Why growth matters

In this article I am going to explain why the stock market's expectations of profit growth is key to successful investing. Slowing or falling profits growth makes it hard to make money no matter how cheap shares might look. Investing in shares with rising and growing profit expectations is a much better strategy.

What share prices tell you

Have you ever taken the time to think about what a share price is? In very simple and practical terms it is a price which is used to buy and sell shares as well as to give a value to your shareholding in a company.

However, share prices give the investor a very valuable piece of information. This is because a share price is theoretically the stock market's estimate of the value of all the company's future per share profits expressed in today's money.

If you understand this, then you can understand why share prices move up and down and this can help you to become a better investor.

Let me explain further.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Valuation 101

The theoretical value of a share is the present value of all its future profits. Professional investment analysts spend a lot of their time trying to forecast future profits. They then discount those profits using an interest rate (this is the annual return demanded by shareholders to compensate them for the risks of owning a share) to get a total value for them in today's money.

An example of how this is done is shown in the table below.

High growth company valuation

| Year | FCFps | Growth | Discount factor | Present value |

|---|---|---|---|---|

| 1 | 10 | 20% | 0.9091 | 9.09 |

| 2 | 12 | 20% | 0.8264 | 9.92 |

| 3 | 13.8 | 15% | 0.7513 | 10.37 |

| 4 | 15.5 | 12% | 0.683 | 10.56 |

| 5 | 17 | 10% | 0.6209 | 10.56 |

| 6 | 18.5 | 9% | 0.5645 | 10.46 |

| 7 | 20 | 8% | 0.5132 | 10.27 |

| 8 | 21.4 | 7% | 0.4665 | 9.99 |

| 9 | 22.7 | 6% | 0.4241 | 9.63 |

| 10 | 23.8 | 5% | 0.3855 | 9.19 |

| TV | 303.9 | 0.3855 | 117.17 | |

Value per share(p) | 217.2 | |||

| Forecast Eps | 10 | |||

| PE | 21.7 |

An analyst is valuing a company which is expected to grow its profits and cash flows strongly in the years ahead. To keep things simple, profits and cash flows are assumed to be identical.

The analyst prepares a forecast of cash flows for the next ten years. Cash flow per share is expected to be 10p next year and will grow to 23.8p after ten years. After that cash flows are expected to grow by 2% forever. It is assumed that investors want returns of 10% per year to own the shares.

An interest rate of 10% is then used to discount the cash flow forecasts to a value in today's money. So 10p per share in one year's time at an interest rate of 10% is worth 9.09p today. This is because if you had 9.09p today and invested it at a rate of 10% it would be worth 10p in one year's time.

The remaining nine years are also converted to present values. As the analyst does not have the time to forecast a company's cash flows for the rest of its life it needs a shortcut at the end of year 10. This is known as the terminal value (TV). It is an estimate of what the shares will be worth in ten year's time.

TV = (Year 10 cash flow x long-term growth rate)/(interest rate - growth rate)

Assuming a long term growth rate of 2%, gives a terminal value of 303.9p or 117.2p in today's money.

All the present value of cash flows and terminal value are added together to get a valuation for the share of 217.2p.

Human beings are not very good at forecasting and so these forecasts should be taken with a pinch of salt. Most people don't have the time or inclination to do them either. Instead, they use valuation shortcuts such as PE ratios.

In our example above, the 217.2p valuation equates to a forecast PE ratio of 21.7 times (217.2p divided by 10p). The key lesson to take away here is that companies with high growth expectations usually have high PE ratios.

A company with no growth expectations will trade on a much lower PE ratio as explained in the table below.

No growth company valuation

| Year | FCFps | Growth | Discount Factor | Present value |

|---|---|---|---|---|

| 1 | 10 | 0.9091 | 9.09 | |

| 2 | 10 | 0% | 0.8264 | 8.26 |

| 3 | 10 | 0% | 0.7513 | 7.51 |

| 4 | 10 | 0% | 0.683 | 6.83 |

| 5 | 10 | 0% | 0.6209 | 6.21 |

| 6 | 10 | 0% | 0.5645 | 5.64 |

| 7 | 10 | 0% | 0.5132 | 5.13 |

| 8 | 10 | 0% | 0.4665 | 4.67 |

| 9 | 10 | 0% | 0.4241 | 4.24 |

| 10 | 10 | 0% | 0.3855 | 3.86 |

| TV | 100 | 0.3855 | 38.55 | |

Value per share(p) | 100 | |||

| Forecast Eps(p) | 10 | |||

| PE | 10 |

In reality there are only two main reasons why share prices change:

- A change in the interest rate required by investors. This changes the present value of future cash flows. Higher interest rates lower them and lower rates increase them.

- A change in future profit forecasts.

Given that interest rates generally change slowly, by far the biggest driver of share price changes is a change in the stock market's view of expected future profits. When these change, share prices can change dramatically. This is what happens when a company announces a profit warning and states that profits will be much lower than previously expected.

Let's return to our high growth company from earlier. Cash flow or profits per share were expected to be 10p next year, but the company says that they will be closer to 8p. To make things worse, it reckons that it will be at least another couple of years before profits can start growing again.

Analysts then slash their profit forecasts. They were previously expecting 13.8p in three years' time but now only expect 8p. This also forces them to radically reduce their long-term growth prospects of the business as well. The share price collapses from 217p to 112p. The PE ratio falls from 21.7 to 14 to reflect the lower growth expectations.

The impact of a profit warning

| Year | FCFps | Growth | Discount factor | Present value |

|---|---|---|---|---|

| 1 | 8 | 0.9091 | 7.27 | |

| 2 | 8 | 0% | 0.8264 | 6.61 |

| 3 | 8 | 0% | 0.7513 | 6.01 |

| 4 | 8.4 | 5% | 0.683 | 5.74 |

| 5 | 9 | 7% | 0.6209 | 5.58 |

| 6 | 9.6 | 7% | 0.5645 | 5.43 |

| 7 | 10.2 | 6% | 0.5132 | 5.23 |

| 8 | 10.7 | 5% | 0.4665 | 4.99 |

| 9 | 11.1 | 4% | 0.4241 | 4.72 |

| 10 | 11.5 | 3% | 0.3855 | 4.42 |

| TV | 146.19 | 0.3855 | 56.36 | |

Value per share(p) | 112.4 | |||

| Forecast Eps(p) | 8 | |||

| PE | 14 |

Why this is important

The key message that I want to get across here is that when you are investing in shares expectations of profit growth are all important. It is very difficult to make money owning shares where profits are falling and are expected to keep on doing so.

You are effectively trying to swim against the tide and it is the tide that usually prevails. You need to swim with the tide and that means buying shares at a reasonable valuation where profits are expected to grow.

We can see how important expectations of growth are by looking at some case studies of share price performances during 2016.

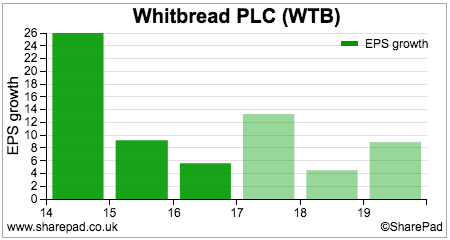

Whitbread - High valuation hit by slowing growth

Whitbread shares have fallen by more than 20% during the last year. 12 months ago its shares were changing hands for £44 or just over 20 times March 2016 EPS of 217p. Today, the shares are valued on just under 14 times forecast earnings as more difficult trading conditions at Costa Coffee and Premier Inn have revised down expectations of EPS growth.

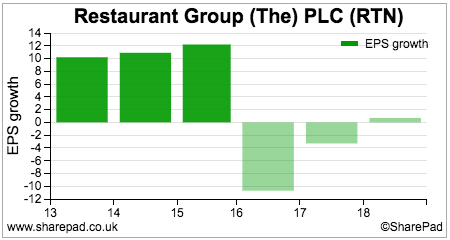

Restaurant Group - Profits warning but no profits recovery in sight

Shares in Restaurant Group has halved during the last year. The forecast PE ratio has fallen from 19 to 11 as the company has released a number of profit warnings.

The low PE ratio and high dividend yield of over 5% might make the shares look attractive. However, analysts are not expecting any profits growth over the next few years.

The shares have tried to bounce off the lows seen in the summer but are struggling to recover. My view is that they probably will not until its profits prospects improve. Restaurant shares could therefore be a classic value trap - they look cheap because there is no growth.

Restaurant Group and Whitbread are classic examples of the risk of owning highly valued shares. The high valuation implies higher future profit growth. When that assumption is challenged or proved wrong the shares can and do fall heavily.

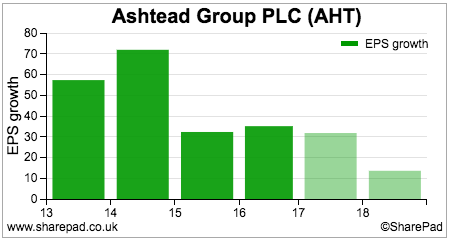

Ashtead - profits growth expected to stay strong

Ashtead shares have had a great 2016 despite a rising share price for many years. The reason is that profits growth has been strong and is expected to remain so.

The shares currently trade on a forward PE of 16.9 times. That's no bargain but is lower than the lofty valuations attached to Whitbread and Restaurant Group a year or so ago. This might mean that they are a better investment proposition provided that forecasts are met.

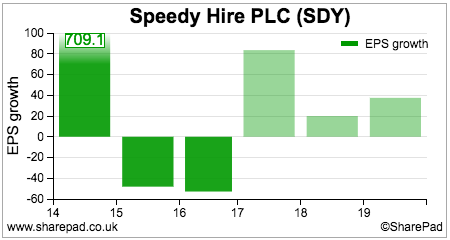

Speedy Hire - profit recovery with strong growth expected

Speedy Hire has been struggling but its shares soared in November when it gave investors a much more upbeat view of its profit prospects.

This kind of share can be interesting, especially for short-term traders. This is because forecasts that have increased once can often quickly rise again and provide upwards momentum to a share price even if a valuation looks expensive.

In my experience, more switched-on company managements have proven to be very adept at being able to keep a bottom draw in order to drip feed a series of profit forecast upgrades into the market.

Say the current EPS forecast for a company is 10p. The company might be confident of achieving 12p but steers analysts towards 11p. Later on in the year it is more confident of hitting 12p as trading is improving. It steers analysts towards 12p but is confident it can do 12.5p. When the results are released and beat forecasts the shares can rise again.

Manufacturing companies with lots of operational gearing (where profits change faster than the change in sales) can see long periods of forecast upgrades as business conditions improve. Investors who ride this upgrade cycle can make a lot of money.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.