How to be a dividend investor

If you are a short-term trader in the stock market then you are probably not too bothered about the dividends from shares. Your focus is on selling a share for more than you paid for it. But if you are looking to build up your wealth over a long period of time then dividends could be very important to your financial well-being.

In this article, I'm going to show you why dividends matter and how you can use them as a strategy to build yourself a nest egg. Then I'll show you how you can look for reliable dividend paying shares in ShareScope.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

What are dividends?

Dividends are your share of a company's after-tax profits paid to you each year.

I'm a big fan of them. I like dividends because they represent a real, tangible return on the shares that I own. Once a dividend has been paid, it cannot be taken away from you. The same cannot be said for a rising share price. Share prices tend to move up and down a lot and there's no guarantee that you will sell for a profit - at least in the short term.

Yet I think too many people are obsessed with the short term changes in the value of their investments. The evening news always talks about what level the FTSE 100 ended the day at. Very rarely is there a mention of the dividends that are paid. This is despite the fact that the dividends from shares and the reinvestment of them is where the real money can be made from the stock market over the long haul.

Why is this?

Dividends and the magic of compound interest

I've never been able to find the source, but Albert Einstein was rumoured to have said that "the most powerful force in the world is compound interest". When it comes to investing - and dividend investing in particular - I'm inclined to agree with him.

Compound interest is essentially earning interest on the interest that you've already been paid.

You can use this strategy to very good effect with dividend paying shares. Instead of spending the dividend you receive, you use it to buy more shares in the company which paid you it, which in turn gives you more dividends in the years ahead. Repeat this process for long enough - the longer the better - and it is possible to turn a small initial sum of money into a large one. This can be the case even if dividends per share or the share price do not change.

Let me show you how this can work.

Let's say that you buy 1000 shares in a company called Bob's Book Stores plc at 100p per share (so an investment of £1,000) when it is paying an annual dividend per share of 4p. Over the next thirty years dividends stay at 4p per share and the share price stays at 100p. If you had kept your 1000 shares you would have received an annual dividend income of £40 (1000 x 4p) or £1200 over thirty years. With your 1000 shares still worth £1000, your investment value would be £2200.

But if you had reinvested the dividends and bought extra shares (To keep things simple, I've ignored the impact of broking commissions and buying whole shares here) each year you'd have ended up with a much better result. At the end of thirty years you would own 3243 shares worth £3243 and have an annual dividend income of £125. This equates to a yield on initial cost of 12.5% (£125/£1000).

An investment of £1,000 in Bob's Book Stores over 30 years:

| Left alone | With dividends reinvested | |

|---|---|---|

| Value of shares | £1,000 | £3,243 |

| Income Received | £1,200 | N/A |

| Investment value | £2,200 | £3,243 |

| Annual income in year 30 | £40 | £125 |

| Yield on cost | 4.00% | 12.50% |

That said, if you pick the right investments you'll find that dividends don't stay flat for thirty years - they can often increase substantially. This makes dividend reinvestment and the power of compound interest even more attractive.

Dividend re-investment in the real world and total returns

Theory is all well and good, but what about what happens in the real world?

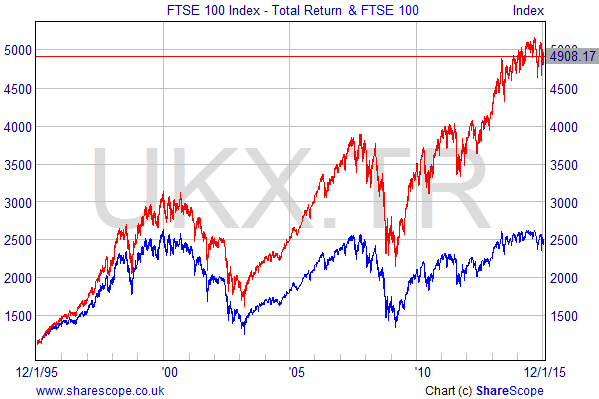

If you look at the chart above, it compares the value of the FTSE 100 total return index (the higher or red line which includes the effect of reinvested dividends) with the price value of the FTSE 100 over the last twenty years (the lower or blue line).

What you will notice is that the chart value of the FTSE 100 isn't the same as its actual value. Don't worry about this. When ShareScope charts two indices against each other, the second index (in this case the FTSE 100) is rebased to the value of the first one (the FTSE 100 total return index) The starting value for both indices in this chart is 1159.

You can now see that the total return index is worth almost twice as much as the FTSE 100 price index which in itself has more than doubled. This is important as it should make you look at investment results in a different way. Investing in shares is not just about the changes in share prices. On that basis, you might think that the FTSE 100 index - which has grown at an average of 3.9% over the last 20 years - has been a fairly disappointing investment.

However, the point I want to get across is that dividends matter and can make up a large chunk of the returns that you get from owning shares. When you look at the impact of reinvesting dividends, the FTSE 100 total return index has grown at an average rate of 7.5% a year which is a lot more respectable.

Dividend re-investment with individual companies

Buy the right share at the right time and you can see spectacular results. Take British American Tobacco (LSE:BATS) for example. Let's say you bought 1,000 shares of this company on the first trading day of 2000 for 332.5p (an investment of £3325 excluding stamp duty and dealing costs) when it was paying an annual dividend of 22.2p (or a dividend yield of 6.7%). Just over fifteen years later, the shares are priced at 3522p and are paying an annual dividend of 144.9p. Most people would be quite happy.

Even if they had spent their annual dividend income, their investment would have increased in value more than tenfold to £35,220. The dividend income as a percentage of the original price paid (144.9p/332.5p) -or the yield on cost - would be an impressive 43.6%.

But say you'd reinvested your dividend income every year and bought more shares with it. Your investment would have soared in value to £69,335 with an annual dividend income of £2753.64 - or a yield on cost of 82.9%.

An investment of 1,000 shares in British American Tobacco since January 2000:

| Left alone | With dividends reinvested | |

|---|---|---|

| Value of shares | £35,220 | £69,335 |

| Income Received | £1,112.60 | N/A |

| Investment value | £36,332.60 | £69,335 |

| Annual income now | £1,449 | £2,753.64 |

| Yield on cost | 43.60% | 82.90% |

Of course, hindsight is a wonderful thing but this example does highlight three very important rules of a successful dividend re-investment strategy:

- It helps to buy shares at cheap price. Back in 2000, companies like BAT were out of favour as lots of people piled into glamorous internet and technology shares. With a dividend yield of 6.7%, the shares looked - and turned out to be - very cheap given that the business was not in trouble and had been increasing its dividend in recent years.

- The importance of dividend growth. Your returns can be turbo-charged if the company is capable of delivering high rates of dividend growth. BAT's annual dividend growth over the last 15 years has averaged 13.3%.

- The power of time. The longer you invest for, the greater the power of compounding on your investment returns.

The emotional benefits of dividend re-investment

I really like this style of investing and use it myself for my share portfolio. What's particularly good about it is that you focus your attentions on the performance of the company and its ability to keep paying a growing dividend rather than what's happening to the share price. The bigger the amount of your investment return that comes from dividends and their reinvestment, the less you tend to worry about share prices.

In fact, with this investment strategy you can actually welcome falling share prices. As long as the underlying business is sound, a falling share price allows your dividend to buy more new shares which means more dividends and potentially boost your long term returns. With this mind-set, you worry less and concentrate on what's important rather than the short-term whims of the stock market. To me this is proper investing and more people would be better off - financially and emotionally - if they put their money to work this way.

Looking for reliable dividend payers with ShareScope

ShareScope can help you look for potentially attractive dividend paying shares. You can do this quite easily using the Data Mining tool. You can access this by clicking on the Data Mining button (denoted by a pick-axe and shovel) at the top of the screen.

I'm going to use this tool to build a list of dividend candidates in the FTSE 350 - the kind of shares that many stockbrokers will offer an automatic dividend reinvestment service for.

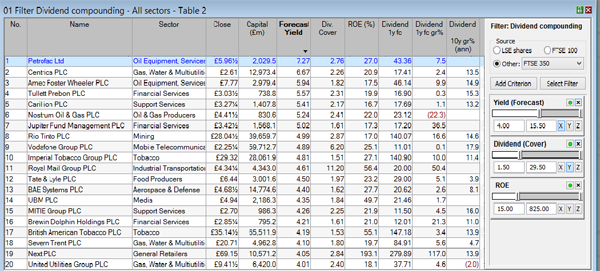

You can see my results in the table:

How to build this table

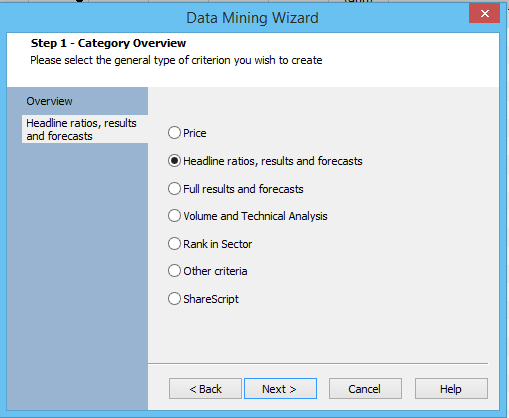

When you click on the Data Mining icon you will be presented with a table. To build a stock screen in it you need to do the following:

- Click on Select Filter and then select New filter. Give your filter a name. I've called this one Dividend compounding.

- Back in the table, go to Source, Other and click on the drop down menu and select FTSE 350. This now sets up your filter to select shares that meet your criteria which are in the FTSE 350 index.

- Now you are ready to set up your filters. Click on Add Criterion and you will be presented with a wizard that looks like this:

Let's say we want to look for shares with a forecast dividend yield of more than 4%. To do this click on Headline ratios, results and forecasts and then click Next. Then select: Yield, Forecast, Result, Finish. You will then see a Yield (Forecast) box on the right hand side of your screen.

- Now set the forecast dividend yield criteria you want. I've set a minimum of 4% here.

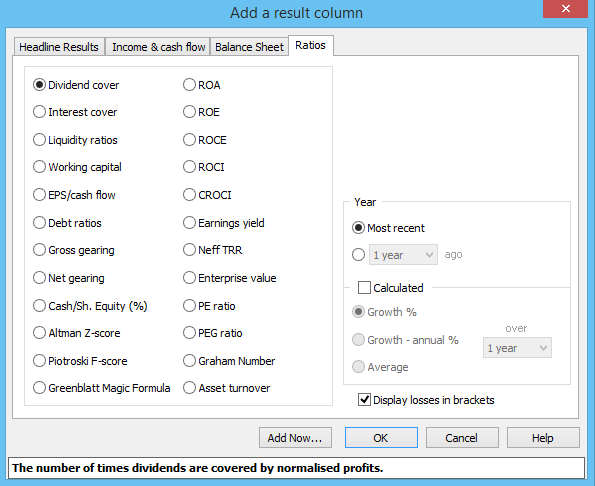

- I then set another couple of criteria. To do this I follow the same process in the Data Mining wizard. I want to see if a company is profitable enough to pay its dividend so I set a criterion for dividend cover (which is a company's earnings per share divided by its dividend per share). I've set this at a minimum value of 1.5 - in other words earnings per share are at least 1.5 times the size of the dividend per share. You can set this up in the Data Mining wizard by clicking Add Criterion, Headline ratios, results and forecasts, Dividend, Cover, Finish. Then set your range in the box.

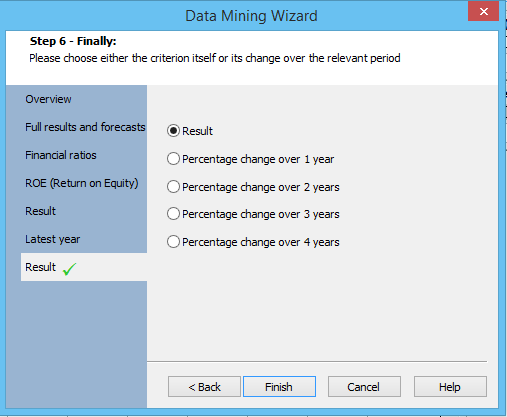

I've also decided that I want some kind of way to filter out bad companies. There are a few ways you can do this but I've chosen return on equity (ROE). This looks at a company's post tax profit as a percentage of the money shareholders have invested in the business. It's a measure of how productive a company is. I've set a minimum of 15% which can be a sign of a reasonable business. The steps are shown in the box below:

You will now have a table of shares that meet your screening criteria. However, what you won't have is the data for the criteria in the table. You can get this by right clicking your mouse in the column headings section of your table and then selecting Add General column or Add Result column.

- Add General column, Yield Forecast

- Add Results column, Ratios, Dividend cover

- Add Results column, Ratios, ROE

Adding a results column is a useful way to look for other indicators that are not in the Data Mining wizard. For this screen on dividend shares, I would also like to know things such as the forecast dividend growth for the companies in the screen and how good they have been at growing their dividends in the past. ShareScope can easily do this.

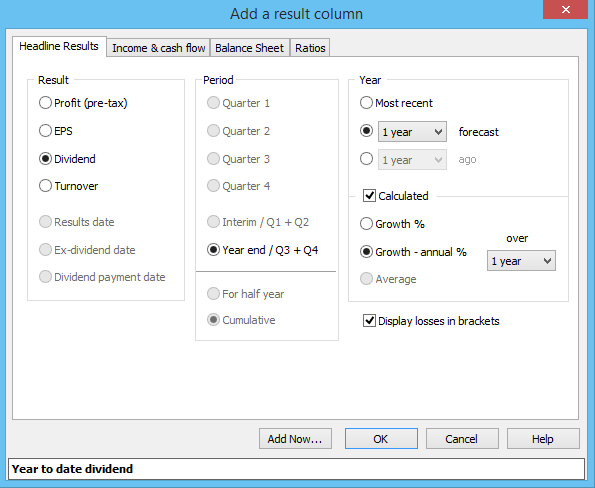

To see the forecast dividend growth follow the steps shown in the box below:

What you should be looking for here is a company that is capable of offering you a growing dividend. I probably wouldn't consider anything less than 3% forecast growth and would avoid any company that has cut its dividend.

A company with a good track record of dividend growth is usually a good sign. Companies that have cut their dividends in the past might do so again so you might want to think carefully before buying their shares. A low rate of past dividend growth might be another warning sign. It might indicate that the company's fortunes are not as good as they were

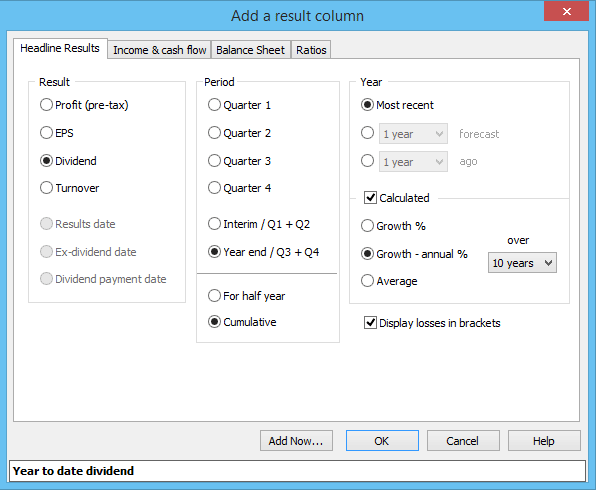

You can check for this in ShareScope as well. I have asked ShareScope to calculate the average annual rate of dividend growth over the last ten years as shown below:

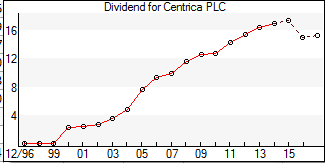

You can easily check the dividend history of a share in ShareScope. A quick and simple way to do this is to point your cursor over the specific company's dividend in your table and you will get a pop-up chart of its dividend history and any forecasts. Here's one for Centrica plc:

Alternatively, in a table you can right mouse click on the share that you are interested in and select Share's Dividend history or press Shift + D on your keyboard.

Other things to consider

- You don't have to base this strategy on shares with above average dividend yields. Companies with low yields currently that are paying out a low proportion of their profits (they have high rates of dividend cover) but are growing quickly can also be candidates for a strategy of dividend reinvestment.

- As with any screen, it should only be a stepping stone in your investment process. Always do your own research before buying a share.

- Be aware that some analyst forecasts may contain special dividends in addition to yearly ones.

If you have any problems following my instructions in ShareScope, please call the Support team and they will show you the way.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.