How are interest rates determined, why they matter and what they can tell investors

We hear about interest rates all the time. The financial and even the mainstream media seem to be obsessed with them at the moment.

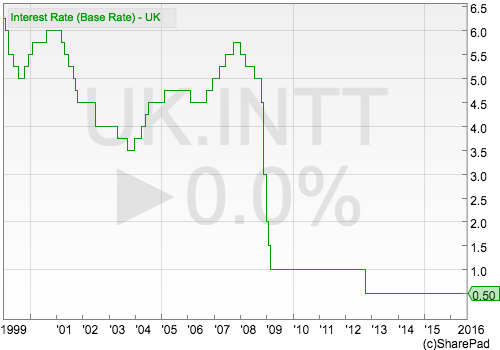

Most of us think about the interest rate we are getting on our savings or paying on our mortgage. Every month the media will report whether the Bank of England base rate has gone up or down or not. Having stayed at 0.5% for over seven years they have just been cut to 0.25%.

Interest rates are effectively the price of money. There are many different types of interest rate which are all important in the financial world. They also have a big bearing on our financial well being. But how is the level of interest set, and why does it matter so much to investors?

Let's take a look at the main interest rates out there.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Bank of England base rates

Every month a group of individuals - known as the monetary policy committee or MPC - get together to set the Bank of England base rate. This is the rate of interest that the Bank will charge to lend to other banks and building societies. In turn, this rate will then have an impact on the rates that they will offer on their savings accounts or charge on their loans and mortgages.

The MPC uses interest rates to try and control the economy. If the supply of money is growing faster than the output of the economy, there's a possibility that prices across the economy might start to rise too quickly and cause inflation. In this case, the MPC may increase interest rates which could encourage people and businesses to save rather than borrow and spend.

At the moment, the MPC wants people and businesses to borrow and spend more rather than save and is keeping interest rates low to try and help the economy grow. Even though the base rate is now 0.25%, many economists think that it will soon be cut again. Some are even talking about the possibility of the base rate going to 0%.

The stock market will often rise in anticipation of an interest rate cut as investors think that this will help the economy and company profits to grow. It can also make the valuation of shares, bonds and property look more attractive and cause their prices to rise. I'll have more to say on this shortly.

The government bond market

Arguably the most important interest rates out there are the ones on government bonds. If you are a serious private investor you need to pay very close attention to this interest rate. It is easy to find it in financial newspapers or on the internet.

In an ideal world a government wouldn't spend more than it takes in taxes each year. Unfortunately they have a habit of spending more than this and have to get the money from somewhere. That place is the bond market.

The interest rates on government bonds depend on lots of things but largely come down to how creditworthy a government and its economy is and the rate of inflation now and expected in the future. They are set by the forces of demand and supply like most other markets. Countries with strong government finances and low rates of inflation will have lower interest rates than those with high borrowings and high inflation.

Interest rates on these bonds are expressed in terms of yields. These can be simple income yields (the bond's annual interest as a percentage of the bond's price) or redemption yields which tell you your total return (interest plus repayment of capital) if you hold a bond until it is paid back (sometimes referred to as the yield to maturity).

Most investors focus on redemption yields.

For example, Germany whose government roughly spends what it takes in - in fact it spent less than it took in 2015 (a "surplus") - has low inflation and a healthy economy and can borrow money for ten years for free. The yield to redemption on its 10 year bonds is -0.03% at the beginning of August 2016.

This means that investors are losing money over ten years. In Japan, the redemption yield is -0.08%. The UK government can borrow money for 10 years at a cost of 0.8%. Governments in many countries have never been able to borrow money so cheaply or have the luxury of investors paying them as is the case in Germany and Japan.

Corporate bond markets

Academics have long argued that government bonds are supposed to be one of the safest assets out there. This is because they rarely go bust. Some governments like the UK's or United States' can even print their own money to pay investors back.

Companies on the other hand, can and do go bust. The interest rates on corporate bonds (the debt of companies listed on the stock exchange) should therefore reflect the higher risk. In other words, they should have to pay more to borrow money than most governments.

That said, big multinational companies such as Unilever can borrow almost as cheaply as, and in some cases cheaper than, governments. This is because they sell products that are always in demand whilst having impeccable finances. In 2016 Unilever has issued 4 year and 7 year bonds with interest rates of 0.085 and 0.5% respectively.

As businesses become more risky and they take on more debt, it makes sense that they have to pay more to borrow money. For example, small UK Oil producer Premier Oil has lots of debt and struggles to make enough money to comfortably pay the interest on it as oil prices have come down. Its bonds which have to be paid back in 2020 currently yield 16.9%. This very high yield suggests that there are plenty of people worrying that investors might not get all their money back.

The interest rate on shares

Shares have interest rates or yields as well. The most common ones are the dividend yield (dividend per share/share price) and the earnings yield (earnings per share/share price).

Shareholders are the last people to get paid from company profits. All the company's bills including the interest on borrowings and taxes have to be paid before they get a penny. This makes shares more risky than corporate and government bonds. Because of this, it could be argued that the dividend and earnings yields on shares should be higher to reflect this.

High quality shares that are capable of delivering consistent profits growth tend to have lower earnings yields than companies that are struggling. Forecast earnings per share (EPS) for Unilever is 156.2p. With a share price of 3434p it has an earnings yield of 4.5%. Struggling and highly-indebted pub company Enterprise Inns has forecast EPS of 20p and a share price of 87.6p giving it an earnings yield of 22.8%.

Basically, demand for safe shares pushes the price up and the yield down; concern about weaker (riskier) companies pushes the price down and the yield up.

Why interest rates matter

Not only do interest rates determine what people, governments and companies pay for money, they also determine the price of most financial assets including shares, bonds and property.

Think about assets in terms of riskiness. Lower risk assets such as government bonds should pay the lowest rates of interest to reflect this. If the interest rate rises on government bonds then the interest rates on other assets should increase as well because they are riskier. But how does this happen in practice?

Lets say investors get worried about the state of the UK government's finances. They no longer want 0.8% interest to lend it money for ten years but now want 4%. The interest rates on other assets may go up by 3.2% as well in order to reflect their higher risk. So the yield on Unilever shares might go from 4.5% to 7.7%.

But companies do not increase their rate of interest or profits to reflect this - at least not immediately anyway. What happens is the prices of bonds and shares tend to fall in price to give a higher rate of interest to new buyers. So for Unilever, the price would be 156.2p/7.7% or 2028p - a fall of over 40% from its current share price.

The reverse happens when interest rates fall. One of the major reasons for the bull market in shares and bonds from the early 1980s to 2000 was that interest rates on government bonds fell rapidly from 15.8% to less than 5%. This made other assets (shares and property) with higher yields look cheap, so investors paid more for them, pushed their prices up and brought their interest rates down.

This trend has continued since 2009.

Central banks across the world slashed interest rates in response to the 2008 financial crisis. Since then government bond yields have fallen significantly and could continue to go lower. With companies profits recovering and growing it is no surprise that we have seen a bull market in shares that has lasted over 7 years now.

The relationship between interest rates and asset prices, can also explain why share prices - even if profits are growing - can go nowhere for years if interest rates are rising as they were between the mid 1960s and early 1980s. The rise in profits is not enough to offset the rise in interest rates.

These examples show why interest rates are so important.

So when you are looking at things like company profits when pondering an investment, have a think about the share's interest rate (dividend yield or earnings yield) as well. Is it high which could suggest that the share is cheap or is it low which could suggest the share is expensive? It could make the difference between making a decent profit or big losses.

Making sense of current interest rates - investors need to focus on earnings risk

So what do the current very low bank interest rates mean for investors.

Up until now it would seem that low interest rates have been very good news, especially for owners of high-quality blue chip shares. The stock market has put a higher value on these types of company (higher PE ratio/lower earnings yield).

How long can this go on? How low can the interest rate on shares go?

I have no idea. However, what I do know is that the higher the valuation of a share goes, the bigger the risk of loss for investors becomes. This is because high valuations need high rates of profit growth to justify them. If that does not happen - and if profits actually stop growing - share prices can and do fall sharply leaving investors with big losses.

My gut feeling is that many investors have seen the fall in interest rates and rise in valuations as something akin to a free lunch which has boosted the value of their portfolios. I am not so sure that some of them have thought about how long profits can hold up and keep growing. There has been a nice boost to overseas profits from a fall in the value of the pound which increases their value when they are converted back into pounds.

Why do I worry about profits growth?

Well, whilst low interest rates have pumped up the valuation of bonds, shares and property they also tell us something else. Ask yourself why interest rates are so low?

They are low because many economies are not healthy and are finding it hard to grow. Consumer incomes have not grown very much since 2008 and debt levels are still high. The fact that people are talking about interest rates coming down and even going negative is not something that you would associate with a healthy economy.

Yet every time there is talk of an interest cut, the stock market goes up because the interest rate on shares looks more attractive compared with bonds. This might be true but bond yields are very low and are arguably overpriced, particularly when you compare them with the rate of inflation.

The UK rate of inflation is currently 1.6% compared with a 10 year bond yield of 0.8%. This means that bond investors are losing money in real terms. For the last 30 years, bond yields have been around 3% more than inflation which suggests a yield of 4.6% would not been seen as unusual.

Does that mean that UK ten year gilts are going to be yielding 4.6% any time soon? Probably not. The repercussions for mortgage rates and house prices could be very bleak indeed if they were.

But could gilt yields suddenly spike? Yes they could. Inflation could easily increase if the pound falls further in value and pushes up the prices of imported goods. It could also go up if the Bank of England prints more money or the government starts giving people free money (called helicopter money after the idea was suggested by former Federal Reserve governor Ben Bernanke) which has been talked about in some circles.

Would bond investors be prepared to accept 0.8% on UK gilts for 10 years in this scenario? My guess is that they wouldn't as they would be losing lots of money. What would the interest rate on shares be? My guess is a lot higher than they are now which would mean a sharp fall in share prices. This fall would be even bigger if profits fell as well.

This risk to share investors has been around for a while now but has not materialised because inflation has stayed low and profits have stayed high.

Good investors spend a lot of time thinking about risks. That why thinking about how stable profits are likely to be and what price you pay for them has always separated good investors from bad ones.

That's why you need to spend time looking at the quality of profits. Ideally you want to see profits growing from selling more products and services. A slowing rate of sales growth might be a sign that a company's fortunes might be about to take a turn for the worse.

If profits have been growing from cost cutting, acquisitions and share buybacks then they might not be sustainable and could suddenly grind to a halt. This is bad news if you are owning an expensive share with a very low interest rate.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.