Simple steps for avoiding dividend traps

Not so long ago it was possible for people to put their savings in banks accounts and government bonds and receive a decent rate of interest in return. Many relied upon that interest as a valuable source of income to live on.

Trying to do that now is all but impossible unless you have huge sums of money invested. The miniscule rates of interest offered by savings accounts and bonds has meant that many people have turned to the stock market for income.

Shares can be a great way to produce a source of income to live on but they also come with lots of dangers. Blindly buying shares with high dividend yields - the dividend income from a share expressed as a percentage of the current share price - can be a mistake.

High dividend yields can be telling you that a share is very risky and that there is a chance that the dividend might be cut. If that happens, then not only can you end up getting less income that you thought but you can lose a lot of money as well as share prices tend to fall when dividends are cut.

Thankfully, there are a few simple checks that you can do in SharePad or ShareScope combined with questions you can ask that can give you a good chance of staying out of trouble.

If you are a relatively new investor seeking dividend income then this article is intended to help you. Hopefully it will show you that analysing companies doesn't have to be complicated and that even very simple questions can tell you enough to make an investment decision.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Spotting dangerous dividend shares

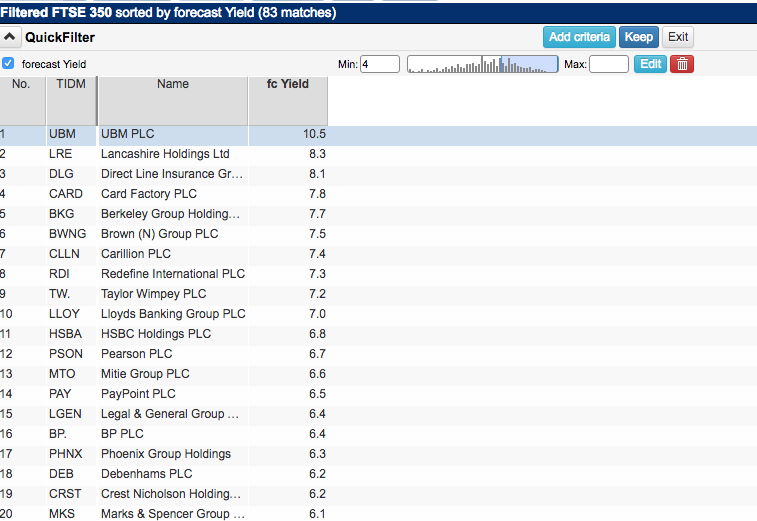

It's very easy to find a list of high yielding shares. Below is a list of shares in the FTSE 350 index that have forecast dividend yields of more than 4%. SharePad is telling me that there are 83 different shares that meet this criteria.

You should not go and buy 83 different shares and sit back and wait for the dividends to start rolling in. Not only would this cost you a lot of money in stamp duty and stockbroker commissions but you would probably end up with some bad and risky shares as well. You need some way of reducing your list of shares down to a manageable number so that you can better focus your research efforts.

SharePad and ShareScope make this easy.

Once you have your starting list of shares you can then use SharePad or ShareScope to start finding out whether these dividends are safe or not. You do this by adding columns to the list which give you some more information.

Dividend cover

This tells you how many times a company's profits - in this case its earnings per share (EPS) - covers the annual dividend per share. The higher the amount of dividend cover the safer a company's dividend is seen to be. In other words, profits can fall by a larger amount before the dividend has to be cut.

Dividend cover of over two times used to be seen as the benchmark for a safe dividend. However, it is not as simple as that. Companies in sectors such as utilities have very secure profits which allow them to pay out a higher proportion of their profits in dividends. For these companies, dividend cover as low as 1.2 or 1.3 times might still be safe.

Mature companies which aren't capable of growing their profits by very much may also decide to pay out most of their profits to shareholders. Dividend cover for these shares will often be low and future dividends are unlikely to grow by much.

Other companies such as real estate investment trusts (REITS) have to pay out most of the rental income from their properties as dividends and will therefore have low dividend cover ratios.

Years of consecutive dividend payments

A company's dividend history can be very telling about how safe its dividend might be in the future. Companies which have cut or scrapped their dividends in the past - perhaps in a recession - might do so again. This is more likely in economically sensitive sectors (known as cyclicals) such as house building or manufacturing where profits tend to move up and down with the fortunes of the economy.

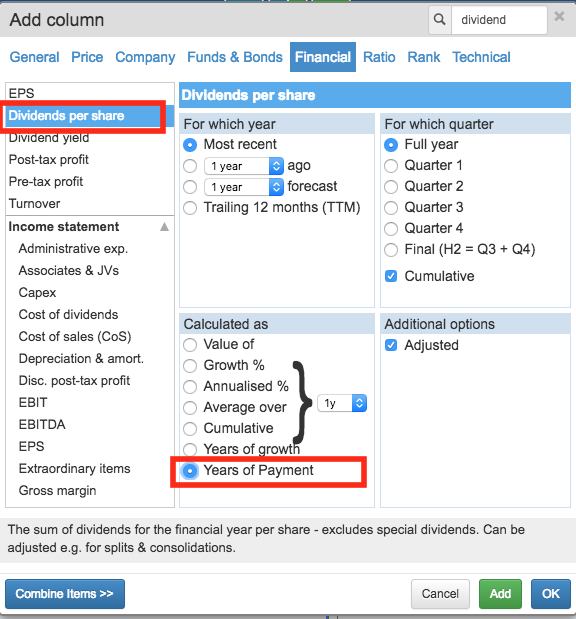

SharePad and ShareScope tell you how many consecutive years a company has paid a dividend for. If a company has been able to pay a dividend for many years this could be a sign that it has a very robust business able to withstand competition and the ups and downs of an economic cycle.

For example, you might want to ask SharePad or ShareScope to find you shares with at least 10 years of consecutive dividend payments. This would mean that they still paid dividends during the 2008-09 financial crisis when many companies did not.

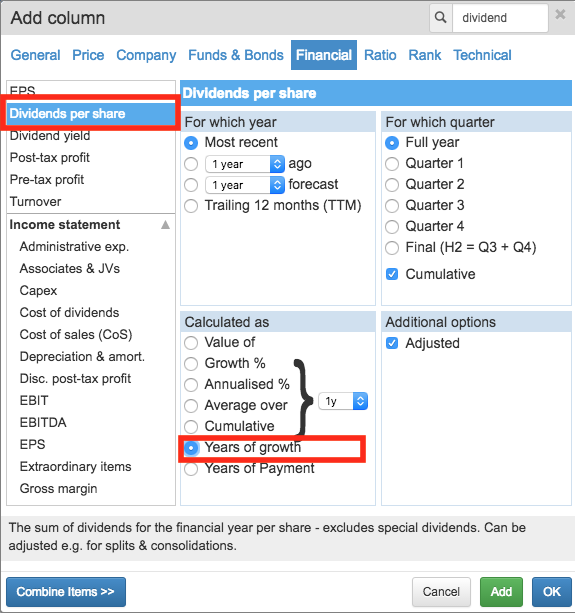

Years of dividend growth

The ability of a company to grow its dividends is a hallmark of quality. Dividend growth is also important to you as an investor. It means that you can potentially own a share that pays you a higher income each year. Not only that, but companies that can keep growing dividends often see their share prices rise over time which can also make you better off.

Companies which have grown their dividends in good times and bad can only usually do so because they have very good businesses.

The longer a company has been able to grow its dividend, the more reassuring that can be to an investor. However, it is no guarantee of future dividend growth. Companies can - and do - run into trouble due to rising competition or taking on too much debt which can cause profits to fall and dividend growth to grind to a halt.

Future dividend growth

If you are looking for income to live on then ideally you want it to keep up with the cost of living so that you can buy you the same amount of goods and services with it in the future.

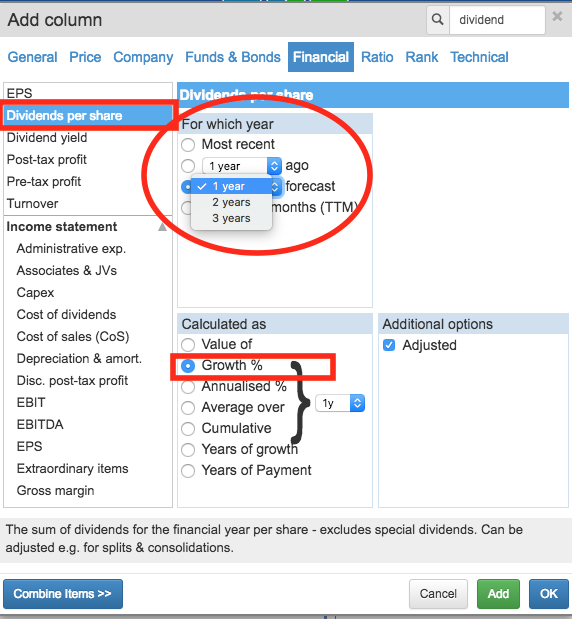

SharePad and ShareScope have forecasts from City analysts which allow you to select shares that look as if they can keep on growing their dividends in the future.

With inflation currently running at just under 2% you might want to look for shares which are expected to grow their dividends by at least 2%. You can get forecast dividend growth rates for the next three years in SharePad and ShareScope.

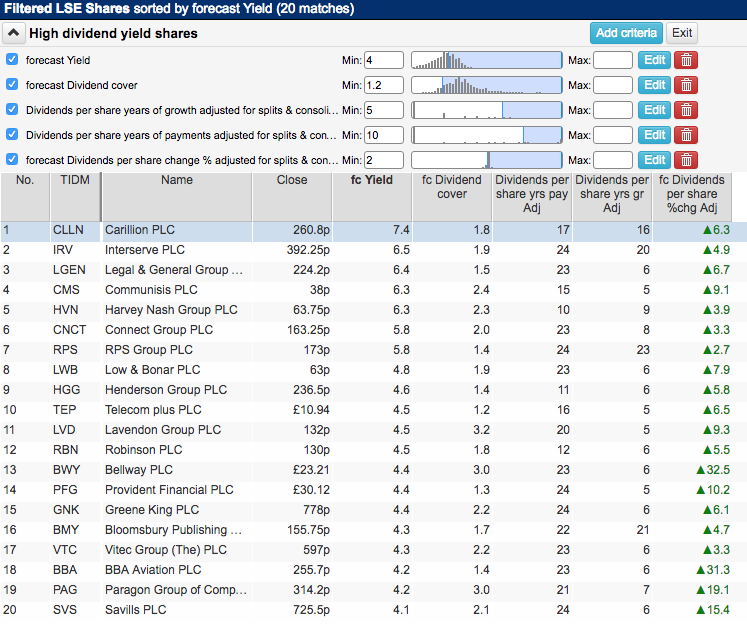

Building a dividend filter

Below is a filter for dividend shares in SharePad which meet the following criteria:

- Minimum forecast dividend yield of 4%

- Minimum forecast dividend cover of 1.2

- At least 10 years of consecutive dividend payments.

- At least five years of dividend growth.

- Minimum forecast dividend growth of at least 2%.

Things to be aware of

Remember that a filter or a screen is the start of your investing process, not the end. The beauty of a well thought out filter it that it can save you hours of time looking for shares to research.

However, you should always use them as the basis for asking more questions about each stock. When it comes to dividends here are some things that are helpful to know.

Read what the company is saying about its dividend payments (you'll find all company announcements in SharePad). For example, are they paying special one-off dividends that make the yield look high at the moment only for it to fall back in the following years? Have they set a target rate of dividend growth or a proportion of profits they will pay in dividends?

Keep an eye out for dividends where the growth rate has been slowing down or where the dividend has been at the same level for a few years. These companies may return to growing their dividends or it may be a sign that they will be cut in the future. You can't be sure unless the company has provided guidance on the former. It may just be best to avoid them.

Be wary of regulated businesses such as water and electricity companies. These companies are subject to regular reviews of the prices they charge their customers by industry regulators. In the past, price cuts imposed by the regulator have forced water companies to cut their dividends.

It is usually a good idea to stay away from companies with lots of debt. As interest on debt has to be paid before shareholders get a penny in dividends, a fall in profits can mean that there is not enough money left over to maintain dividend payments.

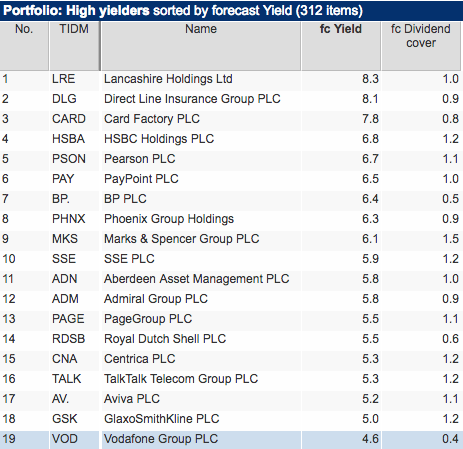

Big dividend yields which might not be safe

Below is a list of high dividend yielding shares with low levels of dividend cover. Extra care and some diligent research is needed if you are relying on these shares for income.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.