Buying low and selling high - a screening approach

I recently wrote about how you make money from owning shares (click here). One way is to sell a share for more than you paid for it. But how do you go about finding shares that give you a chance of doing that?

There's no shortage of ways of looking for shares that can go up in price. However, none of these can be guaranteed to work all the time and when you want them too. For example, you might be right in identifying a cheap share but might not have the patience or time to wait for its true value to be realised.

The key thing to bear in mind is that different investment strategies come with different risks - the risks of losing money. The best investors out there are the ones that seek to get the best trade off between the amount of money they can make with the amount of risk that they are prepared to take to do it. This is a lot easier said than done.

As I've said before, too many investors spend too little time thinking about the risks they are taking with their money. This is the main reason why they end up losing too much of it.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Human behaviour and the stock market

You can have all the financial data and sophisticated analysis tools you desire however, the most important lesson I have learned in nearly twenty years of following the stock markets is that understanding human behaviour is even more important than crunching numbers- and I like crunching numbers.

The stock market is a classic ongoing study in human behaviour, in particular the regular swings in emotions between greed and fear. If you can understand this then you are giving yourself a better chance of being a successful investor. This is why Warren Buffett is often quoted as advising people to be:

"fearful when others are greedy and greedy when others are fearful"

So when share prices are high you should keep your hands in your pockets and when they are crashing you should fill your boots. Many private investors do exactly the opposite.

Investors tend to like the comfort of the herd and going with the crowd. It's very easy to be sucked into buying a share or stock market that has been going up in the hope that it will keep on going up. Throughout history, private investors have been shown to have had an uncanny knack of piling into the stock market near the top.

Yet sentiment towards shares can turn very quickly meaning that share prices can fall as quickly as they went up. Instead of buying shares at lower prices, investors are often paralysed by fear and think that they could lose even more money. So they sell out and lose money. They have lost money because they have bought high and sold low.

If you are trying to make money from owning shares and do better than a stock market tracker fund you are going to have to learn to think and act differently to the investing herd. The good news is that there is a way you can do this.

My favourite screen - 52 week lows

If you are fast and a little bit lucky it is possible to buy high and sell higher - known as momentum investing. This is too risky for me. I feel uncomfortable buying expensive shares because too much of their value is based on growth in future profits and these can be hard or impossible to predict. If expectations of future profits come down then the share price often comes crashing down too. I also don't think that I am smart enough to time the market and sell my shares at their highest price.

A more fertile hunting ground is looking for shares which have fallen in price and been shunned by most investors. Every morning, I run a filter in SharePad for shares that are trading at or near their 52 week low price. The shares that I find on the list tend to be there because the companies behind them are in some kind of difficulty.

Profits may be falling or the company may be embroiled in a scandal (Volkswagen and BP are/have been classic examples of this). Whatever the reason, these are shares that are not popular and may appear to be very unattractive investments at first glance. In most cases there will be lots of shares I wouldn't touch with a barge pole because they are still risky even though the price has fallen.

However, there may be some shares of companies that are in temporary difficulties from which they can recover. Yet the short-term bias of City analysts and many professional fund managers means that they are priced on the assumption that the bad times will continue forever. These are the kind of shares that you should be interested in buying. The pessimistic future baked into the share price means that your chances of losing money can be low. But if the company can recover and people begin to become more optimistic the share price can soar. This is the kind of risk-reward trade off that attracts many so-called value investors.

Building your 52 week low screen

One of the great features of SharePad is how flexible it is in allowing a user to analyse a company's finances and valuation. The same kind of flexibility exists in its filtering functions as well.

Filtering - also known as screening - is a bit like panning for gold in a river. You trawl your pan through the water and sift through the bits of grit and stone in the hope that there might be some gold. In SharePad, you can make your filter as simple or as complicated as you want. The more criteria you add, the more sifting you are doing.

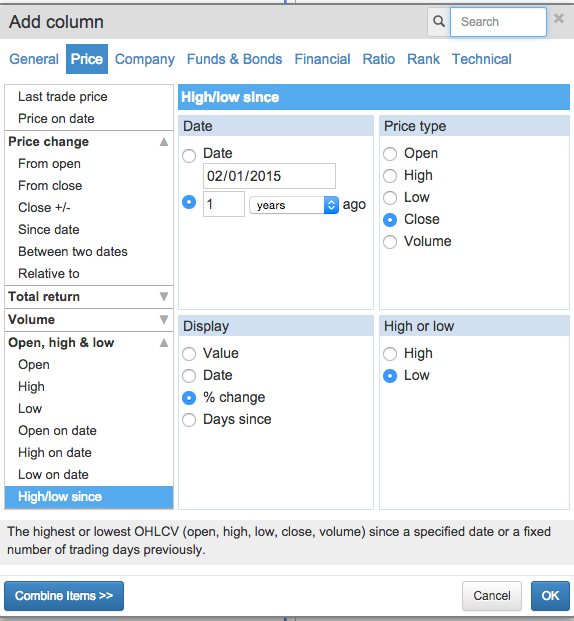

It's very easy to look for shares trading at or near their 52 week lows in SharePad. Click on the filter tab on the left hand side of the screen, select quick filter and then price as shown in the box below. You can then ask SharePad to look for shares on the basis of their percentage change from their lowest price during the last year. I set this to 0%.

It's even easier to find shares trading at a 12 month low in ShareScope. In the List view, no matter what list is displayed, pressing the Tab key on your keyboard will cycle through the full list of shares, the new highs, the new lows and then back to the full list again.

Out of just over 2000 shares that are listed on the London Stock Exchange, there are currently 228 trading at their 52 week low.

Most of these shares are not going to be good investments. Many will be bad businesses or will have too much debt or both. To find shares that might be worth buying, you are going to have to ask SharePad to do some more sifting. How you do this is up to you, but here are some suggestions for what you can add to your filter:

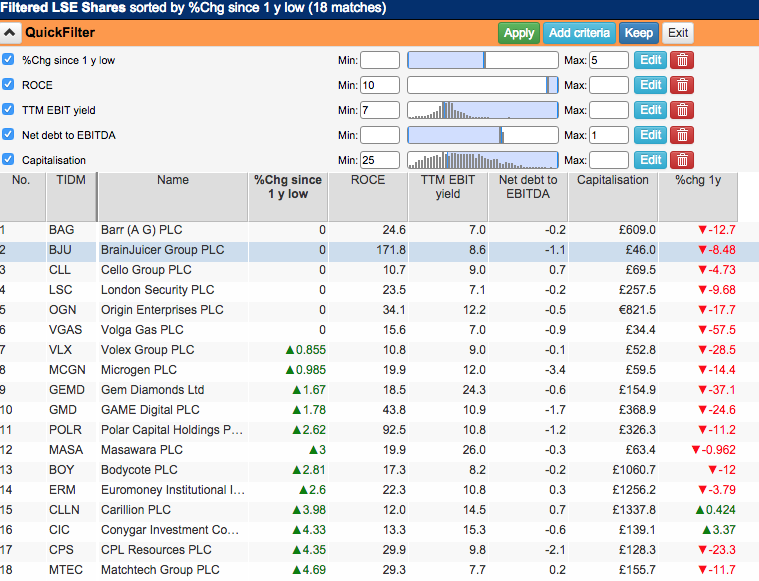

- Cast the net a bit wider. Look for shares that are trading within 5% of their 52 week low. These shares will still be relatively depressed.

- Companies that earn a respectable return on capital employed (ROCE). I've set a minimum of 10%.

- Shares that are not too expensive. Taking into account that profits might be depressed, my valuation criteria is a minimum trailing twelve month (TTM) EBIT yield (EBIT/Enterprise Value) of 7%. ShareScope users will need to use latest EBIT yield (you'll find EBIT Yield as an option under Earnings yield).

- Avoid companies with too much debt. Debt is the enemy of the shareholders and could wipe them out if profits fall a long way or turn into losses. I've asked SharePad to look for companies where the net debt (debt less cash) is no more than the amount of the most recent pre-tax gross cash flow (EBITDA). For most companies, this would be a very conservative level of gearing or indebtedness. ShareScope users could filter for companies with gross gearing of, say, 25% or less.

- A minimum market capitalisation of £25 million.

- I've also added a column showing me how much the share price has changed during the last year. Shares that have already fallen a lot may be more interesting and less risky than those that have not.

This gives me a list of eighteen shares to look at.

Remember, when you are using a filter it should only really be seen as a way of generating ideas for further research. Blindly buying a list of shares from a filter is not usually a good idea. Taking time to know what you are buying usually is.

Action points

There's nothing to say that a share that is at or near its 52 week low won't keep on going lower. By asking some important questions you can lower your chances of buying a dud share. Here are some issues to consider:

- Are the company's problems temporary or more long lasting?

- Are similar companies experiencing the same problems? It is often easier for a company to recover from its own specific problem(s) rather than an industry wide one.

- Is there a plan to restore the company to health? Read the news section in SharePad and the annual report to find out more.

- Are profit margins and ROCE high or low relative to their history and those of competitors? Companies with depressed profits can be good investments if profitability can be restored to previous levels.

- Are the shares cheap compared with history and competitors? Depressed profits combined with a depressed valuation can sow the seeds for big future share price gains if profits recover.

- Have the directors been buying or selling shares recently? Director buying at low prices could be a positive sign. You can easily check this out in SharePad and ShareScope.

- Is there any hidden debt or big pension fund deficit? These can send weak companies into bankruptcy

Unpopular shares can bounce back

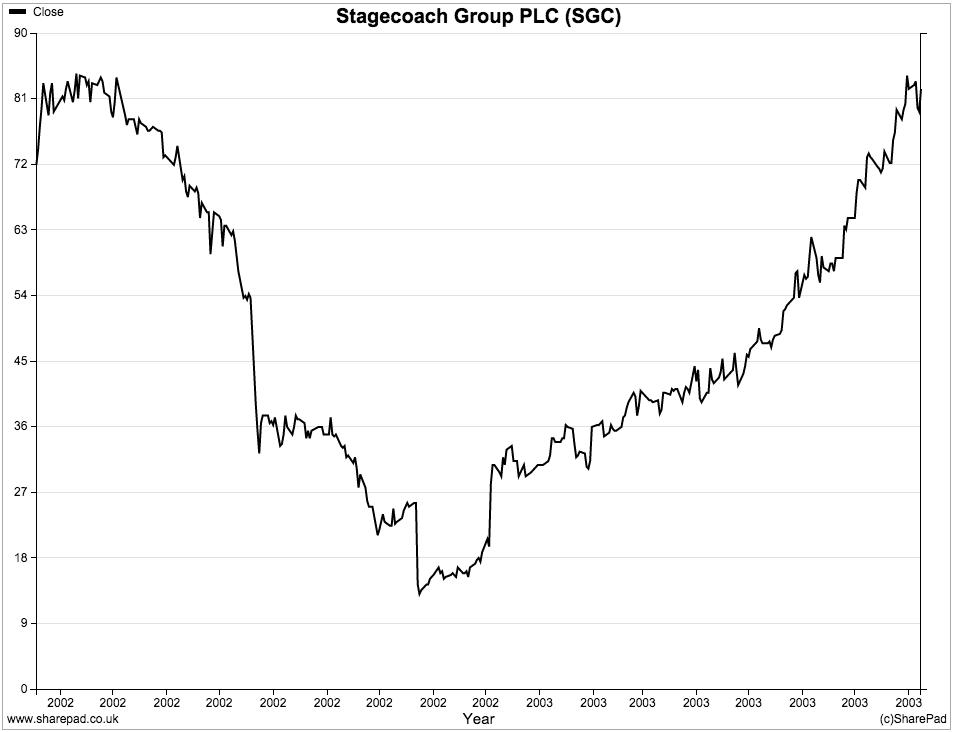

Buying depressed shares can pay off handsomely. Transport company Stagecoach (LSE:SGC) saw its shares plunge to just 13p back in October 2002. A disastrous US acquisition had placed the company's finances under heavy strain and resulted in large asset write downs on its balance sheet. Investors panicked and sold its shares in droves. Some commentators even speculated that the company could go bust. This was despite the fact that its UK businesses were profitable at the time and the company was generating cash. A year later, the shares were over 80p.

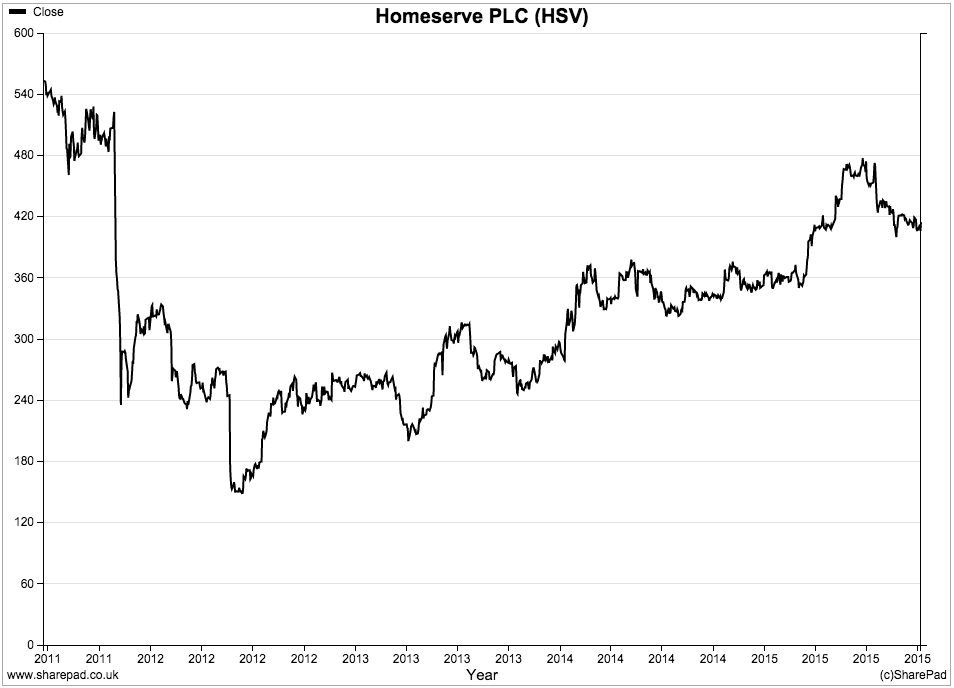

Homeserve (LSE:HSV) was embroiled in a mis-selling scandal back in 2012 which saw its share price plunge. Anyone brave enough to buy has seen a nice profit since then.

To sum up

- Paying high valuations for shares increases your investment risk.

- You can lower your risks by buying shares with depressed share prices.

- A 52 week low screen is a good way of looking for depressed shares.

- Blindly buying shares at 52 week lows is unwise.

- Buying good companies with low debts which are temporarily depressed can be a good strategy.

- Do further research. Make sure you aren't catching a falling knife.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.