Stock Watch: MJ Gleeson

Sheffield-based house builder MJ Gleeson appears to be in very good health. The company distinguishes itself from its sector peers by pursuing a different strategy.

Its focus is on selling affordable houses on redeveloped and regenerated land in the north of England and the north Midlands. It does not build houses in the more affluent south. Instead it buys land there and then works to get planning permissions for it. Once it has done that it then sells the land to other house developers with the aim of making consistently healthy profits.

In this article, I am going to put MJ Gleeson through a financial analysis in SharePad to see where it has come from and where it might be heading in the future.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

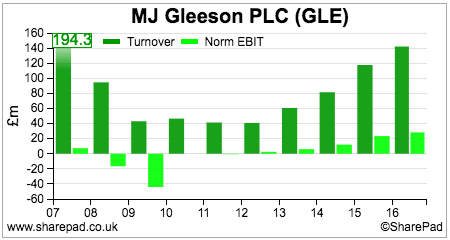

Sales and profit history

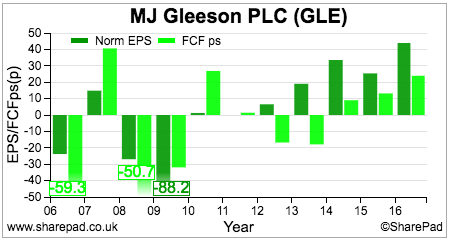

The company's sales and profit history is very similar to those of other house builders. It suffered badly during the recession of 2008/09 and lost money. It spent a few years being barely profitable before increasing sales and profits significantly during the last five years.

The chart above is telling us that house building has been a very cyclical sector. If history is any guide then there's a good chance that it will be again. Whenever you see a profit history of losses you need to be mindful that you might be investing in a company which might be more risky than others out there.

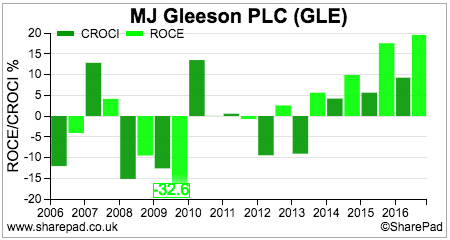

Returns on investment

Returns on capital employed (ROCE) and free cash flow returns on investment (CROCI) have been all over the place. There has been no consistency in ROCE over the last decade, although the company is now looking very profitable with ROCE close to 20% in 2016.

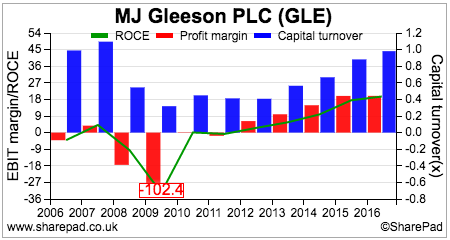

If we dig a bit deeper into the drivers of MJ Gleeson's ROCE we can see that profit margins have been increasing since 2012. So has capital turnover (the value of sales per £1 of money invested in the company) as a result of the company's selling strategy - more on this later.

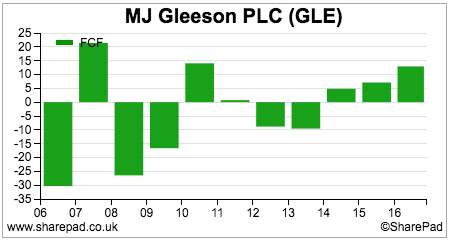

Free cash flow

Just as with profits and ROCE, the company's free cash flow performance has been very volatile. However, Free cash flow has seen strong growth over the last three years.

The company's ability to turn profits into free cash flow has been generally poor during the last decade.

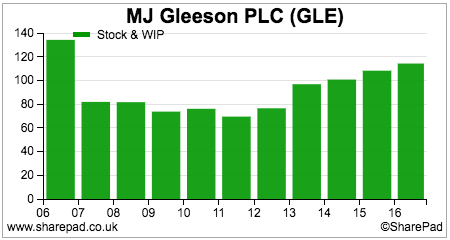

House builders do not tend to spend much money on new fixed assets. The main cash outflows come from the buying of land to build on and the building of houses. This is shown as Stock and Work in progress (WIP) on a house builder's balance sheet. MJ Gleeson's Stock & WIP has been growing in recent years.

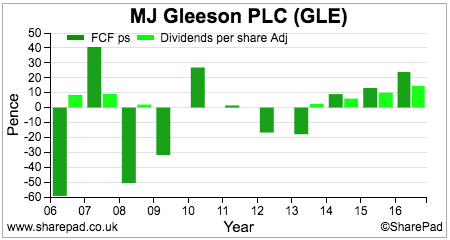

Dividends

The company stopped paying dividends in 2009 and did not start paying them again until 2013. Since then dividend growth has been impressive and has been comfortably paid out of free cash flow.

The patchy dividend track record might be seen as another warning sign of investor risk if the housing market hits a rough patch in the future.

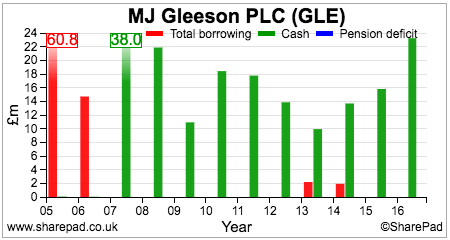

Financial position

The company's finances are currently very strong. It has no debt, no final salary pension scheme - it does have a defined contribution scheme - and rising cash balances. The company is very conservatively financed which lowers the financial risk that shareholders face if profits were to decline in the future.

A closer look at the company's businesses

Gleeson Homes had a very strong year in 2016 with operating profits up 32.7% and operating margins improving to 17.2%.

| Gleeson Homes (£m) | 2016 | 2015 | % change |

|---|---|---|---|

| Sales | 113.6 | 96.1 | 18.21% |

| Operating profit | 19.5 | 14.7 | 32.65% |

| Margin | 17.17% | 15.30% | 12.22% |

| Homes sold | 904 | 751 | 20.37% |

| Average selling price | £125,700 | £123,750 | 1.58% |

| Land bank (plots) | 9284 | 7496 | 23.85% |

| Land bank (years) | 10.3 | 10 | 2.89% |

Unlike some of the bigger house builders where sales have had a significant boost from increased selling prices, this is not the case with Gleeson. Average selling prices only increased by 1.6% with virtually all the sales growth coming from selling more homes.

The company's strategy is based on building affordable homes. Its focus on regenerating brownfield land allows it to keep its land costs low whilst helping to keep on good terms with local authorities and gain planning permission as fast as possible.

Given the serious shortage of affordable homes in the UK, Gleeson looks like it might have a more sustainable and less risky strategy that some of its peers which are more reliant on rising house prices. The company prides itself on building quality homes in deprived areas where the mortgage cost is often cheaper than local council house rents. This makes them affordable to a couple earning only the national living wage. Gleeson is trying to make money by building and selling more houses rather than pushing up selling prices.

Gleeson expects to hit its target of selling 1000 homes a year in 2017 and would have a land bank of more than 9 years if it does. Looking further ahead, the company believes that there is scope to scale its business model to other areas of the north of England and the Midlands. This could mean that the business is eventually capable of building and selling 3,000 houses a year. If it could do this, then the scope for profits growth could be considerable providing the housing market remains reasonably healthy.

There are grounds for caution. Mortgage rates are unlikely to fall in the future and could rise if the yield on UK government bonds continues to rise. Gleeson also seems to be very dependent on the Help to Buy scheme to sell houses (equity loans provided by the government for up to 20% of the purchase price of a house up to £600,000). The scheme accounted for 61% of homes sold by the company last year. If Help to Buy is not extended beyond its current expected end date of 2021 this may have a damaging effect on the number of houses Gleeson can sell.

Gleeson strategic land

The company aims to make consistent profits by buying land in the south of England, getting planning permission for it and then selling it to other house builders. 2016 saw profits increase again.

| Gleeson Strategic Land (£m) | 2016 | 2015 | % change |

|---|---|---|---|

| Sales | 28.4 | 21.5 | 32.09% |

| Operating profit | 10.2 | 8.1 | 25.93% |

| margin | 35.92% | 37.67% | -4.67% |

| Sites | 68 | 68 | 0.00% |

| Acres | 3,843 | 3,936 | -2.36% |

| Plots | 21111 | 21150 | -0.18% |

The size of the land bank is significant and may contain a lot of potential value for Gleeson shareholders. Of the 3843 acres, only 178 acres are currently owned by the company. The rest is under option or the potential to buy. The 178 acres is only on Gleeson's balance sheet for a gross asset value of £50.6 million (net asset value of £43.3m) or just over £284,000 per acre. With planning permission, that land will be worth considerably more.

Bear in mind that land prices are extremely geared to changes in house prices by a factor of between 2 and 3 times. A sharp fall in house prices in the south of England could see a significant fall in the value of Gleeson's strategic land assets.

In its latest annual accounts, the company also says that some big house builders have tried to negotiate down the price of land they have agreed to buy from it following the EU referendum. Medium-sized builders have apparently not done this as they are more in need of replenishing their stocks of land.

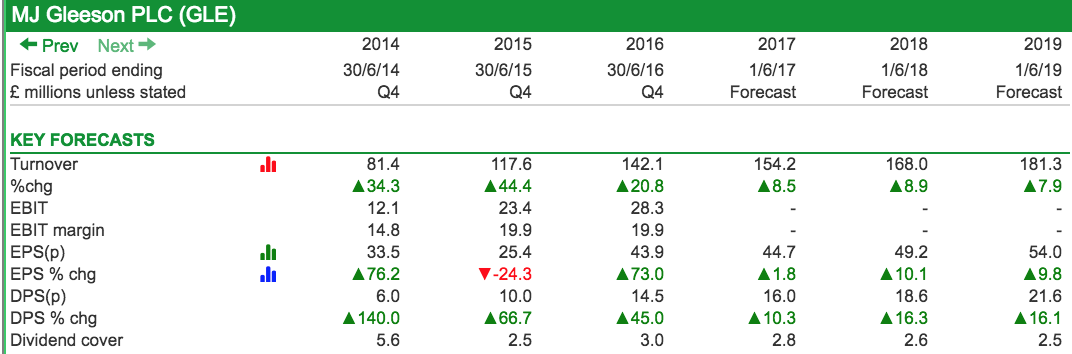

Forecasts and valuation

City analysts are still expecting reasonable growth in turnover, EPS and dividends per share.

This may explain why Gleeson shares trade on a higher forecast PE ratio than most of the house building sector. They also trade on one of the highest P/NTAV multiples which may reflect the potential value of the strategic land bank.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.