Stock Watch: Rotork shares are getting cheaper but are they cheap enough?

Most of us dream of being able to invest in a wonderful company at a very cheap price. Sadly, these kind of opportunities don't tend to come along very often. Great companies tend to have very high price tags (i.e. high PE ratios) attached to them by the stock market. Paying rich prices for them is often the path to investment misery as they seldom live up to the lofty expectations for future profits that are baked into their share prices. Those that ignore the importance of paying a sensible price are frequently left nursing some very hefty losses.

That's why we are often advised to buy cheap shares instead. Nobody expects much from cheap shares so the risk of disappointment and losing lots of money is lower. But if the company behind the shares begins to improve and starts delivering higher profits the share price can go up a lot as more people buy in. Welcome to the world of value investing.

Spotting shares that look cheap isn't that hard. The trouble is that many shares deserve to be cheap because the business behind them isn't that good and cannot grow its profits. A cheap price is often the right price for a good reason. The same principles that apply to cheap cuts of meat and cheap bottles of wine apply to cheap shares too - more often than not you get what you pay for.

Warren Buffett has frequently said that he would rather buy a wonderful business for a fair price than an inferior business for a cheap one. He knows that quality often pays off in the long run and that if he owns a share or business for a long time, paying a fair price will still make him richer as years of steadily rising profits compound. History suggests that Buffett has been right more times than he has been wrong in this regard.

Which leads me nicely on to the subject of Rotork (LSE:ROR). It is not a household name or even part of the FTSE 100 index but for me it has been one of Britain's outstanding companies for a good few years. I'll explain why shortly.

However, Rotork's businesses are now having a tough time which has seen the company's share price fall by a quarter during the last year. Is this an opportunity to pick up a wonderful business at a fair price or will things get worse before they get better?

Let's have a look.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Background

For years people have been moaning about the decline of Britain's manufacturing industry. Yes, the steel mills and shipyards have all but disappeared but Britain is home to many outstanding engineering companies. These companies have moved away from the commoditised end of the manufacturing spectrum and have focused on making niche, highly specialised products that can command high profit margins.

At first glance some engineering companies can seem overly complicated to the private investor. The companies themselves don't often help them by describing their businesses in technical jargon that puts people off. However, spending a little time trying to understand the basic is very worthwhile.

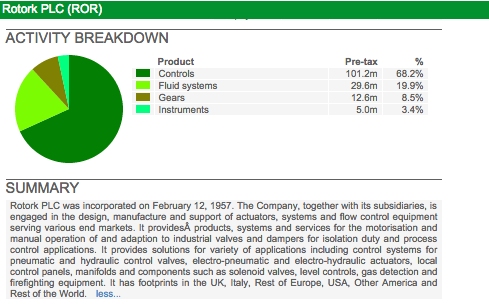

Rotork makes most of its money by designing and selling something known as an actuator. Actuators are used to control the flow of liquids and gases in lots of different types of equipment and machines and are often used to open and close valves in pumps and motors. They are crucial to making sure that equipment and machines work safely and efficiently and are used in thousands of different manufacturing processes. Rotork sells most of its actuators to oil and gas, water and power companies as well as other industries. It also makes money supplying spare parts and servicing customers' equipment.

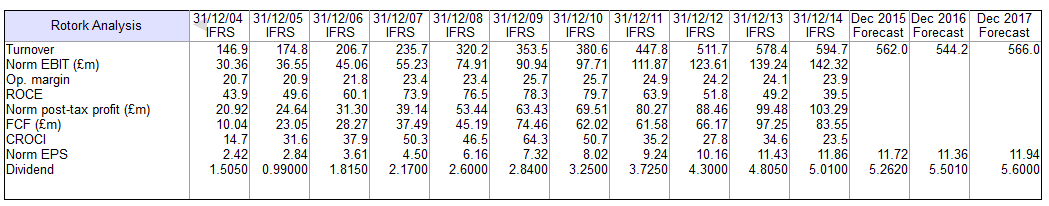

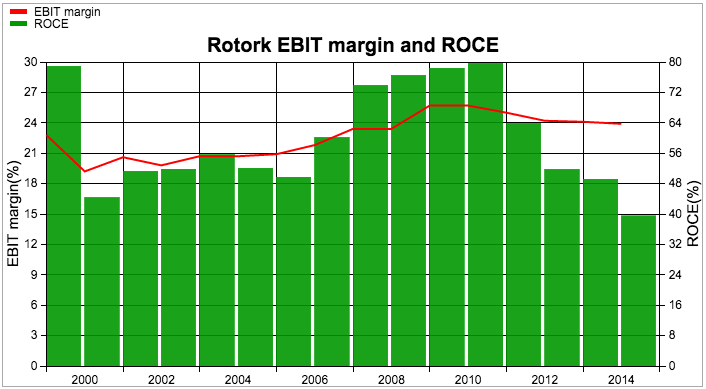

A close look at Rotork's financial history shows that it has two hallmarks of an outstanding business. Not only has it has a track record of rising turnover and profits but also:

- Consistently high operating margins. They have been comfortably over 20% for the last decade.

- Very high returns on capital employed (ROCE). These have been coming down in recent years as the company has been spending more money on buying other companies but they are still around 40%. Not many businesses are as profitable as this.

So what explains Rotork stunning profitability? Here's a few observations:

- It makes very good products that are difficult to compete with. A lot of its actuators go into safety critical and vital applications. Customers can't afford for disruptions to their production schedules whilst an accident would be catastrophic. The actuators they use often have to be approved by industry authorities as well. This means that Rotork's top quality actuators are often the product of choice and can't be substituted by a cheap one from a competitor. This allows Rotork to charge high prices which in turn allows it to earn high profit margins.

- Rotork has a huge range of actuators for use in lots of different industries and applications.

- It provides outstanding service to its customers with staff and offices all over the world.

- It doesn't have lots of money tied up in factories making components. This process is outsourced. Rotork buys in components that are already finished and uses them to make finished products for customers. This means that Rotork has a much lower level of money invested than it might have if it made a lot of the components itself. This is a key reason behind its very high ROCE.

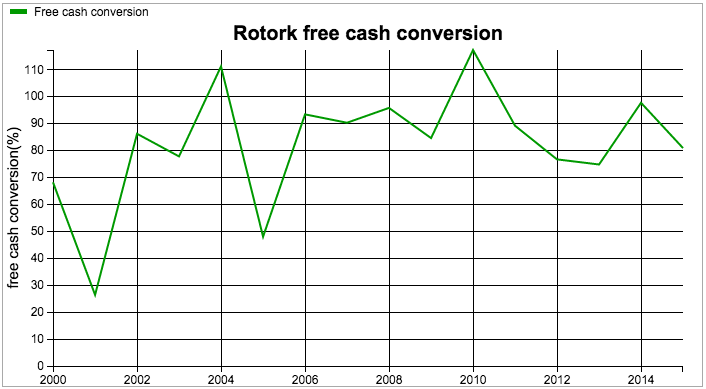

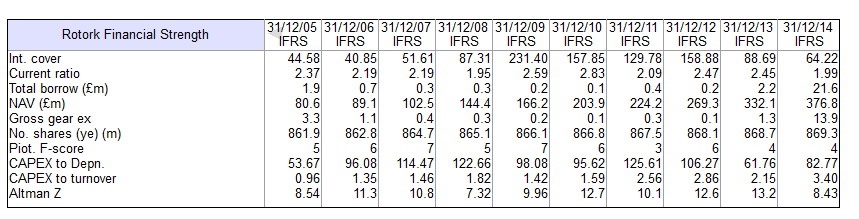

Another attraction for investors is that Rotork seems to be very good at turning its profits into free cash flow. It does not have to plough a lot of its operating cash flow back into new assets (capex). That said, its capex spending has been less than its depreciation charge for the last couple of years and whilst this is not a major issue for an asset light company such as Rotork this trend will need watching.

The company's finances look to be squeaky clean. It has more cash than it has borrowed money - a net cash position - which is very reassuring for investors. The lack of gearing means that shareholders are less exposed to any decline in trading profits than if the company has lots of debt.

So why are Rotork shares at a one year low?

Just over half of Rotork's sales are to the oil and gas industry. The plunging oil price during the last year has seen oil and gas companies pull their horns in. Costs are being slashed and this means they are buying less of Rotork's products.

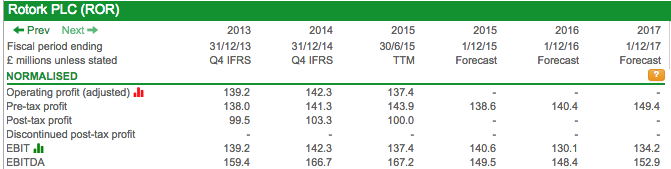

If you look at the trailing twelve month (TTM) income statement, you can see that Rotork's profits have stopped growing.

City analysts don't think that profits are going to start growing fast any time soon. Forecasts for 2017 have Rotork making less money than it did in 2014. That's not good news if they turn out to be true.

Unsurprisingly, this gloomy outlook has been factored in to Rotork's share price. The shares have fallen by more than a quarter during the last year and they are now trading at a 12 month low of just over 206p at the time of writing. Is this an opportunity to buy a wonderful business at a fair price?

Are they good value?

I've no idea what will happen to the oil price over the next few months or years. But this is the key driver of Rotork's future profits. If history is any guide then the oil price will eventually start going up again and Rotork's customers will feel more confident to invest and buy more of its products. But the huge uncertainties about future profits look like they could place a dampener on Rotork's share price for a good while yet.

Even the company seems to be a little in the dark about this year's profits as highlighted by this comment from the half year results release at the beginning of August:

"As in previous years we anticipate that our results will be weighted to the second half. Although we expect the oil and gas market to remain challenging, and the timing of order placement remains difficult to forecast, based on our current order book and project visibility, the Board expects overall performance to be in line with management expectations for the full year."

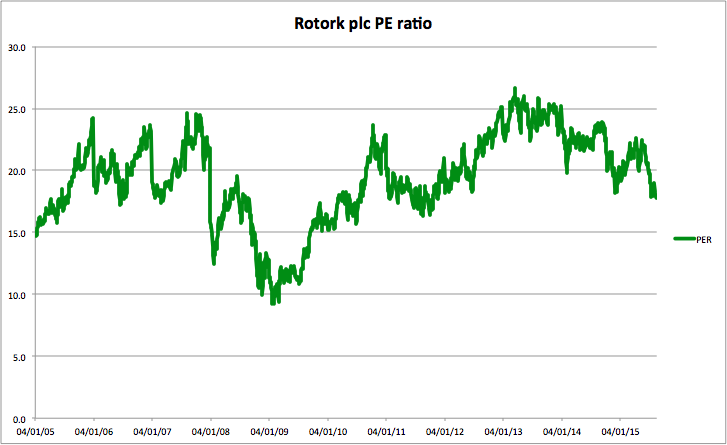

Rotork's shares have become cheaper during the last year. For the last decade they have averaged around twenty times its annual earnings per share and have often changed hands for more than this. Back at the time of the last stock market low in March 2009 you could have picked them up for just over 9 times - a real bargain with the benefit of hindsight.

Just now the shares are trading on 17.8 times City analysts' EPS forecast of 11.7p. That's below its ten year average but in the absence of profits growth doesn't look cheap to me - anything but in fact.

| Name | Price | TTM Norm EBIT % of TTM Enterprise value | fc Norm EBIT % of Enterprise value | fc PE | PE 10y avg | fc Yield |

|---|---|---|---|---|---|---|

| Rotork PLC | 206.05p | 7.59% | 7.88% | 17.8 | 20.9 | 2.5 |

Choosing a valuation yardstick is a matter of personal choice and will depend somewhat on the type of company you are looking at. My preferred valuation measure is EBIT yield which is EBIT divided by a company's enterprise value (market cap plus net debt). I like this measure because unlike a PE ratio it is unaffected by company debt levels and different tax rates. More debt lowers PE ratios and makes companies look cheaper than they really are. EBIT yield is therefore a very clean valuation measure that is good for comparing against other companies.

If possible I like to buy shares with EBIT yields of more than 10%. If a company is growing very quickly then I might lower this threshold to 7%. I don't want to pay too much for a share but realise that in most cases you have to pay up for good companies.

Rotork offers a 7.6% EBIT Yield based on TTM numbers. With strong profits growth that might tempt me but without them it's hard to see the shares as good value at the current price.

Of course, a trade buyer or an investment company with a long-term view might be prepared to buy now and wait for things to get better. On past performance, Rotork would be a great addition to any portfolio but private investors might be better off sitting tight for now.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.