Warren Buffett's best lesson for investors

It's that time of the year when Warren Buffett is guaranteed to be in the news. The publication of his annual letter to Berkshire Hathaway shareholders is always scrutinised for words of wisdom.

The truth is that there's rarely anything new for investors in it. That's because Buffett has stayed with a tried and tested investment formula for decades now. The days when he trawled the stock market for unloved bargains are long gone. The secret to Buffett's success and immense wealth are very simple. He has invested in good companies and has held on to them for a very long time.

If you want to see a great example of the powers of compound interest at work then look no further than Warren Buffett and the growth in profits and stock market value of Berkshire Hathaway. Over fifty years the income from his investments has been reinvested and has snowballed to a mighty sum of money.

Even though 2015 wasn't a good year for Buffett, since 1964 the share price of Berkshire Hathaway has grown at an average annual rate of 20.8% compared to 9.7% for the S&P 500 index (with dividends included). This means he has made 140 times more money than if he had just owned the market.

Most people with money to invest aren't as skilful as Warren Buffett and probably don't have fifty year investment horizons. But that doesn't mean that you can't benefit from what is arguably Warren Buffett's best lesson to investors - the ability to be patient.

Want to learn how to analyse shares like a professional? Download our FREE guide.

Sign-up to our mailing list to receive a PDF of our Step-by-Step Guide to Investing.

Share this article with your friends and colleagues:

Time is the investor's best friend

I've just finished reading the third edition of The Warren Buffett Way by Robert G. Hagstrom. There's lots of stuff in this book that has been said thousands of times elsewhere about how Buffett invests and what kinds of things he looks for in an investment.

However, the real value of this book is to be found in the later chapters. Bits of it are a little heavy going but if you stick with it there's some very interesting and valuable advice there.

Hagstrom spends some time looking at the psychology of investing and why some people are better at it than others. Essentially it boils down to people being their own worst enemy.

Chapter 7 of his book is a real gem and is titled The Value of Patience.

According to Hagstrom, too much money in the stock market is chasing quick wins. This search for instant gratification is stressful and means that people can spend too much time focusing on share prices on a computer screen rather than on actual businesses. This often leads to overtrading and bad decisions which is not only expensive but seldom leads to large gains being made. Investors would be better off taking a long-term approach to building their wealth.

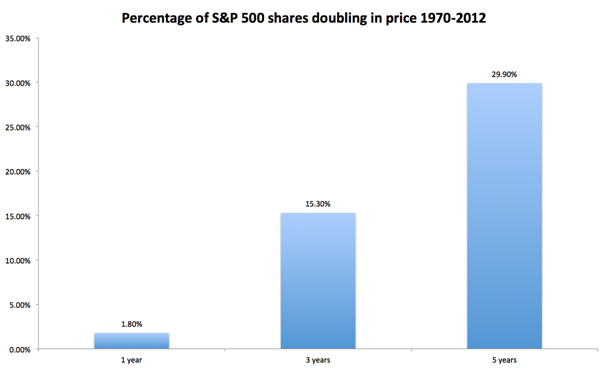

He backs this up by running a very simple study of the performance of US shares. He looks at the results of buying and holding shares in the S&P 500 index over one, three and five year periods between 1970 and 2012 and seeing how many doubled in price or more.

Source: The Warren Buffett Way by Robert G. Hagstrom

A share that doubles in price in five years is a pretty impressive performance. It means an average annual price gain of 14.9%. Hagstrom found that on average nearly 30% of the shares in the S&P 500 doubled in price over a five year time period. To him, this was a clear example of the benefits of long term investing. A rising stock market is clearly useful in helping shares to double in price but Hagstrom found that the "doublers" handsomely beat the performance of the market as well.

What about UK shares?

Having read about the experience of US shares in Hagstrom's book, I decided to look into what had gone on in the UK stock market.

SharePad allows you to do some form of backtesting on various strategies and theories. It's not perfect because of the fact that some companies that were in existence in the past aren't today. You can only test with the shares that are in existence today and so there will be some survivor bias to any backtest. The further you go back the bigger this bias is likely to be.

To look for shares that have doubled in SharePad is simple. It can easily be done through a quick price filter. Just set the dates you want to look at and set the minimum share price change to 100%.

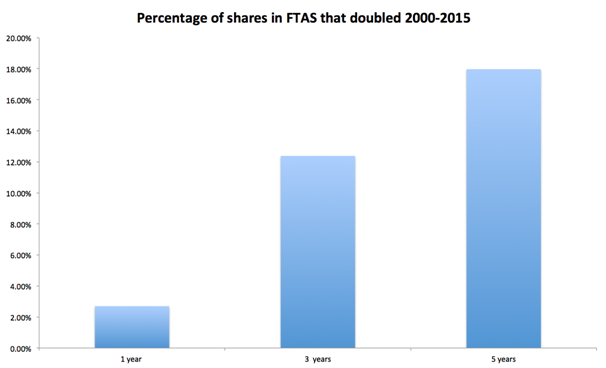

I decided to look at the current constituents of the FTSE All-Share index (633 shares) and to do the same test as Hagstrom between 2000 and 2015. For each year of the period I filtered for stocks that had doubled over the preceding 1, 3 and 5 years.

The average results are shown in the chart below.

Source: SharePad

These results are probably understated and are over a shorter time period than Hagstom's study but do add some weight that the longer you wait, the bigger the chance of finding a share that will post a big gain.

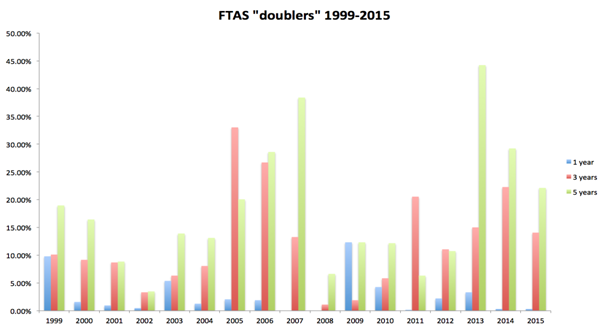

Looking at the results by year you can see some interesting things on how the stock market as a whole influences results. The number of five-year doublers (the green bars) declined from the peak of the dot-com bubble in 1999/2000 to the market low in 2003. We then see a strong recovery up to the next peak in the market in 2007 and another in 2013. Since then the number of shares doubling over five years has fallen whilst the shares doubling in one year have almost disappeared - there were only two in 2015.

Source: SharePad

Looking back even further we can see some more interesting results. If we look at total returns and include dividends received, 386 shares - 61% of the current FTSE All-share index - have doubled from the start of 2009 until the end of 2015.

Over ten years, which takes into account the savage bear market of 2007-08, 182 shares have still managed to double meaning a minimum average annual total return of 7.2%. Over 15 years which takes into account the 2002-03 bear market as well, 260 shares have more than doubled in price (a minimum average annual total return of 4.7%).

So taking a long-term view and being patient seems to have a lot going for it. That only leaves us with one small problem - finding shares that can do well over the long-run.

Finding quality companies at the right price

So we return to the holy grail of investing: buying good companies at good prices.

With a bit of legwork and knowing what to look for it is possible for the private investor to identify quality companies. What's less easy is finding them and having the discipline to buy them at the right price.

What is the right price for a quality company?

There is no right answer to this question but I have been doing a lot of thinking about this recently. You are unlikely to find really good quality companies at bargain basement prices. You are going to have to pay up in most cases.

The trouble is that low interest rates on savings accounts and government bonds have pushed up the price of shares and the shares of many high-quality blue chips in particular such as branded consumer goods companies.

Buffett has a very simple approach to valuation. He calculates a company's owner earnings or cash profits (for more on this click here) and divides it by the current yield to maturity (gross redemption yield) on government bonds. So if he calculates a company has cash profits of 10p per share and bond yield are 5% the minimum value of the share is 200p (10p/5%) - a PE or price to free cash flow multiple of twenty times.

Buffett doesn't ask for any extra yield on top (known as an equity risk premium) because he thinks that the quality of the business reduces risk and that the cash profits in the future - and the value of the share - will be materially higher in ten years time.

The problem with this approach at the moment is that bond yields have been pushed lower and lower in recent years and are close to zero in some countries. The current ten year gilt yield is just 1.5%. I'm not sure that there are many shares out there - no matter the quality of the businesses behind them - that are worth multiples of cash profits of 66.6 times (1/1.5%).

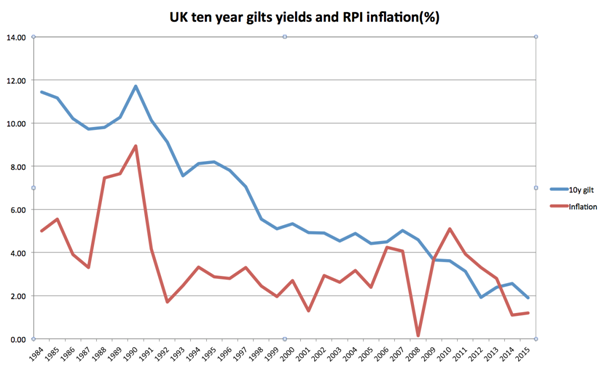

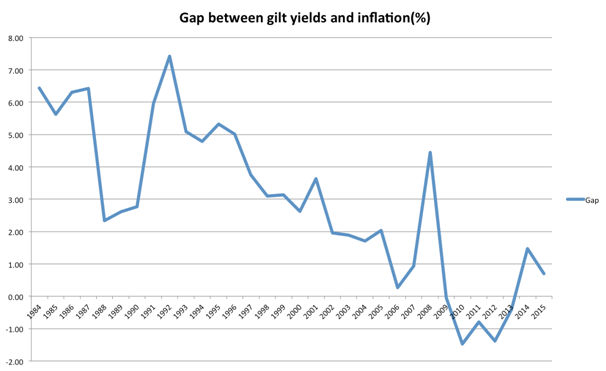

Below is a chart of the yield on ten year UK government bonds (gilts) compared with the rate of inflation since 1984. As you can see, there has often been a big gap between gilt yields and inflation i.e. there was a real after-inflation return on gilts.

Since 2008, this gap has become smaller and has even turned negative (bond yields have been less than the rate of inflation).

If you are going to use the Buffett approach you need to make an adjustment to the current low rates of interest so that you don't end up paying silly prices for quality companies.

You could look at the average gilt yield over the last thirty years of 6.4% and set a price limit on cash earnings at that yield or a multiple of 15.6 times (one divided by 6.4%). The thing is you won't find many shares to buy at this price limit.

Another alternative is to add something extra to the current gilt yield instead. Over the last thirty years the average gap between gilt yields and inflation has been 2.93%. Adding 3% to the current ten year gilt yield of 1.5% would give a minimum yield of 4.5% or maximum multiple of 22.2 times (one dividend by 4.5%).

These may look like very rich valuations to many investors and they are. However, if interest rates stay low - and possibly go lower - then it is a possibility that many shares of quality companies could have these kind of valuations attached to them as some already do. The one caveat here is that to command these valuations these companies need to be able to keep on growing their profits and cash flows.

Shares to look at

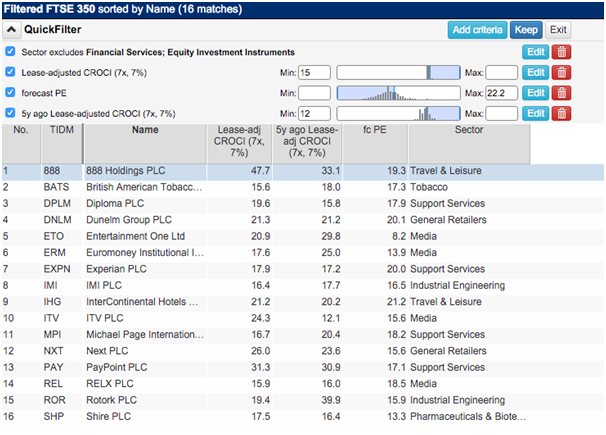

I've used SharePad to narrow down a list of shares that might fit the long-term quality criteria that has served Warren Buffett so well. As always, they will need to be thoroughly researched before buying with a particular focus on their cash-generative qualities.

Here are the criteria I have used in my search:

- FTSE 350 companies - in other words, large established companies.

- Minimum current cash return on capital invested (CROCI) of 15% - a good business.

- Five year average CROCI of at least 12% - a consistently good business.

- Forecast maximum PE of 22.2 times or an earnings yield of 4.5%. You should spend a lot of time looking at cash earnings here and stay in business capex but I've used PE instead of price to free cash flow so that companies with current high capex spending are not penalised. A history of turning a large proportion of earnings into free cash flow is a must.

Summary

- Time and patience are the investor's friend.

- Buying good quality companies and owning them for a long time can be a less stressful and more profitable strategy than trying to get rich quickly.

- Low interest rates have made many quality shares look expensive.

- Adjustments need to be made for low interest rates to set a maximum price for quality shares.

- Growth is very important if valuations are high.

- Investors need to do a thorough analysis of a company's cash flow. A high percentage of profits should turn into free cash flow on a regular basis.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.