Looking for shares to short

Most investors try to make money from shares by selling them for more than they paid for them. But there are some investors who try and make money from selling shares and buying them back at a lower price. This process is known as shorting shares or going short.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

How you make money from shorting

Professional investors short shares by borrowing them from another investor - in return for a fee or interest - selling them and then hopefully buying them back after they have fallen significantly in price and pocketing the difference.

Most private investors cannot do this. However, the availability of spread betting accounts means that private investors can bet on shares falling in price in order to try and make money.

Here's how it works in practice. Say you see a share priced at 100p and you think that it will fall in price. You can set up a spread bet that pays you £10 for every 1p fall in the share price - known as a £10 per point bet.

I am not going to get into the practicalities of spread betting but will just show you very simply how you can make and lose money doing it.

If your reasoning is proved to be correct and the share price falls you can make money as follows:

| Price (p) | Profit at £10 per pt |

|---|---|

| 100 | 0 |

| 99 | £10 |

| 95 | £50 |

| 90 | £100 |

| 85 | £150 |

| 80 | £200 |

| 1 | £990 |

But what if you are wrong and the share price goes up instead of down? You will start losing money. These losses can mount up quickly and end up being very painful.

| Price (p) | Losses at £10 per pt |

|---|---|

| 100 | 0 |

| 101 | £10 |

| 105 | £50 |

| 110 | £100 |

| 115 | £150 |

| 120 | £200 |

| 150 | £500 |

Spread betting can be very risky and is certainly something that shouldn't be practised by inexperienced investors. The same can be said for shorting shares. In the example above you can see that if the share falls to 1p, the profit you make is £990 (at £10 per point) - in other words, your gains are finite.

However, losses are unlimited as there is no theoretical limit to how high a share price might go. If your reasoning is wrong or the stock market just disagrees with you, you can end up losing a lot of money. Shorting shares is a real test of your emotions and not everyone is cut out for it.

If you are happy with the potential risks you are taking on then shorting might be a way for you to boost your returns from the stock market. But how do you go about spotting a share that has the potential to fall in price?

There are lots of people who will use charting and technical analysis to spot short candidates. In this article, I am going to concentrate on company fundamentals instead.

Here are some things that you might want to consider:

Businesses which are already struggling

Keep an eye out for companies that have issued profit warnings - an announcement where a company tells the stock market that its profits will be less than people currently expects. Whilst it is not quite true that profit warnings always come in threes, the first profit warning is often followed by another one.

As the stock market has a habit of extrapolating recent trends, profit warnings tend to lead to falls in share prices and a profit opportunity for shorters.

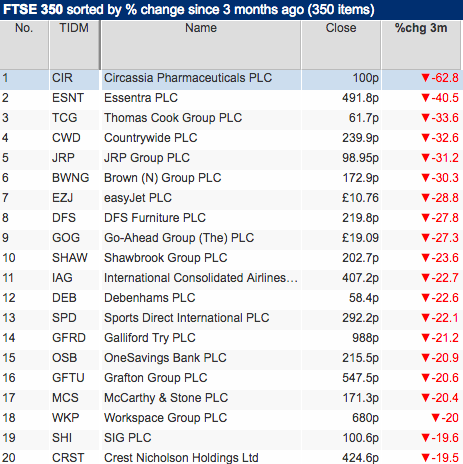

You can easily find a list of beaten up shares in ShareScope. The simple way to do this is to add a price change column to a list of shares for a period of time such as three months and then double click on the column to sort them starting with the biggest fallers.

Have a look at the shares in the list you have created and go into the news feed in ShareScope to see if there has been a recent profit warning. If there has, then there is a possibility that another may follow.

Be careful if you come across a company that has issued lots of profit warnings as a company's bad fortunes can and do improve. You might have missed your opportunity to short the share.

Bad businesses with lots of debt

Just as good businesses can make great investments, the reverse can be true for bad businesses. Throw in too much debt and you can have a lethal mix. If these businesses experience difficult trading conditions then the debt magnifies the problems (this is known as financial gearing) which could lead to a significant fall in its share price.

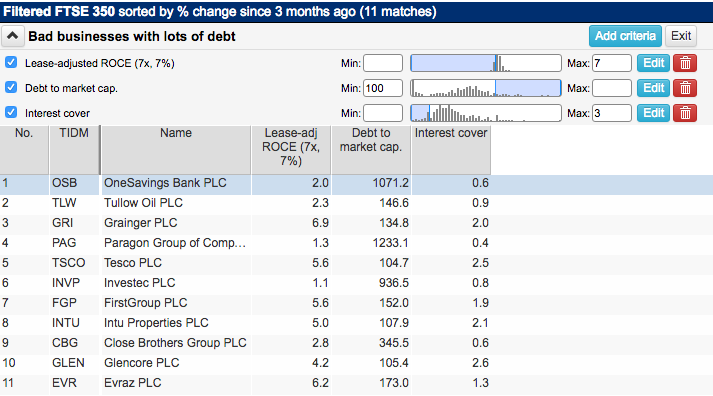

Below I've run a quick filter in ShareScope which might throw up companies that meet the criteria of bad businesses with lots of debt.

- For a bad business I've set a filter of a lease-adjusted return on capital employed (which includes hidden debts) of less than 7%.

- Too much debt I've specified as where a company's total borrowing is more than its current market capitalisation. This measure is an accepted measure of financial distress.

- An added measure of too much debt is interest cover of less than three times.

Once you have your list, you need to research the companies to try and work out if trading is expected to get worse - which is what you are looking for - or better.

Poor quality sources of growth

It's very easy for investors to be fooled into thinking that a company is a growth investment when it isn't really. Good, genuine growth companies don't require lots of extra money to be invested in them to grow. Yet some companies can grow by spending lots of money.

Many retailers are prime examples of this which can make them good short candidates. I've written about this in some of my previous articles. Retailers can give the impression of strong growth by opening lots of new shops. These shops take a while to get up to speed or mature and can boost closely-watched performance measures such as like-for-like sales growth whilst they are doing so.

When the rate of new shop openings slows down or stops, the business stops growing or actually starts shrinking. Many investors only find this out when it is too late - after a company has issued a profits warning.

One of the best ways to spot a retailer to short is to look out for slowing like-for-like sales growth. Restaurant Group (LSE:RTN) is a good example of this in 2015 and early 2016 as shown in the table below.

| Date | LFL (%) |

|---|---|

| 2013 | 3.5 |

| 2014 | 2.8 |

| 2015: | |

| 19 weeks | 2 |

| 26 weeks | 2.5 |

| 34 weeks | 2 |

| 45 weeks | 2 |

| 52 weeks | 1.5 |

| 2016: | |

| 10 weeks | -1.5 |

| 17 weeks | -2.7 |

The company had been opening up lots of new restaurants which presumably were maturing and boosting like-for-like (LFL) sales. LFL sales growth was a healthy 3.5% in 2013 but fell in 2014 and then deteriorated sharply throughout most of 2015.

Companies usually break down their LFL sales growth figures in a reporting period. Have a look at the table below.

| Date | LFL (%) | LFL x weeks | Change | No. weeks | Ongoing LFL |

|---|---|---|---|---|---|

| 2013 | 3.5 | ||||

| 2014 | 2.8 | ||||

| 2015: | |||||

| 19 weeks | 2 | 38 | |||

| 26 weeks | 2.5 | 65 | 27 | 7 | 3.86 |

| 34 weeks | 2 | 68 | 3 | 8 | 0.38 |

| 45 weeks | 2 | 90 | 22 | 11 | 2 |

| 52 weeks | 1.5 | 78 | -12 | 7 | -1.71 |

| 2016: | |||||

| 10 weeks | -1.5 | -15 | |||

| 17 weeks | -2.7 | -45.9 | -30.9 | 7 | -4.41 |

You can gain an edge by working out what happened between the last trading statement and the current one (this does involve a bit of work).

Here's how you work out what happened to Restaurant Group's LFL sales growth between weeks 26 and 34 in 2015:

- For the 34 week figures, multiply the LFL sales figure of 2% by the number of weeks (34). This gives 68.

- Do the same for the previous trading statement: 26 x 2.5 = 65

- Take 65 away from 68 to get 3.

- Divide 3 by the number of weeks between trading statements (8) to get a rolling LFL growth figure of just 0.38%.

You would have learned here that LFL sales had fallen off a cliff despite reported LFL only falling from 2.5% to 2%. Hindsight is a wonderful thing but taking out a short position in Restaurant Group shares on 19th August 2015 when this trading update was released would have worked well as a short, providing you had a bit of patience. Trading did look like it might have recovered slightly after the 45 week update but worse was soon to follow.

Timing a short is not easy and requires a bit of luck.

You should also be wary of companies that grow by regularly buying companies (acquisitions). Buying companies and then cutting costs by integrating them into an existing business can be a good way for companies to grow their profits. In fact, there's nothing wrong with this as long as companies don't pay silly prices as this can depress ROCE significantly.

But buying companies is also a good way to mask the fact that a company's existing businesses are struggling. When the buying and cost cutting stop, profits growth can grind to a halt and the share price can fall a lot.

Overvalued or expensive shares but not just for that reason

One of the biggest mistakes you can make with a shorting strategy is to pick a share that you think is overvalued or one that has gone up a lot thinking it is due a fall.

The stock market rarely works in this way apart from when the market at a whole is crashing. An overvalued share on its own is rarely enough to make it a successful shorting candidate.

In fact a company where trading is buoyant can see its share price continue to go up and cause big losses for shorters. However, an expensive share where trading suddenly deteriorates can see big share price falls.

The problem you have as an investor is shorting before things turn bad. That said, shorting at the first sign of trouble can still be profitable as very expensive shares can fall a long way over a long period of time.

It's often a good idea to build a watchlist of what you see as overvalued shares with low rates of profit growth so that you can act quickly when - and if - their fortunes change.

Don't be greedy when shorting

It's important to not be too greedy when shorting a share. Banking a profit is what you are trying to do. Sometimes though, a company which has been struggling can report an improvement in its fortunes. This can lead to a sharp rise in its share price as people who have shorted the shares realised that the bad times are over and scramble to hang on to their profits. This is known as short covering or a short squeeze.

One way to spot a share that might be vulnerable to a short squeeze is to see if it is already heavily shorted and has a high proportion of its shares out on loan. You can do this by visiting this very useful free website called shorttracker.co.uk.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.