Sector Watch: Small Cap and AIM Retailers

Christmas is the most important time of the year for many retailers as it is when they can make a very sizeable chunk of their annual profits. A good or bad Christmas trading performance can therefore mean the difference between a good or bad financial performance for the year as a whole.

The UK stock market is home to dozens of retailing companies. In this brief overview of the sector, I've decided to focus on the smaller end of the market and will be looking separately at FTSE Small Cap and AIM retailers.

These sector reviews are based on using very simple items of financial information so that you can gain a reasonable understanding of them very quickly.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

FTSE Small Cap Retailers

I will be using a number of tables from SharePad to answer four key questions as to whether:

- A sector or shares within it are in or out of favour.

- A company's financial performance has been good or bad.

- The financial position is weak or strong.

- The shares are cheap or expensive.

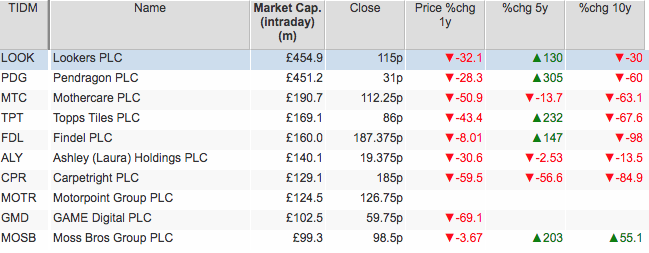

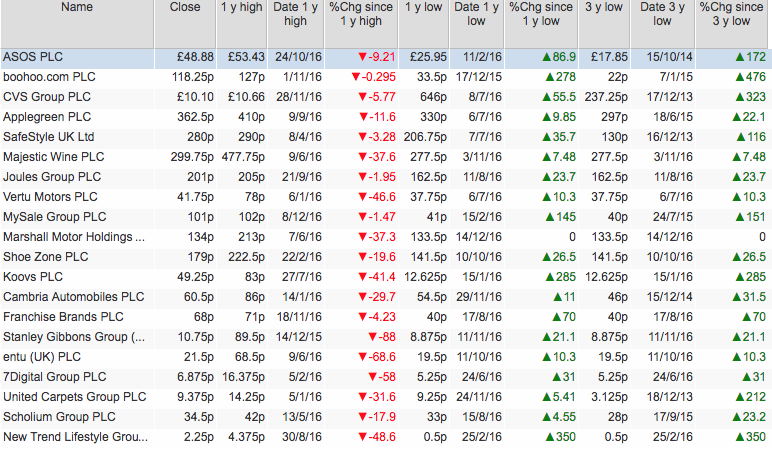

Are the shares in or out of favour?

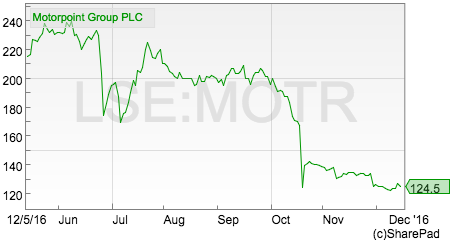

For most small cap retailers the last year can be summed up in two words: A bloodbath. Many shares have been hammered. Motorpoint which listed on the market in May has not escaped the carnage.

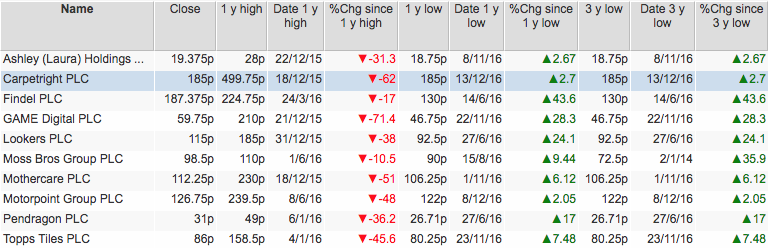

Despite this year's troubles, shares in companies such as Findel, Lookers, Moss Bros, Pendragon and Topps Tiles have delivered stunning returns to investors over the last five years. Carpetright on the other hand has proven to be a terrible long-term investment.

Carpetright shares are so depressed that they are trading very close to levels not seen since the mid 1990s.

Laura Ashley, Mothercare and Topps Tiles are also not far from their 52 week lows.

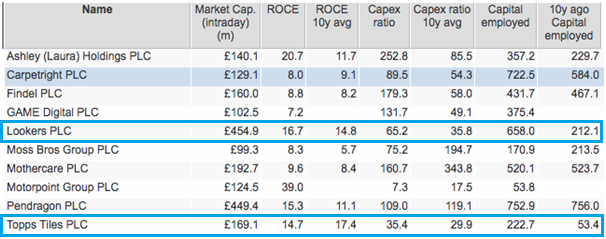

Business performance

High street retailers tend to rent rather than own their shops. This means that weighing up how good they are as a business using ROCE needs to take this into account. The ROCE values in the table below are therefore lease-adjusted. As you can see, many of the companies in this sector do not generate a ROCE of more than 10%. Lookers and Topps Tiles have been consistently the best performers on this measure.

A worrying sign is how capital intensive this sector seems to be. There are some very high capex ratios here which is telling us that large amounts of trading cash flow is being ploughed back into these companies.

A standout case is Mothercare where trading cash flow has been so weak that it has been spending considerably more on capital expenditure. Moss Bros, Pendragon and Laura Ashley also score badly on this measure. Topps Tiles has the lowest long-term capex ratio which may go some way to explaining why it has the best long term ROCE performance.

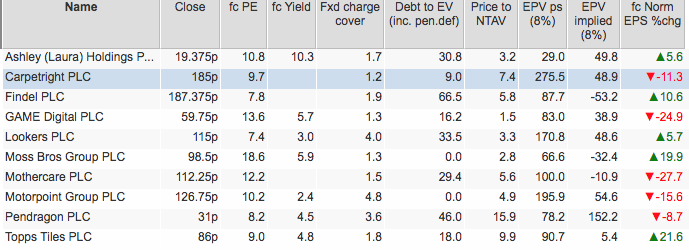

Valuation and financial position

At first glance, it would seem that there are a lot of cheap shares in this sector. Bearing in mind what we have just learned about ROCE and how much cash flow many of these businesses tend to consume, then perhaps they are cheap for very good reason.

Many shares are trading below their earnings power values (EPVs) which suggests that the market is taking a dim view on the ability of these companies to sustainably increase their profits. This might be justified given how sensitive profits are to the ups and downs of the general economy. The other possibility is that there are some undervalued companies in this sector.

Fixed charge cover is the most important measure of a retailer's financial position. It looks at the ability of its most recent trading profits (EBIT) to pay the interest on any debts and the annual rent bill. I'd be wary of fixed charge cover less than 1.5 times which puts Carpetright, GAME, and Moss Bros on a danger list. A meaningful fall in profits could put these companies in financial difficulties.

What seems to be very clear is that the motor distributors such as Lookers and Pendragon have strong financial positions.

What have you learned?

- 2016 has been a bad year for small cap retailing shares. Some shares are trading at very depressed levels.

- Many businesses struggle to generate acceptable ROCE.

- Many companies consume lots of cash flow rather than produce it.

- Valuations are generally very low. Some shares are trading significantly below EPV.

- Car dealerships have reasonable ROCE, strong finances and low valuations. Investors might wish to take a closer look at these companies to see if their shares might be worth buying.

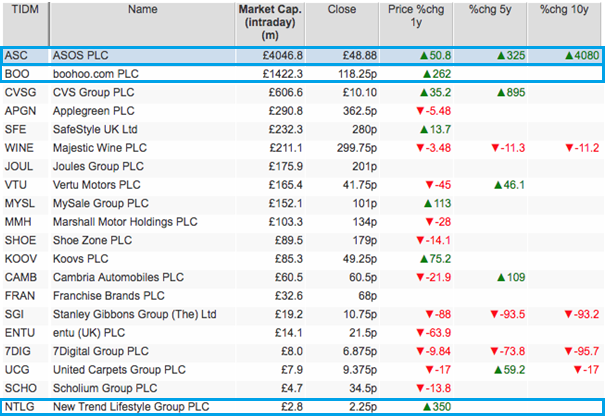

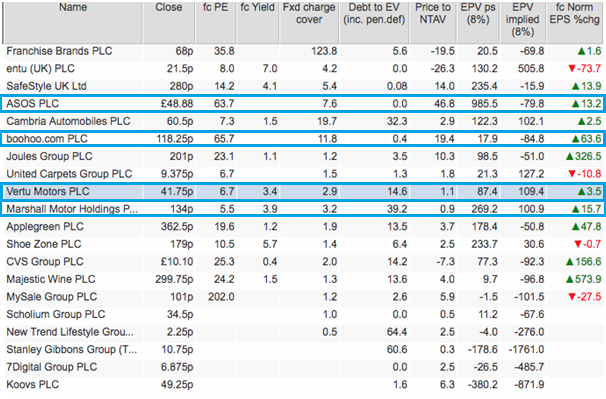

AIM Retailers

There have been some stunning performances from a few AIM retailers during the last year. boohoo.com and New Trend Lifestyle have produced sensational returns for shareholders. ASOS shares have also continued to do well.

Stanley Gibbons has seen its share price collapse and Vertu Motors' shares have also had a rough 12 months.

The share prices of ASOS, Safestyle and boohoo.com remain close to their 52 week highs. Marshall Motor is at a one year low. Majestic Wine shares are not too far off their 3 year low as its business continues to struggle.

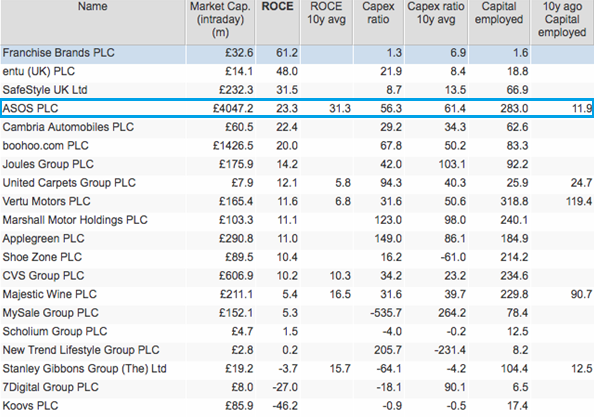

Business performance

The problem with looking at AIM companies is that many of them have not been around long enough to provide a good history of ROCE. There are half a dozen AIM retailers currently producing very good ROCE. Of these, ASOS has a lengthy and good track record.

Valuation and financial position

High flying boohoo.com and ASOS trade on eye-wateringly high valuations. That said, boohoo is expected to grow its profits faster than ASOS. As with their small cap peers, car dealerships Vertu and Marshall are trading on very low valuations. This could make them possible takeover candidates in a consolidating sector. Has the market missed something with these shares or is its pessimism justified?

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.