Stock Watch: Telecom Plus

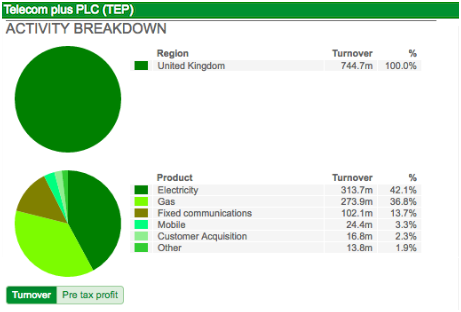

Telecom Plus (LSE:TEP) trades under the Utility Warehouse brand and sells gas, electricity, broadband, landline and mobile phone services to household customers. It also sells gas and electricity to business customers.

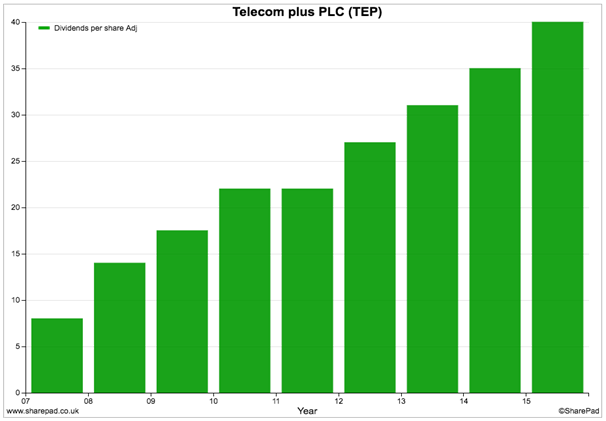

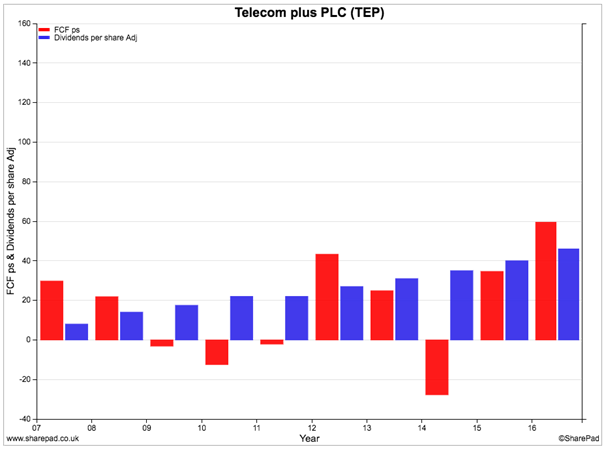

The company was once a firm favourite with investors but has struggled in recent years as volatile gas and electricity prices have made it more difficult for it to grow profits. Despite this it has built a reputation as a reliable dividend payer with a decent track record of dividend growth as shown below. It has recently reported a 15% increase in its annual dividend.

Let's have a look at how the company stacks up against some financial analysis in ShareScope.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

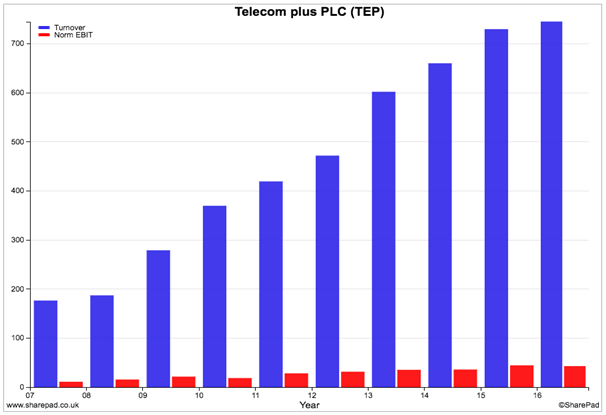

Sales & profit history

Increasing sales hasn't been a problem for the company as it has steadily increased its customer base and the number of products each of them buys. Profits growth has been more lumpy - dependent on what has been happening to wholesale gas and electricity prices. Low wholesale prices in recent years have seen trading profits (EBIT) struggle to grow.

You can see from the chart above that Telecom Plus has very low profit margins as the red (or second) profit bars are a lot smaller than the blue turnover ones. As with all low profit margin businesses, this does not provide the shareholder with much protection if turnover falls or costs increase. That said, the company has been consistently profitable for the last decade.

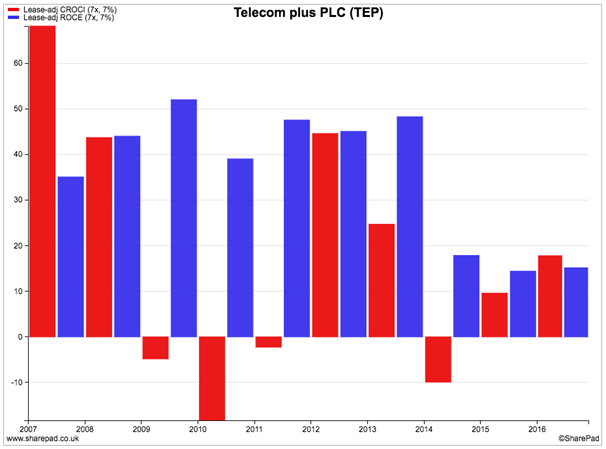

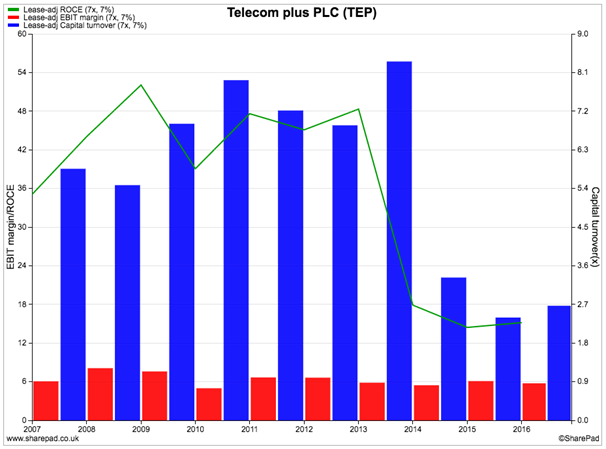

Financial returns

Up until 2014, the company was earning very high returns on capital employed (ROCE) of between 40-50% as it owned very little in the way of fixed assets. A complicated transaction to enter into a new 20 year supply agreement with Npower in 2014 - which involved Telecom Plus buying two companies which had no tangible assets from Npower - saw £220m added to intangible assets which brought ROCE down significantly. However, it was still a respectable 15% in 2016.

Free cash flow returns as measured by CROCI have come down as well for the same reasons as ROCE. CROCI of 17.9% in 2016 is a sign that we may be looking at a reasonable business here (a number higher than 10% is generally considered good) but it can be lumpy depending on movements in working capital which mainly relate to the payments of wholesale gas and electricity costs.

Looking at ROCE in a little more detail in the chart below, you can see why it has fallen a lot. Profit (EBIT) margins have stayed reasonably stable but the capital turnover figure (the amount of sales generated per £1 of capital employed) has fallen from over eight times to under three times.

Given that Telecom Plus is operating in a competitive marketplace and does not own power or telecom networks (which need higher profit margins to fund investment) then profit margins are unlikely to increase much. If ROCE is going to increase then it is going to have to start growing its turnover again without increasing the amount of money invested in the business.

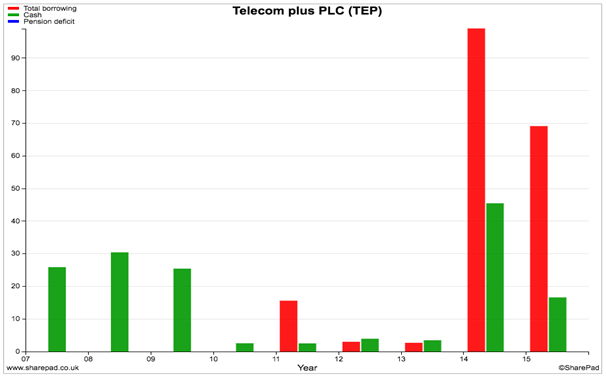

Financial position

The company has a strong financial position. Debt increased significantly with the Npower transaction in 2014 but has been coming down since then. The company has no final salary pension scheme and has a negligible amount of off-balance sheet debt.

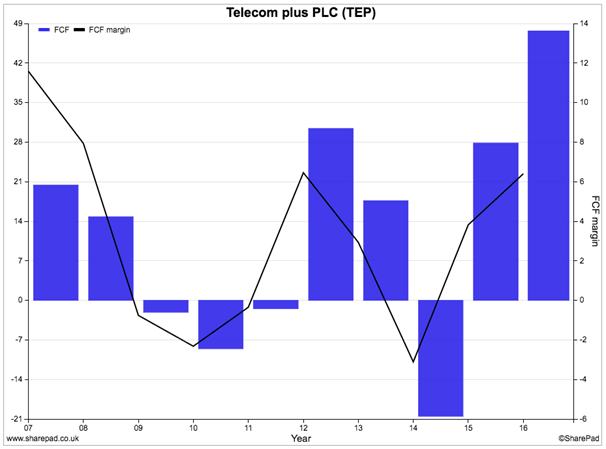

Free cash flow generation

The company's ability to produce free cash flow for shareholders is reasonably albeit a little lumpy. There has been positive free cash flow for four out of the last five years with a big jump in 2016.

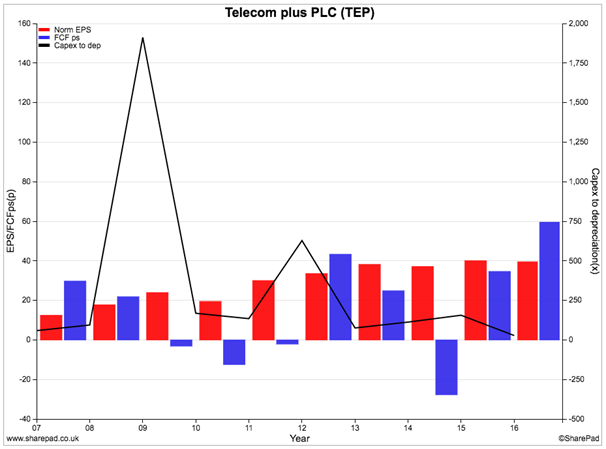

Profit quality is reasonable. For the last five years free cash flow per share has been close to normalised earnings per share (EPS). Free cash flow per share was higher than EPS in 2016 as spending on new assets was much less than depreciation and there was also a working capital inflow.

The company's dividend per share was covered by free cash flow per share in 2016 but this had not been the case for the previous three years. Free cash flow will need to start growing if dividend growth is not to slow down in the years ahead as virtually all of its free cash flow is being paid out at the moment.

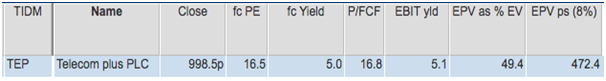

Valuation & future prospects

The company has said that it expects its pre-tax profits for the year to March 2017 to grow modestly to between £55-59m compared with the £54.4m made in the year to March 2016. Dividends are expected to keep on growing but at a much lower rate than last year's impressive hike.

On that basis, it might be hard to argue that the shares are really cheap right now. A 5% dividend yield growing at around 4% is reasonable, but the company is already paying out most of its profits to shareholders. For dividend growth to increase, profits are going to have to start growing at a higher rate.

It is clear that the company is going to find it hard to grow its profits at least in the short-term. It still makes the bulk of its money from selling electricity and gas to households. This is a ferociously competitive market where companies are selling what customers rightly perceive to be a commoditised product and base their choice of supplier mainly on price.

Telecom Plus is locked into a supply agreement with NPower to buy gas and electricity from it. The price it can supply its customers is based on the average standard tariffs of the big 6 energy suppliers with an undisclosed agreed discount. It has also adopted a policy of not offering special introductory discounts for new customers. This has made it uncompetitive in a market where lots of independent energy suppliers are trying to gain new customers.

Elsewhere, broadband internet, landline and mobile phone products are also very competitive. There is no shortage of choice of bundled packages from the likes of BT, Sky, Virgin, Talk Talk and Vodafone. For Telecom Plus to offer better and cheaper products in this market will be a challenge although it has signed up a lot of extra mobile customers during the last year.

Telecom Plus will continue to try wooing customers with the simplicity of a single monthly bill and by offering new services such as home insurance. Ultimately, the company has ambitions to offer pet and car insurance, TV, water and boiler cover. As with its existing services it will be reliant on third party providers and not selling its own products, or owning any infrastructure, but there is scope for the company to grow from selling more services.

The company does seem to have a much better reputation than many of the big 6 energy suppliers which is helpful in winning customers over the long-term. The company's aim is to reach 1 million customers.

That said, customer growth in 2015/16 was only 3.2% (to 568,986 customers) with the average revenue per customer falling as it did in the previous year. Revenue growth of 2.1% in 2015/16 shows how hard it has been for the company to progress.

It also has a unique way of selling its products. It relies on word of mouth rather than advertising. There are 45,000 part time employees who sell to customers and receive a small percentage of revenue in return. This means that Telecom Plus is not burdened with a heavy fixed cost base of salespeople which should allow it to make more money selling products than many of its competitors.

Arguably the company's most competitive asset is its cashback card. This is a prepaid credit card which allows discounts of between 3-7% at over 40 high street retailers such as Sainsbury's and M&S. The discount is funded by the retailers and shows up as a reduction on the customer's monthly utility bill. Some customers have been able to save between 20-30% on their monthly bills using this card which makes it a compelling attraction to switch to Utility Warehouse.

What is surprising though is that only just under a third of the company's customers are using this card. Given the savings available it might be reasonable to expect that this proportion should be a lot higher. The company mentioned in its latest results statement that some customers might not find it easy to use a prepaid card which they have to fund in advance compared to paying with a credit card which they pay for in arrears.

Another risk to bear in mind is that the retailers which accept the card might change the size of the discounts they offer in the future which could reduce the monthly savings on Utility Warehouse's customer bills.

To sum up

- Telecom Plus has been consistently profitable but profits growth has been hard to come by in recent years.

- ROCE and CROCI are reasonable but have fallen significantly from very high levels.

- The company has low profit margins and needs to sell more products in order to improve its ROCE.

- Free cash generation is reasonable and improved in 2016.

- Most of its free cash flow has been paid out as dividends.

- Free cash flow looks as if it will have to start growing otherwise dividend growth might have to slow down.

- The financial position of the company is strong.

- The company operates in very competitive markets.

- Customer growth rates have been declining.

- It is struggling to compete with new entrants in gas and electricity markets.

- Growth in mobile phone customers has been good.

- New products such as insurance are the key to further profits growth.

- Its cashback card can give customers big savings on their utility bills but only a third of its customers are using it. The inconvenience of it being a prepaid card may be putting people off.

- Profit growth in 2017 is likely to be modest.

- The shares offer a big dividend yield but the rate of future dividend growth is uncertain.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.