Stock Watch: Apple

Apple (NASDAQ:APPL) is one of the most talked about companies in the world. Its iconic products such as the iPhone and the iPad are owned by hundreds of millions of consumers.

For years, Apple and its share price defied the sceptics who predicted its demise. Pessimists argued that Apple was trying to defy the laws of consumer electronic products in that over time they tend to get a lot cheaper.

This is true for most electrical goods. If you buy the latest TV set then within a year it will usually be a lot cheaper. Computers with fast processing speeds and lots of memory that used to cost a lot of money can now be bought for a lot less than they could be a few years ago.

Apple has been able to avoid this fate by innovating and continually bringing out new products that people want to buy. Yet its fortunes have been very reliant on one product - the iPhone.

The iPhone accounts for two thirds of Apple's sales and probably an even bigger chunk of its profits. Every couple of years or so, Apple has been able to convince millions of people all over the world to trade in their old iPhone for a newer, better one. This process has been a supreme example of branding that allowed Apple to keep on growing its sales and make amazing profit margins and returns on capital - the kind of things that investors love.

It made investors think that it had a very resilient business model - an economic moat in financial jargon. Perhaps Apple with its loyal users of iPhones, iPad tablet computers, Macs, iTunes Music and Apple TV was different to run of the mill consumer electronics companies? Perhaps it had built an ecosystem that consumers would stay loyal to and keep the profits rolling in for many years to come?

This view is now being put under intense scrutiny by investors. Apple's flagship iPhone appears to have run out of steam. Sales of them across the world are falling and Apple's profits and share price have followed suit. Have the chickens finally come home to roost?

Yet perhaps all is not lost. Warren Buffett's Berkshire Hathaway has recently invested around $1bn in Apple shares. This has got some people excited despite only representing a tiny part of Berkshire's investment portfolio and has pushed Apple's share price up.

Berkshire is well known for investing in resilient businesses with steady, predictable cash flows and high returns on capital and has a knack of buying them at good prices. Is this a seal of approval that gives the green light for investors to fill their boots with Apple shares or are people getting carried away?

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Apple's financial performance has been impressive

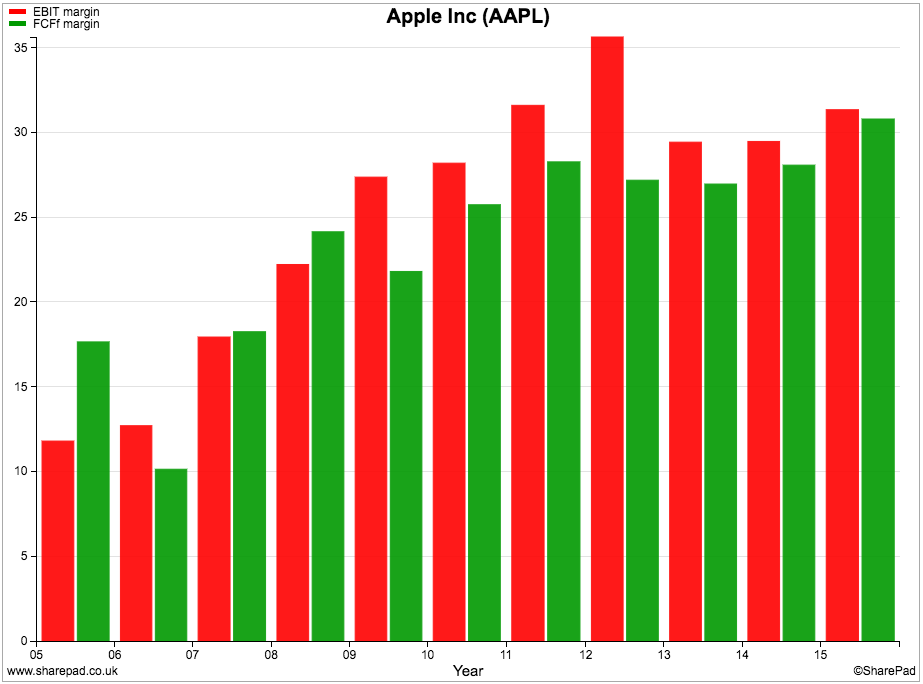

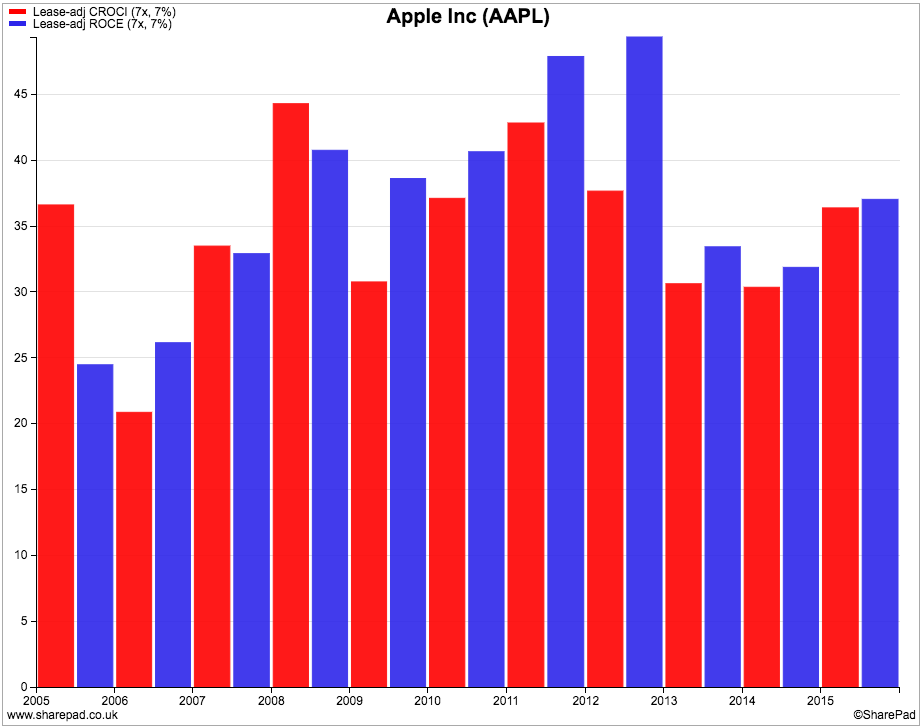

The following three charts show quite clearly why Apple shares attracted such a big following.

It has been incredibly successful at growing it sales and profits.

It has been able to produce consistently high profit and free cash flow margins.

The icing on the cake has been very high free cash flow returns on investment (CROCI) - the number one hallmark of a quality business.

Why wouldn't you want to own a slice of this business?

It's all about future growth

Looking at the past performance of a company is a very important part of an investor's skillset. However if you want to buy good shares for your portfolio it is the future that matters.

The key question that every investor should be asking is whether a company that has been great in the past can keep on being great. To do this it needs to keep on growing its sales, profits and cash flows.

Without growth, a company's shares can become a burden rather than a benefit to your portfolio, no matter how cheap you think they look. This is what is known as a value trap. This is when a cheap share stays cheap or gets cheaper because it cannot grow. Might Apple shares fall into this category?

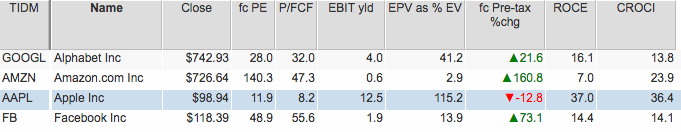

If you compare the valuation of Apple shares with other popular tech stocks such as Alphabet (Google), Amazon.com and Facebook you can see that they are a lot cheaper on every measure. The reason is Apple's lack of profits growth. Its pre-tax profits are expected to shrink by 12.8% according to analysts forecasts. All the others are expected to grow strongly.

Apple's shares are changing hands for just over 8 times its 2015 free cash flow per share. Its earnings power value (EPV) shows that 2015 trading profits explain over 115% of its current enterprise value - which is telling you that the stock market is pricing in lower profits than it made in 2015 forever.

Have Apple's profits peaked?

Apple's share price is giving a very pessimistic signal about its future profits. But could the stock market be right? Could Apple's profits have peaked and now face years of decline? This is where I would be focusing my research efforts if I was thinking of buying Apple shares.

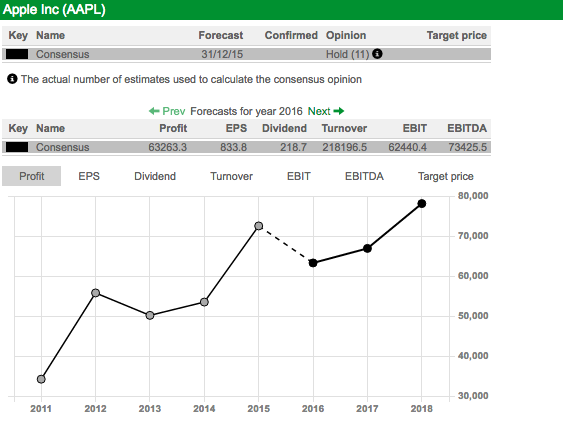

Apple made pre-tax profits in 2015 of $72.5bn. Wall Street analysts think that this number will not be matched in 2016 or 2017.

The current 2018 consensus forecast of $78bn could be wishful thinking if Apple can't persuade people to buy more of its products. If it isn't then we will be looking back and realising that today's share price was probably a good buying opportunity.

So will Apple's profits recover? Things don't look too good at the moment. During Apple's second quarter to the end of March 2016, its sales fell by 12.5% and net profits fell by 22.8%.

The volume of iPhones sold fell by 16.4% and iPads by 19%. Products such as the Apple Watch have probably not done very well because the company gives very little information about it. Income from services such as Apple Pay, iTunes and its App Store are growing but make up a very small part of total sales - they are not enough to get Apple out of its problems.

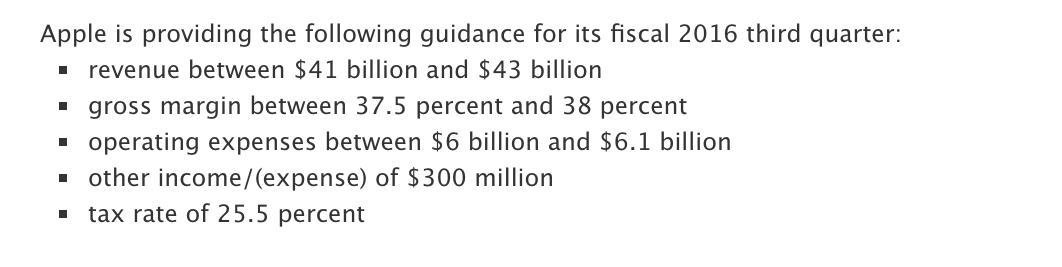

The third quarter looks like it is going to be even worse. Apple, like lots of US companies, gives investors a lot of information to make their own profit forecasts. This is the information it gave investors back in April 2016:

Build your own profit forecast

You can now easily build your own profit forecasts and compare the numbers with last year's third quarter. Here's how you do it:

- Take the revenue number and multiply it by the gross margin figure of 37.5% or 38%. This will give you a gross profit forecast.

- Then take away operating expenses of $6bn-$6.1bn to give you an operating profit estimate.

- Add operating income of $300m to get a pre-tax profit estimate.

- Take the pre-tax profit estimate and multiply it by 25.5% to get an estimate of Apple's tax bill.

- You are then left with an estimate for net income.

In the table below, I have created two profit forecasts based on the ranges given by Apple. On this basis, net income could fall between 25.8% and 32.5%. This is not a pretty picture.

| Apple inc ($m) | Q3 (f) low | Q3 (f) high | Q3 2015 | %chg vs low | %chg vs high |

|---|---|---|---|---|---|

| Sales | 41000 | 43000 | 49605 | -17.35% | -13.32% |

| Gross profit | 15375 | 16340 | 19681 | -21.88% | -16.98% |

| Gross margin | 37.50% | 38.00% | 39.68% | -5.48% | -4.22% |

| Operating expenses | -6000 | -6000 | -5598 | 7.18% | 7.18% |

| Operating income | 9375 | 10340 | 14083 | -33.43% | -26.58% |

| Other income | 300 | 300 | 390 | -23.08% | -23.08% |

| Profit before tax | 9675 | 10640 | 14473 | -33.15% | -26.48% |

| Taxation | -2467 | -2713 | -3796 | -35.01% | -28.52% |

| Net income | 7208 | 7927 | 10677 | -32.49% | -25.76% |

You can then take your forecast on to the next step and calculate a trailing twelve month (TTM) profit estimate for the end of Apple's third quarter. All you need to do is take 2015's fourth quarter results and then add the ones reported in Q1 and Q2 and then add your Q3 forecast. Once you have done this, compare the profit forecast with consensus forecasts for 2016 as a whole in ShareScope.

| Apple inc ($m) | Q4 | Q1 | Q2 | Q3 (f) low | Q3 (f) High | TTM (f) low | TTM (f) high |

|---|---|---|---|---|---|---|---|

| Sales | 51501 | 75872 | 50557 | 41000 | 43000 | 218930 | 220930 |

| Gross profit | 20548 | 30413 | 19921 | 15375 | 16340 | 86257 | 87222 |

| Opex | -5925 | -6252 | -5934 | -6000 | -6000 | -24111 | -24111 |

| Operating income | 14623 | 24161 | 13987 | 9375 | 10340 | 62146 | 63111 |

| Other income | 439 | 402 | 155 | 300 | 300 | 1296 | 1296 |

| Profit before tax | 15062 | 24563 | 14142 | 9675 | 10640 | 63442 | 64407 |

| Taxation | -3938 | -6212 | -3626 | -2467 | -2713 | -16243 | -16489 |

| Net income | 11124 | 18351 | 10516 | 7208 | 7927 | 47199 | 47918 |

Here, I am getting a range of TTM profit forecasts for Apple of between $63.4bn and $64.4bn. The consensus full year profit forecast is currently $63.2bn.

So my low range forecast for the year to June 2016 is about the same as analysts are predicting for the year to September 2016. However, what if current iPhone sales trend continue between July and September? My guess is that Apple will make less than $63.2bn in profits and therefore Wall Street forecasts might be too optimistic. Or maybe I've missed something?

I hope you can see here how an individual private investor with a little bit of arithmetic and diligence can do their own profit forecasts and weigh up if current forecasts are too high or too low and what the risks to them might be. These are the kind of things that you can do which can give you an edge over other investors.

Will the iPhone 7 be a success?

Apple has become too reliant on the iPhone for its profits. It has to convince customers to keep paying lots of money for a new smartphone when they might not need or want one or when they can buy other brands for a lot less.

One of the reasons for Apple's success in the past is that it has been able to keep on selling iPhones without dropping the selling price. Back in the first quarter of its 2010/11 financial year, Apple sold 16.2m iPhones which generated £10.5bn of revenue at an average revenue per unit sold of $645. In the second quarter of 2016 it sold 51.2m units for $32.9bn or $642 per unit - virtually the same.

$642 (about £445) is a lot of money to pay for a phone. When you can buy Chinese smartphones with lots of similar features for less than $200 you begin to realise how much profit Apple must be making on its iPhones.

The danger for Apple is not people switching to Chinese products but changing their iPhone less often. Or they may do what I do which is to buy the oldest model being sold rather than the latest one. If this trend develops - as seems to be happening with iPads - then there is a risk that Apple's eagerly awaited iPhone 7 might not fly off the shelves as other versions have in the past. Also its revenue per iPhone sold might fall.

The other risk is that Apple does not tend to cut its selling prices on its products. It tends to offer the customer more features whilst keeping the price the same. Having bought several iPhones and Macs over the years this is my experience. If Apple drops its prices then its profit margins might fall and it doesn't seem to want to do this. But by not doing so, it faces the possibility that customers buy less from them by holding on to their existing products for longer.

These issues have led to many commentators saying that Apple might have to change and buy a media content company like Time Warner to give it a different type of income stream whist helping it to keep hold of existing customers and bring in new ones.

To sum up

- Apple's shares are not as popular as they used to be.

- But they now look very cheap on many valuation measures.

- It still has great profit margins and cash flow returns.

- Its ability to grow in the future is very uncertain.

- It is still too reliant on the iPhone.

- Profits are falling rapidly.

- 2016 profit forecasts might still be too high.

- Customers may hold on to their existing phones for longer.

- Selling prices remain very high.

- Apple may have to diversify its income stream by buying another company.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.