My 5 rules for safe dividend investing

Shares with high dividend yields can seem very tempting when you are thinking about where to invest this year's ISA allowance. However, blindly buying these types of shares without doing your homework first can often see your investments come a cropper.

High dividend yields can be traps for the unwary. That's because they are often caused by low share prices. This can be a sign that the market believes that the current dividend is unsustainably high. You need to decide whether it is or not.

I've put together 5 simple rules that you can follow to help you reduce the risks of buying a share with a dodgy dividend and allow you to become a better dividend investor.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Don't just focus on dividend yield - dividend growth can be more important

The first mistake that dividend investors can make is believing that higher yields are always better than lower ones. Sometimes this can be true. However, the ability of dividends to keep on growing can be just as - if not more - important.

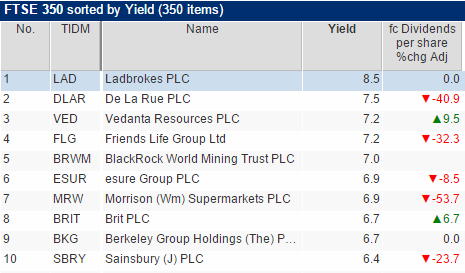

The table above shows the top ten shares in the FTSE 350 ranked by dividend yield at the beginning of April 2015. This is very easy and straightforward to do in SharePad (and ShareScope). I've also added a column in SharePad to tell me the expected rate of dividend growth expected by professional analysts.

As you can see, many of these high yield shares are expected to slash their dividend payments or not grow them at all. Remember, high yields can often be a warning sign that all is not well with a company.

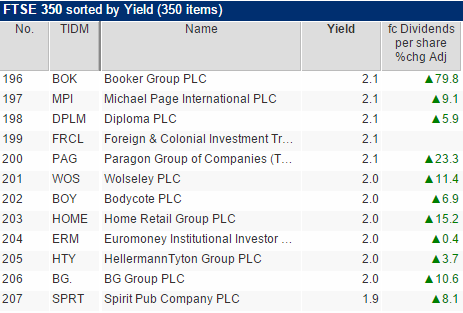

If you can find a share with a reasonably high yield that can keep on growing its dividend then you may have found an investment that can grow in value over the years. What you will tend to find is that there is often a trade-off between dividend yield and dividend growth. High yields often have no or low dividend growth whilst lower yields may offer higher rates of dividend growth as shown in the table below.

If you are looking at dividends from shares as a source of income - say as part of your pension or ISA plan - then it makes sense to pay attention to dividend growth.

For example, you might be tempted to buy a share yielding 5% but where the dividend is growing at only 2% per year. That would give you £50 of income on a £1,000 investment in year 1 and £55.20 after five years. Or you could buy a share with a yield of 2.5% but with dividend growth of 20% per year. Your income on the same £1,000 investment would only be £25 in year 1 but would be £62.20 in year 5. The chances are that the capital value of your shares would have gone up a lot more too. Dividend growth is very important.

Study a company's dividend history

The biggest enemy of a dividend investor is the dreaded dividend cut. This tends to happen when a company's profits fall, perhaps in a recession or with the emergence of a new competitor.

Companies can and do change, but buying shares that have a long track record of paying dividends - and preferably increasing them - can give you some confidence that it has had the ability to cope with the ups and downs of different economic conditions. This may suggest that it can do so in the future as well.

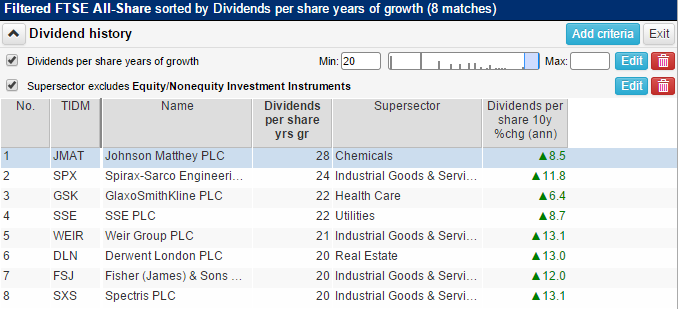

In SharePad, I can easily search for shares with a long history of increasing their dividend payments. It has found that there are eight companies that have increased their dividends every year for at least twenty years. I've also asked SharePad to calculate the annual rate of dividend growth over the last ten years.

Look for a company with strong finances

Companies with lots of debt and big liabilities such as final salary pension fund shortfalls can find it hard to maintain or grow their dividends if trading profits come under pressure. Remember, as a shareholder you are always last in the queue to get paid. If there's not enough profit left over after interest on loans have been paid you may be facing up to a lower dividend or none at all.

By avoiding companies with weak finances you can reduce your risk of buying a share with a dodgy dividend. Also, check out how comfortably profits cover the annual dividend payment (the dividend cover ratio) and ask yourself whether the dividend has any buffers if profits fall.

Some companies try to woo investors by telling them about their future dividend plans. This sounds good in theory but only if profits are big enough and quite often something happens which means they are not. Dividend cover usually applies to the latest set of accounts but in SharePad you can also check the forecast dividend cover (forecast EPS divided by forecast DPS).

A rising dividend with a falling level of dividend cover can be a warning sign of an unsustainable dividend.

Where do the dividends come from? Understand a company's business

Companies need profits and cash flow to pay dividends. This comes from selling products or services to customers at a competitive price. To sleep more soundly, it is a good idea to try and understand how a company makes its money and ask yourself whether it can continue to maintain or increase its profits in the future. Don't just buy a share on the basis of a dividend yield number in SharePad or the newspaper.

Some companies such as utilities - especially water, electricity, gas and telecom networks - have very stable and predictable profits and cash flows which makes them a favourite amongst dividend investors. Other favourites are companies with strong brands which make them difficult to compete against and protects their profits.

Companies whose profits tends to move up and down with the economy such as manufacturers or house builders tend to have less reliable dividends. Technology companies can be very risky too if their products are replaced by something that is better and more up to date.

Re-invest your dividends

Instead of spending your dividend cash, you can use it to buy more shares of a company. This in turn can increase the amount of dividend income that you receive in the future as long as the dividend per share is maintained or increased. This process of reinvesting your dividend payments is known as compounding because it uses the magic of compound interest (earning interest on interest). Do it for long enough and it is possible to turn a relatively small investment into a much larger sum.

Many brokers will allow you to set up an automatic dividend reinvestment instruction for shares in your account. This can be very useful.

One of the great things about dividend reinvestment is that it teaches you to like lower share prices. That's because it allows your dividend cash to buy more shares which can boost your returns when share prices recover.

Be careful though as reinvesting dividends when prices are high and dividend yields are low may not be a very smart decision. You need to keep an eye on your portfolio and make sure that the dividend is still secure and that yields are not too low. Reinvesting your dividend at a yield of 4-5% is a lot smarter than at 2% or less.

Dividend reinvestment is a buy and hold strategy that can work well but it is not meant to be a strategy of buy and forget.

Your own reliable dividend screener

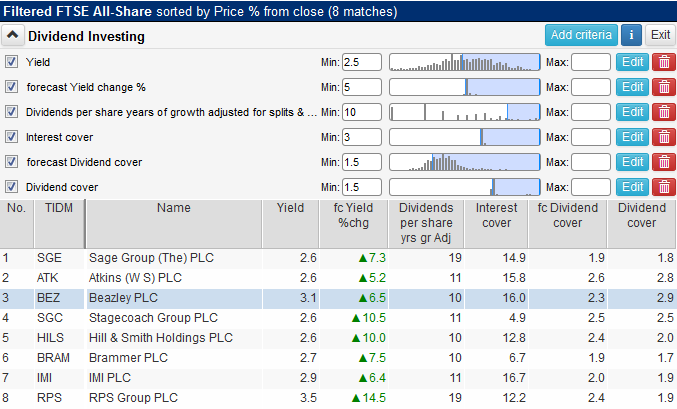

Here's a filter for reliable dividend payers, using SharePad.

At the time of writing, this screen has only found eight shares to do further research on - and all with yields in the range of 2.6 to 3.5%. But remember what I said about lower yields and higher growth.

You will undoubtedly find more if you relax some of the criteria. Bear in mind though, that if you do you may be exposing yourself to more investment risk that you would ideally like.

The other thing to remember is the big advantage that you have as a private investor - you don't have to buy expensive or risky shares. You can sit tight and wait for prices to become more attractive. Sometimes you can be waiting a very long time but this is usually better than paying the wrong price for a share and losing money.

I've summarised these rules into a single sheet (here) which you might like to keep in a folder or stick on your wall. You can read more about dividend investing in Chapter 11 of my Step-by-Step Guide to Investment Analysis - available free at www.sharescope.co.uk/philoakley.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.