Sector Watch: Weighing up pub stocks

No-one wants to be trawling through shares and sectors for hours only to find out that you needn't have bothered. You can avoid this by setting up a series of simple checks to see if spending some time is worthwhile.

In this short article, I am going to show you some very simple data tables in SharePad which can help you to weigh up a sector very quickly. Once these tables have been set up you can find out within a matter of minutes whether:

- A sector or shares within it are in or out of favour

- A company's financial performance has been good or bad

- The financial position is weak or strong

- The shares are cheap or expensive

I am going to be doing a weekly series of sector reviews based on this process. This week, I am looking at the pub sector.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Are the shares in or out of favour?

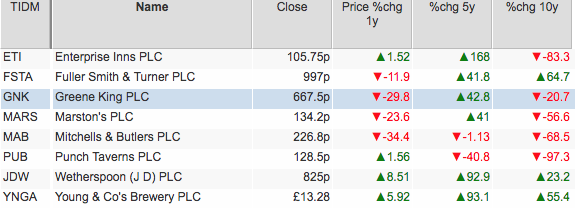

Here we can see the share price performance over one, five and ten years.

The last year has generally not been a good year to own pub company shares, but the last five years have seen some good share price gains. The last ten years has been very disappointing with some big losses. This ten year performance is already telling me that the sector has had some hard times in the past.

Only the shares of JD Wetherspoon and Young & Co have been profitable over one, five and ten years. Mitchells & Butlers and Punch Taverns have been loss making for each of these three periods of time.

My main question from this analysis is has the sector's good run over the last five years come to an end?

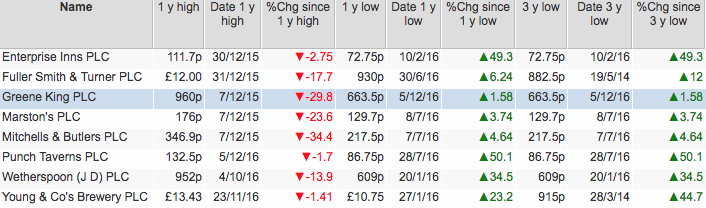

To drill down further and learn a bit more about the stock market's sentiment towards the shares in the sector, I have set up another table. This one above is looking at where the shares are trading in relation to their one year high and low share prices. I've also looked at the three year low share price to see if any shares are particularly depressed.

You can see that Young & Co, Enterprise Inns and Punch are close to their one year highs. Is something good going on with these companies?

Greene King, Mitchells & Butlers and Marston's are trading close to their one year and three year lows. These shares look quite depressed. Is something bad going on with them or could the market have overreacted and created a buying opportunity?

Business performance

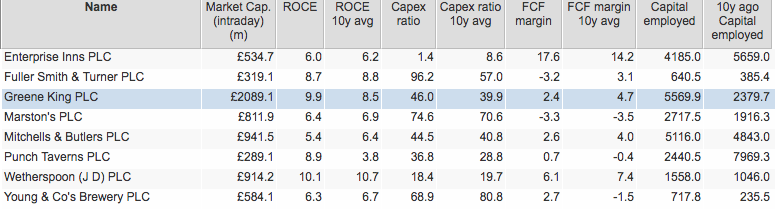

ROCE and Capital employed figures are lease-adjusted.

Analysing a company's financial performance properly does take a bit of time. That said, by looking at three key bits of information you can get a good idea of whether a company has a decent business or not:

- Does it have a high ROCE? How does the current ROCE compare with the 10 year average figure? My threshold for a high quality company is a consistent ROCE of 15% or more.

- Has it been spending a lot of money? The capex ratio tells you how much of a company's trading cash flow has been reinvested back into the company. High capex and high ROCE will create a lot of profits growth. High capex and low ROCE will see low profits growth and poor free cash flow.

- Has the total amount of money invested in the company increased or decreased over the last decade? In other words, has capital employed increased or not.

This analysis does not paint a pretty picture for pub companies. ROCE is - and has been - very unexceptional and verging on poor. Yet the companies have been ploughing a lot of cash flow back into their businesses as evidenced by high capex ratios (capex to operating cash flow). Capital employed has increased significantly for some companies but has been shrinking at Enterprise Inns and Punch Taverns.

What seems to have been going on here is that a lot of money has been invested at very poor rates of return. Ask yourself if this is the kind of sector you want to invest in?

Valuation and financial position

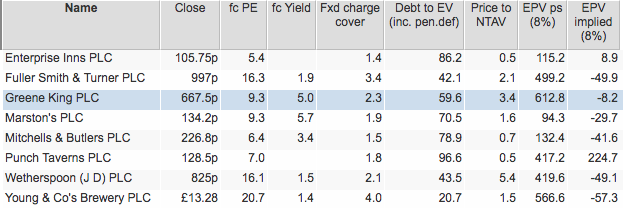

A positive EPV implied value means that the EPV is above the current share

price and suggests potential upside.

With the exception of Young & Co, Fuller Smith & Turner and JD Wetherspoon which have quite high forecast PE ratios, the sector is lowly rated on this measure.

Debt levels are very high compared with current enterprise values. The one exception here is Young & Co. Fixed charge cover of 1.5 or less is starting to get uncomfortable and could suggest that Mitchells & Butlers and Enterprise Inns could have difficulty paying their interest and rent bills if profits fall in the future.

Mitchells & Butlers, Enterprise Inns and Punch Taverns trade at significant discounts to their tangible net asset values. Does this mean the shares could be cheap? Maybe but low levels of profitability as evidenced by low ROCE suggests that the asset values are questionable. As a rough rule of thumb, ROCE should be close to 10% on a consistent basis to believe in asset values on balance sheets. Could the assets have higher values if they were used for something else such as house building?

Only Enterprise Inns and Punch are trading below their earnings power value (EPV) - an estimated value if current profits stay the same forever. Greene King is not too far away from its EPV. Around half of the share price of JD Wetherspoon, Young & Co and Fuller is explained by current profits with the other half dependent on future profit growth. Are these shares too expensive?

What you have learned

- Pub companies look to be out of favour having performed well for the last five years. Some companies are trading close to three year lows.

- They don't look to be high quality businesses. They have low ROCE, high capex requirements and generally have been spending lots of money.

- Debt levels across the sector are quite high.

- Many shares have low valuations.

- Some shares might be overvalued.

- Could Greene King shares be worth looking at further? They are depressed, close to three year lows yet its EPV is suggesting that not much future profit growth is factored into the share price? Is it cheap or a value trap?

How to do this in SharePad

Pub companies belong to the Restaurants & bars subsector so a simple sector filter won't be enough to isolate them. It is best to add the specific companies to a watchlist (portfolio). You could add the whole subsector and then delete the companies which aren't pubs (e.g. Domino's Pizza). The quickest way, if you know the TIDM codes (EPICs), is to create a watchlist, click on the Add to port button in the List (blue) view, then select Add multiple instruments and type in ETI, FSTA, GNK, MARS, MAB, PUB, JDW, YNGA. This will add all the companies in one go.

You can easily create all four tables in my article in the List (blue) view in SharePad. Create a new Setting for each table so you can access them in the future.

If you need any help creating tables in SharePad, look at the tutorials and videos on our Training Zone (look in the Lists section).

Alternatively, for help with any of this, call our customer support team on 020 7749 8555.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.