Improve your chances of picking winning shares with this useful number

How much money a company makes is very important to investors. How it makes its money is even more important.

One of the biggest mistakes you can make as an investor is to solely focus on how much. It is not always correct to say that a company which has bigger profits and a higher growth rate than another one is a better business. It depends on how much money the company is spending to make those profits.

Just as the easiest way to get more income from a savings account is to put more money in it, the same can be true for companies and their profits. Too often, investors can think they are buying into a growth business when really what is happening is that the company concerned is just spending a lot of extra money. Retail companies are a great example of this when they are opening lots of new shops.

Good investors know this. That's why they concentrate their focus on numbers such as return on capital employed (ROCE) and free cash flow rather than earnings per share (EPS).

One of the great things about analysing a company's financial statements is that there is a wealth of information in them if you know which numbers to crunch. Looking at calculations such as ROCE and free cash flow is a very good thing to do but what's even better is understanding how a company ends up with those numbers.

The good news is that there is a useful way to do this.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Introducing the capex ratio

Good businesses make high returns on the money that they invest. They also tend to produce lots of free cash flow as well.

As I said earlier, you can look for shares with high ROCEs and free cash flows. I do, but I've been spending more time looking at another number recently - it's called the Capex ratio. In SharePad we call it Capex to operating cash flow.

Capex ratio = Capex / Operating cash flow

Capex is short for capital expenditure which is the accounting term for the money a company spends on new assets. The capex ratio measures capex as a proportion of operating cash flow (which is the money coming into the business from selling goods and services). The ratio is expressed as a percentage.

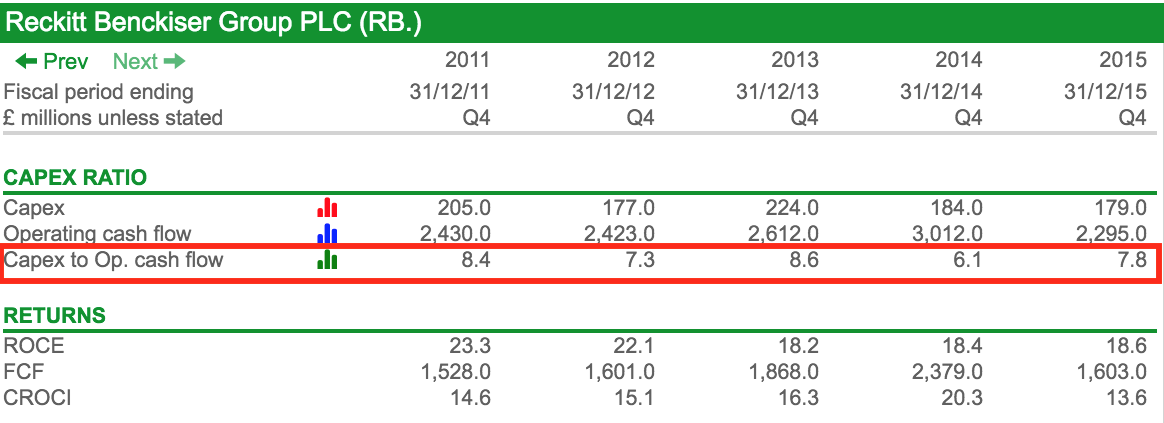

In the SharePad table below you can see the ratio and its components calculated for Reckitt Benckiser.

In 2015, Reckitt Benckiser spent 7.8% of operating cash flow on new assets (capex). This is a very low number and is consistent with the amount of money it has been spending in recent years.

Providing a company is not under-investing and skimping on capex (for most businesses this would mean that capex is at least equal to its annual depreciation expense), the lower the capex ratio the better. A low ratio means that it costs less money to stay in business and there is more money available to pay taxes, interest and, above all else, dividends.

A company with a low capex ratio - as long as it does not have big tax and interest bills to pay - stands a much better chance of generating free cash flow for shareholders and higher returns on capital employed. These are the kind of companies that can make excellent long-term investments - when bought at a reasonable price of course.

Reckitt Benckiser has rewarded long-term investors. Take a closer look at some of its key numbers. Its capex ratio has been consistently low which in turn has fed through to good levels of ROCE, free cash flow and CROCI.

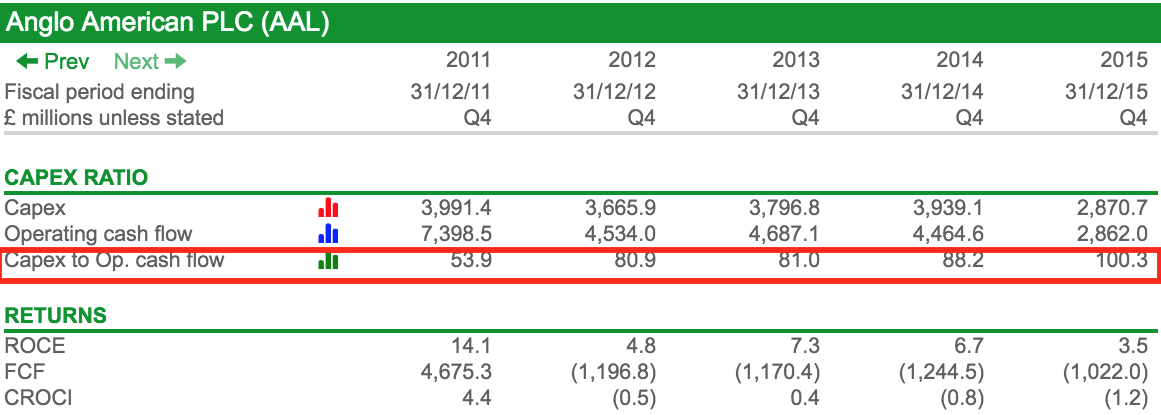

Now contrast Reckitt Benckiser with a company like Anglo American.

This mining company has a very high capex ratio. In recent years it has been spending over 80% of the cash coming into the business on new assets, leaving very little money left over for shareholders. Last year, all of its operating cash flow was eaten up by capex.

With the exception of 2011, Anglo American has struggled to produce any significant free cash flow with cash actually flowing out of the business. Its ROCE has collapsed.

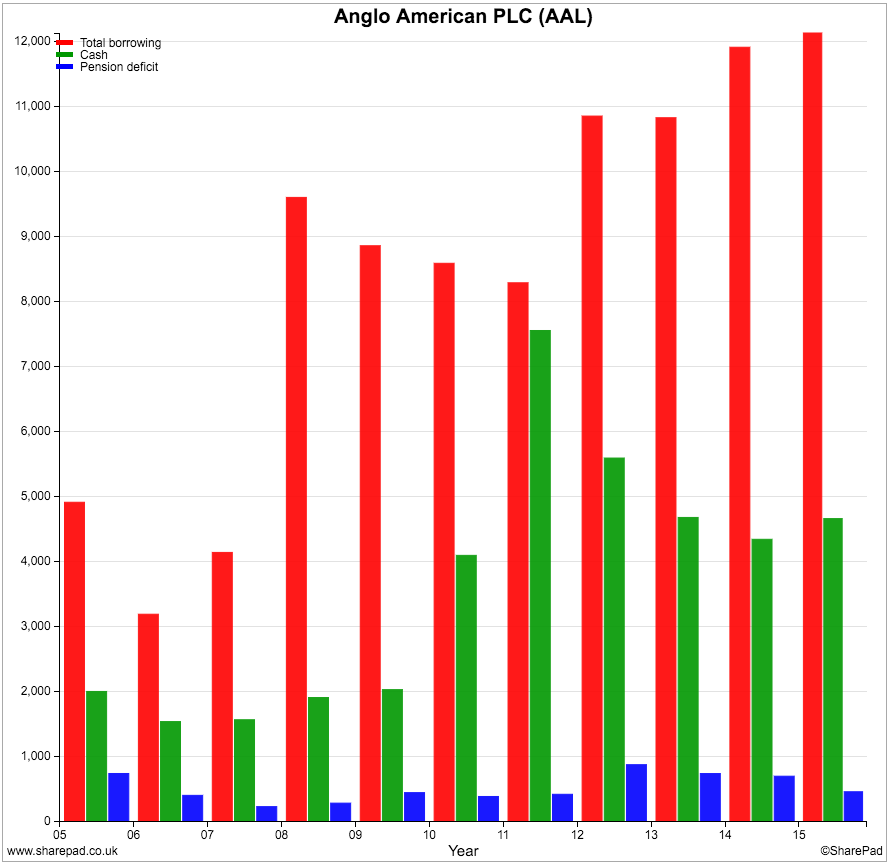

Its financial position has also become much more stretched.

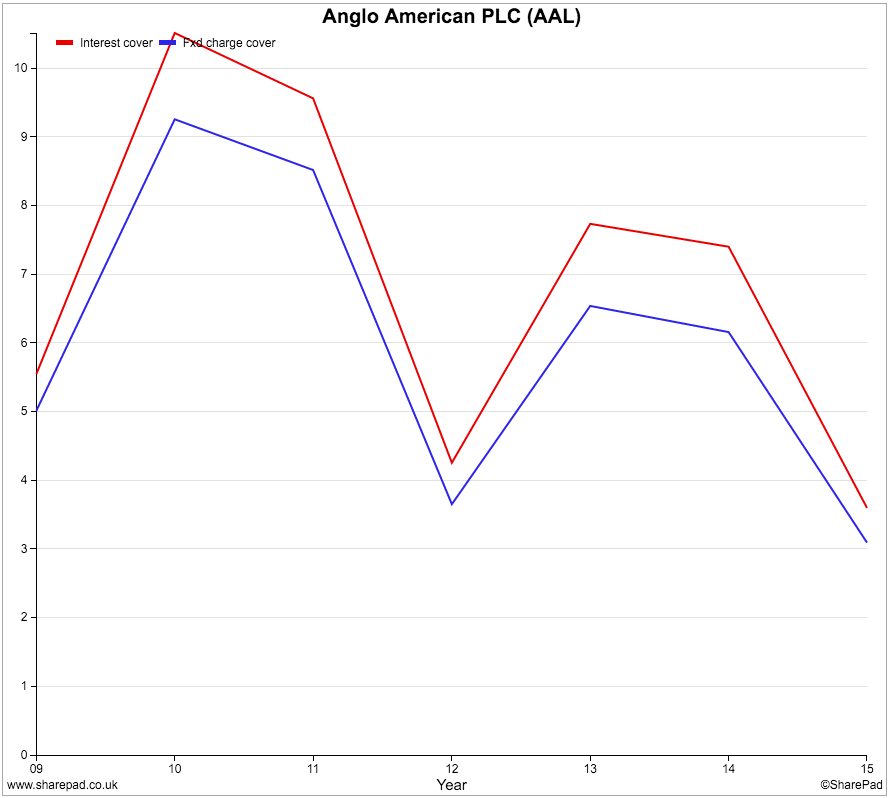

It has had to take on more debt as its cash flows have deteriorated. Interest and fixed charge cover ratios are falling.

The point I am trying to get across is that companies with high capex ratios can be very risky. It often means that they have to take on more debt when times get tough. More debt means more interest to be paid which also means that there is less money left over for shareholders. In the worst case scenario a company could go bust and there could be nothing left for shareholders at all.

You won't be surprised to learn that Reckitt Benckiser has trounced Anglo American as a long-term investment. Over the last ten years Reckitt Benckiser shares have delivered a total shareholder return of 277% compared to minus 50.3% for Anglo American shares. In general it is much more difficult for high capex, asset-intensive companies to produce good, consistent returns for shareholders.

Comparing similar companies

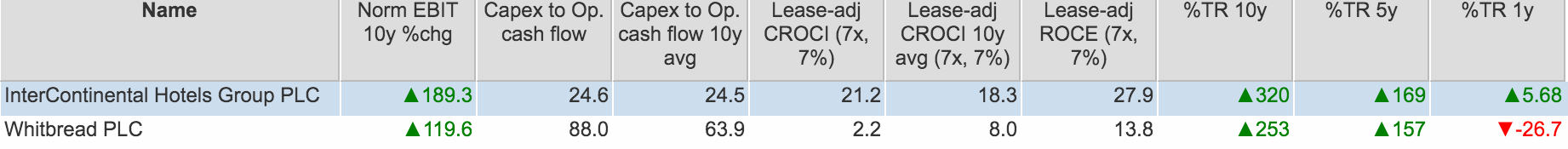

The capex ratio can be a useful way of comparing companies that are in similar lines of business. Below, I compare the performance of InterContinental Hotels Group with budget hotel (Premier Inn) and Costa Coffee operator Whitbread.

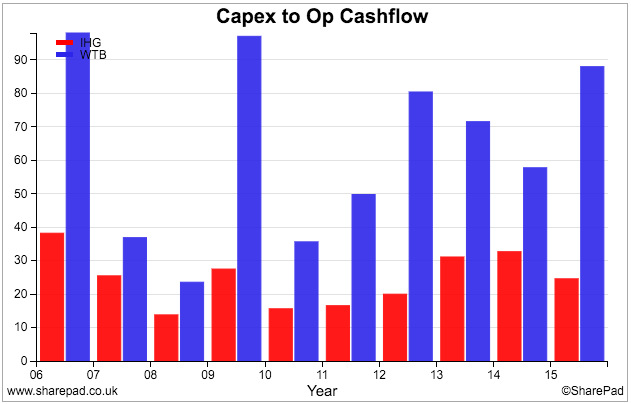

Both companies have seen strong growth in the trading profits (EBIT) over the last ten years. However, Whitbread has spent a much higher proportion of its operating cash flow on new assets than InterContinental - nearly two thirds compared to just under a quarter.

In some years, Whitbread has been spending nearly all of its operating cash flow on new assets as shown in the chart below.

The differences can be explained by their business models.

InterContinental has become a franchiser of its hotels. It doesn't own lots of assets and therefore doesn't have to spend lots of money on keeping them looking nice for guests. In return it gets a cash royalty payment from its franchisees. This allows it to make high returns on capital and generate plenty of free cash flow.

Whitbread on the other hand owns its hotels and coffee shops and is responsible for the capex needed on them. It has also been expanding aggressively opening lots of new ones in recent years. This has resulted in Whitbread spending a much larger chunk of its operating cash flow on new assets than InterContinental.

This higher capex spend has also produced lower ROCE and CROCI numbers as well.

InterContinental has been a better long-term investment than Whitbread with a marked outperformance during the last year.

The lesson here is that there is nothing wrong with spending large amounts of money on new assets as long as they produce high future returns and cash flow. Whitbread's ROCE is reasonable but Intercontinental is making twice the amount.

To sum up

- Investors should focus more on how a company makes its money not just how much money it makes.

- The capex ratio is good at explaining how much money a company spends to make money.

- A lower ratio is better than a higher one as long as company isn't spending too little or under-investing.

- Low capex ratios can feed through to higher amounts of free cash flow and ROCE. This can help companies become better long-term investments.

- High capex ratios are fine if the money spent is making high future returns.

- High capex ratios can put pressure on company finances and increase risks for shareholders.

Disclaimer: Phil Oakley owns shares in InterContinental Hotels.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.