Stock Watch: BT

Shares of UK telecom giant BT (LSE:BT.A) have been a good home for investors' money over the last five years. The company has squared up to its competitors and more than held its own.

But is everything in BT's garden still rosy? I've opened up SharePad to have a closer look at the company.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

A closer look at BT's financial performance

When I begin analysing a company as a potential investment I am essentially trying to answer three key questions when looking at its finances:

- Is it a good business?

- Is it safe?

- Is it cheap enough?

To me, this is where the private investor should be focusing their attention. With a few key ratios, it is possible to get the answers to these questions fairly quickly.

Is BT a good business?

There is no universally accepted definition of what makes a good business but for me I am looking for a company to pass two tests. First, I want it to make consistently good - the higher the better - returns on the money it invests. Second, I want to see lots of surplus or free cash flow.

Let's see how BT stacks up on these measures.

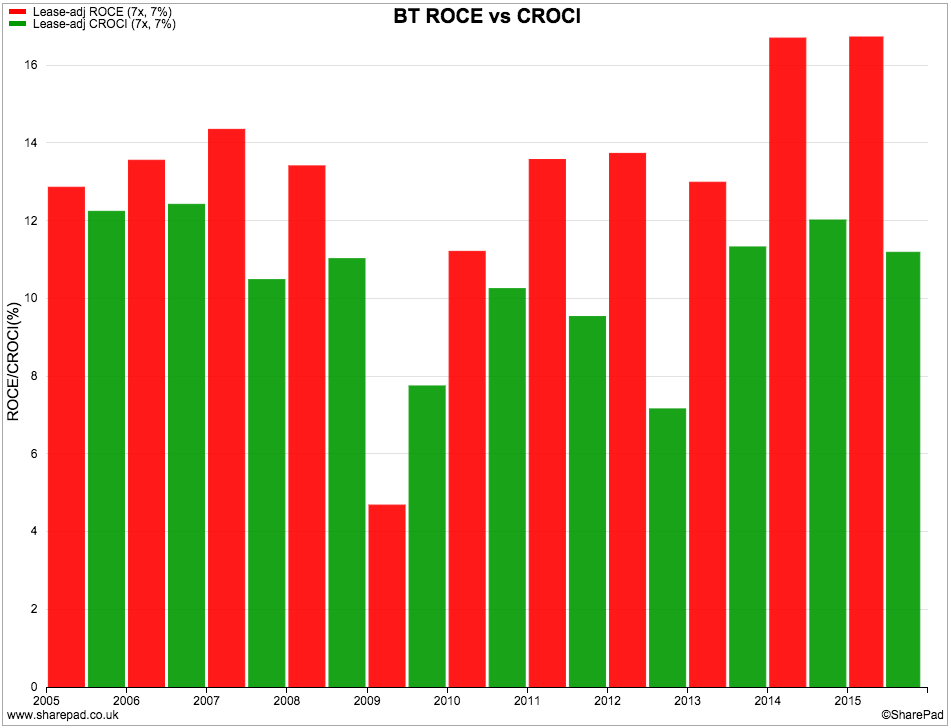

On the chart below, the red bars show BT's return on capital employed (ROCE) and the green bars show free cash return on capital employed (CROCI) over the last ten years. If you can't see the colours, ROCE is the first bar in each pair. Both measures have been adjusted for hidden debts or leases. (For more on this subject click here).

With the exception of a slump during 2008/09, BT's performance on these measures looks pretty decent. During the last three years there has been a spike upwards in returns. With ROCE over 16% BT has the hallmark of a very good company if it can sustain these returns.

CROCI is telling us that BT produces plenty of free cash flow as well which is a good sign. BT's CROCI of over 10% is also a good performance. More on this in a short while.

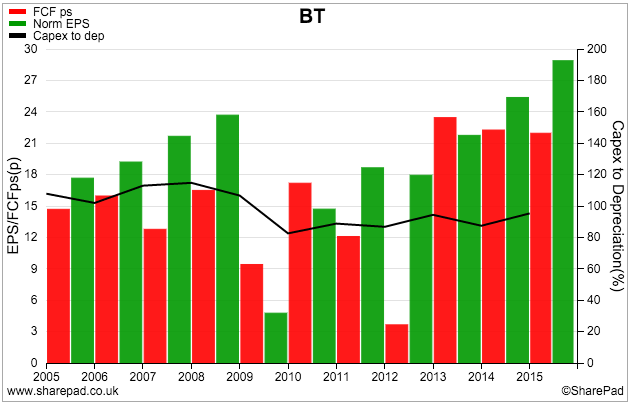

The ability to convert profits into free cash flow is a key test of profit quality and tells you a lot about whether any dividend payouts are sustainable or not. BT seems to be doing a good job of turning its profits (as measured by its earnings per share or EPS) into free cash flow in recent years as shown by the chart below.

A key influence on a company's free cash flow is how much it is spending on new assets or capital expenditure (capex for short) compared with what it needs to spend to maintain the value of its assets (depreciation). This is shown by the black line in the chart above.

As you can see, BT has been spending slightly less than its depreciation charge in recent years which has been helpful to its cash flows. It does beg the question as to whether BT is under-investing? It could also be a sign that its depreciation charge is very prudent and that its profits are conservatively accounted for.

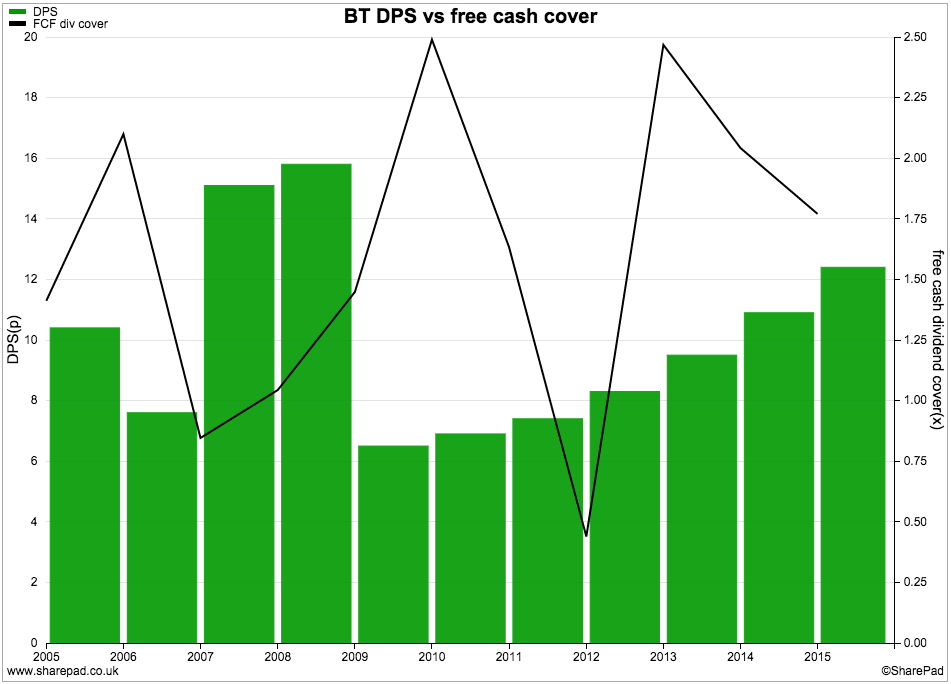

Either way, BT's free cash flow performance has allowed it to pay a growing dividend since 2009. That said, long-term investors in the shares have yet to see their dividend return to 2008 levels when it was cut during a difficult time for the company.

The good news is that BT's current dividend payment is comfortably covered by its free cash flow. This probably explains why BT is confident that it can increase the 2015/16 dividend by 10-15%.

Safety checks

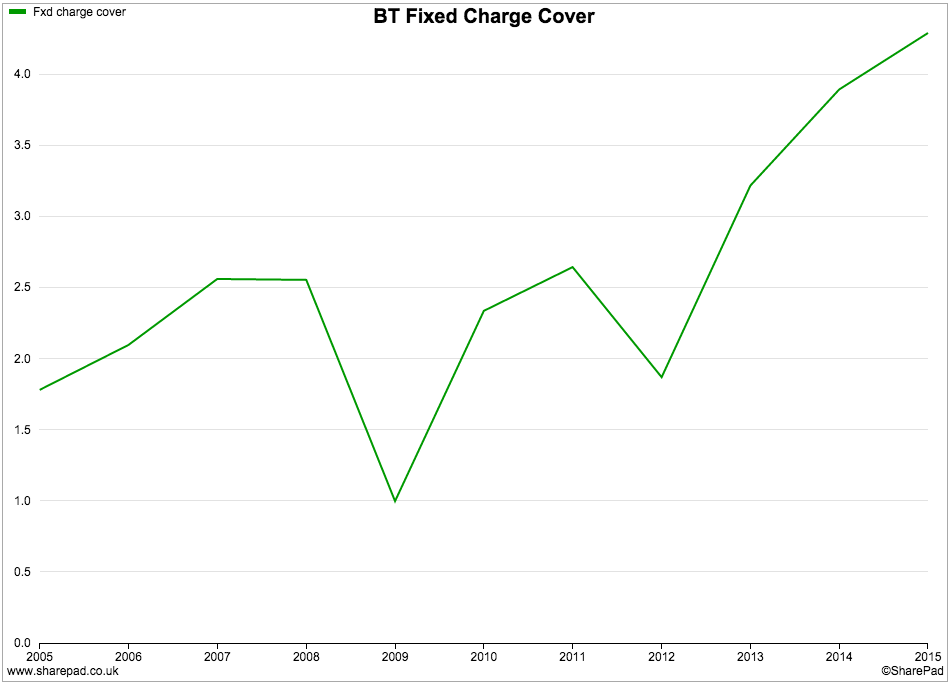

To check out how safe a company is, my go-to ratio is fixed charge cover. This looks at how many times a company's trading profits (or EBIT) can cover the interest payments on any debts and the rental payments on any leased assets.

BT's fixed charge cover is currently over four times and trending upwards. This is a good sign that the company has a strong financial position and that shareholders can sleep soundly in their beds for now.

BT's Pension fund black hole

Pension fund shortfalls or deficits are often ignored by investors. When times are good they are swept under the carpet only to become a focus of attention when the company's fortunes take a downwards turn.

You should not ignore a large pension fund deficit. BT's at over £7 billion is one of the largest out there amongst stock exchange quoted companies. BT has promised to pay thousands of its mainly former employees a pension based on their final salary for the rest of their lives. This is a real liability that has to be made good.

BT's liability to pay pensions in today's money is over £50bn or £7.5bn more than the value of all the assets in its final salary pension scheme. BT paid £876m of top up payments into the scheme in 2015 and has paid a further £625m this year in order to try and bring the deficit down.

Fortunately for BT's shareholders, the company has enough cash flow at the moment to make these payments and still pay a growing dividend. However, if the deficit gets bigger or cash flows get smaller then BT's dividend could be under threat. That's because the pension fund ranks ahead of shareholders to get its hands on the company's free cash flow. Investors need to be mindful of this fact.

How are BT's main businesses doing?

BT's business is split up into four main trading divisions. Let's take a look at them in more detail.

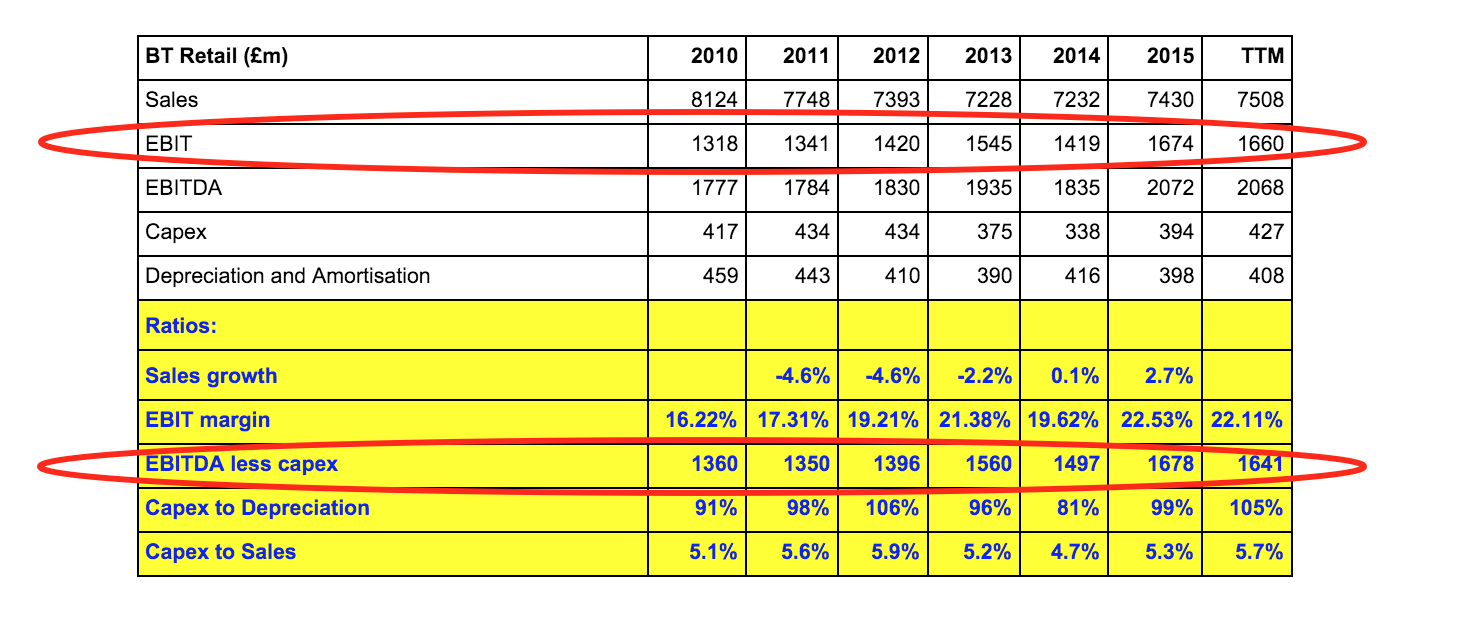

BT Retail

This is the business that most people are familiar with. It sells home phone, mobile phone, broadband and TV to households. It also sells telephone and broadband services to businesses as well.

Up until quite recently, this division has seen declining sales as more households went elsewhere for their phone and broadband internet services. BT was able to keep profits relatively stable by cutting lots of costs and becoming more efficient.

Things changed in 2012 when BT changed its strategy. It realised that it had to stop companies such as Sky taking its profitable broadband customers. So it made a successful bid to enter the TV sport business by buying the rights to Premier League football and a host of other sporting rights. In 2013 it agree to pay nearly £900m over three years for the rights to show Champions' League football by outbidding Sky in the process.

Source: BT annual and interim accounts

This strategy seems to have paid off - at least in the short-term anyway. BT Retail's turnover and profits saw a decent increase in 2015 as more people bought its fibre-optic broadband and TV packages.

Source: BT annual and interim accounts

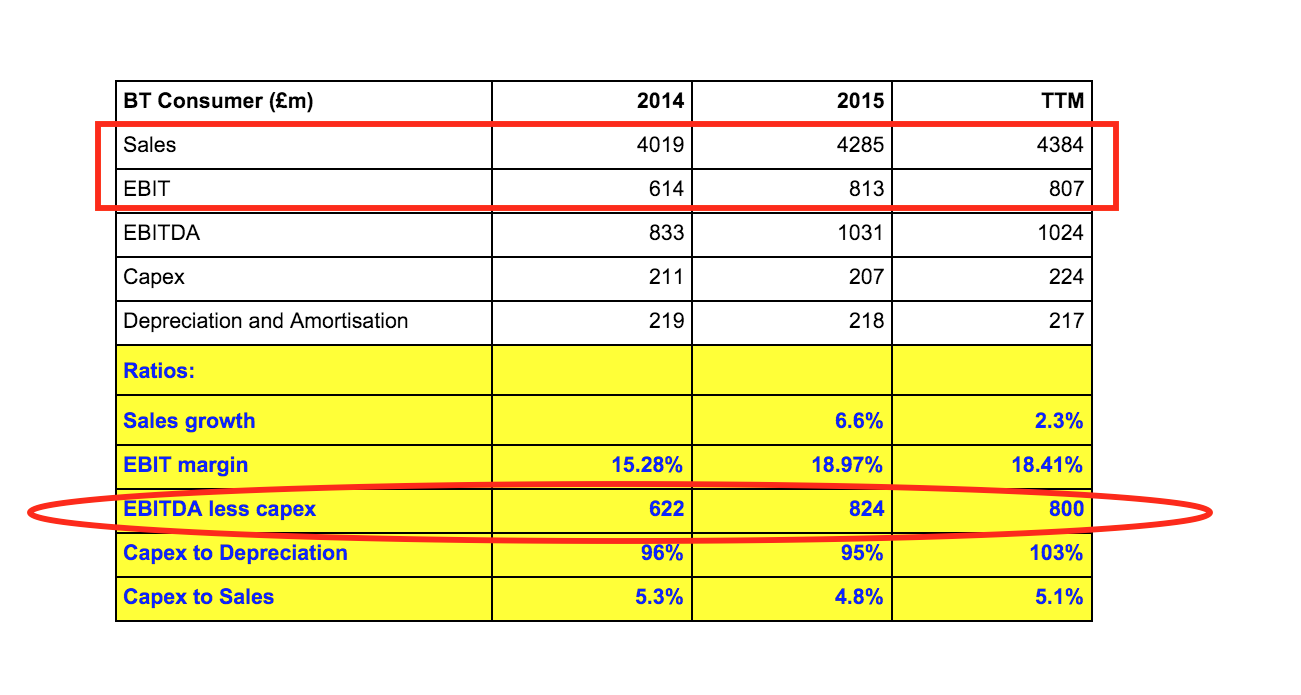

BT now breaks out its Retail business to show the consumer side of it separately. You can see the healthy increase in profits in 2015. If you look at EBITDA less capex - an approximation of free cash flow - you can also see that this business is a good generator of cash flow for BT as a whole.

But if we look at the current trailing twelve month performance we can see that whilst sales are still going up, profits have stopped growing. BT's costs are going up as it has to start paying for Champions' League football rights and its new drama channel called AMC. So far, it seems that it hasn't been able to get enough extra customers on board to pay for it.

Can BT's consumer business get its profits growing again?

Yes, because it looks as if it is just about to get its hands on EE - the UK's biggest mobile phone company with over 24 million customers. Just under a year ago, BT agreed to buy this business for £12.5bn and should get the green light to take control fairly soon.

Those of you with long memories will remember how the mobile phone mania of the late 1990s and early 2000s wreaked havoc with BT's finances back then. Is it making the same mistake again?

It seems that BT has learned from its mistakes. Instead of loading itself up with lots of debt to buy EE, BT is paying for a large chunk of it by issuing new shares to EE's owners - Deutsche Telecom and Orange.

Existing shareholders don't usually like to hear about lots of new shares being issued to new shareholders. It means that their ownership stake in the business goes down. This is not necessarily a problem as long as BT can make a good return on its purchase price.

Let's see how the acquisition of EE stacks up.

It's relatively easy to work out if an acquisition is a good thing or not, providing the company concerned gives you enough information. The best way is to work out the return on investment and see if it is high enough.

With EE, we are in luck. This is what BT has told us in a presentation on its website (click here to see the presentation) that will allow us to calculate the potential return on investment of the deal:

- Purchase price of £12.5bn

- 2014 EBITDA of £1.6bn

- 2015 capex of £0.6bn

- 2014 EBITDA less capex (cash operating profit) of £1.0bn.

- Cost savings worth £3.0bn in today's money (their net present value or NPV).

| BT's Purchase of EE | £bn |

|---|---|

| EBITDA less Capex (A) | 1 |

| Purchase price (B) | 12.5 |

| Return on Investment C= A/B | 8% |

| Value of cost savings (D) | 3 |

| Purchase price less cost savings (E) | 9 |

| Possible return on investment F = A/E | 11.10% |

So if BT can save a lot of costs then the pre-tax return on investment from buying EE looks alright but not sensational. However, this ignores the potential extra profits that can come from selling BT's broadband and pay tv products to EE's existing 24 million customers. There is also the potential to sell more products that work seamlessly between mobile and fixed line networks.

BT calls these "revenue synergies" and reckons that they could be worth up to £1.6bn on top of the cost savings. It seems that EE might end up being quite a good deal for BT.

BT has said that it expects EE to boost its free cash flow per share in the first year of ownership.

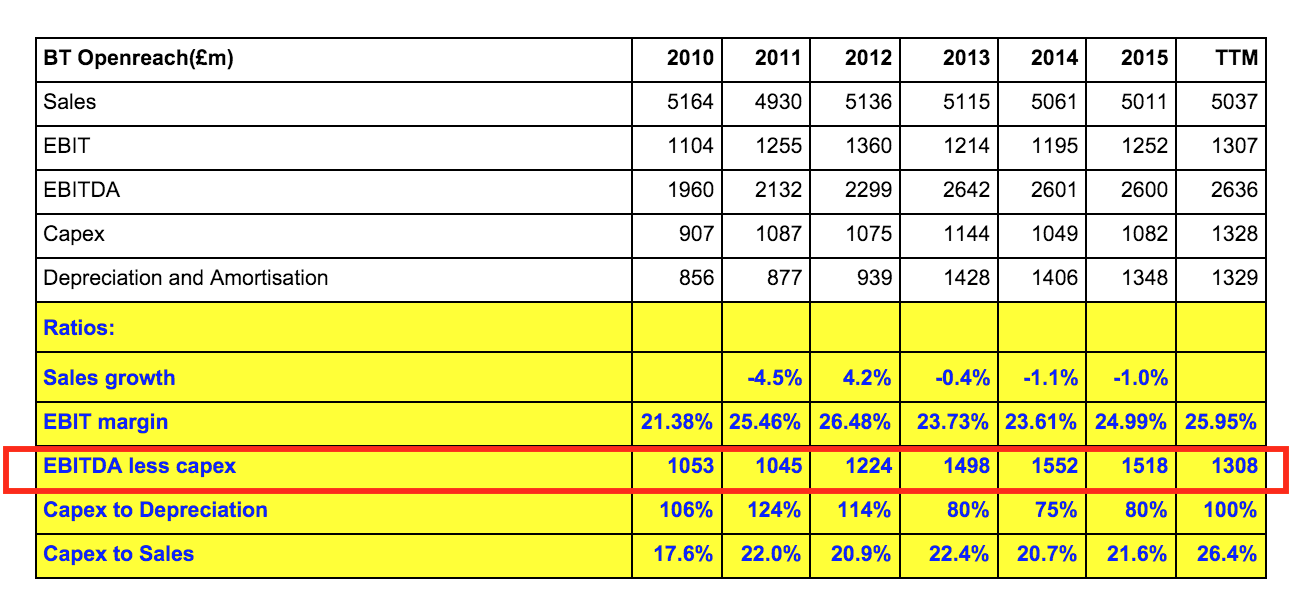

BT Openreach - BT's cash cow

Openreach looks after the last mile of wires and cables between the local telephone exchange and people's houses or businesses. It is often referred to as the "last mile" or "local loop".

It sells telephone and broadband services to BT and other telecom providers such as Sky, Vodadone and Talk Talk. Although it is part of BT, Openreach is separated from the rest of BT.

Source: BT annual and interim accounts

Profits haven't grown that much in recent years, but the EBITDA less capex line highlighted in red above shows that this business throws off a lot of cash flow for BT. Compared with other utility-type businesses such as National Grid or water companies, Openreach is positively swimming in cash. Without this cash flow, BT would probably not be able to pay as big a dividend as it currently does.

Sky and Talk Talk think that BT's ownership of Openreach is a problem. They think it isn't investing enough in new broadband connections and favours BT over them.

Between 2013 and 2015, BT invested around £1bn per year (80% of its depreciation charge) which could be a sign of under investment. Certainly, during the last twelve months (TTM) BT has increased spending to £1.3bn, perhaps as a way of keeping its regulator (OFCOM) happy so that it doesn't force Openreach to be a separate company.

Forcing BT to give up ownership of Openreach might be difficult. There would be long arguments about the allocation of costs and things like the pension deficit. But even if this happened, BT shareholders would end up with the shares in the new company. This might be a good thing as spin offs from BT and other utilities in the past have proven to be very lucrative.

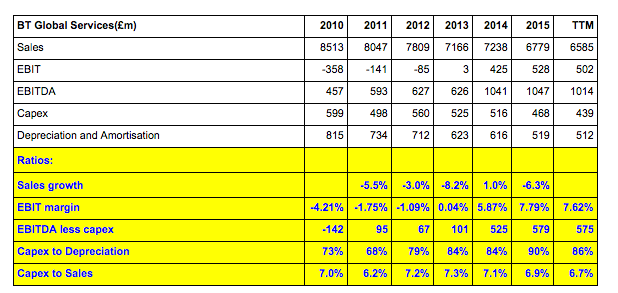

BT Global Services

This business looks after the IT requirements of mainly big companies. It got itself into a bit of a mess a few years ago with an accounting problem and loss of customers. It seems to be on an even keel again now.

Source: BT annual and interim accounts

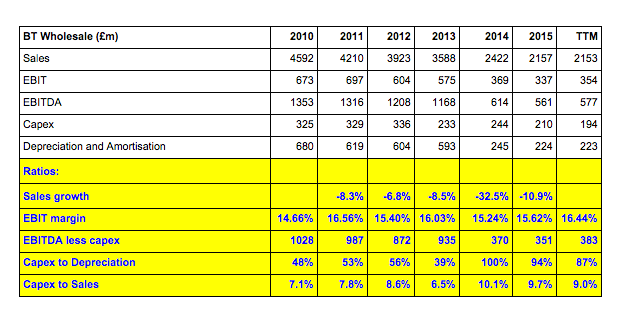

BT Wholesale

This business sells telephone and broadband and other services to businesses who want to offer these services to their own customers. This business has been shrinking in recent years as more companies have been investing in their own telecom assets instead of buying them wholesale from BT.

Source: BT annual and interim accounts

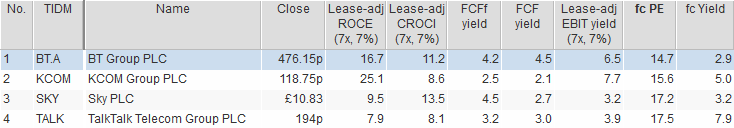

Are BT shares cheap or expensive?

Looking at BT on a selection of valuation multiples then it seems to suggest that its shares are fairly valued rather than really cheap or really expensive. However, they do look cheaper than those of Sky or Talk Talk on measures such as EBIT yield and forecast PE.

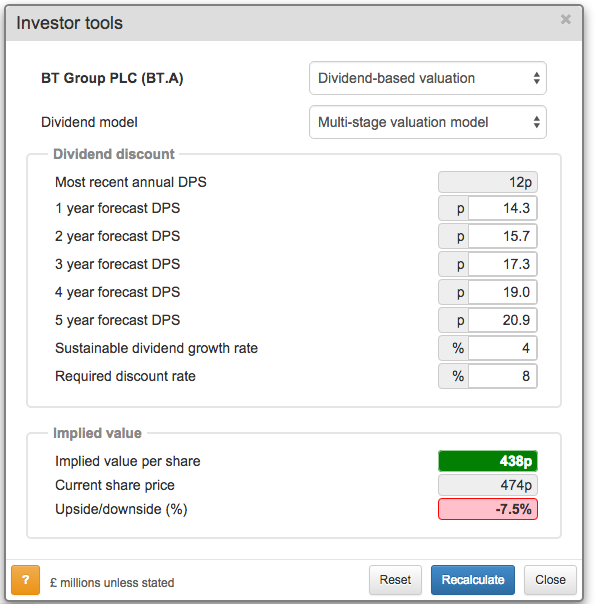

As BT is a significant dividend payer, I've used SharePad's dividend-based valuation tool to see what kind of dividend growth is priced into the shares.

Taking last year's dividend per share of 12.4p I assume 15% growth in 2015/16 to 14.3p. For the next four years, I assume that the cost savings and growth from the EE acquisition allow BT to keep on increasing its dividend at 10% per year.

After that, I assume 4% dividend growth thereafter. This might be an heroic assumption given that mobile telecom companies such as Vodafone are struggling to grow their dividends. BT may also have to use its cash flow to top up its pension fund or spend more money to retain TV sports rights.

With a required return of 8%, this is telling me that continued strong dividend growth is probably already priced into BT's shares.

To sum up:

- BT looks to be a good business. It earns a reasonably high ROCE and CROCI.

- Profit quality looks good with a high proportion being turned into free cash flow.

- The company has a strong financial position with a rising level of fixed charge cover.

- The pension deficit is large and needs to be watched. Currently there is enough cash flow to make big top up payments to the pension fund.

- The dividend per share is comfortably covered by free cash flow per share.

- BT Retail profits growth has stopped.

- EE could be a good deal for BT shareholders

- Openreach is BT's cash cow.

- The shares do not look particularly cheap right now. Strong dividend growth for the next few years might already be reflected in the share price.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.