Stock Watch: Lookers

Lookers is one of the biggest car dealership companies in the UK. Its business is very simple to understand. It makes money from buying and selling cars and from aftermarket services such as servicing and spare parts.

The UK car market has been in rude health since the dark days of the last recession with strong growth in new car sales. Car manufacturers have offered very generous car financing deals to customers - through something known as a personal contract purchase (PCP) - in order to keep their factories busy and the car dealers have done very nicely from this.

Investors in Lookers' shares have also done well up until the beginning of 2016. Since the start of the year, however, the shares have been very volatile with some investors concerned about whether the UK new car market can keep on growing and what the effect of the UK's exit from the EU will mean for consumer confidence in general. The shares are now some way off their 52 week peak but have rallied strongly in recent weeks.

It's time to open up ShareScope and see what the future might bring for the shares.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

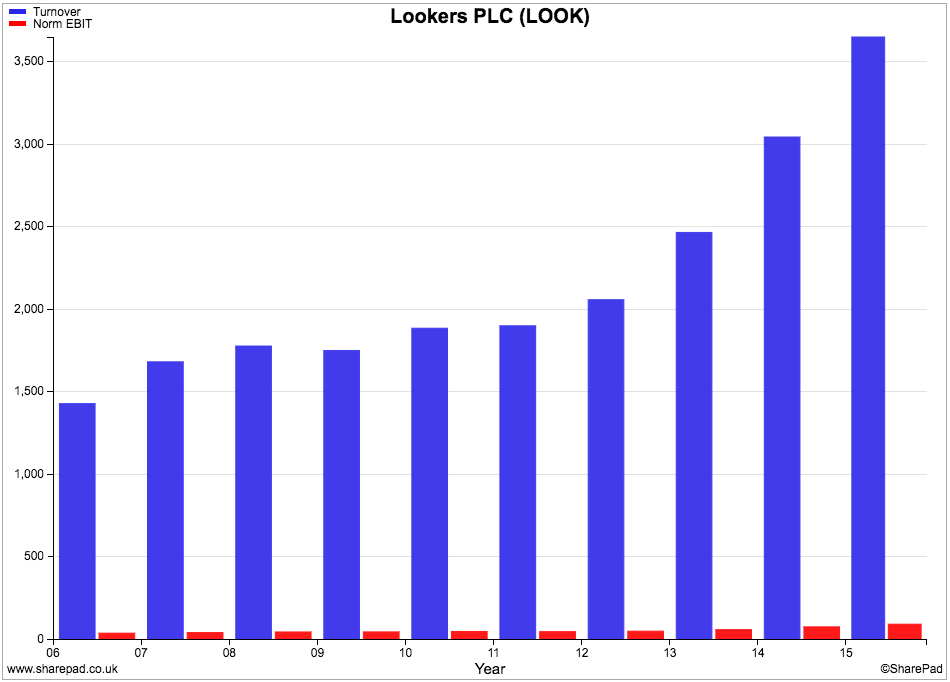

Sales and profit history

Sales growth has accelerated since 2012 after being quite lacklustre before then. You can see in the chart below that trading profit (EBIT - red bars) is very small relative to the turnover (blue bars). This is immediately telling you that Lookers is a very low profit margin business.

That said, profit growth has been in line with sales growth in recent years which is encouraging to see.

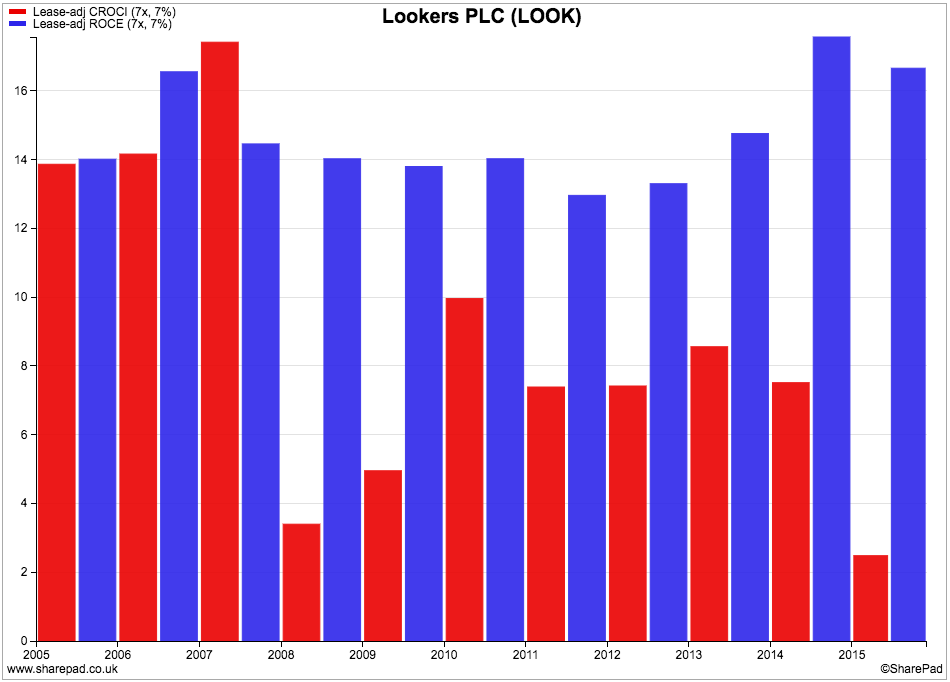

Financial returns

Is Lookers a good business? Not a bad one at all it would seem.

ROCE has averaged 14.8% during the last decade which is pretty decent. CROCI has been more up and down and has averaged 8.3%. Whilst this is not a hallmark of an outstanding business this is quite respectable.

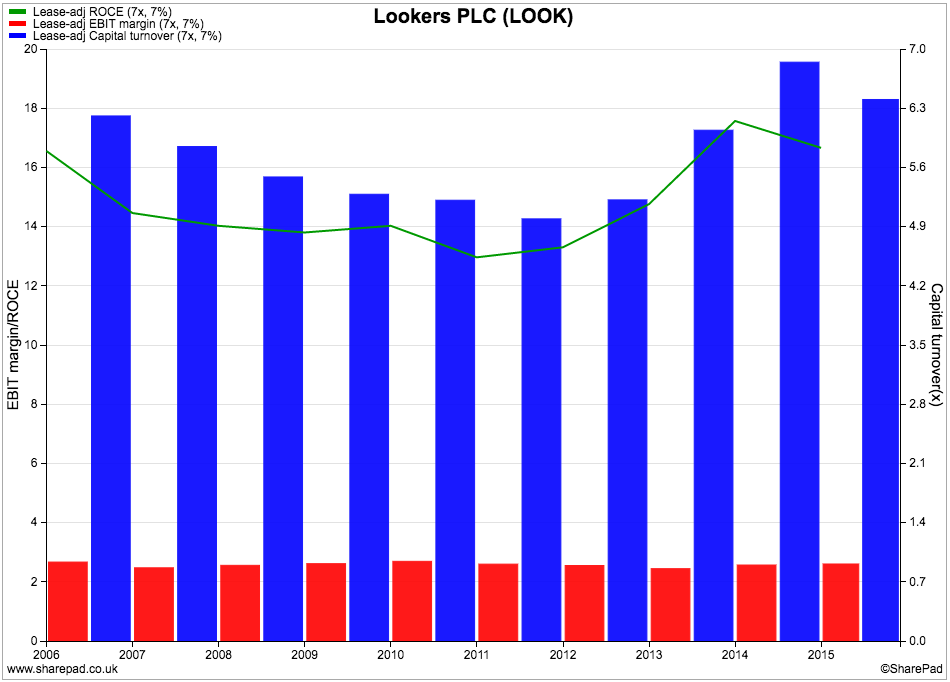

If we take a closer look at how Lookers has achieved its ROCE we can see again that profit margins are very low but capital turnover is very high.

The rise in ROCE since 2012 has been entirely driven by improvements in capital turnover. What we are learning here is that Lookers needs to sell a lot of cars to make a decent ROCE. It was making £6.40 of sales for every £1 of capital invested in 2015 which is a high number. Any downturn in car sales could have a significant effect on Lookers' future ROCE.

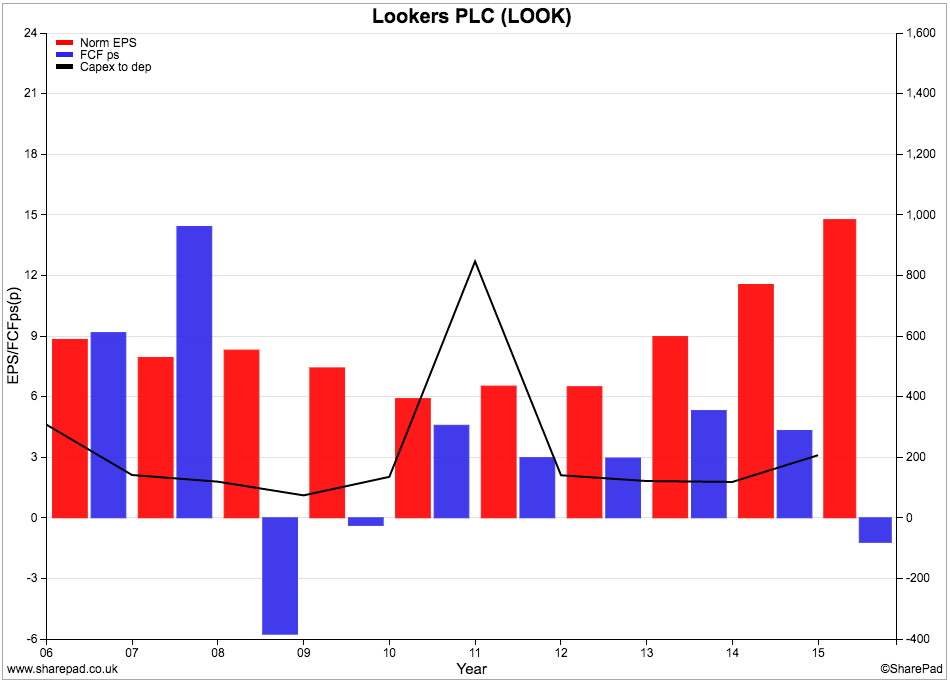

Free cash flow generation

Lookers has produced free cash flow for its shareholders for most of the last decade. That said, the big negative free cash flow per share number in 2008 shows what can happen in a recession when profits fall and suppliers demand faster payments (a decrease in trade creditors).

However, the company has largely failed to consistently turn its earnings per share (EPS) into free cash flow per share.

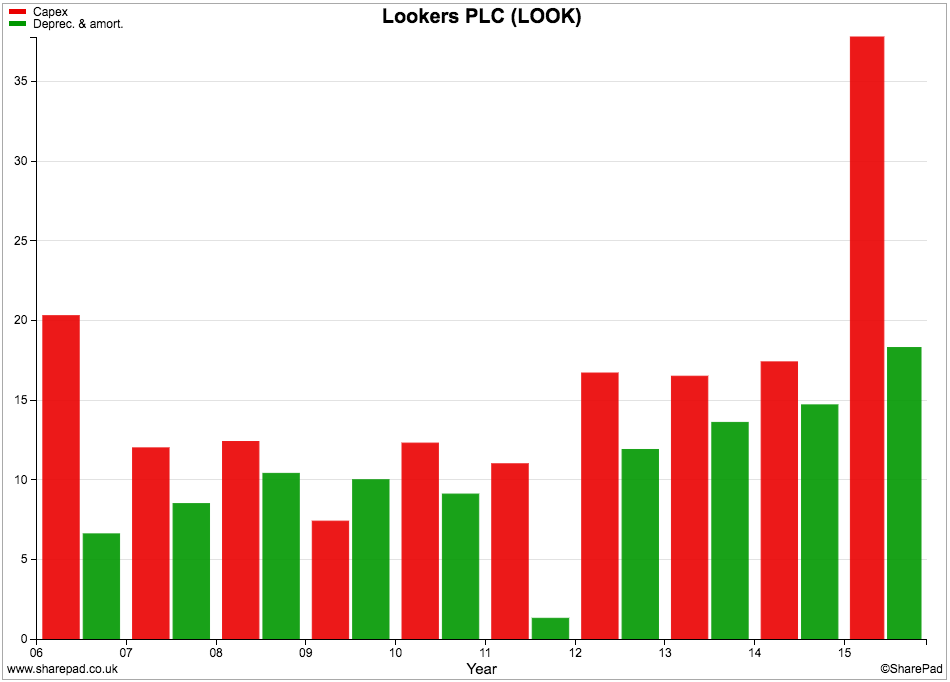

This can be explained by the fact that capex has been significantly more than depreciation, presumably as the company has opened more dealerships.

2014 and 2015 also saw increases in debtors which saw significant amounts of cash flowing out of the business. Investors will want to see this being reversed in future years and the cash coming back into the company.

Whilst free cash flow per share has been lower than EPS it has generally been sufficient to cover the dividends per share paid although not in 2015. Note the lack of dividend in 2009 during the last recession. This could be a sign that dividends from this company might not be safe when the economy takes a downturn in the future.

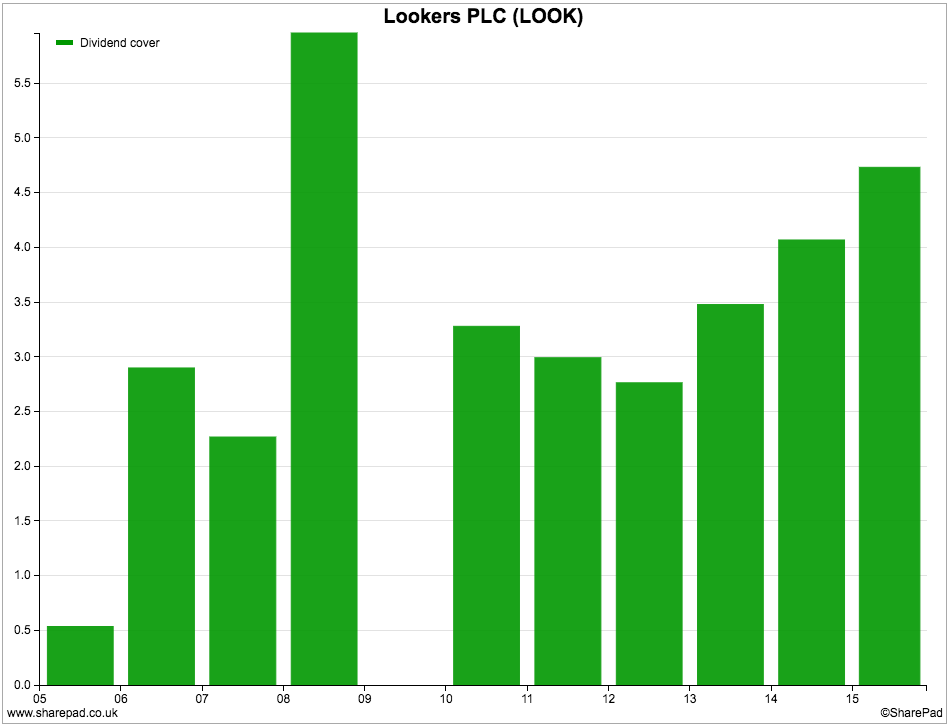

Another interesting thing to note is that the company has a very high level of dividend cover when comparing its EPS with its dividend per share.

Since the dividend payment was restored in 2010, dividend cover has been over three times profits and had risen to 4.7 times. In 2015. Put another way, the company is only paying out 21% (one divided by 4.7) of its profits to shareholders. Going forward, the company is targeting dividend cover of between 3.5 and 4.0 times.

This means that dividends are likely to grow faster than profits over the next few years, but high levels of dividend cover or low payout ratios can contain lots of messages for investors:

- The dividend is fairly safe. Profits will have to fall a long way before the dividend is cut.

- There is scope to increase dividends faster than earnings by reducing dividend cover.

- Dividend cover has to be high because the nature of the company's business means that profits can fall significantly when the economy goes into recession.

- The company wants to retain profits to reinvest in the business and grow future profits.

I think all of the above are true for Lookers. However, I would pay more attention to the company's free cash flow as a driver of future dividend growth than its EPS. This suggests that the current level of dividend payment is sustainable but unless free cash flow improves significantly, high rates of dividend growth for a long period of time are probably unlikely.

Financial Position

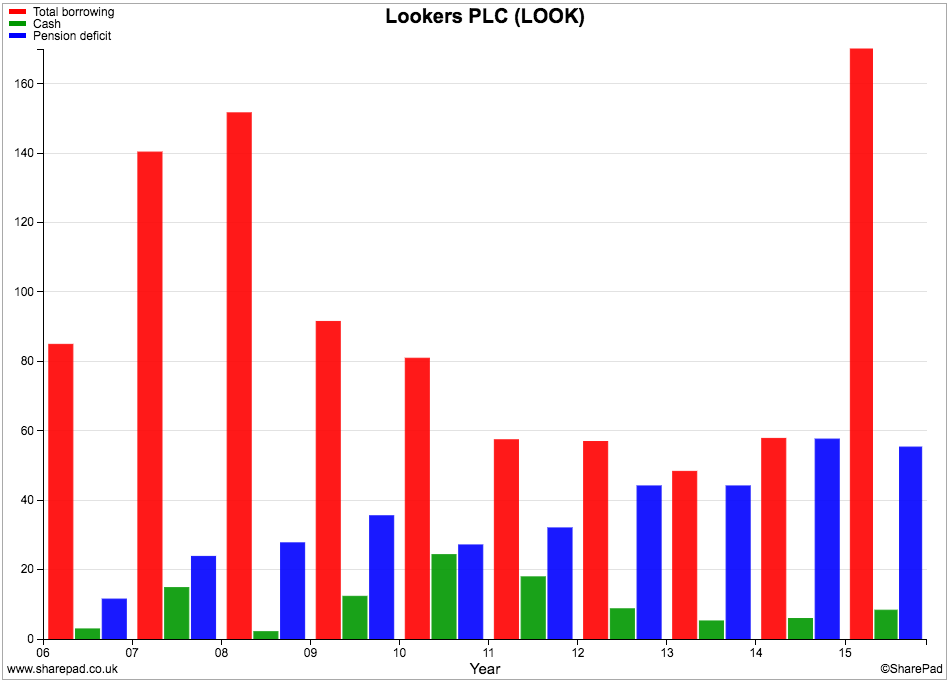

Lookers' financial position looks reasonably safe. Borrowings increased significantly in 2015 as the company spent heavily buying other car dealerships. During the first half of 2016, borrowings have come down significantly due to strong cash generation.

The company has also been raising cash by selling underperforming dealerships and realising money from freehold properties. It has also agreed to sell its Parts division for £120m which should complete before the end of the year. It seems as if Lookers will have very little debt by the end of 2016

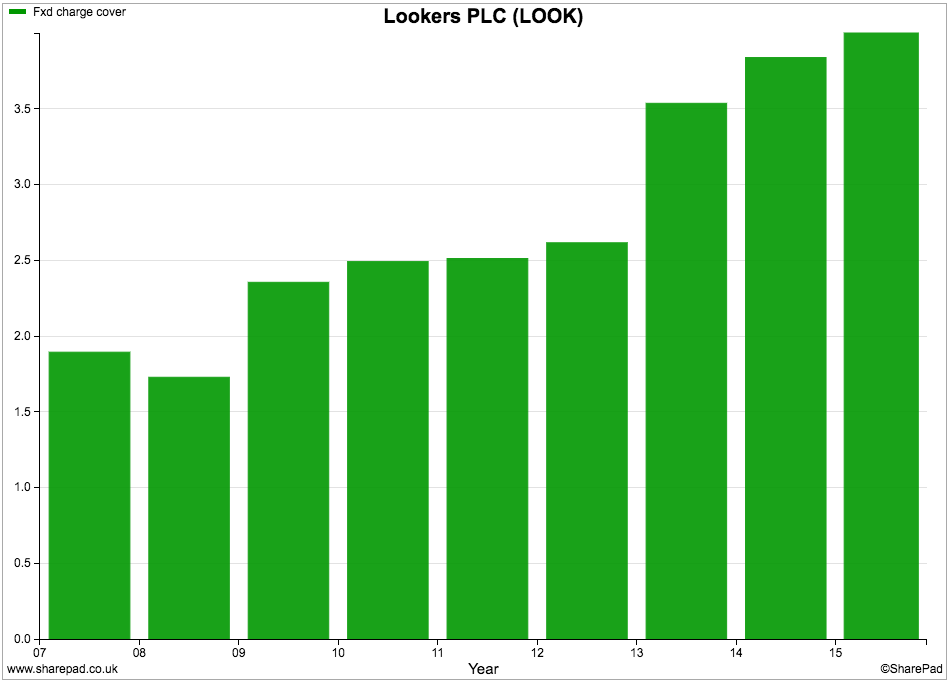

Fixed charge cover of over 4 times re-enforces the view that Lookers' finances are in good shape.

Stock Turnover

One of the most important ratios you can use when looking at a retailer, especially a car dealership, is stock turnover.

Car dealerships need lots of available cars to keep customers happy but these stocks of cars are expensive to finance and tie up a lot of money in the business - which can reduce ROCE. They need to be turned into cash quickly. Stock that stays on a forecourt for too long will often have to be reduced in price and will hurt a company's profitability.

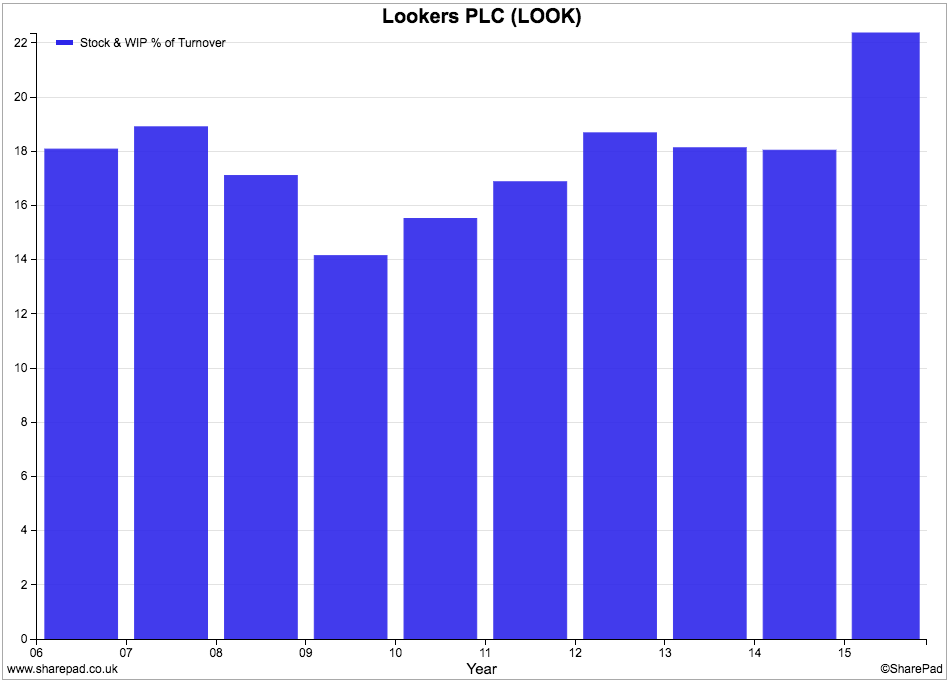

Lookers has high stock levels as a percentage of its turnover at over 22% and this ratio increased sharply in 2015. This could be due to an acquisition or new dealerships close to the year end which means that the stock of cars is on the balance sheet but very little turnover has come from them.

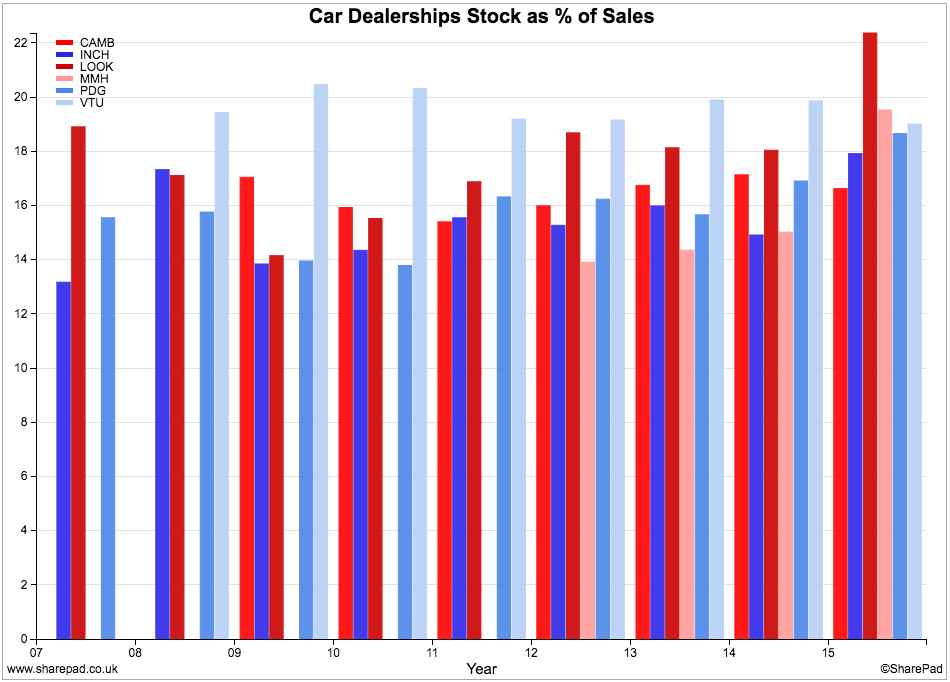

You can use ShareScope to quickly compare similar companies on different financial ratios. This is useful in helping you understand whether a company you are looking at is different or similar to companies in the same industry.

Below is a chart showing the trends in the stock turnover ratio amongst different car dealership companies. You can see that high levels of stock to turnover is common but that Lookers currently has the highest ratio amongst its peer group. This is something that needs watching.

Future prospects and valuation

Whilst the business of buying and selling cars is simple enough to understand it is actually quite easy to misunderstand the business of car dealerships.

The biggest misconception is that their fortunes are entirely linked to the new car market. Whilst the sale of new cars is very important - just over half of turnover for Lookers - it is not the be all and end all for the company.

The sale of second hand cars, repairs and servicing are actually a lot more lucrative for car dealers.

The sale of new cars in the UK has been booming in recent years and has largely been driven by credit in the form of PCP deals. A trip out onto the roads and the motorways will tell you that there are a lot of new cars on the road. In fact just under a quarter of the 33 million cars on Britain's roads are under three years old.

My gut feeling is that the sale of new cars to private consumers will slow down and probably decline in the not too distant future. However, fleet buyers are still buying lots of new cars and this is underpinning the market for now.

The big benefit for dealers from the boom in new car sales in recent years is twofold. Firstly, it has created a growing pool of low mileage second hand cars to sell. Secondly, cars under three years old tend to be serviced through main dealerships rather than independent garages. This should give Lookers and other dealers a growing stream of servicing revenues which will help their profit margins.

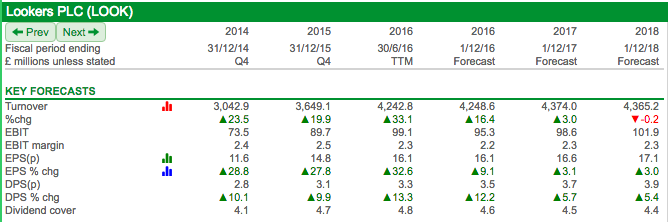

Despite this reasonably positive backdrop, it seems that City analysts are not predicting lots of profit growth for Lookers. The effect of recent acquisitions should help profits grow in 2016 but forecast EPS growth of around 3% in 2017 and 2018 is not particularly bullish.

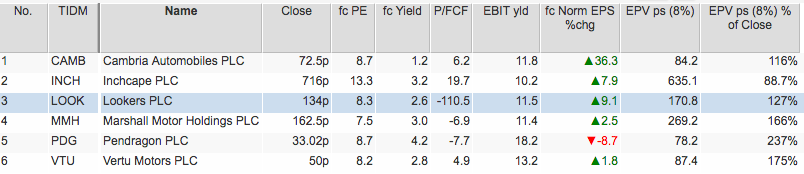

This might go some way in explaining why the shares of car dealerships are trading on very modest forecast PE ratios.

Lookers trades on just 8.3 times 2016 forecast EPS which is very similar to others in the sector. With the exception of Inchcape, all companies are trading at a discount to their earnings power values (EPVs).

The current share prices are effectively telling us that the stock market doesn't believe that the current profits of car dealerships are sustainable. History tells us that profits are cyclical and move in line with the economy and that valuing a company on the basis of record high profits is not particularly prudent.

That said, sometimes the stock market gets it wrong and is too pessimistic about the future. If City analysts are right about slow future profit growth then maybe the current valuations are right and that shares trading below EPV are not a sign of cheapness.

The other thing to consider though is whether the shares are cheap enough to make them takeover candidates. A consolidation of car dealerships in the UK has been ongoing for a while now. Lookers only has around a 5% market share and so could be a buyer or be bought itself without triggering the attention of the competition authorities.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.