Stock Watch: Rolls-Royce

When you are running a company that is listed on the stock exchange you are not allowed to disappoint investors. That's because share prices are usually based on expectations of how much money a company will make in the future. If you then tell investors that you aren't going to make as much money as they thought you were - known as a profit warning - then the company's share price usually goes down - sometimes a lot.

This was the unfortunate situation that the new chief executive of Rolls-Royce (LSE:RR) found himself in on Monday last week. It was the fourth profit warning from the company in the last 18 months. The flow of downbeat news from the company has seen its shares fall from over £12 at the start of 2014 to under £8 now.

Patient investors can make money by buying shares in companies when they are going through a rough patch and the share price is depressed. The key caveat here is that the business must be capable of recovering and making much higher profits in the future. If it isn't then you are just throwing good money after bad. This is known as a value trap.

In this article, I've decided to take a closer look at Rolls-Royce and show you some of the areas you might want to concentrate on when trying to figure out if a company can get itself back on track.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

A good business that is underachieving

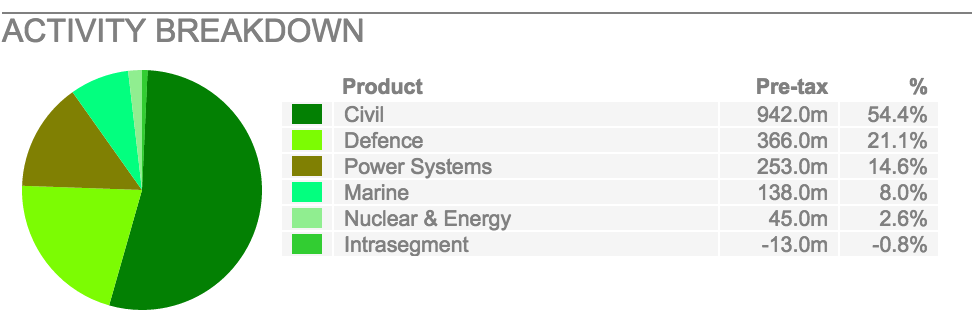

A large part of Rolls-Royce's recent woes have been to do with its Marine business where low oil and gas prices have seen its customers buying less of its products. Yet Marine accounts for only 8% of total profits. Defence profits have also been hit by government spending cuts. But the real value of this business comes from its civil aerospace business - selling aircraft engines to aircraft makers such as Boeing and Airbus.

Civil aerospace could and should be worth a lot of money to Rolls-Royce and its investors. Selling engines in itself is not that profitable. But maintaining them and providing spare parts for their life span of 25 years is. The long-term outlook for this business seems to be very good. As more new planes are built over the next few years, Rolls should have more and more engines to service and provide spare parts for. This should then provide it with a predictable long-term stream of cash - the kind of business that tends to be highly-valued by the stock market.

Yet it seems this business has hit a rocky patch too. It is going to make less money than previously expected as demand for the very profitable Trent 700 engines (which go in Airbus 330 aircraft) is tailing off faster than previously thought. The business is also a lot less profitable than that of its arch rival General Electric.

It appears that many professional investors are losing patience with Rolls-Royce. They are fed up with the promise of jam tomorrow - only to find out that tomorrow never actually arrives - and are selling shares.

Could this be a buying opportunity for a canny private investor? Or is Rolls-Royce the kind of share you should steer clear of? I've opened up my copies of ShareScope and SharePad to try and work this out.

Has Rolls-Royce ever been a good business?

I'd say yes but not consistently so.

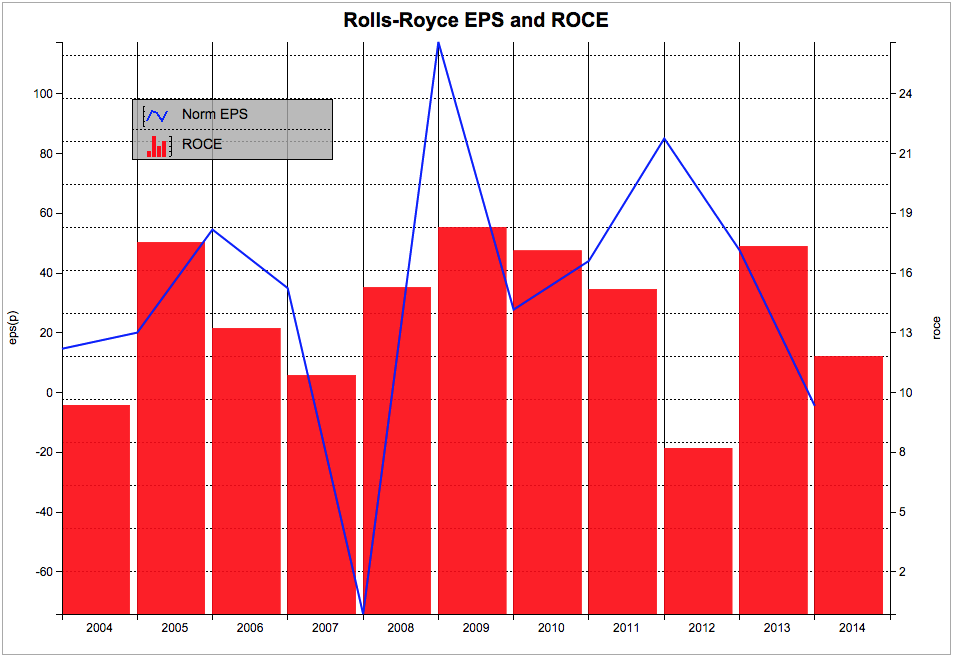

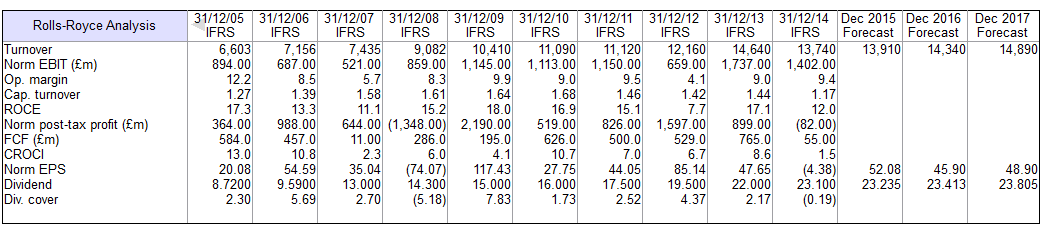

If you take a look at the chart below, you can see that its profits (in this case, EPS) have a tendency to move about all over the place. Their lack of stability in the past is something that would worry me and can be partly explained by the fact that demand for its products is influenced by the state of the economy. However, profits that have been volatile in the past stand a good chance of being so in the future unless the nature of the business changes. The hope for Rolls-Royce investors is that it will as servicing and spare parts - which are needed regardless of what's going on with the economy - become a bigger part of the overall company.

Return on capital employed (ROCE) is the first thing that I look at when weighing up a company. It tells me what a company is getting back in profit (EBIT) as a percentage of the money it has invested.

As you can see in the chart below, the company has been able to earn returns in the mid teens. This is reasonable but not great. 2014 also saw a sharp fall in ROCE.

One positive thing worth noting is that Rolls-Royce has been able to pay a steadily rising dividend. The fact that the company has been able to do this despite having unstable profits is a good sign. But whether it will be able to keep on doing this when its profits -and cash flow - are falling remains to be seen. As you can see from the table above, analysts are forecasting minimal growth in dividends per share over the next three years.

Deteriorating cash flow and finances

Servicing engines and providing spare parts for them should result in lots of spare (or free) cash flow pouring into Rolls-Royce. The trouble for investors is that the company doesn't seem to be very good at consistently generating significant amounts of free cash flow. Free cash flow was just £55m last year and could be negative in 2015. Compare this with the £438m of cash needed to pay the current dividend of 23.1p per share last years and this is a serious issue.

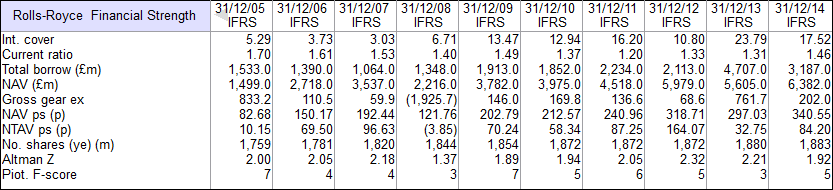

I think that Rolls-Royce's cash flow and cash balances warrant a significant amount of time spent on them if you are thinking about buying (or you already own) shares in the company. At first glance, you will see that the company had over £2.8bn of cash on its balance sheet at the end of 2014. Compare that with just under £3.2bn of borrowings and you could be forgiven for thinking that Rolls-Royce's net borrowings (borrowings less cash) leaves little to worry about.

That may be the case. However, you should always ask yourself how much of its cash balances a company - and its shareholders - can actually get their hands on. Customers may have paid for goods and services in advance and suppliers may be owed cash. This might mean that a lot of a company's cash balance doesn't belong to it as either it is needed to pay bills or hasn't been earned yet.

Always look at a company's gross borrowings (before cash is taken away) and gross gearing (gross borrowings divided by shareholders' equity) to get a more conservative view of its financial position. In 2014, Rolls-Royce's gross gearing was 202% excluding intangible assets. That's quite high and also highlights that the company does not have much tangible equity behind it - net tangible assets per share is only 84.2p (share price is 783p at the time of writing).

However, if you look at a key measure of a company's ability to pay its way - interest cover - you can see that Rolls-Royce has no problem paying the interest on its borrowings. Its interest cover was a very comfortable 17.5 times in 2014.

Also look out for forms of hidden debt such as pension fund shortfalls (or deficits) that could cause a company problems and is typically not included in gearing calculations. Rolls-Royce has a pension fund hole of nearly £3bn that will have to be plugged in the years ahead. Cash that needs to be paid into the pension fund is cash that cannot be paid to shareholders or invested in the business.

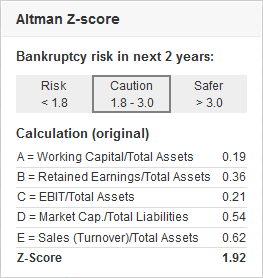

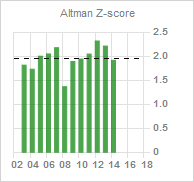

One final point on Rolls-Royce's finances is its Altman Z-score of 1.92. This number suggests that the company's financial position should be treated with caution as it might get into difficulties in the future.

A closer look at Rolls-Royce's Z-score shows you how the number is made up. The main contributor to its relatively weak score is its poor return on total assets (EBIT/Total Assets).

Looking back at Rolls-Royce's Z-score history shows that it has deteriorated in the last couple of years (for more about Z-scores click here).

How cheap are Rolls-Royce shares?

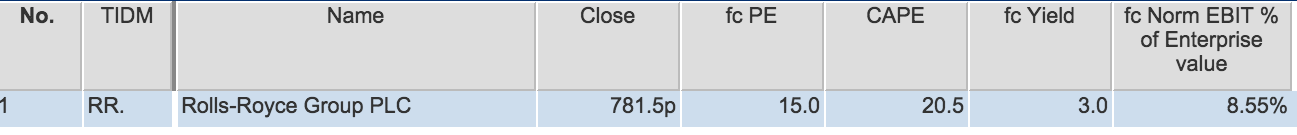

I've used SharePad to have a look at how Rolls-Royce shares stack up on a variety of measures. Bear in mind though that the analyst forecasts which most of them are based on are likely to come down further over the next few weeks as they react to the latest profit warning, so the valuations could look lower (cheaper) than they ultimately will be.

That aside, it's difficult to argue that the shares look really cheap on any measure. My favourite measure of EBIT yield (I've made up a forecast version of this by taking the forecast EBIT divided by enterprise value) is showing 8.55%. It would have to be a lot more than 10% for me to consider them to be really cheap. A forecast PE of 15.0 could indicate the shares are reasonably valued if things were going well, but they are not. A forecast dividend yield of 3% which might not grow that much is hardly tempting either. This leads me to think that Rolls-Royce's share price could fall further

Are the profit warnings over?

This is the crucial question. A new chief executive often tries to get as much bad news out of the way as soon as possible (known as kitchen-sinking) so that things can soon be seen to be improving. If he has done that then perhaps the bad days are behind the company.

However, reading the recent news announcement there could be grounds for caution:

"As outlined in May, we continue to expect 2015 underlying profit before tax to be phased more to the second half than in 2014, led principally by Civil Aerospace and Power Systems. As a result, first half underlying profit before tax is expected to be between GBP390m and GBP430m, or around 30% of the full year, compared with roughly 40% in 2014. Free cash flow is expected to be between GBP(570)m to GBP(620)m compared with GBP(347)m in the first half of 2014."

The company seems to be relying on more of its expected profits to be made in the second half of the year. There may be good grounds for saying this or the company may not be sure and is hedging its bets. If the expected profits don't come through in the second half then another profits warning cannot be ruled out.

There is also an issue of the quality of profits. They would have been £200m worse if a previous provision for losses had not been needed and will be written back to boost this year's profits. This is not a flow of extra cash and is arguably a very poor source of profits.

From the news release in SharePad:

"...These market headwinds should be balanced by good growth in our widebody aftermarket and a larger-than-expected benefit from the reversal of a balance sheet provision on the Trent 1000 launch, as a result of an expected significant improvement in operating performance, and by improved retrospective TotalCare contract profitability. The value of the provision release and contract profitability are expected together to contribute around GBP200m, somewhat more than previously expected."

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.