Are housebuilder shares in a bubble?

Shares of housebuilders have been star performers following their recovery from the last recession. Propped up by ultra low interest rates and the cheap mortgages they have created plus no end of government initiatives to help the housing market, the builders have made hay whilst the sun has been shining and their shareholders have been richly rewarded.

But how long can the good times last? There will always be someone who will tell you that "it is different this time", but if history is any guide housebuilding is a sector which has a tendency to swing from boom to bust.

History doesn't exactly repeat itself but it does rhyme. By studying a company's financial history and how the stock market has valued it through times of boom and bust you can get a pretty good grasp of where its shares are sitting at any particular moment in time.

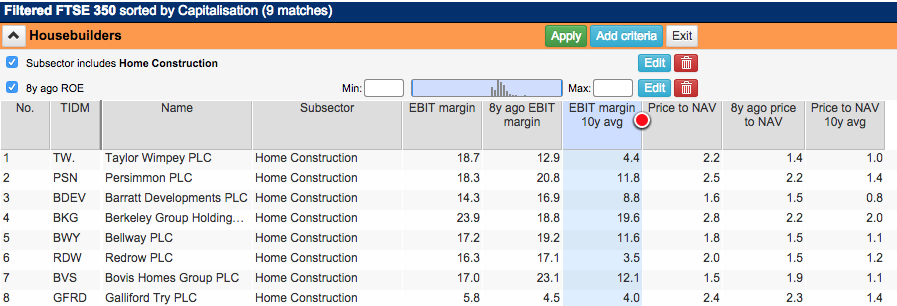

With ShareScope you can study a company's or a sector's financial history quickly and easily. In the table above, I've asked ShareScope to look at the UK housebuilders' profits and valuation.

Let's look at profitability first.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Profitability

Profit margins tell you how effective the company is at turning its sales into profits. Generally speaking, the higher profit margins are the better. ShareScope is comparing current profit margins (based on earnings before interest or tax or EBIT for short) with those earned at the time of the last housing market peak in 2006/07. It is also comparing them with the average profit margin over the last ten years.

Some companies are more profitable - they are making higher profit margins - than they were at the last market peak and a lot more than their ten year averages. Others are close whilst Bovis Homes still has a way to go. What seems to be very clear is that housebuilders are doing very well.

Valuation

That's all well and good but what does the stock market think of these profits? Most City analysts like to value housebuilders by comparing their share prices with their net asset value (NAV) per share. A housebuilder's NAV is essentially the value of its unfinished houses and its land bank less what it owes to lenders and creditors.

When times are good and people are optimistic about the future, the stock market prices housebuilding shares at more than their NAV. When everyone is gloomy and profits are falling, the shares can sell for a lot less than NAV.

Today, the shares of housebuilders look very richly valued with five of them trading for more than twice NAV. With the exception of Bovis, all the housebuilders in the FTSE 350 are more expensively valued than they were at the last market peak.

Does this mean that the shares are going to crash soon? No it doesn't. But buying shares with a combination of high profits - that have a tendency to fall as fast as they rise - and high valuations is seldom a recipe for investment riches.

The danger for investors comes with this process working in reverse - falling profits and lower price to NAV. If housebuilding shares were to trade at their ten year average P/NAV then the losses from here could be big as the following table from ShareScope shows.

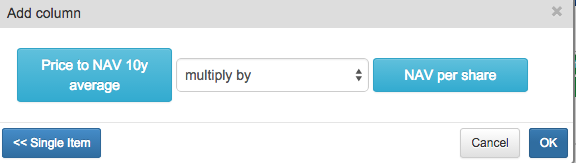

You can ask ShareScope to calculate implied share prices by combining data items. In this case, I've asked it to give me a share price by multiplying the ten year average price to NAV by the latest NAV per share.