Stock Watch: French Connection - a classic value trap?

Buy cheap shares. How often have you been told that this is the best way to make money from the stock market? There's no end of studies out there that can tell us that buying cheap works but what does cheap actually mean?

I find that lots of people confuse cheap with value. For example, it's not difficult to buy a very cheap bottle of wine from a supermarket but if it tastes terrible and you can't drink it then you will have wasted your money. You learn through experience that the bottle of wine is selling for a low price because it isn't very good - it deserves to be cheap. Buying a better bottle of wine which is selling for less than its usual price is likely to be a much better purchase.

Exactly the same can be said of shares on the stock exchange. If you run a filter in ShareScope or SharePad you will find lists of shares that look like they are very cheap with classic hallmarks of cheapness such as:

- Low price to earnings (PE) ratios

- High EBIT yields (EBIT/EV)

- Low price to net asset value (P/NAV)

- Share prices that are at new lows

Most of the shares on these lists are the stock market equivalents of cheap bottles of wine. They are cheap because they deserve to be. They might be businesses that are losing money, facing fierce competition or have lots of debt - or all three. However, if you buy these kind of shares, more often than not you will not make any money and could quite easily end up losing a lot. That's because the shares don't offer any value. They are what are known as value traps.

A value trap is an investment that looks cheap which on closer inspection turns out to be anything but. A bargain share is one that has a low price because it is temporarily depressed but the company has the potential to recover. These are the kind of shares that you should be looking to buy. So instead of buying cheap, it is better to look for undervalued shares.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Why French Connection shares could be a classic value trap

So how do you avoid value traps and what does one look like? Well, you can never be entirely sure that something is definitely a value trap but the shares of struggling fashion retailer French Connection (LSE:FCCN) look like an interesting case study.

How the shares look cheap

Let's start by having a look and see why you might at first glance think that French Connection shares are very cheap:

The shares are close to a 10 year low

Sentiment towards the company's shares is very depressed - reflecting the tough times it is currently going through. The share price has fallen by nearly 60% since peaking at over 60p in February and is close to a ten year low.

The market value of the company's assets appears to be only £8m.

At 23.9p per share, the market value of the company's equity is £23 million. With no debt and £15m of cash on its balance sheet at the end of July 2015 it looks as if the whole business can be bought for an enterprise value - a proxy for the market value of a company's assets or future cash flows - of just £8m (£23m market cap less £15m of cash).

According to SharePad, this is a business that has generated revenues of £170 million during the last year (TTM financial data). If it can turn itself around and start making money again then surely £8m is a bargain price?

French Connection is a Benjamin Graham "net net" share

Legendary value investor Benjamin Graham used to look for bargain shares that were selling for less than their net working capital value per share - known as a net net.

Graham was looking for a very conservative estimate of a company's value. He ignored the value of any fixed assets such as property and calculated a value based on what the company could be liquidated for in a fire sale. He added up the value of current assets such as stocks, debtors and cash less all the company's liabilities. If he could buy a company for less than this net current asset value (NCAV) per share he reckoned there was a good prospect of making money from it.

French Connection is one of the few shares on the London stock exchange that meets this criterion. Based on its balance sheet as of 31 July 2015, its net current asset value per share was 37.8p as shown in the table below:

| French Connection 31/7/2015 | £m |

|---|---|

| Stock | 37.1 |

| Debtors | 23.9 |

| Cash | 15 |

| Total Current assets | 76 |

less: Total Liabilities | -39.6 |

| NCAV | 36.4 |

| Shares in issue (m) | 96.2 |

| NCAV per share(p) | 37.8 |

That's more than 50% above the current share price. Surely French Connection shares have got to be ridiculously cheap?

Why the shares might be a value trap

When you come across a situation like this you have to ask some really tough questions about a company. There are lots of smart investors out there. Why haven't they snapped up the shares at this price?

The company is losing money, future profits are very uncertain

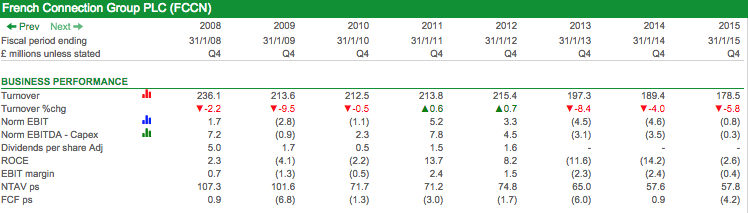

French Connection's pre-tax losses for the six months to July more than doubled to £7.9m. Using one of the new features in SharePad, I've created a custom financial data table (you can do this in ShareScope too) which shows that the business has been deteriorating for years.

Turnover has been falling and the business hasn't made a profit since 2012. Cash has also been flowing out of the business as evidenced by negative values for free cash flow per share. Net tangible asset value per share has almost halved since 2008 which is not a sign of health.

Will the company become profitable again? Management is trying its best to turn the business around and is closing stores but profits aren't expected to come back any time soon. In SharePad I can see that City stockbroker Numis updated its profit forecasts on 21st September. It is predicting a loss before interest and tax (EBIT) of £4m next year and a loss of £3m the year after. Cantor Fitzgerald is predicting a slight profit in 2016 but hasn't made a forecast for 2017.

Even though I used to be a City analyst, I tend to pay little attention to their forecasts as I know that lots of them are little more than guesswork. This is especially relevant with a business like French Connection where profits or losses are highly dependent on Christmas sales. I put a lot more emphasis on recent history and the trailing twelve month figures in SharePad. Here, the picture is grim.

However, if the company can make itself consistently profitable again then it is possible that the shares could end up at a lot higher price than they are now.

The company has lots of hidden debt - the true EV is not £8m

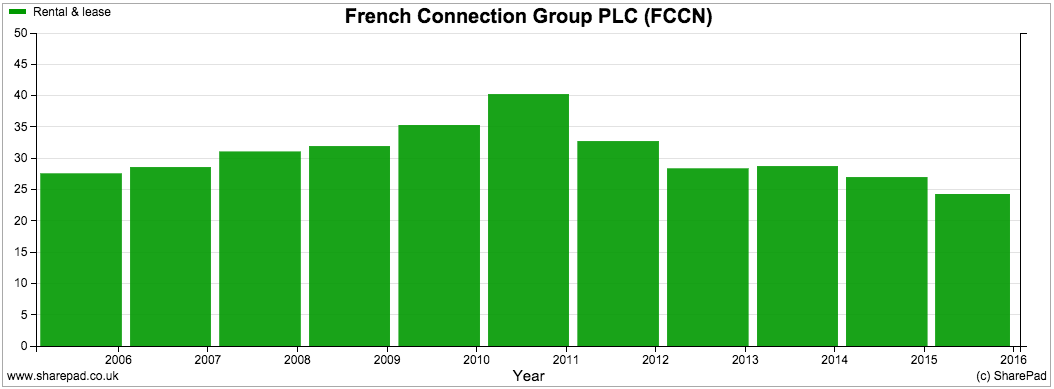

I recently wrote an article about analysing companies with hidden debts (click here to read it) such as retailers who rent rather than own their shops. French Connection looks like it has a lot of hidden debt. It has had large minimum future rent commitments on its stores for many years now. These are not disclosed as a liability on its balance sheet.

Last year its annual rent bill was just under £24.2m (shown in the chart below). In its 2015 annual report it showed £145m of outstanding rent commitments. Being very generous, it would seem that French Connection has hidden debt of at least £100m (I estimate £122m discounting the future leases at 5%) and the EV of the business is at least £108m if these are taken into account.

Net current asset value is probably meaningless

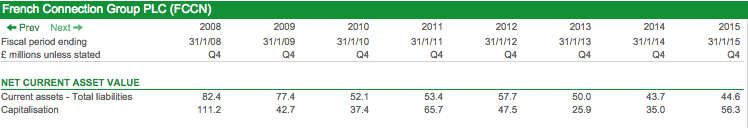

The flexibility available in SharePad has allowed me to compare French Connection's net current asset value (using the combine items feature) with its market capitalisation over time. As you can see, it is not unusual for the shares to trade below the net current asset value.

But this value does not take away the value of hidden debt. Take £100m away from the current NCAV of £36.4m and you are left with a big negative number. It seems that French Connection is unlikely to be a Benjamin Graham type bargain share.

Another vital point that needs to be understood when looking at asset values is that a balance sheet is a snapshot of the company's financial position on one particular day. Its assets and liabilities might look completely different at other times of the year.

Cash balances can vary enormously depending on when a company's customers pay their bills and when a company pays its suppliers. Companies tend to choose a balance sheet date when cash balances are at their biggest. The average levels of cash throughout the year can often be a lot less.

Also for a fashion retailer with lots of stock, it is by no means certain that its balance sheet value could be realised if the company was liquidated. The chances are that the values would have to be slashed to turn them into cash quickly.

These points are worth bearing in mind if you choose to value a company based on the value of its balance sheet assets and liabilities.

To sum up

It can be very easy to confuse a low or cheap share price for an undervalued one. To avoid getting caught in a value trap try and remember:

- Cheap is not the same as being undervalued.

- Shares, like bottles of wine, can be cheap for a reason.

- Profits are usually a better gauge of value than assets.

- Pay more attention to current profitability than analysts' forecasts.

- Balance sheets are just a snapshot on one day of a year.

- Look out for hidden liabilities.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.