How to do a sum-of-the-parts-valuation

A heads up before I start. This article contains quite a bit of advanced investment analysis. If you are interested in how you can do an in-depth valuation of a company whilst improving your understanding of it then read on.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Valuations using multiples

Valuing a company's shares can be quite complicated. It is certainly more of an art than a science and there's rarely - if ever - a right answer. Profits and cash flows and interest rates can move up and down from year to year and so a valuation done today is unlikely to be the same as it was a year ago or in a year's time.

So you cannot definitely say that a company is worth exactly £10 per share or anything else. What you can try to do is make sure that your estimate is reasonable, conservative and probably in the right ball park. Your task is then to buy the shares for less than your estimate to give yourself the best chance of making money.

The most common way of valuing shares is to use multiples of profits, cash flows or assets such as PE ratios, EV/EBIT, price to free cash flow or price to net asset value. Another option is to calculate a company's earnings power value (EPV) based on an estimate of its sustainable long-term profits (for more on this click here).

These approaches do a reasonable job of valuing a company and most private investors don't really need to think or worry about doing anything more sophisticated. Occasionally though, you might want to consider digging a little bit deeper.

One potential drawback of using valuation multiples is that they are based on a single measure of profits, cash flows or assets for the whole company. In the real world, these numbers don't just come from one business but can come from lots of different ones with different characteristics and growth rates. So in some circumstances - where a company has lots of different business units for example - applying a single, blanket multiple to all the company's different businesses and saying they are all worth the same might not be the best approach. You could end up overvaluing some parts of the business whilst undervaluing others.

Professional analysts will sometimes value each individual business unit separately and add them together to get a valuation for the whole company. This method is known as a sum-of-the-parts (SOTP), or break-up, valuation.

I used this method a lot when I was a professional analyst. The big advantage of it is that it forces you to really think about a company and how it makes its money and what is a reasonable valuation for it. I consider it a very valuable part of the analyst's toolkit and think it can make you a better and more knowledgeable investor.

For example, consider a company that has three separate businesses (these are sometimes referred to as divisions). Two of them are doing well and make profits of £20m each and have good growth prospects. The third business is experiencing tough times and lost £30m during its last financial year.

If you were just to value the company on its total profits of £10m (£20m + £20m - £30m) you might come to the conclusion that the shares were not worth bothering with. But if the company has a plan to get the third business back to profitability or get rid of it, you would be left with a company making £40m a year. By using a SOTP valuation you might find that the company is actually undervalued. That's why the approach can be so revealing and powerful for an investor.

Valuing Greene King shares using a SOTP approach

So how do you actually value a company using a SOTP approach?

I'll be honest, it's not always that easy. There are lots of things to consider. By taking you through a practical example, hopefully you will see what kinds of things are involved and how it helps you learn more about a company.

What I will say is that the more things you know and understand about a company and its business, the better your SOTP valuation is likely to be. This will take a bit of time and effort. However, if you have a copy of a company's annual report and a copy of ShareScope and SharePad it is possible to have a good crack at it.

I am going to use brewing and pub company Greene King (LSE:GNK) to show you how to do a SOTP valuation.

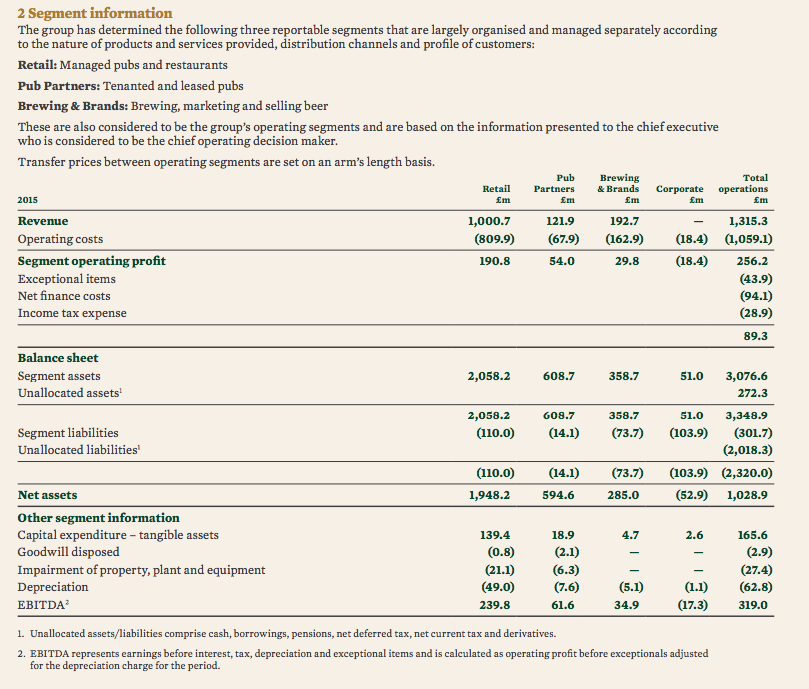

The first step is to go to the notes of the financial statements where you will find a section of segment information as shown below.

This is usually found in Note 2 or 3 to the accounts and contains loads of valuable information from which you can value each business or segment separately. We are given sales, operating profit (or EBIT), assets, capital expenditure, depreciation and EBITDA by segment. All of this is very useful.

As you can see, Greene King has three different businesses that make up its total profits:

- Retail - managed pubs and restaurants

- Pub Partners - tenanted and leased pubs

- Brewing - making and selling beer

There is also a segment called Corporate. This will include the costs of running Greene King as a whole such as head office costs. We will have to take account of this in our SOTP as well.

Before I start valuing each different segment, I always like to crunch some numbers to learn a bit more about the business. You can build up a very powerful spreadsheet and look at the performance over a number of years if you want to. You can see some of the analysis you can do in the table below.

| 2015 | Retail | Pub Partners | Brewing |

|---|---|---|---|

| Sales | 1000.7 | 121.9 | 192.7 |

| EBIT | 190.8 | 54 | 29.8 |

| Segment Assets | 2058.2 | 608.7 | 358.7 |

| Capex | 139.4 | 18.9 | 4.7 |

| Depreciation | 49 | 7.6 | 5.1 |

| EBITDA | 239.8 | 61.6 | 34.9 |

| Ratios: | |||

| EBIT margin | 19.07% | 44.30% | 15.46% |

| Return on Segment Assets | 9.27% | 8.87% | 8.31% |

| Capex to Depreciation | 2.84 | 2.49 | 0.92 |

| Capex to Sales | 13.93% | 15.50% | 2.44% |

| EBITDA less Capex | 100.4 | 42.7 | 30.2 |

| as % of EBIT | 52.62% | 79.07% | 101.34% |

By using the numbers in the segmental note, I can calculate a number of ratios which can tell me a lot about how good - or not - Greene King's three businesses are. This is very helpful because it will help you when you come to valuing each business (good businesses deserve higher valuations and vice versa).

This type of analysis is best done over a number of years so that you can identify trends but to keep things simple I've just looked at the performance for the last financial year to May 2015.

I consider return on capital employed (ROCE) as the best measure of how good a business is. Here, we can calculate a version of ROCE for each business by taking divisional EBIT and dividing by its segment assets. These segment assets are effectively the amount of money that has been invested in each division (capital employed).

None of Greene King's three businesses are making particularly high returns on these assets. In fact, returns are very modest indeed and nothing to shout about. As a rough rule of thumb, businesses with higher returns (say more than 10%) should be worth more than the value of the assets invested in it. From what I can see here, it's debatable whether any of Greene King's businesses are worth any more than their asset value.

The Retail business is by far the biggest division - and will make up the largest chunk of the company's value - and Greene King is spending a lot of money on it. Capex (spending on new assets) was almost three times depreciation (an estimate of how much money is needed to maintain the value of existing assets) in 2015. This means that an estimate of free cash flow (EBITDA less capex) is considerably less than its profits (EBIT). Normally, I wouldn't worry too much about this if the extra money spent was earning a high return but I am not sure that will be the case given the current modest returns.

Pub Partnerships and Brewing are also generating quite a low return. It begs the question as to whether Greene King can grow the value of its business for its shareholders in the future.

Let's get on with valuing each business separately. How you go about valuing each business is up to you. You can choose from a variety of different valuation techniques but make sure you test them for reasonableness. Remember, there is no right answer; you are just trying to get a better understanding of how much a company could be worth - to compare with its current stock market value.

The Value of Retail

This business is where the company primarily owns and manages pubs and restaurants. It is fiercely competitive and faces a lot of cost pressures such as rising wage costs. So how much is it worth?

Given its modest ROCE, I could say that the asset value of £2058.2m is as good a starting point as any. Another approach is to look at the stock market value of similar companies.

| Name | TTM EV/EBIT | TTM EV/EBITDA | TTM price to NAV |

|---|---|---|---|

| Enterprise Inns PLC | 10.9 | 10.3 | 0.4 |

| Mitchells & Butlers PLC | 11.1 | 8.1 | 1.2 |

| Fuller Smith & Turner PLC | 13 | 9.3 | 2.3 |

| Wetherspoon (J D) PLC | 13.8 | 8.5 | 4 |

| Punch Taverns PLC | 9.2 | 9 | 0.2 |

| Marston's PLC | 11.1 | 9.3 | 1.2 |

| Average | 11.5 | 9.1 | 1.6 |

TTM = trailing twelve month

In SharePad you can set up a sector filter and get a range of different valuations for companies in it as shown in the table above. If you want to, you can export this data to a spreadsheet and start playing around with the numbers.

Of the companies above, only JD Wetherspoon is a pure managed pubs and retail business and a direct comparison with Greene King's Retail business. The others have tenanted pubs or brewing businesses as well. EV/EBITDA is often used as a benchmark valuation as it strips out differences in depreciation policies. One option is to value the Retail business at JDW's multiple of 8.5 times. I've chosen to use 9 times to reflect a slight premium which might occur if the business were sold to a trade buyer. This gives a value of £2158m, slightly more than asset value. This looks reasonable to me and not overly generous (we are trying to be a little bit conservative here).

| GNK Retail | £m |

|---|---|

| EBIT | 190.8 |

| Depreciation | 49 |

| EBITDA | 239.8 |

| Value at 9x | 2158.2 |

Pub Partnerships

I am going to keep things relatively simple here. I see tenanted pubs as being very similar to a property business where the main income received is rent from the tenants. So I've decided to value this division at its gross asset value (before debt and other liabilities are taken away) of £608.7m and assume that the properties - the pubs - can be sold for the amount of money that has been invested in them.

Alternatively, you could look to value them on a multiple of income such as EBIT or EBITDA. Punch Taverns and Enterprise Inns are tenanted pub companies. If I take the average of their respective EV/EBIT multiples (10.9 + 9.2) of 10.05x and multiply it by Pub Partnerships' EBIT of £54m you would get a value of £542.7m.

Taking the average EV/EBITDA valuations of Punch and Enterprise (9 + 10.3) of 9.65x and multiplying it by Pub Partnerships' EBITDA of £61.6m gives a value of £594.4m - fairly close to asset value.

Brewing

I've adopted a conservative approach and assumed that current post-tax EBIT of £23.8m can be maintained forever. Assuming that investors want a minimum 8% return this gives an earnings power value (EPV) of £298m (£23.8/8%). (To learn more about EPV's and how to calculate them click here).

Corporate

These are sometimes referred to as central or head office costs. They are costs that are not allocated to a separate division of a company. This is money that is going out of the company which reduces overall profits and its value.

The best way to deal with these is to tax them (money going out reduces tax) and either put a multiple on them or calculate its EPV which I have done in the company SOTP valuation later. This reduces Greene King's estimated enterprise value (the value of the whole company) by £184m.

The other way to think about this is that the corporate costs of £18m could have been allocated to the three separate businesses which would have reduced their profits and valuations.

A couple of other things to consider

Normally, once you have valued all the divisions and adjusted head office costs you can add all your estimates together to give you an enterprise value for the company. You then take away liabilities such as net debt, pension fund deficits, any preference share equity and minority interests. Divide what's left over by the number of shares in issue and you have a value per share.

However, Greene King is a little bit more complicated because just after its year end it bought another pub company called Spirit Group. It issued 89 million extra shares worth £763m and took on extra debt of £657m for a total cost of £1420m.

Spirit Purchase Valuation (£m)

| Equity | 763.1 |

| Debt | 657.5 |

| EV | 1420.6 |

| EBITDA | 163 |

| EV/EBITDA | 8.72 |

To keep things simple, I am going to assume that Spirit is worth what Greene King paid for it. So I will add £1420m to the value of the other businesses. I will also take away £657m of extra debt when calculating the equity value per share.

All done? Not quite.

By combining Spirit with its existing Pubs, Greene King is hoping to save £30m of costs by the end of 2018. This is extra value that has to be factored in. How on earth do you do that?

Valuing Spirit Cost Savings (£m)

| Cost savings | 30 |

| Tax @ 20% | -6 |

| Post-tax | 24 |

| EPV @ 8% | 300 |

| less cost | -25 |

| Value of cost savings | 275 |

| Value today @ 8% (multiply by 0.7938) | 218.3 |

We take the £30m of cost savings by the end of 2018 (I will ignore those made before then for the sake of simplicity and to keep things conservative), tax them at 20% and give them an EPV at 8%. This gives a value of £300m. Greene King says that it will have to spend £25m to achieve these cost savings so we have to take this number away to get to £275m. We then have to discount the value back to a value today (using a discount rate of 8% for three years gives a discount factor of 0.7938) to get £218m.

Greene King SOTP Valuation

Finally we have our SOTP valuation for Greene King of 788p. This is based on an enterprise valuation of £4.6bn less just under £2.2bn of debt and pension deficits. This compares with a current share price at the time of writing of 795p. If my assumptions and reasoning are not too far off beam then it is telling me not to buy the shares at the moment.

I've shown below how the enterprise value (EV) of each business value has been calculated below and translated that into an implied PE to give another view of it.

| £m | EBIT | Tax @ 20% | Post-tax EBIT | EV | Explanation | Implied PE |

|---|---|---|---|---|---|---|

| Retail | 190.8 | -38.16 | 152.64 | 2158.2 | 9 x EBITDA | 14.1 |

| Spirit | 1420.6 | Cost | ||||

| Value of Cost savings | 218.3 | See calculation | ||||

| Pub Partners | 54 | -10.8 | 43.2 | 608.7 | Net asset value | 14.1 |

| Brewing & Brands | 29.8 | -5.96 | 23.84 | 298 | EPV @ 8% | 12.5 |

| Corporate | -18.4 | 3.68 | -14.72 | -184 | EPV @ 8% | 12.5 |

| Total | 256.2 | 4519.8 | ||||

Less: | ||||||

| 2015 year end net debt | -1368.7 | |||||

| Pension deficit | -60.5 | |||||

| Spirit Debt & Pension deficit | -657.5 | |||||

| Estimated Value of Equity | 2433.1 | |||||

| Shares in Issue(m) | 308.9 | |||||

| Estimated value per share(p) | 788 |

Implied PE = Enterprise value (EV) / Post-tax EBIT

I may not be a professional City analyst who follows Greene King as part of their job but I would like to think that my assumptions and reasoning are not too far wide of the mark. With a bit of thought and consideration there's no reason why many private investors cannot put together a reasonable SOTP valuation themselves, especially if they have personal experience of the businesses involved.

Hopefully I have shown you the kind of things that you have to consider when doing a detailed SOTP valuation of a company. Basically, the more you understand a company and its industry the more informed your valuation will be. Remember, you are trying to get to a realistic valuation of a company not striving for its precise value.

To sum up

- Valuations based on total company profits, cash flows and assets are usually fine but can sometimes under or overestimate the values of individual business units.

- SOTP is based on valuing each individual business unit separately.

- SOTP requires a decent understanding of the company which encourages you to know more about what you are potentially buying.

- SOTP can help identify hidden sources of value e.g. loss-making businesses that overshadow more profitable ones.

- Always examine a company's segmental split of profits.

- SOTP can become quite complicated and detailed but doesn't have to be.

- Valuations should be realistic and conservative.

- A buying price for a share should be a lot less than your SOTP valuation.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.