When to sell a share

Warren Buffett has said that his ideal holding period for a share is forever. This advice has passed for conventional wisdom over the years and has led to lots of investors trying to copy him.

There's no doubt that investing in good businesses and holding on to them for a long time (known as a buy and hold strategy) has been a great way to make lots of money.

However, very few of us have the same good fortune as Mr Buffett. These days, he makes most of his money from owning businesses outright which means that he gets his hands on all of their profits. He doesn't have to worry about the ups and downs of the stock market much because most of his investment returns are coming from income (profits) - which once received cannot be taken away - rather than rising share prices - which can fall again.

He also doesn't really have to think about selling his investments either. Over time, his investment skill has allowed him to become one of the world's richest men. His Berkshire Hathaway company is so big and has spread its investments across lots of different businesses that a future stock market crash is unlikely to keep him awake at night.

Most people aren't like Warren Buffett.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Why buy and hold might not work

Buying shares and holding on to them can be a very good investing strategy. One of the great things about investing is the power of compound interest. Buying shares in solid companies and reinvesting the dividends received can allow the investor to build up a tidy nest egg (to read more about this strategy click here) - if you have enough time.

Time is the investor's friend. The longer the time you invest, the bigger the effect of compounding shares of good companies with growing profits and dividends. Time is also good at smoothing out the inevitable ups and downs of the stock market (known in financial jargon as volatility).

But investing is rarely as straightforward as this.

Shares are not guaranteed to keep on going up in price and paying bigger dividends. Companies and their industries change. New competition can come along and quickly turn a best-selling product into a white elephant. Profits can and do fall whilst dividends can be cut or scrapped.

Stock markets are also like manic depressives. Up one day and down the next. They reflect the moods of the investing herd and swing between the extreme emotions of fear and greed. This means that shares can become very undervalued and very overvalued.

Very good companies can often see their shares bid up to insanely high valuations because lots of investors like them - especially in a bull market. Yet a great company with its shares trading on thirty times earnings (a PE of 30) can still be a great company when it is trading on a PE of 15. Or it can become a very bad company trading on a PE of 10.

The fact that companies and the valuation of their shares can change means that buy and hold can also be a very bad strategy that leads to you losing money or not making as much as you could have done. Companies that hit trouble might not recover. Share prices can take years to get back to previous highs - if at all.

One of the harshest lessons you can learn in investing is that losses are very hard to recover from. Most of you will know that a share that halves in price has to then double in price just to recover its losses. Good investing starts off by avoiding big losses and that is why you need to try and work out when to sell a share.

Working out your selling strategy

Selling shares at the right time is not easy.

The trouble is we can get too emotionally attached to the shares that we buy and even fall in love with them. This can lead us to be greedy and think that we can always sell out at a higher price. We think of shares that we have previously sold only to kick ourselves as the price continued to soar. Letting go can be a hard thing to do.

Worse than that is that we can hang on to shares for too long hoping that a falling share price will bounce back. When it doesn't it is possible to be left nursing some very painful losses.

You need to be less emotional and more cool headed when it comes to your investments. Shares are not like people. They won't hate you if you decide you don't want them anymore.

Here are some things to consider that might help you decide when to sell a share:

The company's financial performance begins to decline

One of the main reasons for selling a share of a company is because its financial performance starts to get worse. Good companies rarely become bad companies overnight but there are things that you can keep an eye on which might allow you to sell the shares before the price comes crashing down.

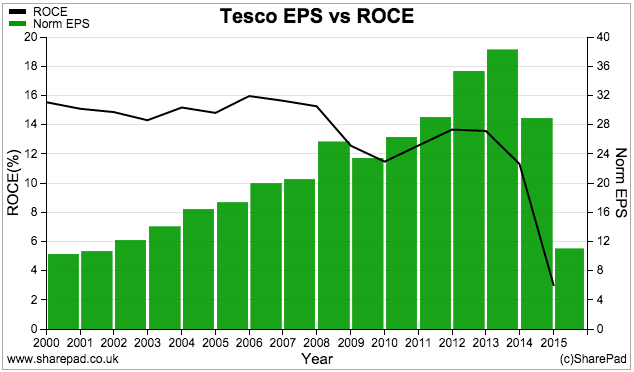

Keep a close watch on the key measures of a company's financial performance such as profit margins, return on capital (ROCE) and free cash flow (the amount of surplus cash a company generates). If these stop rising and start to fall then it could be a sign that the good times might be coming to an end.

For example, Tesco's ROCE peaked and then declined some time before its profits and share price started to fall.

Also look at the rates of growth in sales, profits and cash flow. If growth has slowed dramatically or has stopped altogether this might be a sign to sell out. Pay particular attention to ratios such as dividend cover (is it comfortable or looking stretched?) to get an insight as to whether there will be enough profits - or more importantly cash flow - to pay the dividend and keep it growing in the years ahead.

It's very easy to keep track of these things in ShareScope and SharePad.

Profit warnings

A profit warning is when a company announces that its future profits will be less - sometimes quite a lot less - than investors are currently expecting them to be. Profit warnings usually lead to significant falls in a company's share price.

There's an old saying in the City that profit warnings tend to come in threes. This is often true. In my experience though, there are two types of profit warnings which might require different responses from the investor.

You need to work out if the profit shortfall is just a blip or the beginning of a trend. If it is a blip and the company can recover from it quickly then any share price fall might be a buying opportunity. If it is due to trading conditions getting worse then selling might be a good idea as things often get worse before they get better.

Large acquisitions with debt

From time to time a company will make spend a lot of money buying another company - known as an acquisition. Some commentators will hail it as a deal which will transform the company's fortunes.

This can be true, but it might change things in a bad rather than a good way. Investors should always be wary of companies that regularly buy other ones. It can be a sign that the company is not capable of growing on its own (the financial jargon for this is known as organic growth).

The biggest risk for the buying company's shareholders is that the management pays too much for a company and does it with lots of borrowed money. If the company then hits a rough patch then it may struggle to pay the interest on its debts which means that dividends can shrink and the share price can fall rapidly.

Look at the return on investment the company is getting on its purchase and work out what will happen to key ratios such as financial gearing and interest cover. If the return on investment (profits being bought divided by price paid for the company including the loans taken on) is low (say less than 7-8%) and the finances of the company are stretched then selling the shares might be a good idea. For more on weighing up a takeover, click here.

The valuation of the shares is very high

As I said earlier, popular companies that are growing rapidly can have very high valuations (such as PE ratios) attached to their shares. This is often aided by a bull market for shares in general.

The danger for investors is that shares become very overvalued and can come crashing back to earth when profits stop growing.

Value investors will try to buy shares when they are undervalued and sell when they are fairly valued. They will work out in their minds what a fair value for the shares is and sell when the share price reaches that valuation. They do this before they buy the shares in the first place.

For example, an investor might buy a share on a price to earnings ratio (PE) of 15 thinking that they are worth a PE of 20. When the PE gets to 20 they sell.

Even though they might have made a handsome profit many investors using this kind of approach sell out too early. This is often due to momentum investors (investors who look to make money betting that a recent share price trend will continue) being attracted to the shares whilst they have been going up.

To avoid selling out too early, you might want to consider using some momentum indicators such as moving averages or relative strength (RSI). You then sell when the share price hits your chosen momentum target. You can easily set alarms for momentum indicators in ShareScope or SharePad.

Large share sales by company directors

This is not an automatic sell signal as sometimes directors sell shares for legitimate reasons (such as divorce settlements). That said, directors selling large chunks of shares is hardly a ringing endorsement of the company's valuation and can be seen as a sign that they think the shares are too expensive.

Just as director buying is seen as a positive sign to buy shares, director selling can be a sign for you to do the same. At the very least, news of a director selling should get you to ask some important questions about your investment.

You own too much of a share

Most share investors like to spread their investments across lots of different shares to avoid having all their eggs in one basket (known as diversification). Quite often, they decide not to have more than a certain proportion of their portfolio (say 5% or 10%) invested in one share.

When a share exceeds its target proportion of a portfolio (by going to 7% or 12%) investors will often sell some to reduce it back to its target level. They will then reinvest the proceeds into a share which they still like but has not done as well. This process is known as portfolio rebalancing and can be a good way of selling high and buying low (most investors lose money by buying high and selling low) which can increase the amount of money you can make from your share portfolio.

You've found a better investment

Sometimes you will come across a share that you would like to own but you don't have any spare money. One way to raise the cash to buy the shares it to sell a share or shares that you already own even if there is nothing wrong with them.

You've made a mistake

We are all human and this means we make mistakes from time to time. This is very true when it comes to investing.

Understanding the companies behind the shares in your portfolio is an ongoing process. Occasionally - hopefully not too often - you will find something out about a company that you missed in your initial analysis of it.

This might be something that makes you uneasy about owning the shares (such as a hidden liability or a business where the profits will start falling soon). If this happens it can often be a good thing to admit your mistake and sell the shares. It can save you from a lot of financial pain later on.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.