Stock Watch: Domino's Pizza - can a great investment stay great

If you've been a long-term shareholder in Domino's Pizza (LSE:DOM) you are probably very happy with your investment. Years of consistent profits growth have been rewarded by a very generous valuation of its shares by the stock market.

Shares like Domino's are the kind of investment that every private investor would have loved to have had in their portfolios. You only need a few of these and hold on to them for a reasonable length of time to build yourself a very impressive nest egg. They are the kind of shares that ShareScope and SharePad users are trying to find every day.

If you are fortunate enough to own Domino's or a similarly successful share then what you really want to know is whether the good times can continue and whether the share price can keep on going up.

I'm going to show you how, armed with ShareScope or SharePad, you can try and work this out.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Background

British people love take-away food. Walk down any high street and you'll be spoilt for choice for something to eat. The market for fast food has kept on growing and looks like it can keep on doing so. Take-away pizza has become a firm favourite and Domino's has established itself as the clear market leader.

Domino's owns the exclusive franchise to sell pizzas under the Domino's Pizza brand in the UK, Ireland, Germany, Switzerland, Luxembourg and Liechtenstein. It has 894 stores - 813 of them are in the UK. Since opening its first store in Luton in 1985, the company has grown its profits at a very healthy rate. It sold over 75 million pizzas in 2014.

If you've ever made your own pizza then you'll know that the basic ingredients that go into making them are fairly cheap. If you then look at the prices that they are selling for in your local Domino's Pizza shop or on its website you won't be surprised to find out that selling pizzas is very profitable indeed.

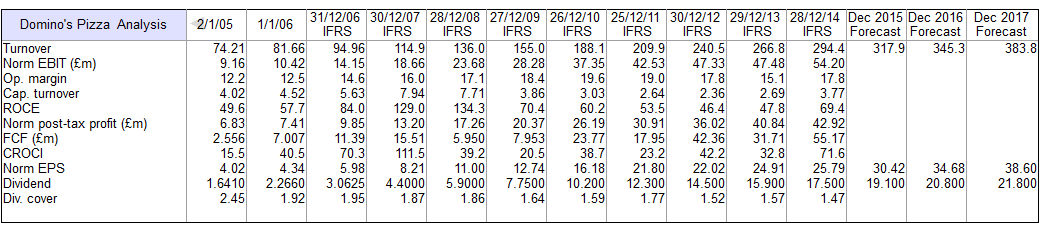

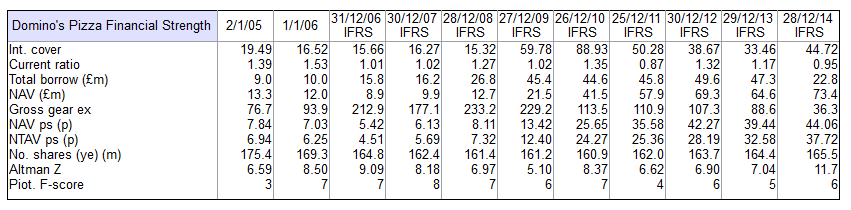

When I start looking at a company's financial history, I tend to build a results table in ShareScope with all the key financial data that I want to concentrate on. This is probably my favourite feature in ShareScope because it allows you to analyse a company very effectively and very quickly. You only have to build a results table once and it will give you the same information for any share that you are looking at. You can change the data in the table very easily with a helpful wizard. (In SharePad, you'll find this information on the Financial tabs but we'll be adding the ability to build your own table soon.)

Let's see what it is telling us about the past performance of Domino's:

You can see that turnover and profits have been growing nicely and are expected to keep on doing so. What's particularly encouraging is that operating profit margins have stayed consistently high which is a good sign.

However, the real hallmarks that Domino's is an excellent business is returns it makes on money invested. Its return on capital employed (ROCE) was a stunning 69.4% in 2014 - even though ROCE has been much higher in the past - and its cash return on capital invested (CROCI) was even better at 71.6%.

A focus on quality, service and branding along with moving more orders onto the internet is producing consistently good results. That said, the real reason for Domino's high returns is the fact that it is a franchise business. Its 100 franchisees take on a lot of the costs of the business such as property costs (Domino's leases shops and then sublets them to franchisees) and pay Domino's a share of their profits. So despite there being nearly 900 shops the total amount of money invested by Domino's is less than £70 million. The franchise nature of the business means that Domino's can make high returns on investment and turn most of its profits into free cash flow - a scenario that most business owners dream of. This allows Domino's to pay a large chunk of its profits and cash flow in dividends each year.

Domino's finances are in rude health. It has more cash than it has borrowings (a net cash position) and can meet its financial obligations very comfortably. One other thing to point out is that the number of shares in issue has fallen over the last decade. This is a positive sign as it is telling us that the company isn't having to tap shareholders for fresh money in order to grow.

So, an analysis of Domino's financial history is very reassuring.

But how will profits keep on growing?

The key risk for a business like Domino's is that its high profits will attract competition from other fast food chains and that it will run out of places to open new pizza shops. Its future profits will largely be determined by three things:

- Selling more pizzas from existing shops

- Opening more shops

- Maintaining or increasing its profit margins

It seems to be doing a good job of selling more pizzas from its existing shops. Like-for-like sales in the UK went up by 11.3% in 2014 and started 2015 growing at just under 10%. Its Irish shops are seeing sales grow as well. Domino's has invested a lot of money into driving more sales from the internet (you can order a pizza from an X-Box games console!) and this seems to be paying off.

As far as opening more shops is concerned, Domino's reckons that it can have up to 1200 of them in the UK over the next few years compared to just over 800 now. Its recently opened shops have been doing well and the company is confident that there are enough places to open up and make good money.

Domino's has been trying to build up its businesses in Germany and Switzerland but both these areas are currently loss making. It has found the German market very challenging and it remains very uncertain as to whether Domino's can have anywhere near the same success abroad as it has in the UK. This might be one of the key stumbling blocks to growing the business and could make it even more reliant on the UK. To me this seems to be one of the key risks facing shareholders. Keep an eye on the news feed for trading statements and broker updates.

The stability of profit margins in the past should give investors some confidence that they can remain high. The company places a high importance on controlling the cost of pizza ingredients so that the business can remain competitive. It is also opening another supply chain centre in 2017 which should make the business more efficient.

I might be wrong, but unless the UK economy hits the rocks then it seems that analysts have good grounds to predict that profits can keep on growing - at least for the next few years.

Can the shares retain their high valuation?

Growing profits is all important. But so is the price placed by the stock market on those profits. One of the biggest risks for investors in richly valued shares such as Domino's (where the PE ratio is high) is that the stock market will lose some of their enthusiasm for them in the coming years if results disappoint or the stock market falls. There is not a lot of room for things to go wrong at the current price.

How Domino's Pizza shares are priced

| Name | Close | Market Cap. | fc PE | PE 10y avg | fc Yield | fc Dividend cover | EBIT yield |

|---|---|---|---|---|---|---|---|

| Domino's Pizza UK & IRL PLC | 780p | £1,299.5m | 25.7 | 24.3 | 2.4 | 1.6 | 4.2 |

At 780p the shares trade at a high forecast PE of 25.7 times. This is telling us that expectations for future profit growth are currently high. This is very similar to the ten year average PE (a nice useful feature in SharePad and ShareScope) which is telling us that the company has been able to keep investors happy and maintain a high valuation in the past.

A very quick and powerful way to work out what the future might bring for a share investment is to see what the share price might be if the expected EPS are priced at different PE ratios.

This is easy to do and is shown in the table below. The next three years' forecast EPS are multiplied by different PE ratios attached to them.

Possible future share prices at different PE ratios

| fc Norm EPS | 2y fc Norm EPS | 3y fc Norm EPS | |

|---|---|---|---|

| Domino's Pizza UK & IRL PLC | 30.4p | 34.7p | 38.6p |

| Possible share prices: | |||

| Price at PE of 25.7x | 781p | 892p | 992p |

| Price at 10y avg PE of 24.3x | 739p | 843p | 938p |

| Price at PE of 30x (p) | 912 | 1041 | 1158 |

| Price at PE of 20x (p) | 608 | 694 | 772 |

| Price at PE of 15 (p) | 456 | 521 | 579 |

If the shares remain priced at their current PE (25.7) or 10 year average and the EPS forecasts are met then shareholders will continue to do well. I think it's unlikely that the shares will become more richly valued (by this I mean that the PE ratio will increase) but if that happened shareholders would have even more to celebrate.

To me, the biggest risk facing shareholders is that the PE ratio will go down (known as PE multiple compression) even if EPS continues to go up. A PE of 20 - which is still high by most investors' standards - would see the shares trade at a similar price as today in three years' time. A PE of 15 would see quite substantial losses.

(For more on the risks of buying and owning high PE shares click here).

Hopefully what you have seen is some of the things you can look out for when weighing up highly valued shares. Leaving aside the all important share price for a moment, here are the three key questions you need to find answers for:

- Have profits been growing for a reasonable length of time? At least five years as a bare minimum.

- Are profit margins and financial returns consistently high?

- Can profits keep on growing in the future?

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.