Are defensive shares overvalued?

People are always debating whether the stock market, or certain shares, are cheap or expensive. Others use the benefit of hindsight and tell you that the answer to this question was obvious after there has been a big change in share prices.

That's no good to most people. We all want to know whether shares are cheap or expensive before prices change. But how do you go about answering this all important question?

Along with buying the shares of bad businesses, the biggest risk that an investor can take on is to pay too much for the shares of very good businesses. High share prices imply expectations of high profits in the future. If those expectations are not met then share prices invariably fall a long way and investors can lose lots of money that they will never get back. History is littered with examples of this.

As the chart above shows, the UK stock market - as represented by the FTSE All-Share index - has experienced a stellar rise since the trough of March 2009 and has exceeded its 2007 peak. Yet, this stock market rise has been kinder to some companies than others.

The financial crisis of 2008 saw many investors get their fingers badly burned. They learned that the stock market can make them poorer just as quickly as it can make them richer. This led to a change in some investors' behaviour leading them to invest in the shares of defensive businesses - companies which not only sell products or services that people continue to buy through good times and bad but also make lots of money whilst doing so. These companies tend to be concentrated in industries such as tobacco, pharmaceuticals and branded consumer goods.

These types of shares have continued to be popular in recent weeks with many of them receiving a boost from the fall in the value of the pound which could boost the sterling value of their overseas profits. But are they now too expensive and are investors in them exposing themselves to the risk of losing money?

In this article, I am going to use ShareScope to see if I can shed some light on this question.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

How do valuations today compare with the 2007 stock market peak

I am going to start off by keeping things fairly simple. There are lots of sophisticated ways to value shares but I will stick with using price to earnings (PE) ratios and dividend yields and compare these at the last stock market peak in June 2007 with the values in July 2016. It is possible to do this in ShareScope given that they have over 20 years of financial data on companies.

| TIDM | Name | Close 1/6/07 | Close 12/7/16 | PE 2007 | fc PE | Div yield 2007 | fc Div yield |

|---|---|---|---|---|---|---|---|

| AZN | AstraZeneca PLC | £26.83 | £44.76 | 12.3 | 16 | 3.47 | 4.4 |

| BATS | British American Tobacco PLC | £17.16 | £48.40 | 25.92 | 20.8 | 6.4 | 3.5 |

| DGE | Diageo PLC | £10.85 | £21.34 | 22.78 | 24.4 | 3.02 | 2.8 |

| GSK | GlaxoSmithKline PLC | £12.92 | £16.39 | 12.86 | 18.6 | 4.1 | 5 |

| IMB | Imperial Brands PLC | £19.23 | £40.13 | 16.62 | 16.7 | 3.14 | 3.9 |

| RB. | Reckitt Benckiser Group PLC | £27.53 | £75.25 | 23.15 | 26.2 | 2 | 1.9 |

| ULVR | Unilever PLC | £15.67 | £35.86 | 15.51 | 23.3 | 3.26 | 2.9 |

To calculate the PEs in this table, I have taken the price of each share on 1st June 2007 and divided by the earnings for the year. This is an estimated forecast PE at the time and assumes profits were in line with forecasts.

All the shares above have made gains since the 2007 peak - some of them very sizeable ones. With the exception of British American Tobacco (LSE:BATS) all of them trade on higher PE ratios in July 2016 than they did back then. But you will also see that shares such as Diageo and Reckitt Benckiser were highly valued then as well. Unilever shares on the other hand have seen a significant increase in their valuation.

Glaxo, Astra Zeneca and Imperial Brands have higher dividend yields now than they did back in 2007. Others have seen their dividend yields trend lower.

These valuation measures could be used to make the case that some of these shares are very expensive with forecast PE ratios of 23, 24 and 26. To justify these kind of valuations two things generally have to be accepted and come to pass:

- Future profits growth will be strong.

- Investors are happy to accept a lower interest rate and are therefore putting a higher valuation on future profits.

The outlook for future profits growth is always difficult to predict. However, companies such as Diageo, Reckitt Benckiser and Unilever are big global companies that are unlikely to grow much faster than the global economy over the long run.

Instead, it seems that lower - almost nonexistent - interest rates on bonds and savings accounts are pushing an increasing number of investors into these shares. Because they have steady and relatively predictable profits and cash flows due to the goods that they sell they have become to be seen as being 'bond like' themselves. It is this bond proxy status that has been used to justify the higher valuations attached to many shares.

Are low interest rates lulling investors into a false sense of security?

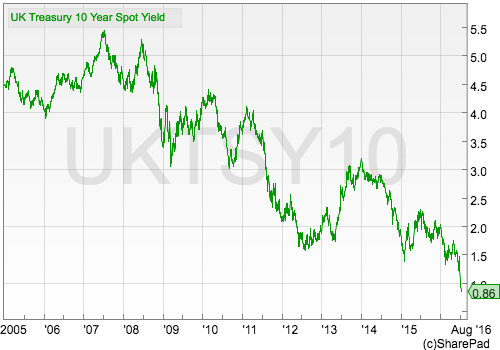

Back in June 2007, the yield on UK ten year government bonds (gilts) was over 5%. The financial crisis saw interest rates slashed as lots of bonds were bought with printed money (quantitative easing) in order to stimulate the economy. The UK's decision to leave the EU has seen investors looking for safe havens which have pushed bonds prices higher and yields below 1%.

Historically, high bond prices and low bond yields have signalled danger for investors in shares. They have been seen as a sign of recession and low profits growth or falling profits ahead. This outlook has been reflected in the falling share prices of housebuilders and property companies in recent weeks but the prices of quality, bond-like shares have continued to go up.

What is going on?

It's useful to think about the interest rate - or required return - that investors want from shares.

The positive case for the current behaviour in share prices is that the lower interest rate on government bonds can justify a lower interest rate on shares. Investors will be getting a higher interest rate on shares than they are on bonds with the added prospect that this interest rate will increase if profits grow.

A good way to estimate the interest rate on shares is to calculate an earnings yield. This is the inverse of a share's PE ratio (one divided by the PE ratio) and can be calculated by dividing EPS by the current share price.

I use earnings yield because EPS is the profit available to shareholders. The company decides how much of this, if any, to pay back to shareholders or invest in the business. I don't use dividend yield because companies pay out differing proportions of their EPS to shareholders (dividend payout ratio).

Let's have a look at how the interest rate on shares compared with the interest rate on government bonds back in June 2007.

Defensive shares earnings yields vs gilt yields in June 2007

| Name | Earnings yield | 10yr gilt yield | Gap | Inflation | Real gilt yield |

|---|---|---|---|---|---|

| AstraZeneca PLC | 8.1 | 5.16 | 3 | 2.43 | 2.73 |

| British American Tobacco PLC | 3.9 | 5.16 | -1.3 | 2.43 | 2.73 |

| Diageo PLC | 4.4 | 5.16 | -0.8 | 2.43 | 2.73 |

| GlaxoSmithKline PLC | 7.8 | 5.16 | 2.6 | 2.43 | 2.73 |

| Imperial Brands PLC | 6 | 5.16 | 0.9 | 2.43 | 2.73 |

| Reckitt Benckiser Group PLC | 4.3 | 5.16 | -0.8 | 2.43 | 2.73 |

| Unilever PLC | 6.4 | 5.16 | 1.3 | 2.43 | 2.73 |

Here my earnings yields are based on the PEs calculated for the earlier table. You can find all this data - including the bond yields and inflation - in ShareScope.

In very simple terms if the earnings yield on a share is more than the yield on government bonds then the shares might not be expensive. Bear in mind that shares are much riskier than bonds and usually have to offer a higher interest rate to reflect this risk. Where the earnings yield is less than the bond yield, the shares are possibly expensive and need high rates of future profit growth to justify their share price.

Astra Zeneca, GlaxoSmithkline, Imperial Brands and Unilever all offered interest rates that were higher than 10 year gilt yields back in June 2007. The others did not and were arguably expensive then.

Now let's look at the same list of shares in July 2016.

Defensive shares earnings yields vs gilt yields in July 2016

| Name | Earnings yield | 10yr gilt yield | Gap | Inflation | Real gilt yield |

|---|---|---|---|---|---|

| AstraZeneca PLC | 6.3 | 0.86 | 5.4 | 1.4 | -0.54 |

| British American Tobacco PLC | 4.8 | 0.86 | 3.9 | 1.4 | -0.54 |

| Diageo PLC | 4.1 | 0.86 | 3.2 | 1.4 | -0.54 |

| GlaxoSmithKline PLC | 5.4 | 0.86 | 4.5 | 1.4 | -0.54 |

| Imperial Brands PLC | 6 | 0.86 | 5.1 | 1.4 | -0.54 |

| Reckitt Benckiser Group PLC | 3.8 | 0.86 | 3 | 1.4 | -0.54 |

| Unilever PLC | 4.3 | 0.86 | 3.4 | 1.4 | -0.54 |

The interest rates from the shares are lower than back in 2007 but the gap between the interest rate on bonds is positive for all of the shares. This fact is being used by some investors to state that these shares are not expensive.

However things were different back in 2007.

For the last thirty years, the yield on 10 year UK government bonds has averaged around 3% more than the rate of RPI inflation. In June 2007 the gap was 2.73%. In July 2016, ten year gilt yields are 0.54% less than inflation.

In other words, bonds are very expensive. Using expensive bonds to justify the valuation of shares might therefore be a mistake and could be leading investors to think that shares aren't expensive when they could be.

Given that RPI inflation in the UK is 1.4%, adding a 3% inflation premium to that number would give a fair estimate of UK ten year bond yields of 4.4%. How would the valuation of our list of shares look if this was the case?

| Name | Earnings Yield | 10 year gilt yield | Gap | Inflation | Real gilt yield |

|---|---|---|---|---|---|

| AstraZeneca PLC | 6.3 | 4.4 | 1.9 | 1.4 | 3 |

| British American Tobacco PLC | 4.8 | 4.4 | 0.4 | 1.4 | 3 |

| Diageo PLC | 4.1 | 4.4 | -0.3 | 1.4 | 3 |

| GlaxoSmithKline PLC | 5.4 | 4.4 | 1 | 1.4 | 3 |

| Imperial Brands PLC | 6 | 4.4 | 1.6 | 1.4 | 3 |

| Reckitt Benckiser Group PLC | 3.8 | 4.4 | -0.6 | 1.4 | 3 |

| Unilever PLC | 4.3 | 4.4 | -0.1 | 1.4 | 3 |

The likes of Diageo, Reckitt Benckiser and Unilever would start to look expensive.

| Name | Gap 2007 | Fair Gap 2016 |

|---|---|---|

| AstraZeneca PLC | 3 | 1.9 |

| British American Tobacco PLC | -1.3 | 0.4 |

| Diageo PLC | -0.8 | -0.3 |

| GlaxoSmithKline PLC | 2.6 | 1 |

| Imperial Brands PLC | 0.9 | 1.6 |

| Reckitt Benckiser Group PLC | -0.8 | -0.6 |

| Unilever PLC | 1.3 | -0.1 |

Pharmaceutical shares look better value but would still be more expensive than they were back in 2007. Tobacco shares look better value than they did in 2007 on this measure.

In my opinion, an interest rate of 4.4% should be pretty much the minimum you get for owning a quality share. If you want to reduce your risks then you should look at getting a much higher interest rate than this. This is often referred to as having a margin of safety. To convert this into a target PE, divide 1 by 0.044 (4.4%) giving 22.7.

Diageo, Reckitt Benckiser and Unilever all have higher PEs than this. Are they overvalued? Possibly. Maybe not if they deliver strong growth in future profits. Time will tell if they are capable of doing this.

Are quality defensive shares heading for a fall?

I've no idea and am not going to make that prediction.

The point I want to make is that it looks as if the risks associated with buying and holding some of these shares is increasing. To be a good investor, you should spend a lot of time thinking about the risks you are taking with your money. Losses are hard to recover from.

Given the high valuations on the shares of quality companies, investors need to spend time thinking about whether profits, cash flows and dividends can grow at a reasonable rate in the future. If you can satisfy yourself that this is possible then share prices may stay high. If profits disappoint then share prices can fall rapidly.

A good example of this happening is the case of Restaurant Group (LSE:RTN). Whether this company could be described as a top-quality company is very debatable but it is a great example of how an expensive share can fall from grace very quickly when profits stop growing. It provides a valuable lesson in the risk of owning highly-priced shares.

Just over a year ago these shares were trading at over 20 times forecast earnings. Today, the forecast PE is just over 10 and some shareholders have lost an awful lot of money.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.