Don't rush to invest your ISA allowance

March is the time of year when people tend to start feeling a bit more cheerful about life. The dark days of winter have passed and it's time to start thinking about the prospect of the lighter and warmer days ahead. It's also the time when private investors are bombarded with endless ideas of how to spend their annual ISA (individual savings account) allowance.

ISAs are a great way to save for your retirement, your children's future or a rainy day. If you are fortunate enough to have up to £15,000 spare (£15,240 from April 6th) then the ability to protect your investment income and profits from the hands of the taxman is too good to resist.

Every year, there's no shortage of advice given in the financial press. Some of it is good, some of it isn't. One regular piece of wisdom is to make sure that you use allowance before the April 5th deadline. This is good advice. The other frequently offered tip is to put your money to work straight away. You might be itching to invest as well but this isn't always the best course of action.

Generally speaking, one of the best ways to grow your nest egg is to have your savings invested for as long as possible. This allows the magic of compound interest to work and is one of the reasons why great investors such as Warren Buffett have become so wealthy.

Using the same logic, it is usually futile - if not impossible - to try and think that you can outsmart the markets by buying shares when they are selling for rock bottom prices and the offloading them when they become really expensive. If you are investing for a long time - 10 years or more - then some people think that you shouldn't worry about what the level of the stock market is because more often than not it goes up and you will make money.

I disagree. It's not as simple as this. If only it was.

The price you pay to invest in something ultimately determines what you get back from it. History tells us that investors who buy cheaply or at fair prices make more money than those who pay high prices. Blindly buying and hoping for the best just because the market has tended to go up over time isn't a smart thing to do. You can and should do better than this.

So should you be putting your ISA allowance to work in the stock market now or in the next few weeks?

I think the answer to this question could depend on whether you are investing in a stock market fund (made up of lots of different shares) or putting your money into individual shares.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Fund investing - Can the bull market keep on running?

Of course it can. But that doesn't mean it will. If you are investing in a stock market fund -especially one that tracks the value of a stock market index - then it's probably a good idea to think about whether any fresh money you invest is going to allow you to grow the value of your savings pot. You need some way of weighing up the value of the stock market.

We are just over six years into a bull market in shares which began at the depths of the financial crisis at the end of 2008 and the beginning of 2009. Back then investors were frightened and pessimistic about the outlook for shares. Usually this is the ideal time to invest and so it has proved to be. Anyone who took the plunge, held their nerve and bought shares has done very well.

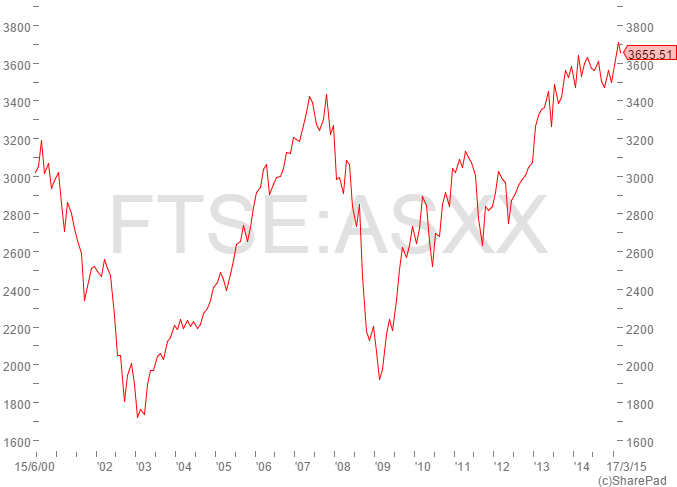

FTSE-All Share Index (ex investment companies):

In the UK, the FTSE 100 has more than doubled in value as has the broader market measured by the FTSE-All Share Index (shown above). Over in America, the S&P 500 index has been an even better investment and has more than tripled since the March 2009 lows. Buying a cheap stock market tracker fund back then would have paid off handsomely.

However, if history is any guide then this bull market will end. As to when it will and how badly, then your guess is as good as mine.

The stock markets have been given a huge helping hand by the world's central bankers. These people set interest rates - the price of money - and they have reduced them to almost zero in order to help economies recover from the damage done by the financial crisis and the recession that followed.

As a consequence of this, interest rates on savings accounts and government bonds have been screwed down to absurdly low levels. In some cases, investors are even getting a negative interest rate on bonds. This means they are guaranteed to lose money if they hold them until they mature. Work out the logic of this if you can.

Given this backdrop, it is not really surprising that the value of stock markets have soared. The dividend yields on many shares - their effective interest rate - look a lot more attractive than savings accounts and this is why lots of people have bought them and their prices have gone up - a lot. There are plenty of investment experts out there that think that this is a good enough reason for the bull market to keep on running.

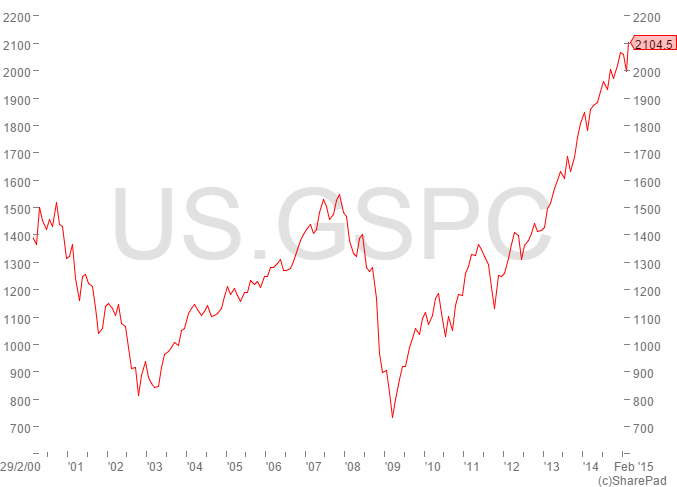

S&P 500 Index:

This might well happen. But if you are investing in a stock market fund, the general level of the market matters a great deal. Putting your ISA allowance to work in an expensive market could mean that your savings don't grow as fast as you want or need them to.

So by all means make sure you use your ISA allowance but don't be in a rush to invest it. Learning to wait for the right investment at the right price is not time wasted. What you learn whilst you are waiting can make a big difference.

So how do you work out if the stock market is cheap, fairly valued or very expensive?

This question is what many investors are trying to work out. There's no easy answer to it. However, there's a few simple checks you can do to get a feel of the market that SharePad can help you with.

1. Look at a price chart

Has the price been going up for a long time or has it been falling? Charts can be a very useful tool to help time when you invest. It's often better to buy after prices have fallen rather than jumping on to something that has been rising fast.

2. Valuations

Look at price earnings ratios (PEs) and dividend yields and see how they compare to history. Do valuations look high or low?

FTSE-All Share PE ratio:

The PE ratio of the FTSE-All share index is just under 16 times. That's a lot higher than it was back in 2009 but probably not too high to suggest that the UK stock market is really expensive.

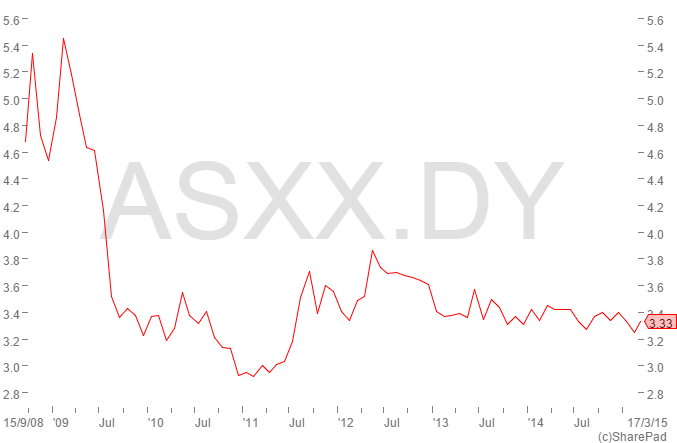

FTSE - All Share Dividend Yield:

The current dividend yield is 3.33%. This is higher than the interest rate on most savings accounts and government bonds and possibly explains why people will keep on putting their money into shares. As far as the dividend yield as a measure of the stock market's value is concerned, this measure might be saying that the value of the UK market may be fair rather than really cheap or expensive. A yield of over 5% back in 2009 with hindsight was a sign that the market was cheap whereas a yield of 2% at the height of the technology bubble in 2000 (not shown on the chart) was a sign that the market was overvalued.

3. Sentiment

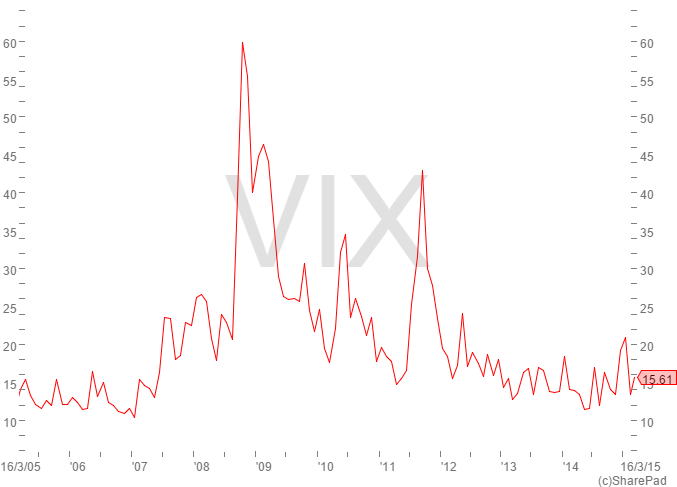

Back in January, I wrote about volatility - how much share prices bounce around and how you can use it as a measure of investor sentiment. You can look at a measure known as the VIX index which relates to the S&P 500. When the value of the VIX is low it may be a sign of overconfidence and complacency amongst investors. When it is high, pessimism is high which could signal a buying opportunity. What happens to America's stock market tends to feed through to the UK's so the VIX can be a useful measure to keep an eye on in SharePad.

VIX Index:

The VIX is at a very low level compared with its ten year history and at similar levels to the last stock market peak in 2007/08. Warren Buffett is famous for saying, "be fearful when others are greedy and greedy when others are fearful". Well, there doesn't seem to be much fear in the US stock market at the moment. It may not crash any time soon, but current levels may not be a great buying opportunity.

You don't have to invest

You can make up your own mind whether you should buy a stock market fund now or in the next few weeks and months. But the key advantage that you have as a private investor is that you don't have to invest if you don't want to. Lots of professional fund managers have to stay fully invested in shares even if they think they are very overvalued. You don't have to. Instead you can leave cash uninvested in your ISA account and wait for prices that you are comfortable with.

Investing in individual shares

If you are to make money from a stock market fund you usually need the value of lots of different shares to be rising - usually the biggest ones in the fund. This is not a problem in a rising market but it can leave you with a few problems in a falling market.

But if you decide to invest in individual shares then your fortunes are tied to a single company rather than the market as a whole. Some people think this increases your level of risk. Others such as Warren Buffett believe that if you do your homework and wait to pay the right price then you are not increasing risk at all, but giving yourself the chance to do a lot better than the stock market.

You do not need to own hundreds of different shares or even dozens of them. It is quite possible to put together a portfolio of 10-20 shares in good companies that can allow you to build up a healthy nest egg over the long haul.

Whilst it is true that a falling stock market can affect all shares, it is possible to find bargains in all types of market and make money from shares whatever is happening to the stock market in general. You just need to know where to look. SharePad can help you with this.

How to look for winning shares with SharePad

One of the good things about investing in shares is that there are many different ways to try and spot winners. I'm going to show you how to adapt various styles of investing to go about this. Remember, that you must research shares and companies fully and make sure you understand the potential risks and rewards before you invest.

You can do all this very easily in SharePad. It can help you find shares that meet certain criteria by setting up filters. Once you have a list, you can then use SharePad to do further research to see if some shares are worth buying or not.

Do not worry if you can't find any shares that meet your criteria. This might mean that the stock market is too expensive. Don't be tempted to relax your standards to find shares either, you might live to regret it. It is much better for your financial well being to sit on your cash and wait for shares to meet your standards.

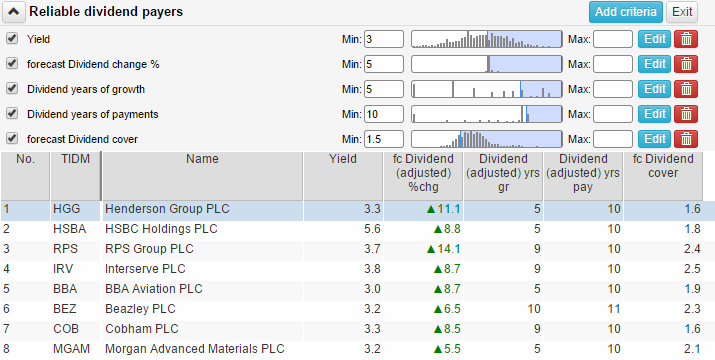

Reliable dividend payers

Buying the shares of companies that pay large dividends and reinvesting them is a good way to build up the value of your portfolio over a long period of time (see my article on this here).

You can set up a filter in SharePad to look for shares that have been reliable dividend payers in the past and therefore might be in the future. You can set up lots of different criteria but I've given you an idea of how you might do this above.

I am asking SharePad to look for shares with a dividend yield of at least 3% and where the dividend is covered by profits at least 1.5 times to give some degree of safety to the dividend payment. I also want a company that has a good track record of paying dividends in the past as it can show that it has been able to keep paying shareholders in different economic climates. This will give me some confidence that it can keep on paying dividends in the future.

Dividend growth is what turbo charges your returns from dividend shares. So I am asking SharePad to look for shares that have been growing their dividends for at least five years and are expected to grow them by at least 5% in the next year.

After all these criteria have been set, SharePad has produced a list of 8 shares to look at further.

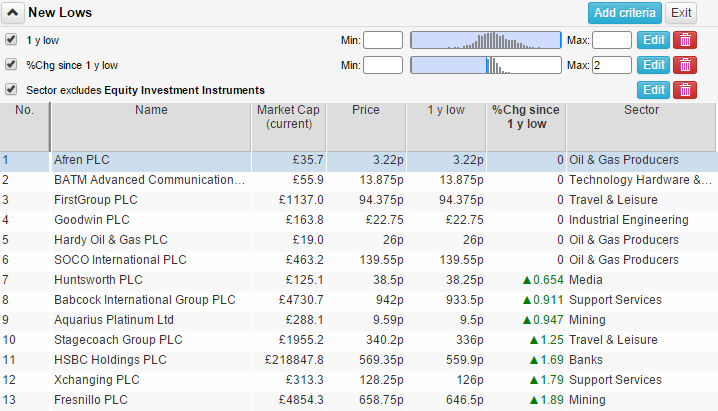

Distressed shares

The stock market tends to shun companies that are going through tough times, sometimes too much. This can see share prices fall to levels where they become very cheap.

One way to spot distressed shares is to look for those that are trading close to their one year share price low. I've set up a filter in SharePad above that looks to find shares where their prices are within 2% of their one year low. SharePad has given me 13 possible shares to investigate on this basis.

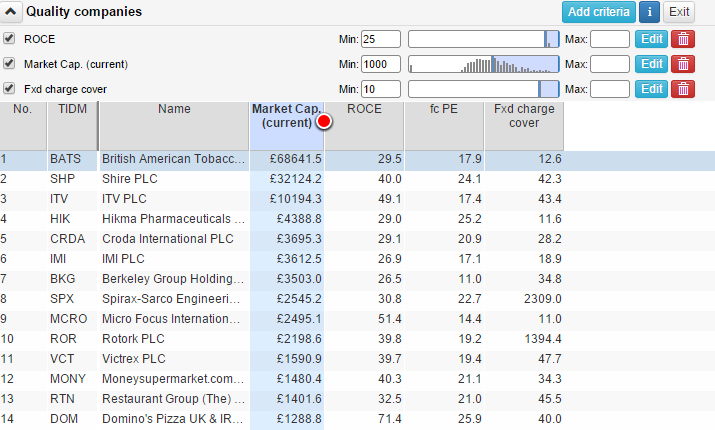

High quality companies

Buying shares because they look cheap can often be a mistake. That can be because they often have poor future prospects or weak finances. In other words they deserve to stay cheap.

Buying the shares of quality companies that make high returns on the money they invest (return on capital employed or ROCE) and have strong finances can be a better way to make money from the stock market. It is broadly the approach of Warren Buffett that has helped to make him one of the richest people on the planet.

I've asked SharePad to find shares with a market value of more than £1bn, with a minimum ROCE of 25% and a fixed charge cover (the ability of profits to pay the company's rent and interest bills) of at least 10 times to show a strong financial position. Companies that meet these criteria could be high quality businesses. SharePad has found 14 shares to do further research on.

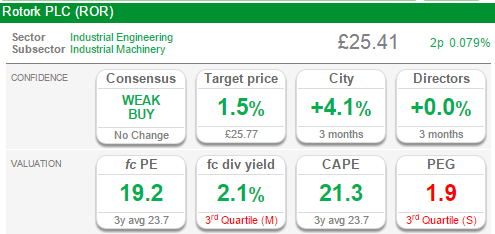

One of the quick checks you can do is compare the current valuation of a particular share with its historical range. You can tell SharePad to do this or you can look at this in the company's dashboard which you access by clicking on the Summary tab.

I've gone into the dashboard section of Rotork below. If you look at the forecast PE measure there is also a figure for the three year average PE as well. Rotork's forecast PE is 19.2 times compared with its three year average PE of 23.7 times. Is this telling you that Rotork shares are good value? Possibly, but both PE ratios are high numbers and you will have to do more research to see if Rotork shares are worth paying up for.

Learn to be patient - create your own watchlist

Patience is a virtue when it comes to investing. It's all about buying the right share at the right price. You can control your risks by trying to understand the business you want to buy a slice of. This takes time and discipline but is well worth the effort. With SharePad you have a comprehensive set of tools at your disposal to find winning shares and these can help you learn a great deal about a company. When you find some interesting shares SharePad also gives you everything you need to learn about a company's financial history, its valuation and the latest news about it.

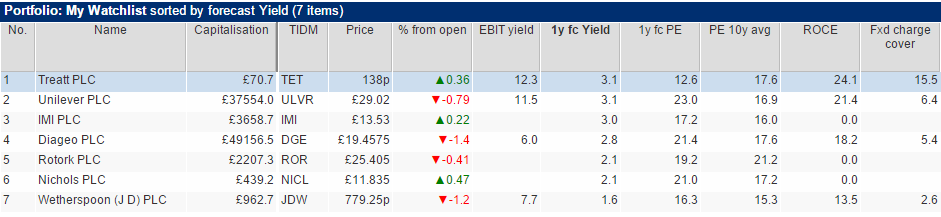

You can build a watch list in SharePad and wait for the right time to buy. I've done this in the table above. Determining the right price to buy a share is not an exact science and you can use lots of different yardsticks. I've put in a column for the ten year average PE for each company on my watchlist. I probably won't consider buying any of these shares until the PE drops below the ten year average value.

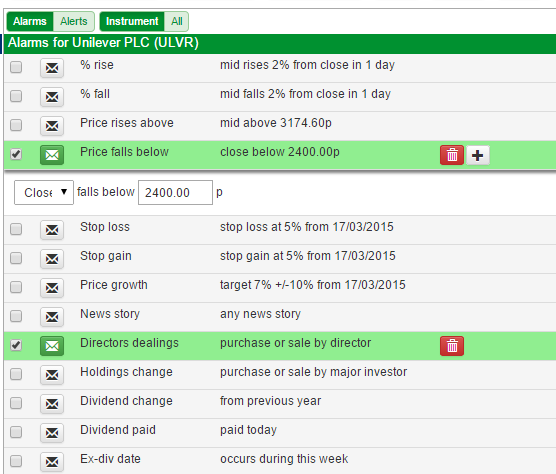

You can also set up alarms to alert you when a share meets your price target or when an important piece of news has been announced.

As you can see with Unilever above, I've set an alarm for SharePad to send me an email when its share price falls below 2400p and when its directors buy and sell any shares.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.