Alpesh Patel: How to use my filters

Alpesh's Value/Growth Filter

Medium risk - 6-12 month holding period - target 25% return

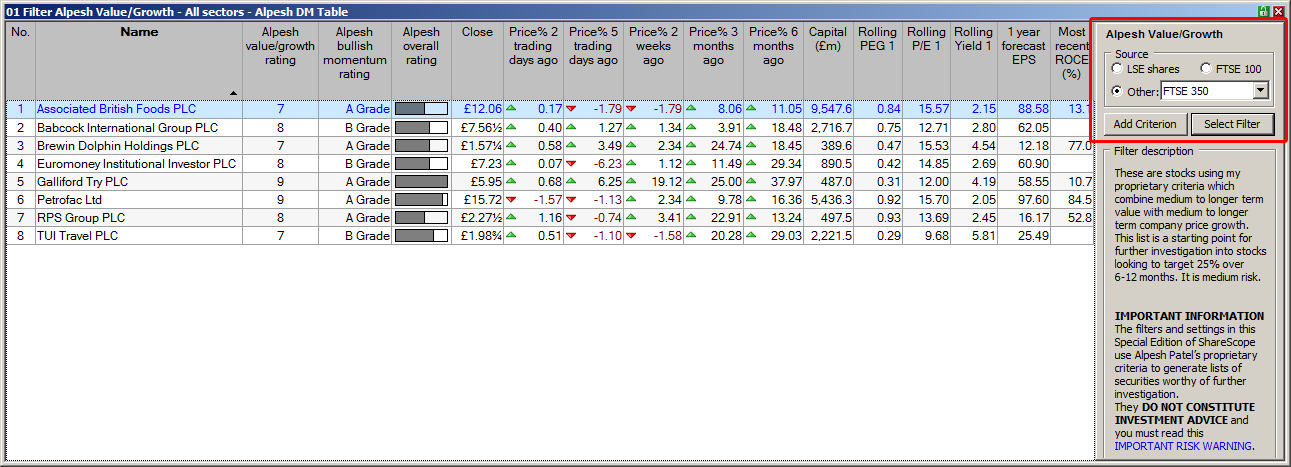

This filter is for buy and hold investors. It identifies stocks which look like they will rise steadily over the next 6-12 months based on positive growth indicators, excellent value and price momentum. I recommend you view the results of this filter with the Alpesh DM Table setting.

You don't need to do any further analysis with this filter although I do like the monthly MACD to rising or at least flat. In previous years when I have given annual stock picks, I have simply taken the stocks from this filter on the day.

Note that the stocks in this filter will change over time - as the fundamental and technical characteristics of the stocks change. The point of the filter is that you can take the stocks from the filter ON ANY DAY and hold them for 12 months. Once you have invested in stocks from the filter, it doesn't matter if they subsequently fall out of the filter. If one of your original stocks falls below the 25% stop loss, choose another from the filter.

Remember, my target return is based on holding a basket of these stocks. For various reasons, individual stocks may bomb (think of at BP in 2010). I recommend holding 14 stocks from the filter, ideally purchased over a month. However, the Value/Growth filter may contain dozens of stocks which, in practical terms, may be too many for you to buy. So which ones should you invest in? I like to choose a mix of FTSE 350 stocks and smaller caps (including some AIM stocks). You can change the source list right at the top of the filter bar underneath the filter name (see highlight on the image above).

If there are more stocks than this in the filter, try the following:

- Look in my newsletter for the stocks I prefer.

- Sort by Alpesh Overall Rating (in the Alpesh DM Table).

- Check recent news for each stock for positive or negative sentiment.

- Do not focus on specific sectors - you need to be diversified.

If the stocks you select achieve the target growth ahead of schedule, there is nothing to stop you taking profits or half-profits early. I set a 25% stop loss.

NOTE: My Value/Growth Rating, which appears in the Alpesh DM Table and on the Alpesh Radars, is based on the growth and valuation criteria used in this filter but NOT the momentum criteria. This is why the stocks in this filter are not just those with the highest Value/Growth Rating. They will have a good combination of Value/Growth and Bullish Momentum Ratings.

Momentum/Value Filter

Medium risk - 2-3 month typical holding period - target 20% return

This is a data mining filter that I use to identify stocks that are both strong on price momentum and well supported on valuation grounds. The idea is that because they are well-valued, the momentum should not peter out.

Now these moves may play out over a couple of months or a couple of days. However the filter can also pick out stocks that have already run out of steam. With this filter, unlike my Value/Growth one, I look at the chart of each stock using my Momentum Radar to decide whether to trade or not.

There are two essential criteria: firstly, the price must be in an upward trend; it may have flattened out but the overall trend must be up. Secondly, the daily MACD must be going up.

My filter automatically excludes stocks under 30p but any stocks under 100p outside the FTSE 350 have to be considered as having a riskier profile. Of course, it always pays to check company news for contract losses, resignations, scandal, detrimental legislation, etc.

I would also suggest that you add Ex-dividend flags to your charts so you avoid trading just before the stock goes ex-div.

See Trade Management for how I determine my entry point, stop loss, profit target and exit strategy.

The ideal Momentum/Value trade has the following attributes:

- The price is rising in a relatively straight line.

- Price volatility is low which means a reduced risk of being stopped out.

- The MACD is rising and isn't at historically high levels - suggesting that there is scope for further rises.

- RSI and Stochastic are also rising but this is not essential. They are premature indicators and can have 'topped' out in advance.

However, it is rarely this straight-forward so let's look at some examples from the filter.

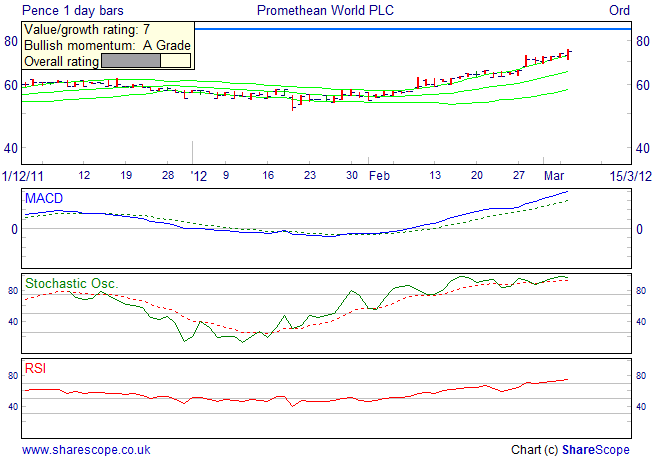

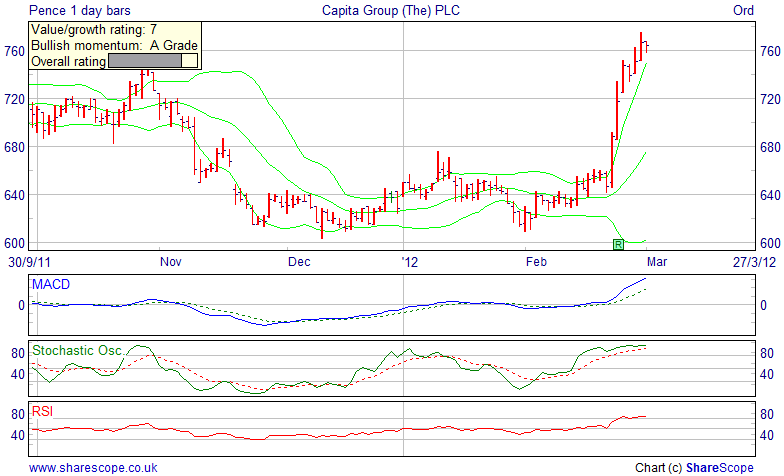

Attractive: You can see here that the stock is starting to rise again steadily. The MACD also confirms that as it too is rising.

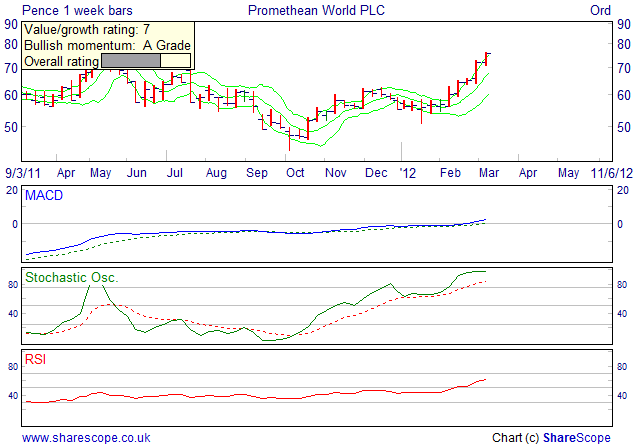

If I am concerned that the MACD (and RSI in this case) are looking extended then I check that the weekly MACD is still relatively low:

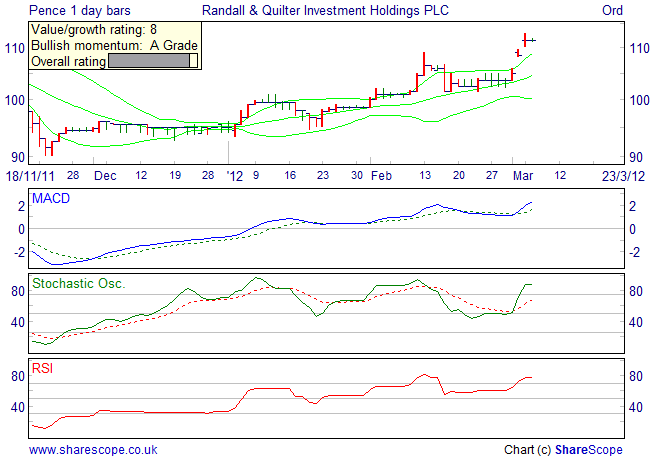

Less attractive: Since being in the filter, this stock has risen sharply. We have to be careful with it in the short-term because clearly it cannot keep on going up vertically.

Less attractive: I would avoid illiquid stocks like this - they will usually have a wide bid/offer spread as well which will eat into your profits.

Bullish Short-term Momentum Filter

Medium-high risk - 1-3 month typical holding period - target 20% return

This filter finds short-term bullish trading opportunities - ideal for spread-betting. It picks out instruments which have positive short-term price momentum. We are hoping to catch the wave and ride it for a short time - anywhere from a week to 3 months. As this filter ignores fundamentals, it is higher risk than my Momentum/Value filter.

I look at the Bullish Momentum filter when I am bullish on the broader market and want to take a quick advantage. This filter serves another clever purpose: if there are no stocks in it, I turn a little bearish about the market (and turn to the Bearish Momentum filter).

By default, my filter searches the entire database of LSE shares but because there are no fundamental measures involved you can use this filter with any instruments - stocks, indices, commodities or foreign exchange. You can choose the list of instruments (the "source list") searched by the filter in the Data Mining view.

It is important to look at the price chart of each instrument. Some of the instruments in this filter may have already made their move.

See Trade Management for how I determine my entry point, stop loss, profit target and exit strategy.

The ideal Bullish Momentum opportunity has the same attributes as for Momentum/Value trades:

- The price is rising in a relatively straight line.

- Price volatility is low which means a reduced risk of being stopped out.

- The MACD is rising and isn't at historically high levels - suggesting that there is scope for further rises.

- RSI and Stochastic are also rising but this is not essential.

Let's look at some examples:

Attractive opportunities:

Bad choice stock: possibly already made its move.

Of course, if you don't look at the filter every day some opportunities may have been in the filter for several days. Look at the chart below: the price and momentum indicators have turned down.

Bearish Short-term Momentum Filter

Medium-high risk - 1-3 month typical holding period - target 20% return

This filter picks out stocks that have shown recent downward price momentum. These stocks are different because we are looking to "short" them either using Contracts for Difference (CFDs) or by spread betting. We are hoping to jump onto the avalanche and hop off near the bottom.

The criteria I have chosen identify stocks that have been declining in price but which are also somewhat overvalued.

These stocks are higher risk and I always check the news looking for something negative which might explain the fall.

These moves could take several days to several months. Note, however, that these stocks may have already made their move.

See Trade Management for how I determine my entry point, stop loss, profit target and exit strategy.

Let's look at some examples:

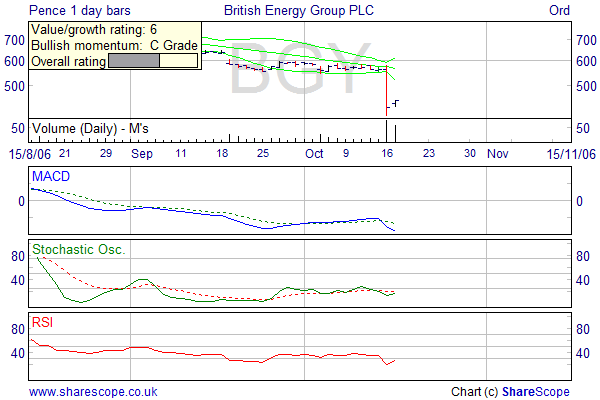

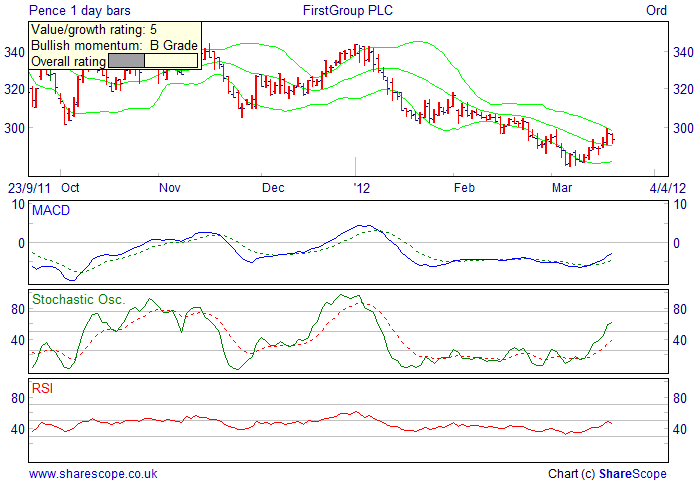

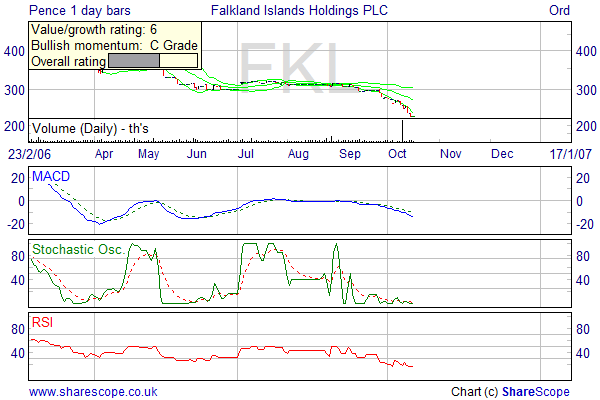

Good choice stock: smooth falls, momentum for falls clearly in place.

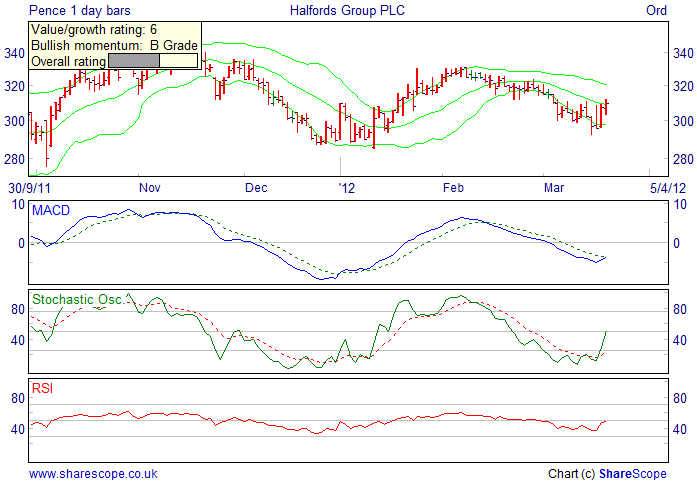

Bad choice stock: whilst the stock has fallen, I am concerned about its last day rise.