Free cash flow isn't always what it seems

The best investors don't spend huge amounts of time looking at a company's profits. Instead they spend a lot of time looking at its free cash flow in order to work out how good or bad a company's shares might be as an investment.

By focusing your attentions on free cash flow it is possible to get closer to the truth about a company's financial performance. Too many times, investors have learned the hard way that profits aren't always real. Free cash flow is a much better way to spot really good companies whilst keeping you away from the really bad ones. This is what successful investing is all about.

Yet like many things in investing, free cash flow is not as simple and straightforward as it might seem to be. You need to take the time to understand how free cash flow - or the lack of it - is being created. Sometimes there is a lot more to a company's free cash flow performance than initially meets the eye.

In this article, I am going to show you some of the things you need to look out for when you are studying a company's free cash flow.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

What is free cash flow?

In layman's terms it is the amount of cash that a company has left over every year to pay its lenders and shareholders. It is essentially a company's cash profits. It is called free cash flow because the company is free to do anything it wants with it. For example it can use it to do the following:

- pay dividends

- buy back its own shares

- expand its business so it can make more money in the future

- buy other companies

- pay off its debts

There is no universally accepted way to calculate a company's free cash flow but essentially there are two types that you need to be aware of which are shown in a SharePad cash flow statement below.

- Free cash flow for firm (FCFf) - This is the amount of cash left over to pay lenders (interest) and shareholders. SharePad calculates this by taking the net cash from operations (which is trading cash flow less tax paid), adding any dividends received from joint venture companies and then taking away capital expenditure (the amount of money spent on new assets). During 2014, Reckitt Benckiser generated just over £2.4bn of free cash flow which is available to pay interest to lenders, dividends to shareholders or any of the other options listed above.

- Free cash flow for equity (FCF) - This is the amount of cash that essentially belongs to the company's shareholders. As an investor in shares, this is the number you should be paying a lot of attention to. To calculate it, you take FCFF and then take away the interest paid to lenders, dividends paid to preferred and minority shareholders and then add any interest income received. During 2014 Reckitt Benckiser generated just over £2.3bn of free cash flow for its shareholders.

Why companies with lots of free cash flow can be very good investments

This boils down to three main reasons:

1.The profits are real and turn into cash

One of the first things you should do when checking out any company is see how good it has been at turnings its profits (which lots of people look at) into free cash flow (which not as many people do). You can do this by comparing a company's earnings per share (EPS) with its free cash flow per share (FCFps). This is known as free cash flow conversion.

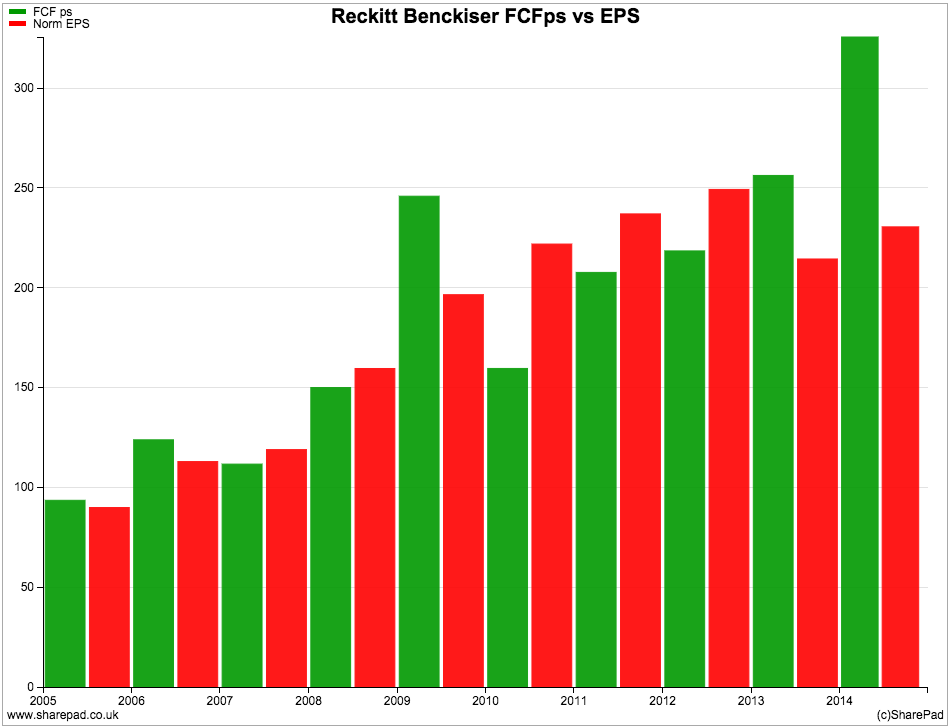

Reckitt Benckiser above has been very good at turning its profits into cash (as shown in the chart below) which can explain why it has been a very good share to own over the long haul.

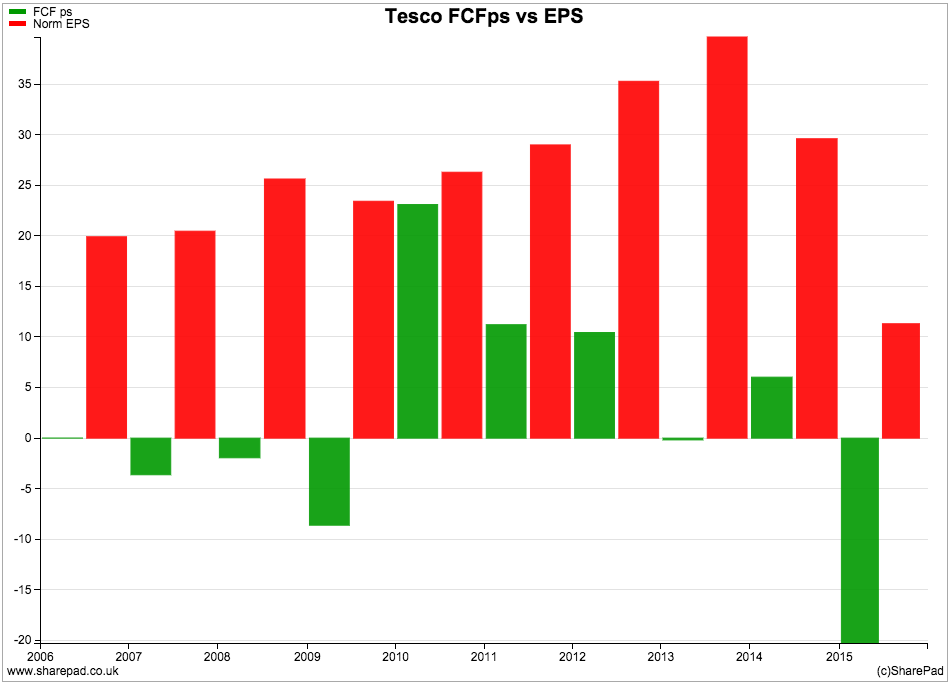

In stark contrast, Tesco has been a very poor cash converter and has been a very bad share to own in recent years.

2. They need less cash flow to maintain and grow sales and profits

Companies that produce lots of free cash flow generally don't have to invest in lots of new assets every year (capex) to maintain their sales and profits. It is often the case that they don't need to spend lots of money to grow either. This also means that they tend to have high returns on capital employed (ROCE) as well - another hallmark of a very good business.

3.They are less risky

If a company is generating lots of free cash flow it is usually less reliant on other sources of finance such as loans. This might not worry investors when banks are happy to lend money. But when times are tough - such as during the credit crunch back in 2008 - banks can and do ask for their money back which can leave companies in very precarious situations.

But free cash flow is not always what it seems to be

It would be great if we could just follow a simple rule of buying companies that have lots of free cash flow and avoiding the ones that don't. As with most things in investing, it is not as simple as this.

The problem facing investors is that most calculations of free cash flow are very similar. This means that they can ignore other things going on elsewhere in the cash flow statement which can lead to free cash flow being understated or overstated. In turn, this can result in you buying a bad company which you think is good - because it appears to have lots of free cash flow - and rejecting a good company that you think is bad - because you don't think it has any free cash flow.

As well as calculating a company's free cash flow, you also need to study its cash flow statement closely to really find out what's going on.

Let's look at a few real companies so you can better understand what I am going on about.

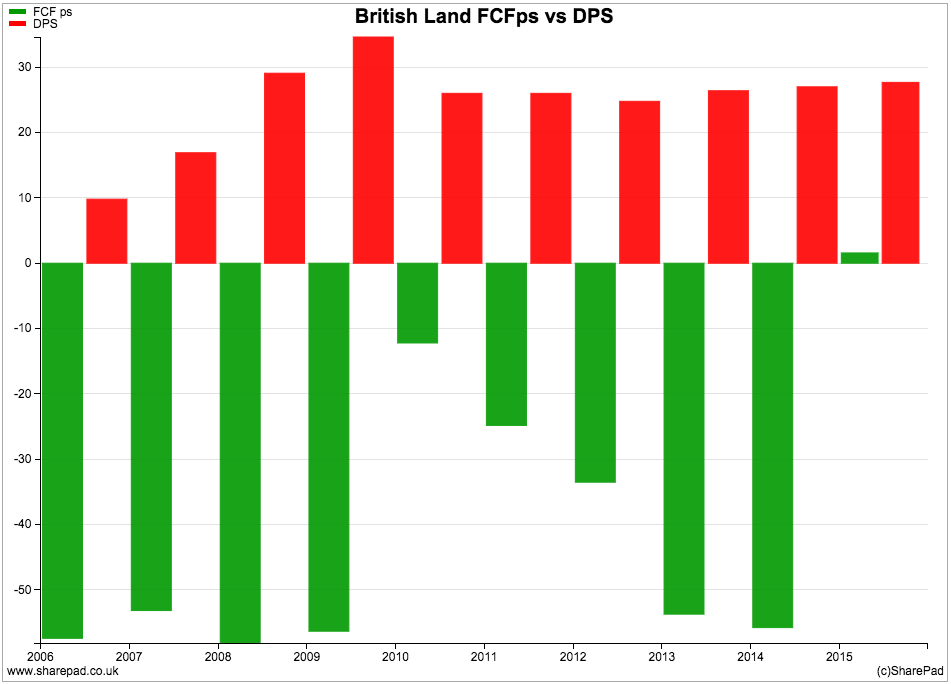

British Land - no free cash flow but paying dividends

Using a standard calculation of free cash flow you might be forgiven for thinking that British Land is a basket case. It has produced no free cash flow for years but has still been paying a dividend. How on earth has it been able to do that?

In normal circumstances this situation would be a ginormous warning sign to avoid the shares. But in British Land's case it might not be.

Take a closer look at its cash flow statement.

British Land owns and builds commercial properties such as offices and shopping centres. As you can see from its cash flow statement above it has been spending a reasonable amount of money on new assets each year - generally more than the amount of cash that has been coming into the business. This is why its free cash flow has been negative.

Yet the standard calculation of free cash flow tends to ignore cash flows that are generated by selling assets. Some people do include it.

Generally speaking, I agree with excluding these cash flows as selling assets aren't usually a regular and dependable source of cash compared with trading or operating cash flows. Unless of course you are a property company like British Land where making money from selling properties is a normal part of your day-to-day activities.

| British Land (£m) | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | Cumulative |

|---|---|---|---|---|---|---|---|---|---|

| Free cash flow | -361 | -356 | -105 | -219 | -299 | -484 | -560 | 17 | -2367 |

| Asset sales | 1460 | 904 | 279 | 68 | 59 | 699 | 352 | 315 | 4136 |

| Adjusted FCF | 1099 | 548 | 174 | -151 | -240 | 215 | -208 | 332 | 1769 |

| Cash dividend cost | 161 | 188 | 154 | 139 | 212 | 203 | 159 | 247 | 1463 |

| FCF div cover | 6.83 | 2.91 | 1.13 | -1.09 | -1.13 | 1.06 | -1.31 | 1.34 | 1.21 |

When the asset sales are added back to free cash flow British Land's performance does not look as bad. If you go back to 2008, you can see that British Land has sold over £4bn of assets compared with a cumulative free cash outflow of nearly £2.4bn. When these sales are taken into account, British Land has generated enough cash to pay its dividends paid over the last eight years.

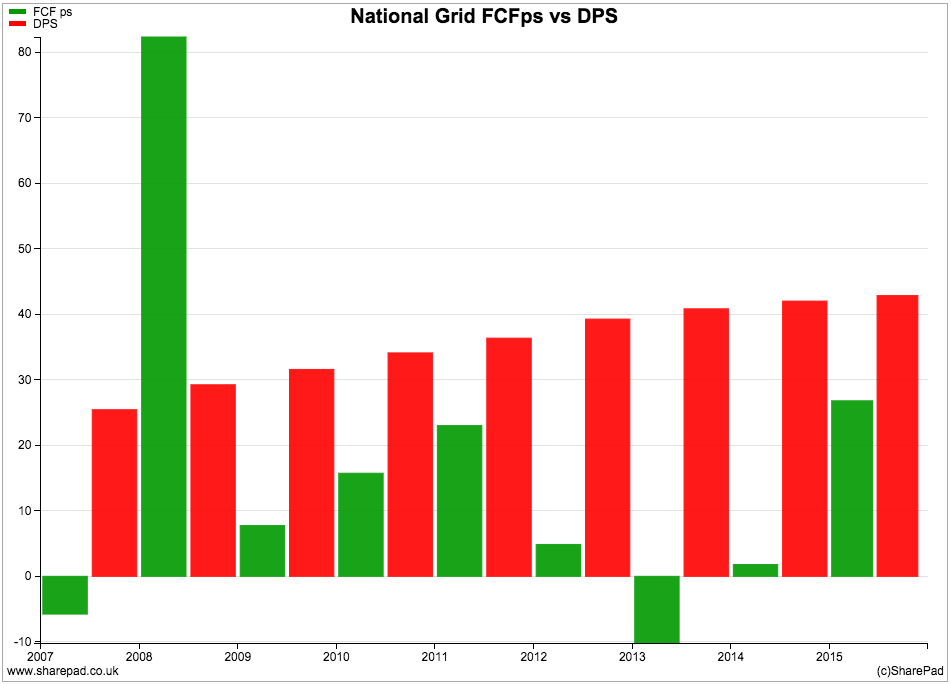

National Grid - poor free cash flow due to large investments

Companies that are spending a lot of money on new assets to grow their business will often have negative free cash flows. This does not mean that they are always bad businesses. In fact, quite the opposite might be the case.

Cash flowing out of the company today which is invested wisely - by this I mean earning a reasonable ROCE - should result in more cash coming into the business in the future. If so, then the company should become more valuable. In this case, negative free cash flow might be seen as a sign of strength rather than a sign of weakness.

The key thing to grasp about free cash flow is the relationship between the amount of money a company needs to spend to stay in business (known as maintenance capex) and how much it is spending to expand its business (growth capex). This is not always easy to work out but often a company that is investing to grow will be producing a reasonable amount of free cash flow after maintaining its assets.

Utilities like National Grid are a special case of this kind of free cash flow analysis. They are regularly investing more money than they need to maintain their existing assets and cash flows which actually hides the fact that they are generating free cash flow (click here to read more about this).

If you were to dismiss these kinds of companies because their free cash flows (after all capex) were negative you might be missing out on some very good investment opportunities. If the growth capex is producing a respectable ROCE then negative free cash flow is not a bad thing. It is when a company over invests (Tesco is a good example) and has negative free cash flows combined with a falling ROCE that you should start worrying. Comparing capex trends with ROCE is a good check to see if money is being invested well.

Conversely, high free cash flows might be a sign of weakness. It might signal that a company has run out of places to invest or it is a business in decline.

As a rough rule of thumb, you can compare a company's capex spending with its depreciation (an estimate of maintenance capex) to try and work out what might be explaining a company's free cash flow performance and what stage of development it is in.

| Type of Company | Amount of Investment | Free cash flow |

|---|---|---|

| Growing/Overinvesting | Capex > Depreciation | Negative |

| Mature/Stable | Capex = Depreciation | Positive |

| Declining/Underinvesting | Capex < Depreciation | Positive |

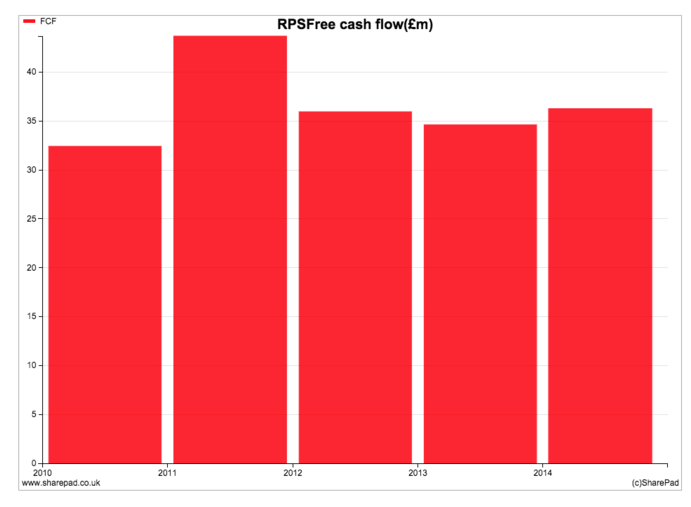

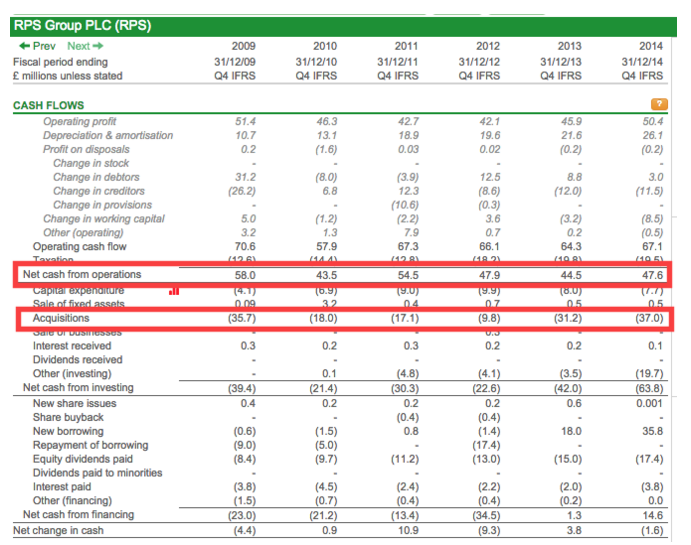

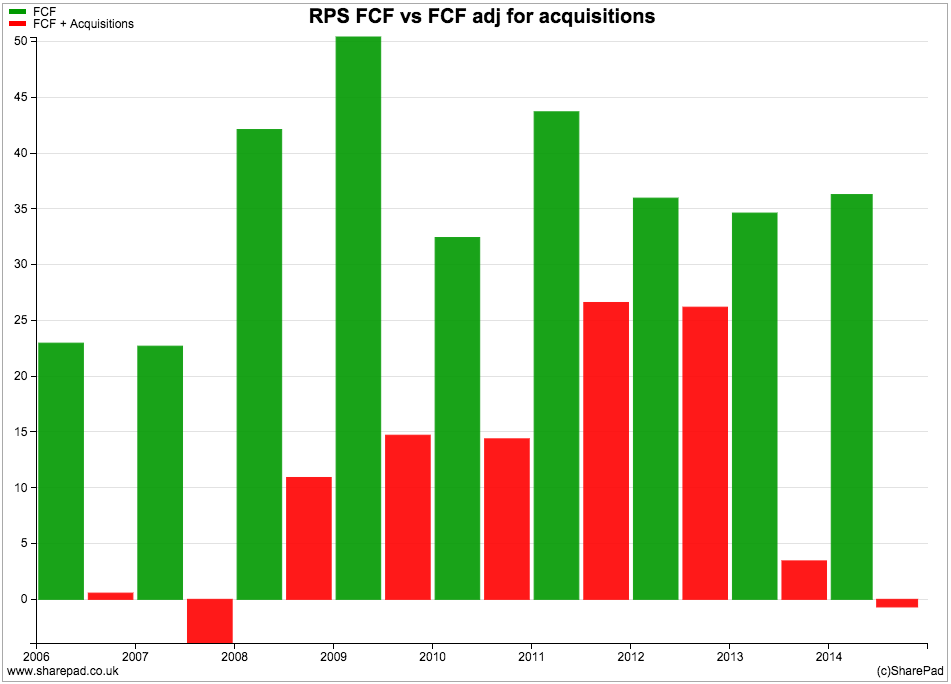

RPS - Free cash flow but regularly buying companies

Sometimes you can come across companies that seem to be producing lots of free cash flow when in reality they are not. If you study the investing section of the cash flow statement more closely, large cash outflows might not be found in the capex section but can be found somewhere else such as acquisitions.

RPS - a consultancy company - appears to generate lots of free cash flow. As it is mainly a people business it has very low capex requirements. However, it does seem to buy other companies every year. When this happens, the cash spent on acquisitions should probably be used to calculate free cash flow.

When this is done for RPS, its free cash flow is significantly reduced.

Free cash flow can be manipulated too

Free cash flow is a popular way to weigh up a share because many investors have become suspicious of company profits. They think - rightly so - that profits are too easy to manipulate. Yet, free cash flow can be manipulated as well and you need to know how to spot this.

Companies can boost their free cash flow in many ways. Here are a few ways they can do this:

- Delay paying their bills until after the end of the financial year - this increases their trade creditors and boosts operating cash flow and free cash flow for the year.

- Sell debtors to a credit company - This is known as debt factoring which allows a company which sells products on credit to turns those sales into cash faster than might have been the case.

- Cut back on investment - slashing investment in new assets can boost free cash flow but might harm the long-term prospects of the business.

- Buy businesses rather than invest in new assets - a standard calculation of free cash flow might ignore this.

This is why you should look at a company's free cash flow over a number of years (I suggest at least five) and look at the trend. You need to look at what is causing free cash flow to change as not all free cash flow should be valued the same.

Ideally a company should be generating free cash flow because its profits are growing. This is the highest quality of free cash flow. Companies that are boosting cash flows through changes in working capital (paying their bills later, collecting their debtors faster and holding less stocks of finished goods) or cutting capex might be doing the right thing but these kinds of improvements are not always achievable year after year.

To sum up

- Free cash flow is better than profits for weighing up a company.

- You need to know how a company generates its free cash flow.

- Studying other parts of the cash flow statement is a must. Often you can find signs that free cash flow is under or overstated.

- Look at a company's free cash flow performance over at least five years.

- Negative free cash flow can be a sign of strength as well as a sign of weakness.

- It is possible for a company to manipulate free cash flow.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.