How to weigh up a takeover bid

Last week oil giant Shell made a takeover bid for BG Group. How many of you were kicking yourself for not buying BG shares recently or selling them too soon? What does this takeover mean if you own shares in Shell? Should you be pleased or worried?

Takeovers are part and parcel of life for companies that are listed on the stock exchange and their investors. They can be fascinating whilst adding a bit of excitement to your investing. At the same they can also be dangerous for your wealth.

Owning a share of a company that gets taken over can be very rewarding. Hopefully you will feel quite happy because the bidder is offering to pay a lot more than the recent share price which represents a full and fair value for the company.

For shareholders of the bidding company things aren't always rosy. Lots of takeovers often fail to make them better off. That's usually because the company doing the bidding pays too much to buy the target and subsequently doesn't make enough profit to justify the price paid.

So how do you weigh up a takeover bid? Here are a few things to think about.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Can you spot a takeover target?

With takeovers, hindsight is a wonderful thing. You look back and often see something that could have highlighted that the company concerned was a sitting duck. In real life though, buying a company in the hope that it will be taken over is not always easy to do. For example, BG Group has been touted as a takeover candidate for the last twenty years. You could have been waiting a long time for another company to turn up and buy it. That said, there are some things you can look out for which can make takeovers more likely.

BG had four things that made it a tempting takeover candidate:

- A low share price

- Problems with its business and management

- Desirable assets

- Strong finances

A low share price and business problems

In many ways trying to spot a takeover candidate is very similar to how some investors look for bargains. It's also easy to forget that companies are essentially investors too. They are looking to get the best returns on their money.

One of the tried and trusted ways to do this is to look for companies that are experiencing some kind of temporary distress that they might be able to recover from. The sharp fall in the price of oil and gas during the last year means that most of the companies that look for and produce it are making a lot less money than they used to.

Take a look at the chart below and you can see the share price of BG (the black or dark line) plotted against the oil price (the blue or lighter line). For much of the last five years there seems to have been a strong relationship between the direction of BG's share price and the direction of the price of oil. You can use these kind of charting tools in SharePad and ShareScope to help you understand why a share price might have behaved in a certain way.

Yet BG's woes are down to a lot more than a falling oil price. Not so long ago, BG was a star of the oil and gas sector and seemed to be able to grow its profits rapidly. Then it hit a sticky patch and stopped growing. It's highly regarded chief executive left the company whilst his replacement struggled to get to grips with the business. Throw in a falling oil price and BG's share price fell from nearly £16 to under £7 in just a few years - low enough to attract the attention of other oil and gas companies.

Desirable assets

BG's share price had become distressed. But this was not enough on its own to make it a takeover target. Lots of things can fall in price but that doesn't mean they are necessarily good value, particularly if the company's assets are of poor quality. What makes BG different is that it has assets - such as big oil fields in Brazil and a world leading liquefied natural gas (LNG) business - which other companies would like to get their hands on. The sharp fall in the BG share price has now put these assets on sale at a tempting price for the likes of Shell. If the oil price recovers, Shell may be getting a very good deal (more on this in a minute)

Strong finances

The other thing that BG had which helped to make it a takeover target was strong finances. It doesn't have a lot of debt and can pay its interest bills easily (you can check all this out very easily in SharePad and ShareScope). This makes it an easier takeover target because the bidding company can use BG's profits to pay the extra interest on any debt it uses to buy the company. If BG already had lots of debt then this would be more difficult. In fact, some companies can take on debt to protect them from being taken over by borrowing money to pay a special dividend or buying back lots of shares.

Is it a good deal for the buying company?

If you own shares in the company being bid for whether you are happy largely depends on the price being offered. The same is true for the shareholders of the bidding company but in a slightly different way.

The reason why lots of takeovers fail to enrich the bidding company's shareholders is because the price paid for the takeover is too high. How do you go about working out whether the price paid is too much or a good deal?

Often companies will talk about the impact on earnings per share (EPS) for the next few years. They might say that the takeover will increase EPS immediately or it will take three years. Clearly, the longer it takes the more expensive the takeover has probably been.

In my opinion, EPS is a very crude measure of company performance. With the cost of borrowed money being very low these days, buying companies with debt is an easy way to enhance EPS (the return on investment has to be higher than the interest rate on borrowed money). There is a better way to work out whether a company is getting a good deal.

You should calculate the return on investment of the takeover. The company announcement should give you lots of details of the numbers involved whilst some of the other numbers can be found in SharePad/ShareScope.

Here's how you go about working it out:

| ROI of Shell buying BG | ||

|---|---|---|

| Cash (p) | 383 | Cash per BG share offered |

| 0.4454 Shell shares (p) | 917.524 | Value per BG share based on Shell share price of 2060p |

| Takeover price (p) | 1300.524 | Cash and share values added together |

| BG Shares in issue (m) | 3414.4 | Taken from SharePad |

| Market Cap (£m) | 44405 | Takeover price multiplied by the total number of BG shares |

| Net debt (£m) | 7846 | BG's 2014 net debt taken from SharePad |

| EV paid (£m) | 52251 | The takeover market cap plus net debt - the total buying price of BG |

| 2015F EBIT (£m) | 1985 | Taken from SharePad |

| ROI | 3.80% | EBIT/Takeover EV |

| Savings (£) | 1712 | $2.5bn of cost savings at a $/£ ER of $1.46 |

| Adj EBIT | 3697 | 2015F EBIT plus cost savings |

| Adj ROI | 7.10% | Adj EBIT/Takeover EV paid |

You can use this type of calculation to weigh up any takeover. What you are essentially doing is looking at the profits being bought as a percentage of the price paid for the whole business (its enterprise value). This is exactly the same calculation used for an earnings yield (EBIT/EV) in ShareScope/SharePad and one that has been used by investors such as Joel Greenblatt in his magic formula for picking winning shares.

What you can see is that the takeover value at the time of writing is 1300p. This values all the outstanding BG shares at £44.4bn. If we add the £7.8bn of net debt then the total price being offered for the whole business is £52.2bn.

But what is Shell getting back in return for this outlay? When looking at enterprise values you need to consider the right profit measure to compare with it. In this case it is EBIT (the pre-tax profits available to pay interest on debt and shareholders). From SharePad, we can see that the expected EBIT for BG in 2015 is £1.5bn giving a return on investment of just 3.8%.

However, Shell reckons that there are cost savings of $2.5bn (£1.7bn at a $/£ of $1.46). If we add these on to the £1.5bn then we get potential profits of £3.7bn and a return on investment of 7.1%.

That doesn't look too appealing to me. So why is Shell offering 1300p per share?

If you go into SharePad and look at BG's financial history you can see that in better times it made EBIT of over £5bn. If the oil price recovers back to the levels seen in recent years then perhaps BG can make £5bn again. Throw in £1.7bn of extra profit from cost savings and Shell could get a return on investment of 12.8% which would be more acceptable to its shareholders. But will oil prices recover?

| ROI on BG with a profit recovery | |

|---|---|

| EBIT (£m) | 6700 |

| EV paid (£m) | 52251 |

| ROI | 12.82% |

Takeovers and the potential for a trading profits

Whenever you see a takeover deal that involves a mixture of cash and shares then sometimes there is potential to make a profit even if you don't own the shares of the company being taken over - yet.

Let me explain how this can happen. Let's look at the Shell offer for BG. It is based on 383p in cash and 0.4454 Shell shares for each BG share. With a Shell share price of 2060p this values BG shares at 1300p each.

| Cash (p) | 383 | Cash per BG share offered |

| 0.4454 Shell shares (p) | 917.5 | Value per BG share based on Shell share price of 2060p |

| Takeover price (p) | 1300.5 | Cash and share values added together |

Yet BG shares are trading at 1174p. Why is this? Perhaps people believe that the deal won't happen. Or perhaps the share price of Shell will fall because the oil price won't recover?

However, if the deal does go through and the Shell share price stays at 2060p or higher, a short-term trader buying BG shares could make a reasonable profit by buying at 1174p and selling for 1300p. Remember to do your own research before contemplating something like this.

Looking for bargains elsewhere in the oil sector

Will other oil companies be taken over and how do you identify possible candidates?

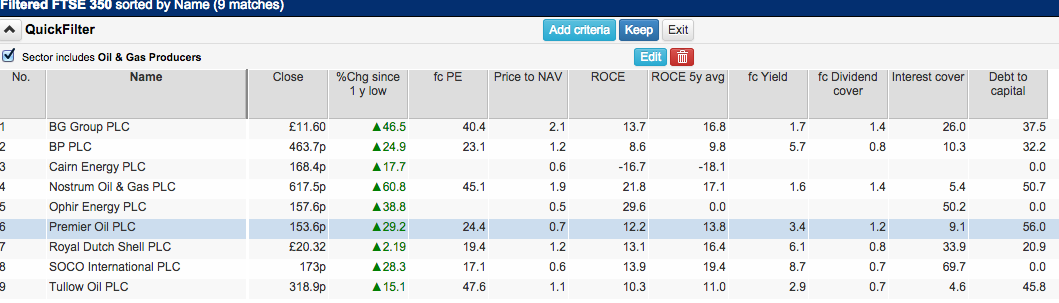

In SharePad and ShareScope, you can set up a filter to look at a sector. Below, you can see I've asked SharePad to look at the oil and gas producers in the FTSE 350. I've then added various columns to see how distressed the companies are and what kind of state their finances are in.

You can see that many shares are comfortably above their one year lows. What is also striking is that the forecast dividend cover of many shares is less than one suggesting that the dividends may not be safe.

PE ratios are high because profits (EPS) are low but some shares are trading below their net asset values (price to NAV of less than one). You can also look at their financial positions (interest cover and debt to capital) and compare the current return on capital (ROCE) versus the five year average.

If I was looking at this sector in SharePad/ShareScope and trying to make sense of the huge amount of financial information available, I would be focusing my attention on some particular numbers for takeover candidates. First and foremost, I would want to see a sound financial position with low levels of debt and high levels of interest cover. I'd look at the five year average return on capital employed (ROCE) to give me an insight into what levels of profit could be made if oil and gas prices recover and business conditions become more favourable. I'd probably pay more attention to asset values than profits when it came to valuing the businesses and so would look for a low Price to NAV in preference to a low PE ratio.

This is the kind of analysis that you can quickly do in ShareScope and SharePad to help generate possible investment ideas. I always take a look at a company's annual report to get a good understanding of the business.

When it comes to oil and gas producers there are other things that you can do as well - such as comparing the enterprise value of companies with their reserves of oil and gas.

| Name | Enterprise value ($) | Reserves (boe) millions | EV/boe ($) |

|---|---|---|---|

| BG Group PLC | 66131 | 5920 | 11.17 |

| BP PLC | 140176 | 17523 | 8 |

| Cairn Energy PLC | 870 | 56.1 | 15.5 |

| Nostrum Oil & Gas PLC | 2076 | 571.1 | 3.64 |

| Ophir Energy PLC | 1087 | N/a | |

| Premier Oil PLC | 2500 | 243.3 | 10.28 |

| Royal Dutch Shell PLC | 203730 | 13790 | 14.77 |

| SOCO International PLC | 764 | 40.8 | 18.73 |

| Tullow Oil PLC | 6251 | 345.3 | 18.1 |

Oil is priced in dollars. So it makes sense to get the market value of a company in dollars. SharePad gives you the option of calculating a company's enterprise value in dollars automatically which is very useful.

I've done this for FTSE 350 oil and gas producers and then exported the list to a spreadsheet. I've then taken their oil and gas reserves (boe - barrels of oil equivalent) from their annual reports and asked the spreadsheet to calculate the enterprise value per barrel of oil of reserves (Ev/boe).

To be conservative you might want to focus on proved and probable reserves (sometimes known as "2P" reserves). These figures might be given for you or you might have to work them out yourself. To convert gas reserves - which are usually quoted in billion cubic feet (bcf) - to barrels of oil equivalent you multiply the gas number by 0.19.

This is a measure used by some professional analysts to look at the value of oil explorers and producers. It can be quite useful given that the low oil price may mean that it is cheaper for companies to buy oil reserves on the stock exchange rather than incur the costs and risks of looking for it themselves. Be careful with this measure though. An enterprise value may relate to other businesses and not just oil reserves, whilst some oil reserves are better quality and easier and cheaper to get out of the ground than others.

That said, it's something that you could look at over time or compare with previous prices paid in oil and gas takeovers.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.