Why supermarkets are the most hated shares on the stock market

The fact that Britain's big supermarkets are having a tough time is widely known. Food prices are falling whilst increasing numbers of people are shopping at discount supermarkets such as Aldi and Lidl and deserting the big chains.

These trends have played havoc with the profits of the three supermarkets that are listed on the London stock exchange - Tesco, Sainsbury's and Morrisons. This week it was reported that the amount of money betting that the share prices of Sainsbury's and Morrisons would continue to fall - known as going short on a stock - is at a record high. Online grocer Ocado is also seeing its shares attracting more short interest.

It seems that lots of people are thinking that the worst is yet to come for the big supermarkets. So they are borrowing shares from other investors and selling them in the hope they can buy them back at a lower price in the future and pocket the difference.

Time will tell whether these bearish bets will pay off. I've no idea how far profits will fall. What I do know is that people are right to worry about them. From what I can see, it is highly debatable whether Tesco, Sainsbury's and Morrisons have been capable of making any real money at all in the past. Why should the future be any different?

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Forget about profits it's all about cash flow

Investors are often advised to look at a firm's cash flow rather than its profits if they want to see the truth about its money-making potential. This is good advice. That said, a company's free cash flow (the amount of cash left over after interest, tax and spending on new assets have been taken care of) tends to be very lumpy depending on whether it is investing heavily or not. Profits tend to have a much smoother profile.

However, if you read some investment books they will often tell you that free cash flow and profits will eventually converge over a long period of time. So I decided to see if this was true for the big supermarkets. The results are shown below and they don't look pretty.

| Cumulative Free cash flow since 1992 (£m) | Tesco | Sainsbury's | Morrisons |

|---|---|---|---|

| Operating cash flow | 64518 | 25181 | 13335 |

| Dividends received | 321 | 27 | 0 |

| Interest received | 851 | 507 | 96 |

| Cash in | 65690 | 25715 | 13431 |

Capex | -50223 | -21178 | -9406 |

| Interest paid | -7694 | -2880 | -901 |

| Tax paid | -8781 | -3644 | -2257 |

| Cash Out | -66698 | -27702 | -12564 |

Free cash flow for shareholders | -1007 | -1987 | 867 |

Extra Information: | |||

| Depreciation & Amortisation | 18436 | 9807 | 4343 |

| Capex to Depreciation | 2.7 | 2.2 | 2.2 |

| Normalised post tax profits | 30212 | 10523 | 5649 |

| FCF as % of Norm post tax profits | -3.33% | -18.88% | 15.35% |

One of the really good things about ShareScope and SharePad is the huge amounts of historical financial data it has. I've been able to get cash flow data going back to 1992 for the three listed supermarket shares. Comparing profits and free cash flow over a period of 22-23 years should be a long enough time period to see what's been going on.

What I've done is calculate the cumulative free cash flow since 1992 and compared it with the cumulative post tax profits that have been reported since then. It makes for very grim reading.

Are supermarkets really profitable at all?

Tesco has reported over £30bn of profits but hasn't produced a penny of free cash flow. In fact over £1bn has flowed out of the company. Sainsbury's is even worse with nearly £2bn of free cash outflow compared with over £10bn of profits reported. Only Morrisons has generated cumulative free cash flow, but that only amounted to just over 15% of its post tax profits since 1992.

Why is this?

It boils down to the fact that they have been spending huge amounts of money on new assets (capex). If you compare capex with depreciation and amortisation (a proxy for the amount of money needed to be spent to maintain a company's asset base) then you can see that the supermarkets have been spending comfortably more than twice depreciation - nearly three times for Tesco.

It's fair to say that a lot of this money has been spent on new supermarkets but it's also fair to assume that a lot has also had to be spent to keep existing supermarkets ship shape. More than the depreciation expensed to calculate profits? My guess is yes.

What is undeniably true is that supermarkets have shelled out huge amounts of cash on assets - over £50bn in Tesco's case - for very little in return. It can also explain why dividends have been slashed - because there hasn't been enough cash to pay them. It looks like they've been paid for by selling supermarkets to property companies (known as sale and leaseback) and borrowing money. You can't do this forever.

Supermarket shares are not cheap

Another reason why so many investors are betting against the supermarkets is because their shares don't look particularly cheap, especially if you believe that there's a risk that profits forecasts are too high.

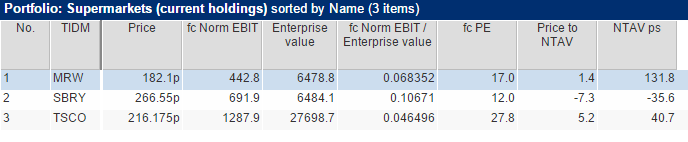

On the basis of forecast EBIT yields (forecast EBIT/Enterprise Value) and PE ratios, Morrisons and Tesco are not particularly tempting. Sainsbury's looks cheaper if it can make the profits currently being forecast by analysts but not overly so.

It is also worth noting that asset values - a reason used to support the shares in the past - are not providing any comfort either. All three shares trade at prices above their net tangible asset per share values. Sainsbury's doesn't have any net tangible assets at all.

What about future free cash flows? The supermarkets are slashing their capex which might help free up some cash at long last. But if the capex isn't enough to keep stores in good condition then this might be a bad move. Shoppers might go elsewhere and sales and cash flow could go down rather than up.

That's why supermarket shares are so disliked just now.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.