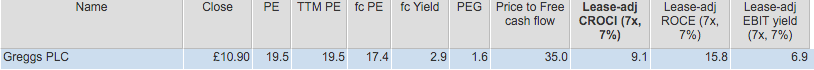

Valuation and future prospects

Greggs strong trading performance has led to a reasonably high valuation being attached to its shares. A forecast PE of 17.4 and a PEG ratio of 1.6 look fair and not too frothy if there is further profits growth in the years ahead. The shares look expensive based on free cash flow.

If we take a further look at analysts' forecasts we can see that they are expecting another year of strong growth in turnover and profits and another decent year to January 2018.

Current trading is good with like-for-like sales during the first 8 weeks of the company's financial year up by 4.2%. With wages growing faster than inflation, consumers have more money in their pockets and this is clearly helpful to Greggs.

Greggs will also keep on benefiting from low food ingredient costs but has decided to give its workers a decent pay rise. Even so, City analysts currently expect profit margins to keep on going up.

Despite a big hike in the recent dividend, analysts are currently predicting continued strong dividend growth. The company has said that it will pay out half its profits. Any surplus cash will be paid out as a special dividend as was the case last year.

Looking further out it seems that there is plenty to be optimistic about. The company is targeting 2000 stores in the UK from the current 1600 which will provide a natural source of growth.

On top of this Greggs is also changing the formats and locations of its stores which has the potential to boost sales and profits. Just over 80% of its shops have been converted to its "food on the go" format which has been producing good returns.

The company is also opening and relocating its shops away from the high street where less people are shopping and towards areas with better prospects such as retail parks, service stations and transport hubs.

Greggs continues to operate in a fiercely competitive market. There is no shortage of places for people to buy their breakfasts and lunches.

However, the company has differentiated itself from the competition by making a lot of its own food in-house (which gives it a cost advantage as well) and preparing fresh food in its shops. It has also been introducing popular new products such as breakfasts, low calorie sandwiches and coffee - all at very competitive prices which are often much cheaper than more up market outlets. This has been a major reason for its past success and gives it a good chance of doing well in the future as well.

To sum up

- Greggs is a very successful business that is doing well.

- ROCE is on an upwards trend driven by higher profit margins

- Free cash flow performance is being held back increasing amounts of investment in the business.

- The company is debt-free and intends to remain so.

- The shares have a reasonably high but not excessive valuation attached to them.

- Analysts expect further strong profits growth for the next couple of years.

- Current trading is good.

- There is scope for growth from growing the number of shops as well as changing the format and locations of existing shops.

- Greggs makes a lot of its own food which gives it a point of difference in a competitive market.

- Its low prices also give it an edge over the competition.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.