Have we forgotten what investing is all about?

Last week my self-invested pension fund (SIPP) lost about 3% of its value in a couple of days. By the beginning of this week it had regained all that it had lost.

It's never pleasant seeing the value of your hard earned savings fall but I've learned to accept that this is what can happen from time to time when you invest in the stock market.

Some people have a hard time accepting this fact. They love the feeling of making big gains in a short period of time but can't stand it when the market pushes down the value of their shares.

The experience of looking at their computer screen and seeing a sea of red with big unrealised losses staring them in the face is just too much to take. Often this causes them to panic and fear that they will lose even more money. So they decide to sell and take the losses. The stock market often recovers and they feel that it is safe to start buying shares again.

This is not what investing should be all about. In fact this kind of behaviour is not investing at all. It is a form of speculating or gambling.

Don't get me wrong. There's nothing wrong with this approach if you understand what's going on and how the market works. I know of plenty of people who enjoy trying to find the next big winner through spread betting or trading accounts and are fully aware of the risks and rewards involved. But they admit that they wouldn't run their SIPP or ISA account in this way.

The forces of fear and greed have been part and parcel of the stock market since it came into existence and will always be with us. To be a good investor you have to realise this and use it to your advantage. By this I mean you should sell when share prices are too high and buy when they are too low. Many people do exactly the opposite.

The problem is that it is too easy to buy and sell shares with a click of a computer mouse. We have too much information with the value of our investments changing by the second.

Ask a business owner if they think about the value of their company every hour or every day. Most of them won't give it a second thought. What's more important to them is the amount of sales, profits and cash flows it is producing. In other words they are concerned first and foremost about income. If you want to be a successful investor you should start thinking about the shares in your portfolio the same way.

Shares represent a small slice of ownership in a business. Instead of obsessing about the hour-to-hour or day-to-day movements in share prices you should just concentrate on what matters - the performance of the business.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Defensive dividend investing and the power of compounding

Buying shares which pay a decent dividend is one of the best long-term investing strategies out there (by long-term I mean at least ten years). Dividends don't bounce around like share prices do (they are less volatile) and once paid cannot be taken away. This is what makes dividend investing a less risky investing strategy than one based on big share price gains.

By focusing your attention on a company's ability to keep on paying a dividend - in other words how well the company is performing - and sticking with these companies for a long time it is possible to make good money from shares.

The key to making money from the stock market is buying good companies at good prices (not too high) and holding on to them for a long time. Time and patience is all important because it allows the wonders of compound interest to work its magic. This is the main reason why Warren Buffett has become one of the world's richest men.

Dividend investing strategies are great for harnessing the power of compound interest. It works by reinvesting the dividend income received to buy more shares. This in turn gives you more income next year to buy more shares and so on. Repeat this process for long enough and the value of your investment can grow significantly even if dividends and share prices don't go up.

This is the kind of strategy that is great for taking the stress out of stock market investing. It makes you think about shares as real businesses and stop obsessing about share prices. All you need to concern yourself about is whether the dividends are still being paid and that the share price is not too high.

This second bit is very important. If the share price goes too high and the dividend yield drops too low, the power of compound interest is weakened. If this happens you might want to consider selling a share and finding another suitable one with a higher yield. You should also sell the share if the dividend is cut.

But how do you go about finding the right kind of shares?

Finding reliable dividend payers

In Chapter 14 of The Intelligent Investor, Benjamin Graham wrote about how a defensive investor - someone who wanted to make satisfactory returns from owning shares without taking big risks - could go about picking shares for their portfolio. His advice essentially boiled down to buying bigger, established companies which had a long history of profits and dividend payments.

On top of these criteria, the companies should not have too much debt and the price of their shares should not be too high in relation to their profits and assets. In other words they should not be trading on high PE ratios (no more than 15 times their three year average EPS) or high price to net asset values (A P/NAV of less than 1.5).

Whilst containing a lot of sound advice some of Ben Graham's methods have become a bit too restrictive in today's markets. His focus on asset values was more useful in a day when stock market indices were dominated by big industrial companies. Things have changed a bit since then.

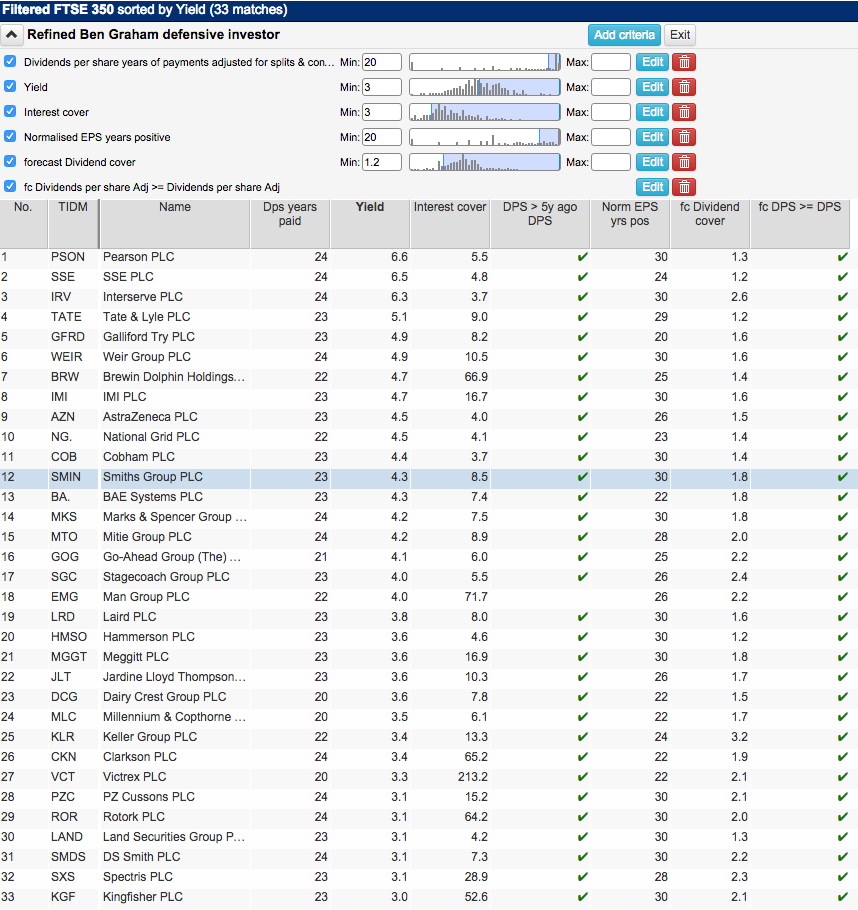

I used SharePad to find me a list of shares using Graham's defensive investment criteria and it only found me one share in the FTSE 350 which qualified on all seven tests. So I've decided to adapt it slightly for today's dividend paying shares.

Here are the criteria for the SharePad filter:

- A focus on bigger, more established companies. Shares will be picked from the FTSE 350 index.

- Dividend payments for at least twenty consecutive years. In other words companies that have paid a dividend through good times and bad. This is a good indicator of a resilient business.

- No losses - positive earnings per share - for at least twenty years. Again a test of resilience.

- A current dividend yield of at least 3%. I want shares that are reasonably valued.

- Forecast dividend cover of at least 1.2 times. I don't want to eliminate high yielding utility shares which tend to have lower rates of dividend cover, but want to get rid of current high yielders with unsustainable dividends.

- Interest cover of at least three times. I want companies that don't have too much debt. Utility companies can usually have lower rates of interest cover as their profits tend to be more stable.

- The current dividend per share must be higher than the dividend per share five years ago. In other words there has been some dividend growth because the company's performance has been reasonable.

- Forecast dividend per share is expected to be higher or the same as the current dividend per share. No dividend cuts are expected.

SharePad has produced a list of 33 shares as shown in the table below.

No screen or filter is bulletproof and should be used as a way of selecting shares to research further. Hopefully what this filter will have achieved is to get rid of shares that are too small, too risky and too expensive but find those that have been reliable dividend payers in the past and might be so in the future.

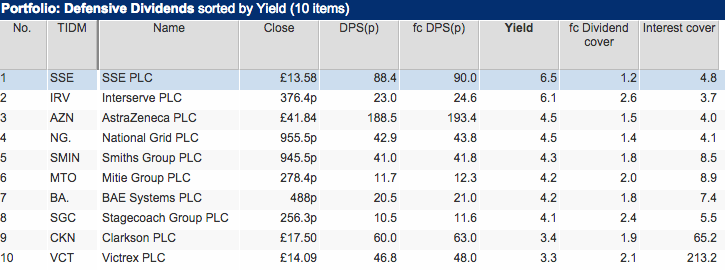

33 shares should give the private investor a fighting chance of building a diversified portfolio of at least ten shares. As an example, I've put together a list of ten shares in the table below.

The dividend histories of these shares and the recent company announcements on dividend policies have been taken from SharePad and are shown in an appendix at the end of this article.

Now, let's see how the power of compound interest can work on a portfolio like this.

I've assumed that the current dividends per share are maintained in the future - there is no growth or cuts. I've also assumed that the share price stays the same. This won't happen but I've done this to keep things simple.

The table below shows what happens to the annual income and value produced by a £100,000 portfolio equally invested in the ten shares above with their current dividends reinvested annually at their current share prices.

The effect of dividend reinvestment and compounding has been understated as I've assumed only one dividend is paid per year. In the real world dividends will be paid and reinvested twice or sometimes four times a year. This will boost the power of compounding.

| Year | Income (£) | Portfolio Value (£) |

|---|---|---|

| 1 | 4,534.37 | 104,530 |

| 2 | 4,750.40 | 109,281 |

| 3 | 4,977.26 | 114,258 |

| 4 | 5,215.53 | 119,474 |

| 5 | 5,465.81 | 124,939 |

| 6 | 5,728.73 | 130,668 |

| 7 | 6,004.97 | 136,673 |

| 8 | 6,295.23 | 142,968 |

| 9 | 6,600.26 | 149,569 |

| 10 | 6,920.86 | 156,489 |

| 20 | 11,191.62 | 247,415.83 |

As you can see, the portfolio produces an initial annual income of just over 4.5% (£4,534.37 divided by the initial investment of £100,000). Just as an aside, that's about the same as a 55 year old man would get today from handing £100,000 over to an insurance company and buying a fixed annuity for the rest of his life.

But look at how the value of the portfolio and the income it produces steadily builds over the next ten years. Remember this all comes from reinvested dividends. No extra money is added to the portfolio.

After ten years, the income has increased to £6,920 and the value of the portfolio has increased to £156,489. This is only a compounded average annual return of 4.58% but the power of time and compound interest has boosted the annual income from a £100,000 investment by over 50%. If you are a 45 year old looking to retire in ten years' time that doesn't look too bad, especially if interest rates stay at their current low levels.

Yet things could get even better. What if share prices fall but dividends paid don't? You should be jumping up and down and cheering. That's because your dividends will buy you even more shares and boost the power of compound interest even more. Instead of getting depressed when the stock market falls you should be happy because there's a good chance you are going to be better off in the future.

And that's what investing should be all about.

To sum up

- Stop obsessing about the ups and downs of the stock market.

- Focus on the performance of the underlying business - sales, profits and cash flows are what really matters.

- Dividend strategies can take a lot of stress out of stock market investing.

- Dividend reinvestment and the power of compound interest can make you money even if dividends and share prices don't go up.

- Share price falls can be good news if you own good dividend paying companies.

- Time and patience are very important. The power of compound interest works better the longer the time you invest.

Appendix: Dividend histories and current dividend policies

SSE

"SSE still expects to report an increase in the full-year dividend for 2015/16 that will at least be equal to RPI inflation; and

-- confirms that SSE is targeting an increase in the full-year dividend for 2016/17 of at least RPI inflation, with annual increases thereafter of at least RPI inflation also being targeted."

28th January 2016

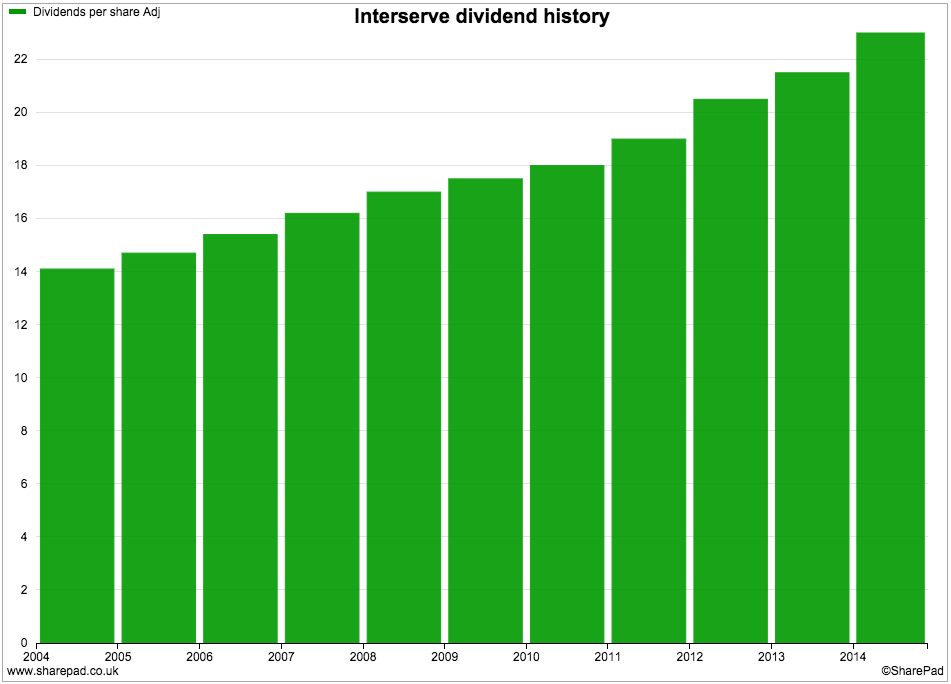

Interserve

"Reflecting our performance and prospects, the Board has approved a further increase in the dividend of 5 per cent to 7.9 pence per share (half year 2014: 7.5 pence per share) which will be paid on 23 October 2015 to shareholders on the register at the close of business on 18 September 2015."

12th August 2015

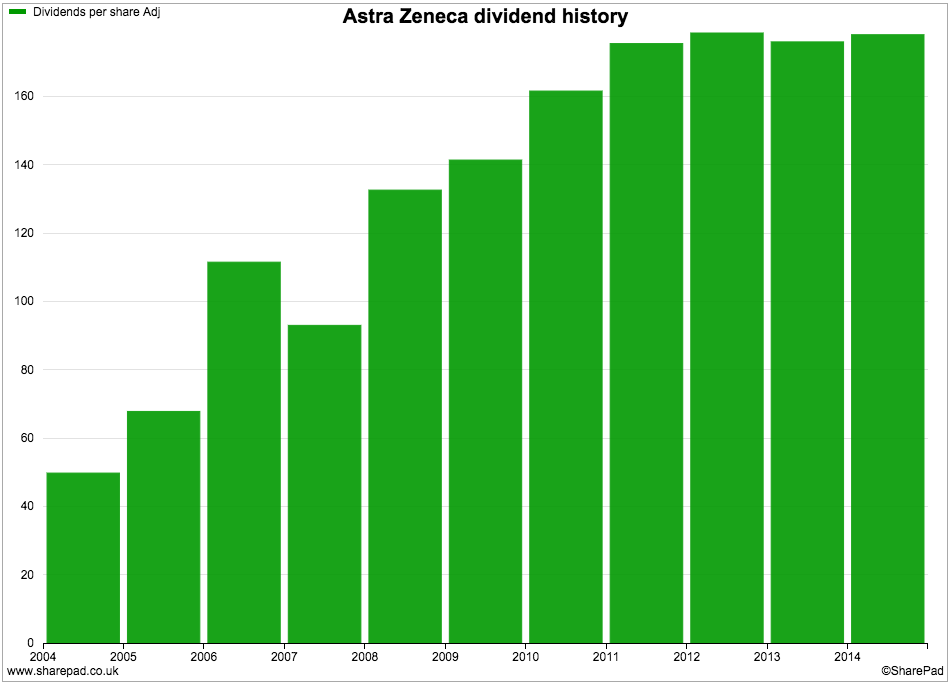

Astra Zeneca

"The Board has declared a second interim dividend of $1.90 per share (131.0 pence, 16.26 SEK) bringing the dividend per share for the full year to $2.80 (188.5 pence, 23.97 SEK). The Board reaffirms its commitment to the Company's progressive dividend policy."

4th February 2016

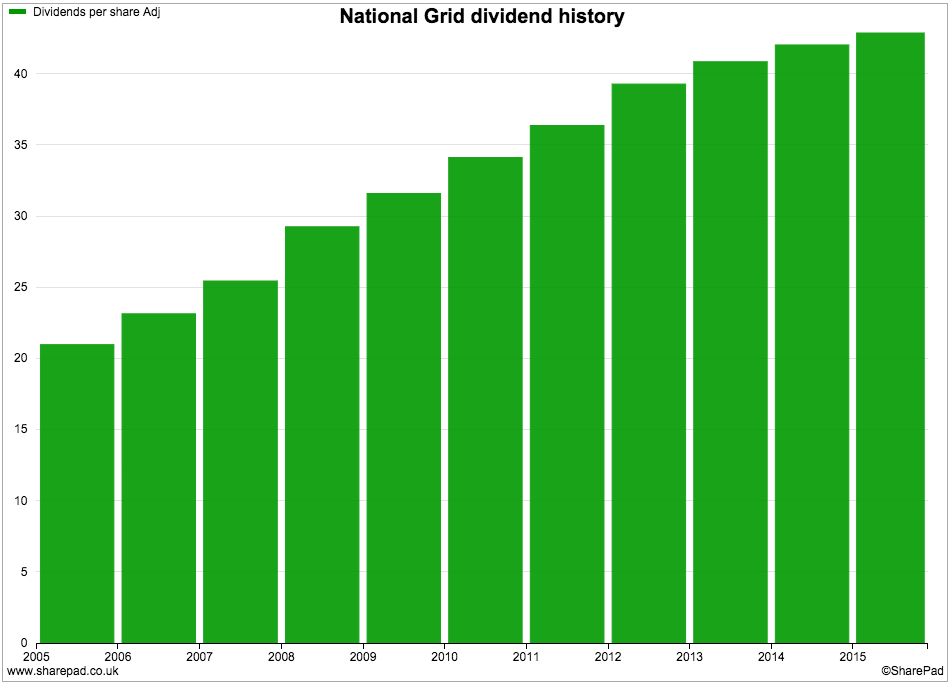

National Grid

"On track to deliver another year of good overall returns and dividend growth"

18th November 2015

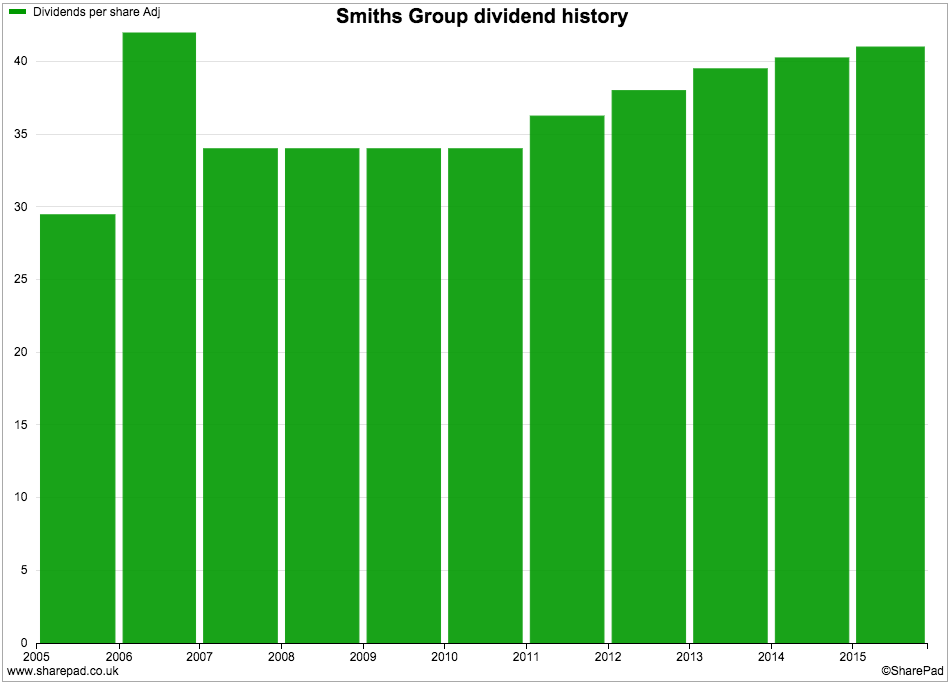

Smiths Group

"The Board has a progressive dividend policy for future payouts while maintaining a dividend cover of around 2.5 times. This policy will enable us to retain sufficient cash-flow to meet our legacy liabilities and finance our investment in the drivers of growth. While the medium-term objective is to maintain this dividend cover, we will operate some flexibility in applying the 2.5 times cover to take account of short-term impacts such as foreign exchange.

The Board has recommended a final dividend of 28p per share giving a total for the year of 41p, an increase of 2% reflecting the strong cash conversion in the year. The final dividend will be paid on 20 November to shareholders registered at the close of business on 23 October. The ex-dividend date is 22 October."

23rd September 2015

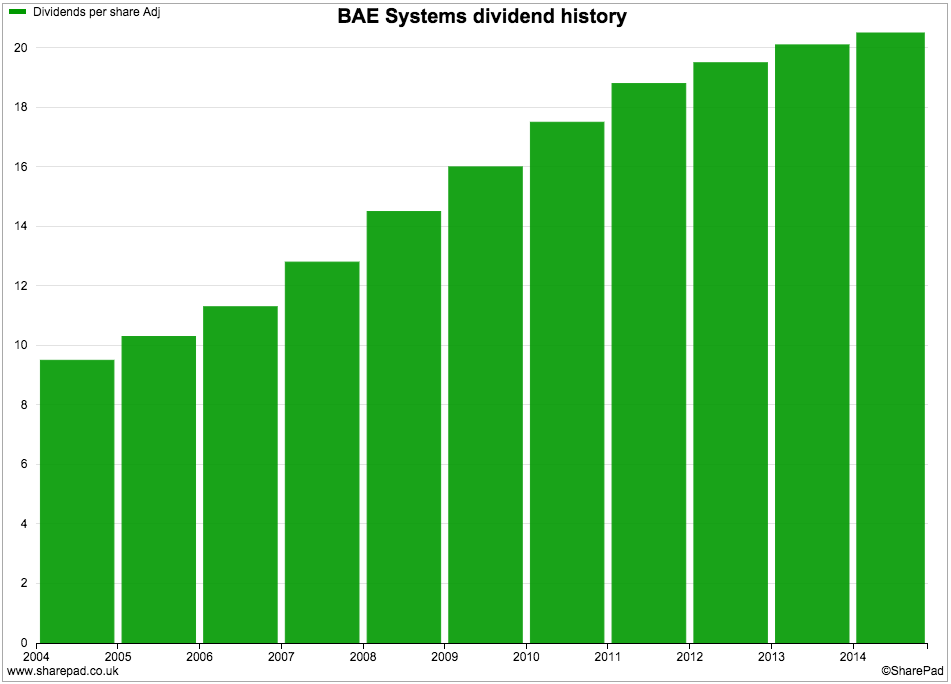

BAE Systems

"The Board has declared a 2% increase in the interim dividend to 8.4p for the first half year to 30 June 2015."

30th July 2015

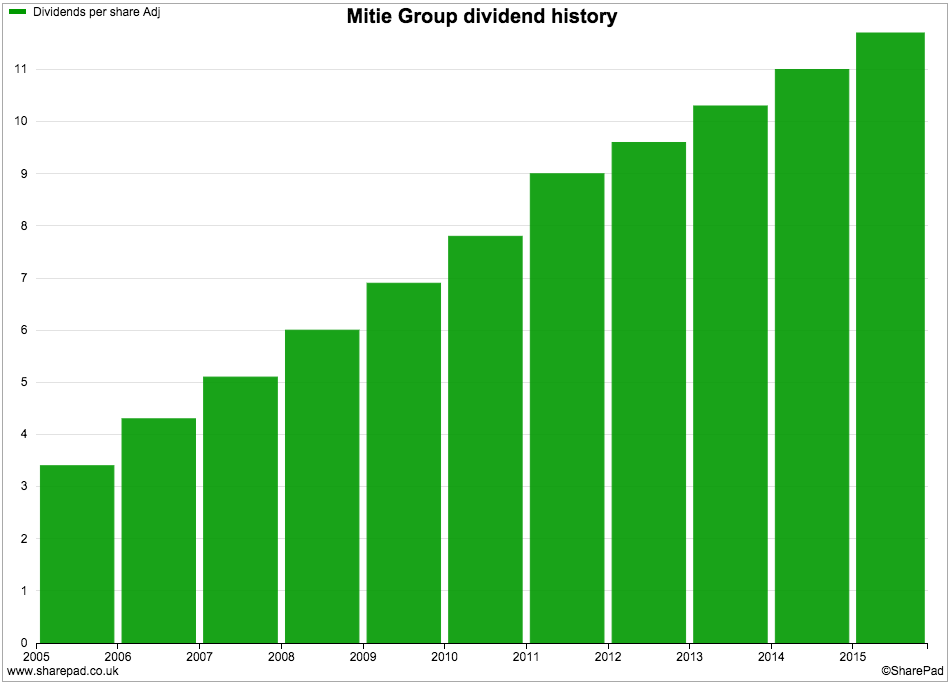

Mitie Group

"The group has a strong track record of dividend growth and it is the Board's policy to grow dividends at least in line with the underlying earnings of the group, whilst maintaining dividend cover at a prudent level. The interim dividend declared by the Board of 5.4p per share (HY15: 5.2p per share) represents an increase of 3.8% on the prior year. The dividend represents a cover of 2.1 times earnings per share."

23rd November 2015

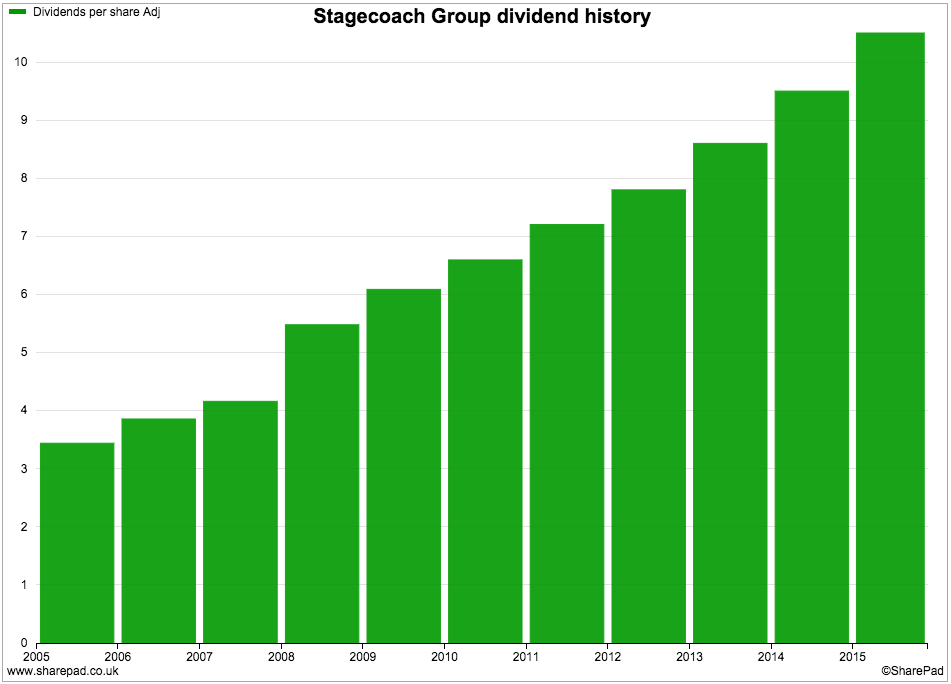

Stagecoach Group

"Shareholders are benefitting from our financial performance and the interim dividend is up 9.4% to 3.5p per share (2014: 3.2p). This is consistent with our policy of generally setting the interim dividend per share at approximately one-third of the rate for the previous full financial year. The dividend is payable to shareholders on the register at 5 February 2016 and will be paid on 2 March 2016."

9th December 2015

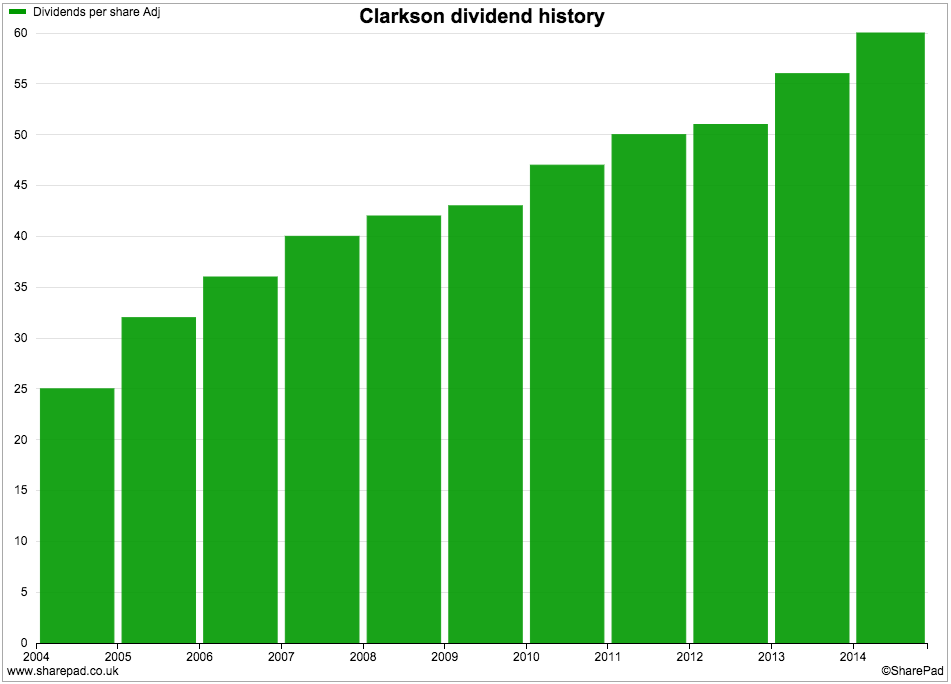

Clarkson

"The board has declared an increased interim dividend of 22p per share (2014: 21p per share) which will be paid on 25 September 2015 to shareholders on the register at the close of business on 11 September 2015."

17th August 2015

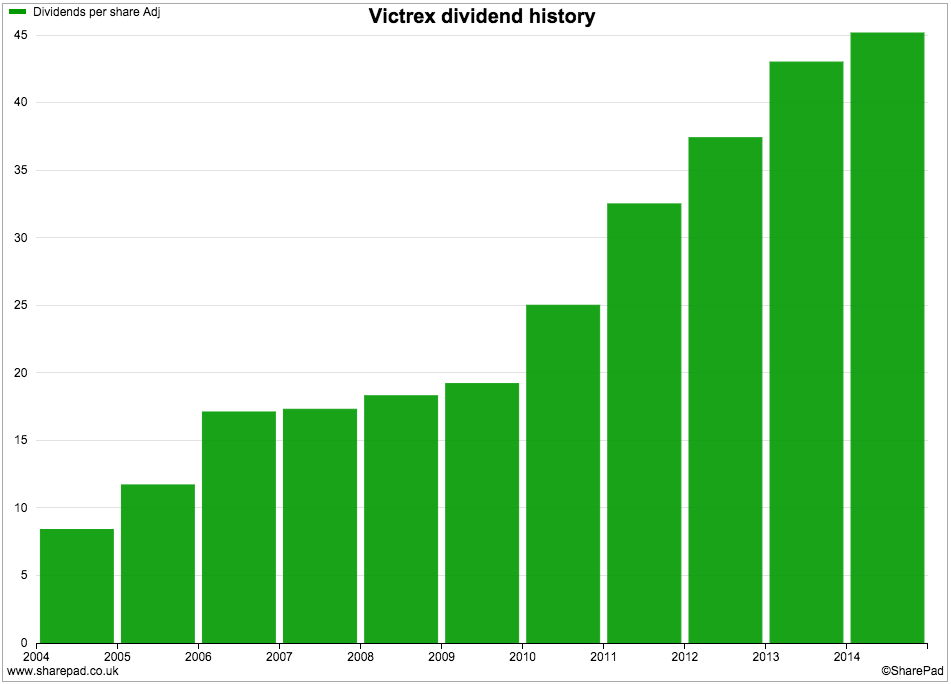

Victrex

"Growth investment remains our top priority. The policy for our regular dividend remains unchanged, with dividend growth expected to be in line with earnings growth and cover maintained at around 2x. After this, Victrex will return around 50% of the net cash balance to shareholders, via a special dividend, subject to a 50p/share de minimis level.

Victrex will seek to retain a net cash position over the medium term, which is highly valued by our customers and provides us with investment flexibility and an agile balance sheet. We continue to target Mergers & Acquisitions (M&A) opportunities and, if presented with a compelling investment opportunity, would be prepared to enter a net debt position, whilst seeking to return to net cash over the medium term.

For the current year, the Group is proposing to pay a final regular dividend of 35.09p per share. Dividend cover is at 2.1x (2014: 2.1x). The full regular dividend for the year, incorporating interim and final dividend, is 46.82p per share, an increase of 4% (2014: 45.15p)."

8th December 2015

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.